QUOTE(Davidtcf @ Mar 25 2022, 09:18 AM)

Few dollars perday, 1 mth can mean rm100 difference. Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

|

|

Mar 25 2022, 09:30 AM Mar 25 2022, 09:30 AM

|

Junior Member

55 posts Joined: Jan 2014 |

|

|

|

|

|

|

Mar 25 2022, 09:49 AM Mar 25 2022, 09:49 AM

|

Senior Member

3,520 posts Joined: Jan 2003 |

imo if want to compare, then do it vs Versa - its closest competitor.

Go+ has limit of RM3k only anyway. still better than keeping cash in savings account. as long I see got some interest earned i'm happy. |

|

|

Mar 25 2022, 10:00 AM Mar 25 2022, 10:00 AM

Show posts by this member only | IPv6 | Post

#663

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(Davidtcf @ Mar 25 2022, 09:18 AM) that's the beauty of lowyat peeps |

|

|

Mar 25 2022, 10:06 AM Mar 25 2022, 10:06 AM

Show posts by this member only | IPv6 | Post

#664

|

All Stars

14,858 posts Joined: Mar 2015 |

|

|

|

Mar 25 2022, 10:10 AM Mar 25 2022, 10:10 AM

|

Junior Member

152 posts Joined: Jan 2022 |

QUOTE(Davidtcf @ Mar 25 2022, 09:49 AM) imo if want to compare, then do it vs Versa - its closest competitor. Majority all have move from Versa to KDI Save for better & attractive return (for this year only).Go+ has limit of RM3k only anyway. still better than keeping cash in savings account. as long I see got some interest earned i'm happy. Yea, is happy to see the return grow daily |

|

|

Mar 25 2022, 10:20 AM Mar 25 2022, 10:20 AM

|

Senior Member

7,553 posts Joined: May 2012 |

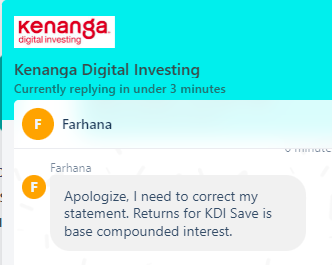

QUOTE(Sheng890624 @ Mar 25 2022, 10:10 AM) Majority all have move from Versa to KDI Save for better & attractive return (for this year only). but it is not compounded. so in the long run, it is no good. it will be like FD which you put for lock in 9 month. different here is no lock down Yea, is happy to see the return grow daily Now I have doubt if we can get those mentioned return when we withdraw all now. Sometimes, it is marketing to trick you that you earn a lot of interest but may not be the case when withdraw now This post has been edited by ericlaiys: Mar 25 2022, 10:22 AM TOS liked this post

|

|

|

|

|

|

Mar 25 2022, 10:25 AM Mar 25 2022, 10:25 AM

|

Junior Member

55 posts Joined: Jan 2014 |

QUOTE(MUM @ Mar 25 2022, 10:06 AM) 👍 If we take KDI max limit of 200k for 3%, vs 200k for say 2.4% on similar platforms. The difference is about there RM100 pm.For to hv a variant of RM100 pm, between kdi n other similar platform... The deposited amount would hv to be large. Only limited people has that. But that wasnt the point, im more concerned with how they calculate the interest if u made withdrawals cuz some ppl have mentioned there has been some discrepancies. This post has been edited by Jwkhor: Mar 25 2022, 10:34 AM |

|

|

Mar 25 2022, 11:07 AM Mar 25 2022, 11:07 AM

|

Junior Member

117 posts Joined: Jan 2019 |

KDI does not have the direct debit option yet right? Means i have to manually go into the app and deposit thru fpx everytime?

|

|

|

Mar 25 2022, 11:10 AM Mar 25 2022, 11:10 AM

Show posts by this member only | IPv6 | Post

#669

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Mar 25 2022, 11:14 AM Mar 25 2022, 11:14 AM

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(ericlaiys @ Mar 25 2022, 10:20 AM) but it is not compounded. so in the long run, it is no good. it will be like FD which you put for lock in 9 month. different here is no lock down yes my point also.. if wanna earn more then go for lock in period via a good FD for low risk.Now I have doubt if we can get those mentioned return when we withdraw all now. Sometimes, it is marketing to trick you that you earn a lot of interest but may not be the case when withdraw now If don't mind higher risk, invest into Equities (stocks). If don't like Bursa, then invest into US, or our neighbor SG stock market for nice returns. Medium/low risk, invest into MY/SG/AU etc REITs stocks. Argue over small dollar and cents in KDI Save really make me |

|

|

Mar 25 2022, 11:55 AM Mar 25 2022, 11:55 AM

Show posts by this member only | IPv6 | Post

#671

|

Junior Member

711 posts Joined: Sep 2021 |

QUOTE(ericlaiys @ Mar 25 2022, 10:20 AM) but it is not compounded. so in the long run, it is no good. it will be like FD which you put for lock in 9 month. different here is no lock down Just treat it as 9 mth FD at 3%. Apa susah. Still a big win. Remember cash also liquid. I can take out some and invest elsewhere when appropriate, WITHOUT LOSING INTEREST. Also good for storing emergency funds.Now I have doubt if we can get those mentioned return when we withdraw all now. Sometimes, it is marketing to trick you that you earn a lot of interest but may not be the case when withdraw now Many win factors already. Compound or not compound not important |

