This post has been edited by MGM: Sep 10 2015, 07:44 AM

Attached thumbnail(s)

USD/MYR drop, V2

|

|

Sep 10 2015, 07:30 AM Sep 10 2015, 07:30 AM

Return to original view | Post

#1

|

All Stars

18,407 posts Joined: Oct 2010 |

Say in sep2009, u have rm200k cash n put half in each RM's FD(4% int) n USD's FD(1% int, USD/MYR=3.6). And now after 6 years, u decided to convert the USD to MYR at 4.3, guess what, they give the same returns. I am assuming the USD's FD at 1% or could it be higher/lower due to QE?

This post has been edited by MGM: Sep 10 2015, 07:44 AM Attached thumbnail(s)

|

|

|

|

|

|

Sep 10 2015, 10:41 AM Sep 10 2015, 10:41 AM

Return to original view | Post

#2

|

All Stars

18,407 posts Joined: Oct 2010 |

QUOTE(cherroy @ Sep 10 2015, 09:16 AM) USD virtually has zero interest rate since 2008 or around the max interest rate one may get is 0.25%. Over the years, I have invested in KLSE unsystematically, I won some and lost some and felt that this is a no win situation. Maybe I have not mastered the tricks like so many of the experts here. Which is why I am comfortably invested in ASX knowing that they consistent gives 6-7% until the recent scares flaring out like wild fire. I am starting to look into asset diversification and corelation(don't want to be caught in the situation where 1 asset gain is canceled out by 1 lost).Then in my example USD FD would be worst off. One may be better off with investment in USD asset like stock or treasuries or bonds. But this subjected to risk of the particular asset that may drop down in value. But the I am comparing the same asset type. This is the dilemma that always facing by investors. There is no "safe" or "secured" place. If USD economy doesn't revive back even after then QE and poise to rate hike, we won't see the USD strength like what is happening currently. I actually see this coming knowing that one day the QE will unwind but not at this magnitude, I initially thought that USD/MYR would not exceed 3.80 which is what refrain me from investing in SGD & USD. I know of a friend who invested in China Stocks over the last ten years. With a intial investment of RM1m in 2005, the value rose to RM5m in 2007, then it came down to RM1m+ after the crisis and dingdong there until this year when it rose to RM4m+. When I told him that 1 bird in hand is better than 2 in the bush, he replied that this time is different. Unfortunately it is now back to RM1m+. If he is to liquidate all now, he will still makes some money (may be 3-4%/pa). May be it is the rollercoaster feeling that he is after. So this would be considered a long term investment but without appropriate timing of cashing out it is just like a rollercoaster ride. This post has been edited by MGM: Sep 10 2015, 10:46 AM |

|

|

Sep 10 2015, 01:21 PM Sep 10 2015, 01:21 PM

Return to original view | Post

#3

|

All Stars

18,407 posts Joined: Oct 2010 |

Any special reason why Thai Baht is stronger than MYR when Thailand is not short of troubles lately? MYR's fair value should at least be on par.

|

|

|

Sep 10 2015, 01:51 PM Sep 10 2015, 01:51 PM

Return to original view | Post

#4

|

All Stars

18,407 posts Joined: Oct 2010 |

QUOTE(Hansel @ Sep 10 2015, 01:43 PM) Well, the way I see it, the neighbouring has always had problems for as long as the investing public can remember, hence the Baht is immune from falling further. Prbs are a norm for them. For Msia, I believed what we are going through now are very unique and the scandals are really bad compared to history. So it is more on perception than fundamental? Investors are immune to the troubles in Thailand. So if Malaysia political problems subsided/solved then MYR should strengten.This post has been edited by MGM: Sep 10 2015, 01:53 PM |

|

|

Sep 13 2015, 10:58 AM Sep 13 2015, 10:58 AM

Return to original view | Post

#5

|

All Stars

18,407 posts Joined: Oct 2010 |

Dr.M has accessed to Petronas account?

