if i may, for discussion purposes, to debate a little:

1. pricing. with more than average pricing to begin with, what upside do you reckon can this achieve? with rm750k price tags, 20% increase would be alarmingly close to the 1 million tag. ( when the opposite P.Tropika launched it was 200psf, now subsales around 400psf, so how to explain? what we think impossible now, might be possible in the future)

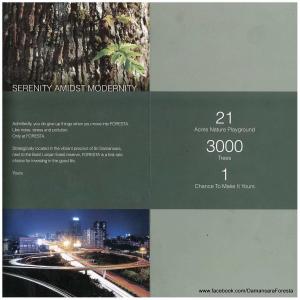

if talking about future, everything under the sky can sell above 1 mill in the future. so let talk selling after completion. can market absorb the 1 million thing in 2015.2. 21 acres forest. yes. nice to see, nice to hold. but need to pay for it, no? quit rent, assessment and maintenance? but still think this is advantage lah...(mainatainance RM0.25, this project take 10 years to complete, so at least LnG will mainatain the forest for 10 years, thereafter handover to JMB)

Take 10 years to build??? you sure so long?

Maintenance fees RM0.25 is estimation only, check your DMC, they can make amendments anytime on this fees during JMB. so can increase right?cons:

2. narrow access - yes. and it also happens to be the ONLY access unless roads linking to DP is opened up.

(If link to DP open up, we need to move this point from cons to pro)

- agreed - 3. think late delivery is quite certain. but in recent times, it could be a blessing. you should worry more on non-delivery. LAD only paid up to maximum of 10% of SPA prices if i'm not mistaken

(LnG is the main developer of BSD, they have been developing BSD for more than 20 years - so got track record, BSD is a synonium to their LnG brand name. They have applied to extend the contstruction time to 42 months, so for investors more time buffer. Late delivery doesnt bother investors as it is under DIBS)

I believe you mentioned most ppl here buy for own stay, why mention investor now? As rental for this is

Even Investor need to realise they profit and move else where not being tied down for unneccasary4. landslide issues. this is definitely a big big area of concern with ever changing climate conditions. (Phase 1 investor/flipper will be safe no matter what, if anything happen, how can LnG sell their following phases? they need to cover their backside, then they need to ensure no landslides)

You answer is simply say : ahh, dun worry, the dev will settle the phase 1 owner no landslide during construction to make sure they can sell, but later how?But if this factor not exist, the price is not 4++psf

9 utama instead. price per sq ft wise, it's cheaper and location wise + freehold status is better right?

(9 utama? u meant the See hoy chan? Build Then Sell concept, pay 10% get loan then can move in already, no room for investor to cari makan, good for own stay lah)

only strong investor can build and sell, and even after completion, there room to grow, if not who will buy sub-sales, unles you say all buyer in this project are flipperlet me throw in the 2 cents too,

price psf is low for this project, just that the built up is too large and therefore push the selling price very high entry.

buying for own stay ok lar, investment may be too high entry yo let go later

Again no project is perfect, we not only look at the flaw but also the opportunity.

I would have got one if the size is smaller --ard 1000sf - 4++K

Nov 24 2011, 12:17 AM, updated 12y ago

Nov 24 2011, 12:17 AM, updated 12y ago

Quote

Quote

0.1699sec

0.1699sec

0.26

0.26

6 queries

6 queries

GZIP Disabled

GZIP Disabled