QUOTE(z800r @ Jan 7 2014, 11:23 PM)

hi. i owned a yippie-i account. my parents n sis will bank-in money to that account every month. and that account attached to maybank2u.com lah..

now, i just started small online business. and at the same time, my customer bank-in their money to this yippie-i account also. so, i feel a bit insecure lah..

now, my plan is, my yippie-i account strictly for my family only. so i plan to open an m2u saver account, and put rm250 in this account. my customer will also bank-in to this m2u saver account. not to my yippie account anymore. can or not like this??

yes, you will have 2 saving account number under m2u 'All Account', your customer can directly bank in to your m2u-saver account if you provide them the m2u-saver account number

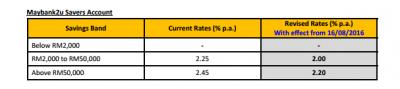

btw, m2u-saver i paid dividend even < rm2K

QUOTE(z800r @ Jan 7 2014, 11:23 PM)

what i dont understand is, under my maybank2u.com account, there will be 2 accounts rite, yippie and this m2u savers account. my family bank in to yippie. customer bank in to m2u savers. but, i only have 1 debit card, from the yippie account. how i want to withdraw the money from my m2u savers account? need to transfer to the yippie account, then only can withdraw??

after you open m2u-saver online, your m2u-saver will directly link to your debit card which you open the m2u online account with it. then you can withdraw all account which link to this debit card, just make sure to choose "other amount/other account" during cash withdrawal, so that you could select which account to withdraw. i tried with fast cash 100/200/300 it will directly withdraw from primary saving account.

QUOTE(z800r @ Jan 7 2014, 11:23 PM)

after 3 months, then only can close the account for free right? i need to transfer the rm250 to my yippie account, then only close m2u saver account rite?

thanks..

i read faq regarding this m2u savers in maybank website. but i need to understand it in simple word. sorry, a bit blur.

not sure is it 3 months or 6 months, can read the faq.

you can close the account by go to All Account>m2u-saver account details> Close Account

then you can choose to transfer the amount, interest/divided accrual, and penalty (if close within 3/6 months)

transfer method it provide, own account transfer, open 3rd party transfer or even open IBG transfer

This post has been edited by edwardccg: Jan 8 2014, 11:31 AM

Jun 23 2011, 08:04 AM, updated 15y ago

Jun 23 2011, 08:04 AM, updated 15y ago

Quote

Quote

0.3623sec

0.3623sec

0.22

0.22

6 queries

6 queries

GZIP Disabled

GZIP Disabled