QUOTE(kart @ Mar 5 2025, 10:35 AM)

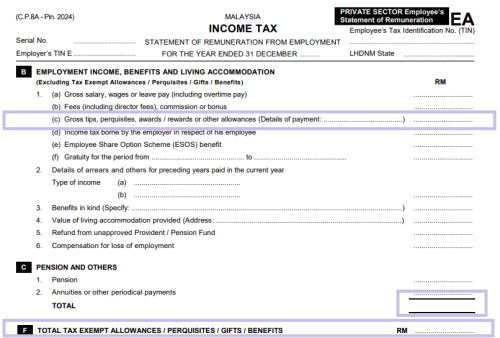

Since MSS is considered as a compensation for loss of employment, I would like to ask how I should fill up the statutory income from sources of employment, e-Filing BE Form.

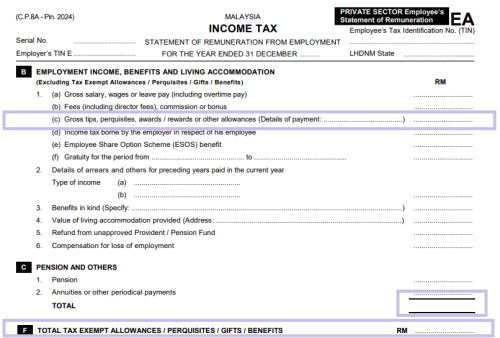

The issue is that in EA form given by my former company, the total employment income includes the MSS compensation (stated as 'Pampasan kerana kehilangan pekerjaan').

If I fill this total employment income as the statutory income from sources of employment in BE Form, the MSS compensation will be subjected to income tax.

If I am not mistaken, the statutory income from sources of employment in BE Form should be same as the total employment income stated in EA form.

u r right about this and your concern about the discrepancy in EA form is valid, perhaps visit the nearest LHDN branch and seek for advice?

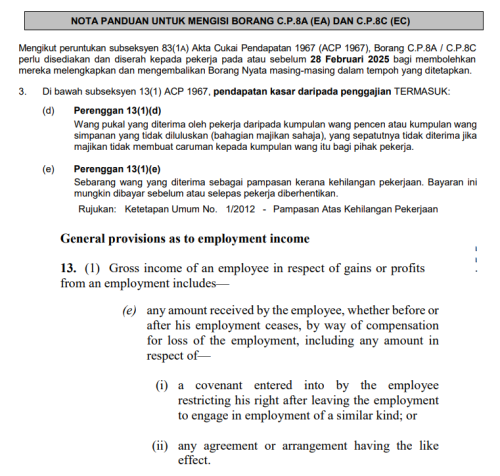

theoretically, the 'Pampasan kerana kehilangan pekerjaan' in section B.6 of EA is referring to s13(1)(e)

» Click to show Spoiler - click again to hide... «

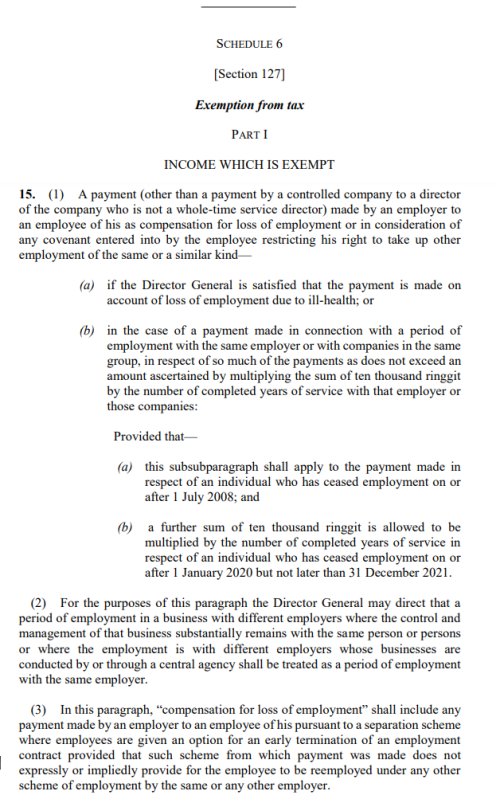

form EA guidebut since u r eligible under paragraph 15 of Schedule 6

» Click to show Spoiler - click again to hide... «

the compensation shall not be included in B.6 of EA

QUOTE(mamamia @ Mar 5 2025, 03:27 PM)

long service award (provided that the employee has exercised an employment for more than 10 years with the same employer).

i've 10 years long service award in July 2024, so, am I consider working more than 10 years and entitled for tax exemption of up to RM2000 for YA2024 as by end of Dec 2024, I've worked 10 years + 5 months..

should be entitled to but which section in EA was the long service award?

if not section F, then u r in the same shoes as above

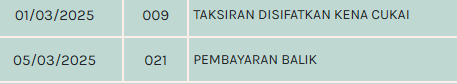

First time breaching 5 digits refund. Hopefully will get it by Friday. Fingers crossed.

First time breaching 5 digits refund. Hopefully will get it by Friday. Fingers crossed.

Mar 5 2025, 08:09 AM

Mar 5 2025, 08:09 AM

Quote

Quote

0.0210sec

0.0210sec

0.80

0.80

6 queries

6 queries

GZIP Disabled

GZIP Disabled