|

|

|

Sep 14 2015, 10:38 PM Sep 14 2015, 10:38 PM

Return to original view | Post

#6

|

All Stars

18,407 posts Joined: Oct 2010 |

|

|

|

|

|

|

Sep 15 2015, 02:56 PM Sep 15 2015, 02:56 PM

Return to original view | Post

#7

|

All Stars

18,407 posts Joined: Oct 2010 |

QUOTE(AVFAN @ Sep 15 2015, 02:32 PM) Premature claim. Market too volatile even within the same day. Best not to claim. |

|

|

Sep 16 2015, 01:41 PM Sep 16 2015, 01:41 PM

Return to original view | Post

#8

|

All Stars

18,407 posts Joined: Oct 2010 |

QUOTE(Hansel @ Sep 15 2015, 05:01 PM) For me, I would buy-in straight since I am of the opinion that I am in for the long term. When u TT the funds to your USD foreign currency account in Singapore, is there any limit/restriction imposed? How much is incurred for currency conversion n fees?I would go down to Singapore and open a foreign currencu account in Singapore. I would then return to Msia and TT the funds to my USD foreign currency account in Singapore. When the funds are in, I may buy some USD-denominated funds in Singapore via Philips Capital. I use Philips Capital. |

|

|

Sep 16 2015, 07:30 PM Sep 16 2015, 07:30 PM

Return to original view | Post

#9

|

All Stars

18,407 posts Joined: Oct 2010 |

|

|

|

Sep 16 2015, 08:01 PM Sep 16 2015, 08:01 PM

Return to original view | Post

#10

|

All Stars

18,407 posts Joined: Oct 2010 |

QUOTE(wil-i-am @ Sep 16 2015, 07:55 PM) ValueCap's funds will soften decline, not trigger boom But the 20b has not even been deployed yet.http://www.malaysiakini.com/news/312524 The uptrend experienced by Bursa 2 days ago will fizzled out? |

|

|

Sep 17 2015, 10:02 PM Sep 17 2015, 10:02 PM

Return to original view | Post

#11

|

All Stars

18,407 posts Joined: Oct 2010 |

QUOTE(AVFAN @ Sep 17 2015, 04:29 PM) zeti has some advice: That's only half of the story, she also said:falling rm, gst, weak economic outlook. cars, houses, food included, i suppose. in short, she is saying we are all poorer, accept it and make adjustments. She told the daily that during the 1997/1998 financial crisis, Malaysia took 18 months to recover. “Our track record has shown us that every time we have been set back, time and again, we have been able to bounce back. It is more than once. We bounced back, and we bounced back quickly,” she was further quoted as saying. – September 17, 2015. - See more at: http://www.themalaysianinsider.com/malaysi...K.5EHYZWwn.dpuf |

|

|

Sep 17 2015, 10:43 PM Sep 17 2015, 10:43 PM

Return to original view | Post

#12

|

All Stars

18,407 posts Joined: Oct 2010 |

|

|

|

Sep 18 2015, 12:16 AM Sep 18 2015, 12:16 AM

Return to original view | Post

#13

|

All Stars

18,407 posts Joined: Oct 2010 |

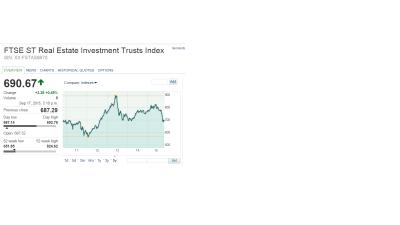

QUOTE(Hansel @ Sep 17 2015, 10:49 PM) I am really glad that I have my foreign-currencies investment income now with which I can use to pay for my overseas-related expenses, eg, my travelling abroad. Congrats Say if I had invested rm250k(SGD100k) in S-reit(instead of ASx) 3 years ago, would my present value in S-reit > SGD100k (rm300k)? My present value of the ASx is roughly rm250k+21%=rm302k. Based on the chart below, FTSE ST Real Estate Investment Trusts Index SIN: XX:FSTAS8670 was about the same level 3 years ago compare to now.~700. Does the chart includes dividend? Attached thumbnail(s)

