let's recap...!

the usd strengthening or rm weakening started about a year ago, sometime in oct 2014 when rate was about 3.30.

on 6 jan 2015, a thread emerged on the subject:

https://forum.lowyat.net/topic/3461956that day, rate had already moved to 3.56.

today, it is 4.20. peak day closing was 4.339 on 8 sep 2015.

so, from a year ago, -27%.

from jan, i.e. 9 months, -18%.

let's not worry about how right or wrong anyone has been or how clever or silly some comments were since jan but spend more time on what has been useful in protecting one's blood sweat and tears rm savings.

i recall some methods thrown out. how useful or useless have they been?

let's not bother with rm denominated methods as there is no fx involved.

my take over the last 1 year:1. us stocks/etf's - on average, there is zero cap gain, maybe a small loss. plain fx gains, excl transaction costs.

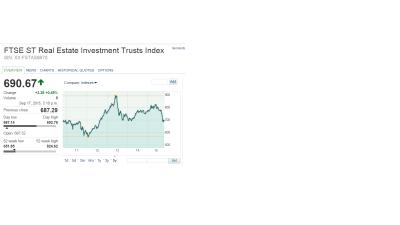

2. sg stocks/reits - stocks probably lower but with fx gains; sg reits not much cap gain but dividends and fx gains.

3. gold - flat in usd, no dividends, fx gain less buy-sell spread.

4. dual currency/foreign currency accounts; usd or sgd cash - pure fx gains less buy-sell spread.

5. european, asian, emerging markets stocks, unit trusts, other funds - pls comment as i hv no idea.

6. what else?

the clear and present danger: all this is not going away anytime soon. it may be only the beginning of a long period of volatility and uncertainty. there is still the fed rate hike issue, china's slowing economy, commodities supercycle at bottom, oil price may fall further, continued currency wars, etc. plus our infamous local politics, of course.

i personally have done a bit of 1 and 2, quite glad i did that. wish i had done more.

for the young with zero savings or debt but plenty of energy, the world is there for you.

for the about to retire, pensioners or wheelchaired, what you have is all you got; lose it, get robbed or get devalued, no one will help you.

even bnm governor has advised us to "adjust".

it is a major and serious issue that impact all of us.

lastly, saying "other countries also affected" does not help, we all already know, no need to dwell on that.

so, pls comment and share yr experience, plans and what not!

This post has been edited by AVFAN: Sep 19 2015, 07:00 PM

Sep 9 2015, 10:24 AM, updated 11y ago

Sep 9 2015, 10:24 AM, updated 11y ago

Quote

Quote

0.1579sec

0.1579sec

0.89

0.89

6 queries

6 queries

GZIP Disabled

GZIP Disabled