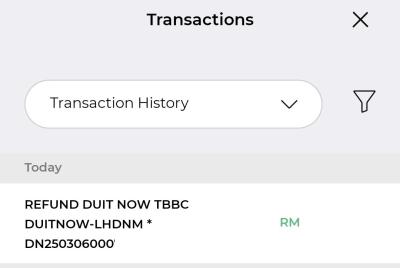

efiled on 01 Mar 2025 11pm ish

Updated status, refund in progress on 6 Mar 2025 thru DUITNOW.

Updated status 2, refunded on 6 Mar 2025.

This post has been edited by ineser: Mar 6 2025, 04:21 PM

Income Tax Issues v4, Scope: e-BE and eB only

|

|

Mar 1 2025, 11:19 PM Mar 1 2025, 11:19 PM

Show posts by this member only | IPv6 | Post

#10441

|

Senior Member

1,068 posts Joined: Oct 2009 From: Kuching, Sarawak |

|

|

|

|

|

|

Mar 1 2025, 11:42 PM Mar 1 2025, 11:42 PM

Show posts by this member only | IPv6 | Post

#10442

|

Senior Member

5,608 posts Joined: Jan 2010 |

QUOTE(moiskyrie @ Mar 1 2025, 10:58 PM) Receipt under whose name?Medical treatment, dental treatment, complete medical examination, special needs or carer expenses incurred on parents is allowed as a deduction up to RM8,000. Complete medical examination expenses are allowed as a deduction up to RM1,000. Parents refer to natural parents or foster parents where the individual is an adopted child. Parents shall be individuals resident in Malaysia Expenses on medical treatment for parents which qualify for deduction include: (i) Medical treatment, complete medical examination or special needs - must be evidenced by a medical practitioner registered with Malaysian Medical Council (MMC) certifying that the medical condition of parents requires medical treatment, complete medical examination or special needs and is supported by an official receipt. Medical treatment and complete medical examination must be provided in Malaysia. https://www.hasil.gov.my/media/i3xpkyx4/exp...es_be2024_2.pdf This post has been edited by tzxsean: Mar 1 2025, 11:44 PM |

|

|

Mar 2 2025, 06:08 AM Mar 2 2025, 06:08 AM

|

Senior Member

3,217 posts Joined: Dec 2006 From: City of Neko~~Nyaa~ |

QUOTE(MUM @ Mar 1 2025, 11:02 PM) then should be can claim..as those is prescribe by hospital doctor.... QUOTE(tzxsean @ Mar 1 2025, 11:42 PM) Receipt under whose name? receipt no name...(those receipt from register like big pharmancy, etc)Medical treatment, dental treatment, complete medical examination, special needs or carer expenses incurred on parents is allowed as a deduction up to RM8,000. Complete medical examination expenses are allowed as a deduction up to RM1,000. Parents refer to natural parents or foster parents where the individual is an adopted child. Parents shall be individuals resident in Malaysia Expenses on medical treatment for parents which qualify for deduction include: (i) Medical treatment, complete medical examination or special needs - must be evidenced by a medical practitioner registered with Malaysian Medical Council (MMC) certifying that the medical condition of parents requires medical treatment, complete medical examination or special needs and is supported by an official receipt. Medical treatment and complete medical examination must be provided in Malaysia. https://www.hasil.gov.my/media/i3xpkyx4/exp...es_be2024_2.pdf buy from pharmacy ... follow the prescribe by hospital doctor... |

|

|

Mar 2 2025, 11:36 AM Mar 2 2025, 11:36 AM

|

Senior Member

1,556 posts Joined: Jan 2003 |

QUOTE(tzxsean @ Mar 1 2025, 11:42 PM) Receipt under whose name? We can only claim tax relief for Parent if the receipt payor name is us, not parent name?Medical treatment, dental treatment, complete medical examination, special needs or carer expenses incurred on parents is allowed as a deduction up to RM8,000. Complete medical examination expenses are allowed as a deduction up to RM1,000. Parents refer to natural parents or foster parents where the individual is an adopted child. Parents shall be individuals resident in Malaysia Expenses on medical treatment for parents which qualify for deduction include: (i) Medical treatment, complete medical examination or special needs - must be evidenced by a medical practitioner registered with Malaysian Medical Council (MMC) certifying that the medical condition of parents requires medical treatment, complete medical examination or special needs and is supported by an official receipt. Medical treatment and complete medical examination must be provided in Malaysia. https://www.hasil.gov.my/media/i3xpkyx4/exp...es_be2024_2.pdf Most of my parent medical receipt payor name is my parent name. |

