QUOTE(money_tree888 @ Jun 28 2022, 09:15 AM)

because i was a tax resident of Malaysia until May 2022. I have sinced moved out of Malaysia. In 2023, won't I need to declare income from Jan-May 2022?

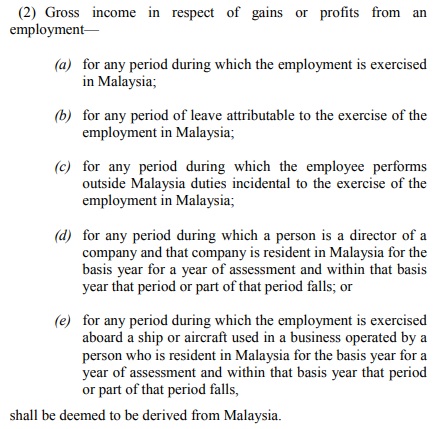

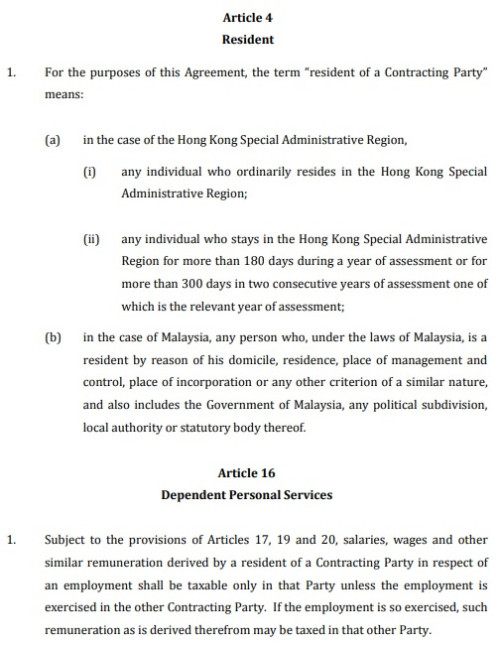

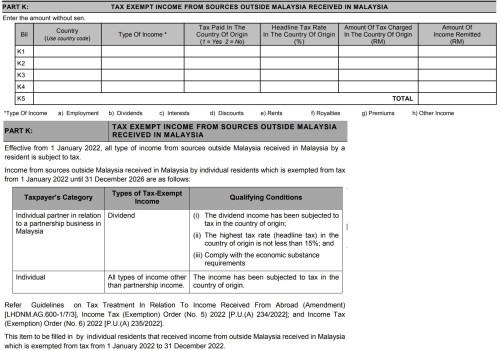

so the higher tax referring to the tax rate of non-resident?u could either be a resident or non-resident for a year of assessment (YA 2022: Jan - Dec 2022), but you cannot be a tax resident for a particular period in a year of assessment (e.g. Jan-May 2022)

there are four scenarios, obviously Jan 1 - May 31 = 151 days < 182 days

https://phl.hasil.gov.my/pdf/pdfam/PR_11_2017.pdf

QUOTE(Micky78 @ Jul 20 2022, 09:15 PM)

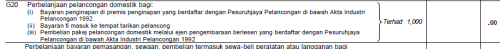

if i have two house rental out.. one is having profit and another unit is at a lost after deduct all allowable expenses.

in the tax submission, can i combine the rental income for both unit or only declared the rental income making a profit/positive?

income from real properties can be grouped as single source, in simple English, sum up all rental income then deduct total expenses from all propertiesin the tax submission, can i combine the rental income for both unit or only declared the rental income making a profit/positive?

refer to example 14: https://phl.hasil.gov.my/pdf/pdfam/PR_12_2018.pdf

Jul 28 2022, 04:54 PM

Jul 28 2022, 04:54 PM

Quote

Quote

0.0431sec

0.0431sec

0.43

0.43

7 queries

7 queries

GZIP Disabled

GZIP Disabled