|

|

|

|

|

|

Sep 18 2015, 08:52 AM Sep 18 2015, 08:52 AM

Return to original view | Post

#14

|

All Stars

18,407 posts Joined: Oct 2010 |

QUOTE(AVFAN @ Sep 18 2015, 01:03 AM) we all hope so for the sake of the younger generations. Extracted from this article:but will probably be harder and longer this time with so much more debt now than before. and what sectors will be the "saviors"? palm oil does not look like it. oil and gas will certainly not be it given latest analysis from opec and goldman: OPEC says no $100 oil until 2040: Reuters sources http://www.cnbc.com/2015/09/16/oil-prices-...stock-draw.html OPEC forecasts oil prices will grow by no more than $5 per barrel a year to reach $80 by 2020, with rival non-OPEC production growth slowing but not fast enough to fully clear the current oil glut, according to OPEC sources. The report forecasts that non-OPEC supply would amount to 58.2 million barrels per day by 2017, some 1 million barrels per day lower than in the previous forecast. Even if markets begin to rebalance as low oil prices are hurting high-cost non-OPEC producers, prices are unlikely to return above $100 per barrel until 2030-2040, according to one of the sources. With the price at this level, wonder what will happen to the shale0il industry, shutdown? This post has been edited by MGM: Sep 18 2015, 08:53 AM |

|

|

Sep 18 2015, 08:56 AM Sep 18 2015, 08:56 AM

Return to original view | Post

#15

|

All Stars

18,407 posts Joined: Oct 2010 |

QUOTE(Showtime747 @ Sep 18 2015, 08:08 AM) I wish it was that simple. Interest rate increase --> then this happen, interest rate decrease --> then this happen. Things are unpredictable nowadays, prices probably already factor this in the stock market.Interest rate increase, by convention, stock market should come down. Yesterday interest rate no increase, stock market should celebrate and rise. But DJ come down. Unpredictable Sorry, cherroy already explained above. This post has been edited by MGM: Sep 18 2015, 08:58 AM |

|

|

Sep 18 2015, 10:47 AM Sep 18 2015, 10:47 AM

Return to original view | Post

#16

|

All Stars

18,407 posts Joined: Oct 2010 |

QUOTE(cherroy @ Sep 18 2015, 09:21 AM) A lot of time, forecast is not materializing one. Some 'forecastors' probably have certain agenda.Mind that early 2000, there was a time oil price fell below USD20, which was a supply destruction factor, that lead to non-stop bull run in oil price afterwards that sending price to USD140. So oil price if staying at low point for a period of time, it could be repeating the history of another supply destruction as last time. We can see many oil company are reducing their capex significantly which could limit the future supply capacity. Had anyone forecast oil will be USD40, when oil price was USD140 time? Almost none, all said going to be above USD150 or USD200 Had anyone forecast USD will be so strong when QE started time? Many said USD will be worthless instead. The more people forecast on same path, the likelyhood it won't occur. If forecast always materialize as what it forsee, then making money in the market become extremely easy, lot of people can become rich just based on forecast. Yet, in reality it is not. |