|

|

Mar 2 2025, 12:00 PM Mar 2 2025, 12:00 PM

|

All Stars

14,927 posts Joined: Mar 2015 |

QUOTE(labtec @ Mar 2 2025, 11:36 AM) We can only claim tax relief for Parent if the receipt payor name is us, not parent name? I think, just think,Most of my parent medical receipt payor name is my parent name. IF, the the bill and receipt are of different names, then, The invoice or payment bill must state your parent name and them attach the receipt to it. The receipt must have the name of the tax relief claiming children. Relationship can be proven from birth cert or legal adoption papers if needed. IF, the payment receipt is under the parent name, then any tax relief claiming children can use it to claim tax relief. Again, Relationship can be proven from birth cert or legal adoption papers if needed |

|

|

Mar 2 2025, 12:03 PM Mar 2 2025, 12:03 PM

Show posts by this member only | IPv6 | Post

#10446

|

Newbie

1 posts Joined: Feb 2012 |

Hi all, do you all have any record in refund for 2024 assement after submited BE afrer open yesterday?

I had submited mine yesterday but saw from refund there no record. Wondering if is because i submited during weekend? |

|

|

|

|

|

Mar 2 2025, 12:23 PM Mar 2 2025, 12:23 PM

Show posts by this member only | IPv6 | Post

#10447

|

Senior Member

5,608 posts Joined: Jan 2010 |

QUOTE(labtec @ Mar 2 2025, 11:36 AM) We can only claim tax relief for Parent if the receipt payor name is us, not parent name? Technically u need to ask the invoice or receipt issued under ur name ….Most of my parent medical receipt payor name is my parent name. Im not too sure how lenient some IRB officers are to allow claim if supporting under parents name https://www.yycadvisors.com/parents-medical...rents-name.html This post has been edited by tzxsean: Mar 2 2025, 12:26 PM |

|

|

Mar 2 2025, 02:02 PM Mar 2 2025, 02:02 PM

Show posts by this member only | IPv6 | Post

#10448

|

Senior Member

2,092 posts Joined: Dec 2009 From: Malaysia |

QUOTE(gracias @ Mar 2 2025, 01:03 PM) Hi all, do you all have any record in refund for 2024 assement after submited BE afrer open yesterday? Check back tomorrow or Tuesday as all our tax haven't been 'Ditafsirkan' just yetI had submited mine yesterday but saw from refund there no record. Wondering if is because i submited during weekend? gracias liked this post

|

|

|

Mar 2 2025, 10:08 PM Mar 2 2025, 10:08 PM

Show posts by this member only | IPv6 | Post

#10449

|

Junior Member

353 posts Joined: Jan 2003 From: kuala lumpur |

Submitted 22xxxx 2-Mar-2025

|

|

|

Mar 3 2025, 09:51 AM Mar 3 2025, 09:51 AM

Show posts by this member only | IPv6 | Post

#10450

|

Junior Member

394 posts Joined: Dec 2017 |

For voluntary EPF contribution if I contributed 100k, can I claim 7k or only 4k? No other claims (mandatory EPF or insurance, etc.) under this section.