|

|

Mar 25 2022, 12:00 PM Mar 25 2022, 12:00 PM

|

Senior Member

2,608 posts Joined: Apr 2012 |

Daily Compounded Deposit should mean that each deposit are accumulated together and not separated unlike FD into diff cert. However KDI Save with daily interest is quite interesting enough, in the near future i would utilise it as usually a large amount of my funds are suspended in my various saving accounts , less than a month, while waiting for deployment. Now if we can get more clarity on the product the better it is. cybpsych liked this post

|

|

|

Mar 25 2022, 12:44 PM Mar 25 2022, 12:44 PM

|

Junior Member

109 posts Joined: Aug 2017 |

QUOTE(ericlaiys @ Mar 25 2022, 10:20 AM) but it is not compounded. so in the long run, it is no good. it will be like FD which you put for lock in 9 month. different here is no lock down Didn't KDI confirm its daily compounded? And the stats from my deposit bears out this also. Am I missing something?Now I have doubt if we can get those mentioned return when we withdraw all now. Sometimes, it is marketing to trick you that you earn a lot of interest but may not be the case when withdraw now QUOTE(Sheng890624 @ Mar 4 2022, 09:50 AM) Guys, latest update : This post has been edited by Kelangketerusa: Mar 25 2022, 12:55 PMReturns for KDI Save is base compounded interest We can ignore to withdraw the returns right now  |

|

|

|

|

|

Mar 25 2022, 01:21 PM Mar 25 2022, 01:21 PM

Show posts by this member only | IPv6 | Post

#674

|

Junior Member

992 posts Joined: Jun 2013 |

We are entering rising interest environment, expect more FI/investment company offering higher interest rate. KDI is one of the best right now, if any other higher, we still can liquidate from KDI with no concern of penalty or losing interest rate and move over to another platform. c64 liked this post

|

|

|

Mar 25 2022, 01:54 PM Mar 25 2022, 01:54 PM

|

Senior Member

3,182 posts Joined: Nov 2008 From: KL |

Across different threads, people don't seem to understand the meaning of "emergency" of emergency funds, and keep trading liquidity off for extra cents. My goodness, it's supposed to be super liquid. You have to be able to access it within minutes. FD can fulfill that role because you can liquidate it within minutes online, the few ringgits of interest lost dont matter compared to the liquidity you get. Why would you put EMERGENCY fund in money market funds like KDI, Stashaway Simple, Versa? familyfirst3, imforumer, and 4 others liked this post

|

|

|

Mar 25 2022, 02:18 PM Mar 25 2022, 02:18 PM

|

Junior Member

472 posts Joined: Jul 2006 |

Anyone know how often is the interests distributed for KDi Save ? I notice the interests is not updated daily.

|

|

|

Mar 25 2022, 02:47 PM Mar 25 2022, 02:47 PM

|

Junior Member

992 posts Joined: Jun 2013 |

QUOTE(honsiong @ Mar 25 2022, 01:54 PM) Across different threads, people don't seem to understand the meaning of "emergency" of emergency funds, and keep trading liquidity off for extra cents. Most of the emergencies event can settle with credit card, example: hospitalizationMy goodness, it's supposed to be super liquid. You have to be able to access it within minutes. FD can fulfill that role because you can liquidate it within minutes online, the few ringgits of interest lost dont matter compared to the liquidity you get. Why would you put EMERGENCY fund in money market funds like KDI, Stashaway Simple, Versa? In fact MM serve as a safety net for us to prevent macau scam where the fund is not as liquid as FD My 2 cents |

|

|

Mar 25 2022, 02:48 PM Mar 25 2022, 02:48 PM

|

Junior Member

992 posts Joined: Jun 2013 |

QUOTE(Sitting Duck @ Mar 25 2022, 02:18 PM) Anyone know how often is the interests distributed for KDi Save ? I notice the interests is not updated daily. Mine KDI Save update everyday after 430pm, even weekend Sitting Duck liked this post

|

|

|

Mar 25 2022, 02:48 PM Mar 25 2022, 02:48 PM

|

Senior Member

4,507 posts Joined: Aug 2005 From: Klang/Shah Alam |

QUOTE(c64 @ Mar 25 2022, 11:55 AM) Just treat it as 9 mth FD at 3%. Apa susah. Still a big win. Remember cash also liquid. I can take out some and invest elsewhere when appropriate, WITHOUT LOSING INTEREST. Also good for storing emergency funds. FD got PIDM protection but this doesn't. KDI Invest can still lose money although the risk is minimal.Many win factors already. Compound or not compound not important Comparing it to FD is not apple to apple. The advantage over FD is it's daily interest. You can take out money anytime without worry losing your whole month interest or whatever month interest like FD. 5p3ak, Sitting Duck, and 2 others liked this post

|

|

|

Mar 25 2022, 02:49 PM Mar 25 2022, 02:49 PM

Show posts by this member only | IPv6 | Post

#680

|

Senior Member

2,106 posts Joined: Jul 2018 |

until today yet to obtain any referral reward, reckon they are tracking referral manually through excel sheet

|

| Change to: |  0.0172sec 0.0172sec

0.33 0.33

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 12:31 PM |