|

|

Sep 19 2015, 08:06 AM Sep 19 2015, 08:06 AM

Return to original view | Post

#17

|

All Stars

18,407 posts Joined: Oct 2010 |

QUOTE(dreamer101 @ Sep 19 2015, 12:04 AM) MGM, I am prepared even if rm drop to 5.00 against USD. Sorry but I don't believe Mysia econ will crash n not recover, on this I have more faith with DrZeti than Dreamer.Are you PREPARED if RM drop further or Malaysia economy crashes and never recover?? <<I unfortunatefully didn't manage to diversified, >> The past is gone. Are you DIVERSIFIED enough to prepare for the worst in the FUTURE?? Dreamer I am not DIVERSIFIED enough if u mean investing out of Mysia. My networth within Mysia consists of oilpalm estates, ASx and EPF. I thought I am diversified enough within Mysia. I have some shares in KLSE n some private companies and a fully paid house which I am staying in n 2 years of emergency funds in FD. I also believe that oil price will rebound. Worst come to worst I just have to shelf my plan of early retirement and continue to work as I can live with my employment income without touching my networth which is appreciating ~6-8%/year although in RM terms. I also believe that it is too late to diversified out at the current exch rate, so just have to wait out for the rebound. Or maybe I will start buying nonlocal UT. I am treating my ASx as a high-interest savings acc waiting to channel them out when the time is right. My ASx has appreciated by 46% since 2009, while USD/MYR has increase from 3.5 to 4.2, 20% increase (at 46% USD/MYR has to touch 5.11). Would like to see your view on Oil for the next 5 years? This post has been edited by MGM: Sep 19 2015, 08:30 AM |

|

|

Sep 19 2015, 08:45 AM Sep 19 2015, 08:45 AM

Return to original view | Post

#18

|

All Stars

18,407 posts Joined: Oct 2010 |

QUOTE(Showtime747 @ Sep 19 2015, 08:34 AM) Just a few months ago when US$ touches 3.80 I also thought it is too late. Or BNM will intervene. Then it breached 4.00 psychology barrier and I thought that is the max it could go. And then it breached 4.30....is 4.50, 4.80, or even 5.00 coming ? You r right I am no longer bold, cos I am no longer in prime years for investment, I am more into preserving my wealth.Now US$ is taking a breather. It is a good time to enter if you really believe in diversifying. There won't be the "best time" for investment. You can only see a longer term view of the RM - will it come back ? Or hopeless ? And then hold on to your foresight and act accordingly. "Waiting for rebound" is just an excuse for the "not so bold" |

|

|

Sep 19 2015, 08:59 AM Sep 19 2015, 08:59 AM

Return to original view | Post

#19

|

All Stars

18,407 posts Joined: Oct 2010 |

QUOTE(dreamer101 @ Sep 19 2015, 08:32 AM) MGM, Wa, u guys are fast. Like I said I believe the econ would not crash but maybe go into recession. Even if I lose my job, I believe I could easily get a job in Spore(if not for the daily travel) to tide me over. At the moment I only need 2% of my networth for yearly living expenses n currrently this networth is appreciating at ~6-8%. I think I can even stop working now, and my networth will still appreciating at 4-6% (but in depreciating RM).<<Sorry but I don't believe Mysia econ will crash n not recover, on this I have more faith with DrZeti than Dreamer.>> What if she no longer in charge of BNM?? <<Would like to see your view on Oil for the next 5 years?>> It is not going to recover over the next 5 years. Beyond the next 5 years, Oil would not matter to Malaysia anymore since Malaysia would not export enough oil to have enough Oil Money. So, without the Oil Money, how is THE GOVERNMENT to continue deficit spending and keep the economy going?? <<continue to work as I can live with my employment income?>> If the economy crashes, you will not have a job. <<my networth which is appreciating ~6-8%/year although in RM terms.>> Which may or may not generate enough cash flow in RM to feed you and your family. It is VERY SIMPLE. Why take the RISK that you might be wrong?? Why put all your eggs into ONE basket??? You have ENOUGH. Having MORE is not that important. Making sure that you do not lose money is more important. Dreamer |

|

|

Sep 19 2015, 09:04 AM Sep 19 2015, 09:04 AM

Return to original view | Post

#20

|

All Stars

18,407 posts Joined: Oct 2010 |

QUOTE(dreamer101 @ Sep 19 2015, 08:59 AM) MGM, I hope to slowly diversified out of the country carefully which was why I seek your advise previously on Vanguard's products.Then, why are you putting all your eggs into ONE basket?? If this basket crashes, you will not be able to get any back. There is no second chance for you. Dreamer |

|

Topic ClosedOptions

|

| Change to: |  0.0729sec 0.0729sec

0.93 0.93

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 02:23 AM |