My guess is 7k. Just want to verify. |

|

|

Mar 3 2025, 09:55 AM Mar 3 2025, 09:55 AM

|

Senior Member

937 posts Joined: Jun 2006 |

hi for parent caregiver,

if its shared by siblings, we just divided by number of pax? eg we're hiring caregiver 5k per month, but the caregiver center receipt is under my sister name, so we siblings can divide? |

|

|

Mar 3 2025, 10:06 AM Mar 3 2025, 10:06 AM

|

All Stars

26,529 posts Joined: Jan 2003 |

QUOTE(Mattrock @ Mar 3 2025, 09:51 AM) For voluntary EPF contribution if I contributed 100k, can I claim 7k or only 4k? No other claims (mandatory EPF or insurance, etc.) under this section. 7k, there is an infographic few pages back.My guess is 7k. Just want to verify. This post has been edited by Human Nature: Mar 3 2025, 10:07 AM Mattrock liked this post

|

|

|

Mar 3 2025, 11:15 AM Mar 3 2025, 11:15 AM

|

Senior Member

2,215 posts Joined: Oct 2010 |

QUOTE(Mattrock @ Mar 3 2025, 10:51 AM) For voluntary EPF contribution if I contributed 100k, can I claim 7k or only 4k? No other claims (mandatory EPF or insurance, etc.) under this section. Should be 7K total.My guess is 7k. Just want to verify. Mattrock liked this post

|

|

|

|

|

|

Mar 3 2025, 11:51 AM Mar 3 2025, 11:51 AM

|

All Stars

14,927 posts Joined: Mar 2015 |

QUOTE(cHaRsIeWpAu^^ @ Mar 3 2025, 09:55 AM) hi for parent caregiver, Just guess, just guess only.if its shared by siblings, we just divided by number of pax? eg we're hiring caregiver 5k per month, but the caregiver center receipt is under my sister name, so we siblings can divide? After having fulfilled as per image from explanatory notes. For your scenario, .. Do a documentation for claims under this clause item, in advance in preparation of just in case lhdn audit. It should at least contains minimum info like Total carer cost incured with attached compiled receipts for that ITR year. Total you are claimed as per your ITR for that year. Balance who is claiming, how much each of them are claiming, their names, relationship, nric and tax file numbers. So it will make it easier for the lhdn auditor to confirm. Easier and faster for them, easier and faster you go home. Ha ha ha. Just my guess This post has been edited by MUM: Mar 3 2025, 11:52 AM Attached thumbnail(s)

cHaRsIeWpAu^^ liked this post

|

|

|

Mar 4 2025, 06:13 AM Mar 4 2025, 06:13 AM

Show posts by this member only | IPv6 | Post

#10455

|

Senior Member

2,092 posts Joined: Dec 2009 From: Malaysia |

This year seems kinda slow it seems for ‘cukai ditafsirkan’

|

|

|

Mar 4 2025, 06:31 AM Mar 4 2025, 06:31 AM

Show posts by this member only | IPv6 | Post

#10456

|

Senior Member

1,974 posts Joined: Dec 2011 |

QUOTE(Mattrock @ Mar 3 2025, 09:51 AM) For voluntary EPF contribution if I contributed 100k, can I claim 7k or only 4k? No other claims (mandatory EPF or insurance, etc.) under this section. My guess is 7k. Just want to verify. QUOTE(akhito @ Mar 1 2025, 12:56 PM) This post has been edited by ipohps3: Mar 4 2025, 06:34 AM |

|

|

Mar 4 2025, 06:33 AM Mar 4 2025, 06:33 AM

Show posts by this member only | IPv6 | Post

#10457

|

Junior Member

589 posts Joined: Jun 2010 |

|

|

|

Mar 4 2025, 07:00 AM Mar 4 2025, 07:00 AM

Show posts by this member only | IPv6 | Post

#10458

|

Senior Member

2,092 posts Joined: Dec 2009 From: Malaysia |

|

|

|

Mar 4 2025, 07:20 AM Mar 4 2025, 07:20 AM

|

All Stars

14,927 posts Joined: Mar 2015 |

If long time still no "cukai ditafsirkan",

If long time no go have tea at lhdn, Then, be prepare lor. Ha ha ha |

|

|

Mar 4 2025, 07:31 AM Mar 4 2025, 07:31 AM

|

Senior Member

2,092 posts Joined: Dec 2009 From: Malaysia |

|

| Change to: |  0.0190sec 0.0190sec

0.50 0.50

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 02:01 AM |