Outline ·

[ Standard ] ·

Linear+

Maybank m2u savers 2.1% pa, 2 gud 2 b true 4 savings acc?

|

cklimm

|

Mar 2 2015, 07:09 PM Mar 2 2015, 07:09 PM

|

|

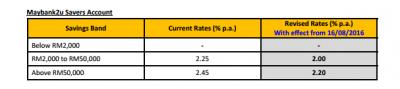

QUOTE(mechaweirdxe @ Mar 2 2015, 06:53 PM) Hi, I was just about to open a savers-i account, but then i saw at savers-i page, the indicative divident rate is now only 1.55% for accounts with balance rm2000-rm50000. I thot is was around 2.0++% last time? in this case, wouldn't the savers account be more better 2.25% p.a? as i don't really have any background in economic or banking, can anyone explain why does it change? there is an effective period below the table. does this the %% will change for each period? and there is 3.15%p.a for balances below 2k?  M2U-iThis post has been edited by cklimm: Mar 2 2015, 07:09 PM Attached thumbnail(s) M2U-iThis post has been edited by cklimm: Mar 2 2015, 07:09 PM Attached thumbnail(s)

|

|

|

|

|

|

cklimm

|

Mar 2 2015, 07:56 PM Mar 2 2015, 07:56 PM

|

|

QUOTE(mechaweirdxe @ Mar 2 2015, 07:14 PM) oh yeah, that too.lol. any ideas? Its like yelling :"keep only anything below RM2000"  |

|

|

|

|

|

cklimm

|

Aug 9 2016, 11:05 PM Aug 9 2016, 11:05 PM

|

|

QUOTE(Legozz @ Aug 9 2016, 10:54 PM) I opened a Maybank One Solution (with Personal Saver Account). Now I transferred all my savings to m2u savers, leaving only RM2 in the Personal saver account. Can I dont use the Personal Saver account (PSA) at all (because i only use the m2u savers)? Will the PSA go dormant? If it does, what will happen to my m2u? because the m2u is opened online after i got my PSA.. Basically, what Im asking is, since m2u savers can only be opened as a second savings account, can it still exist after the first saving account go dormant? M2u needs minimum 2k to enjoy 2.1% interest, while the PSA earns 1.6% from the first ringgit in the account, it is worth while to keep, in case you have low balances |

|

|

|

|

|

cklimm

|

Aug 11 2016, 09:23 PM Aug 11 2016, 09:23 PM

|

|

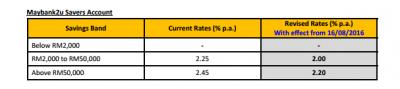

Guess what, Maybank is reducing their M2u saver rate http://www.maybank2u.com.my/WebBank/casa-r...-rates-0816.pdfThis post has been edited by cklimm: Aug 11 2016, 09:24 PM Attached thumbnail(s)

|

|

|

|

|

|

cklimm

|

Oct 24 2016, 09:59 PM Oct 24 2016, 09:59 PM

|

|

QUOTE(monara @ Oct 24 2016, 09:56 PM) Ok got it... thanks. Another thing i may ask, for daily interest calculation, are bank using 12am for the cut off time for the daily balance, or other time like working hours? Anyone have idea about this. In the old days, the cut off time was like 6.37pm, when bank closes and finished their wrap up. Nowadays, not sure |

|

|

|

|

|

cklimm

|

Feb 5 2017, 10:15 PM Feb 5 2017, 10:15 PM

|

|

QUOTE(celaw @ Feb 5 2017, 09:58 PM) If is let say 9.30pm, then we can exploit it with GIA-i account. Everyday morning withdraw the GIA-i to earn 3.5%, then put at savings account until 9.30pm to get another 2%, then put back at GIA-i @ 9.45pm. too many abnormal transactions may lead to account closure, do at own risk |

|

|

|

|

|

cklimm

|

Feb 18 2021, 09:32 PM Feb 18 2021, 09:32 PM

|

|

QUOTE(Ramjade @ Feb 18 2021, 07:32 AM) Nowadays no one uses m2u savers anymore. Use versa. You get 2.46%p a No instant withdrawal though. You wait about a day to get your money back. Ram, what versa? Thats new to me |

|

|

|

|

Mar 2 2015, 07:09 PM

Mar 2 2015, 07:09 PM

Quote

Quote

0.0297sec

0.0297sec

0.38

0.38

7 queries

7 queries

GZIP Disabled

GZIP Disabled