‘Manager vs Machine’ report finds that passive funds have fared better in choppy markets

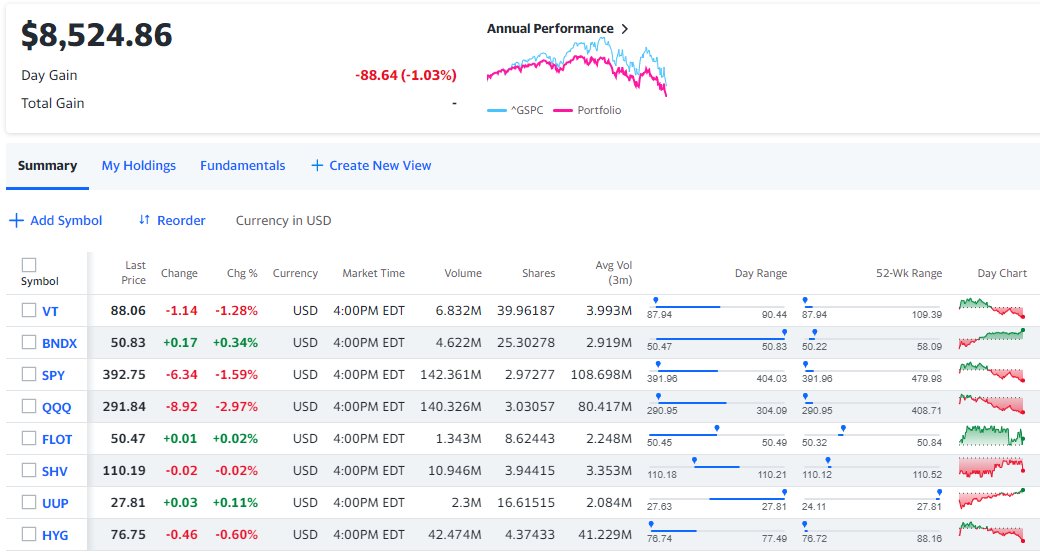

Have you dared to look at your investment portfolio recently?

I have sympathy for “armchair investors” who would rather hide under a cushion than see how badly their Isa or Sipp has been clobbered since the start of this year. However, some research about active funds made me sit up and take notice this week.

In the first six months of this year, nearly two-thirds (60 per cent) of actively-managed equity funds have fallen further than the market.

Yes, you read that right. Actively-managed funds — where you pay extra for a team of well-remunerated fund managers to cherry pick stocks they think will outperform — have actually

underperformed cheaper passive funds that simply track the nearest comparable index.

“In a year where markets have been falling and longstanding trends have gone into reverse, you might have expected active fund managers to perform better,” says investment analyst Laith Khalaf, author of AJ Bell’s “Manager versus Machine” report.

The report, which examines the performance of actively managed equity funds in seven key Investment Association sectors compared with the average passive fund performance, shows the opposite is true.

Active performance has been particularly miserable in the UK, where only 12 per cent of active funds managed to outperform a passive alternative.

AJ Bell found the average UK active fund returned -13.5 per cent in the first half of 2022, compared with -4.4 per cent from the average passive fund (all of its figures are net of charges). Either way, you would have lost money — but investors in passives would have lost substantially less.

The average UK passive fund performance has been flattered by the relatively buoyant FTSE 100, which is heavily skewed towards big oil and commodities. By contrast, the typical UK active fund is considerably underweight in large caps. UK fund managers have a bias towards small and mid-cap stocks, which tend to have a better long-term growth story, but performance has been hit as fears of recession grow.

Active managers have had a better start to the year across the pond, where 40 per cent of US equity funds outperformed their passive equivalent — a big improvement on the 19 per cent that did so a year ago.

Again, the average return for both was negative (-11.8 per cent for passive versus -13.3 per cent for active) but the absence of big tech was the common theme uniting the top-performing active funds.

According to data from Morningstar, GQG Partners US Equity has notched up a cumulative return of 8.8 per cent and US equity income funds from Quilter and BNY Mellon have both achieved over 6 per cent.

Look under the bonnet of these funds, and you’ll find oil majors such as ExxonMobil, financial services companies like US Bancorp and Comerica and defence stocks like Raytheon Technologies — barely a Fang in sight!

In the UK, the two best-performing active funds (Invesco UK Opportunities and Jupiter UK Special Situations) are both heavily weighted towards BP, Shell and BAE Systems.Whether you plump for a passive or active strategy, the thought of investing in UK funds could be rather academic for investors on these shores.

We’re still more likely to be pumping our money into US equity funds, according to the latest Investment Association data, with £241mn of inflows in April compared with £689mn of outflows for UK funds in the same month — a fact reflected in the best-buy tables of UK stockbrokers.

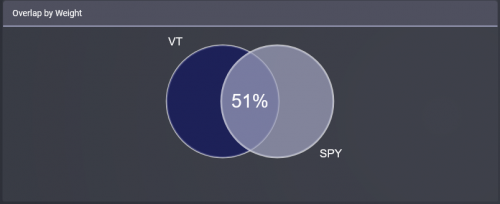

Yet this is building up considerable concentration risk — and younger investors seem especially prone to this.

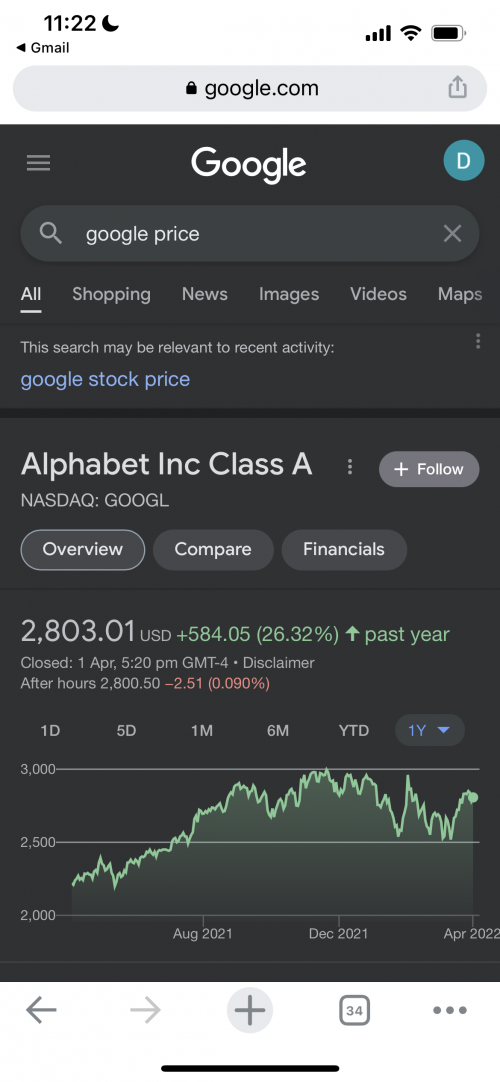

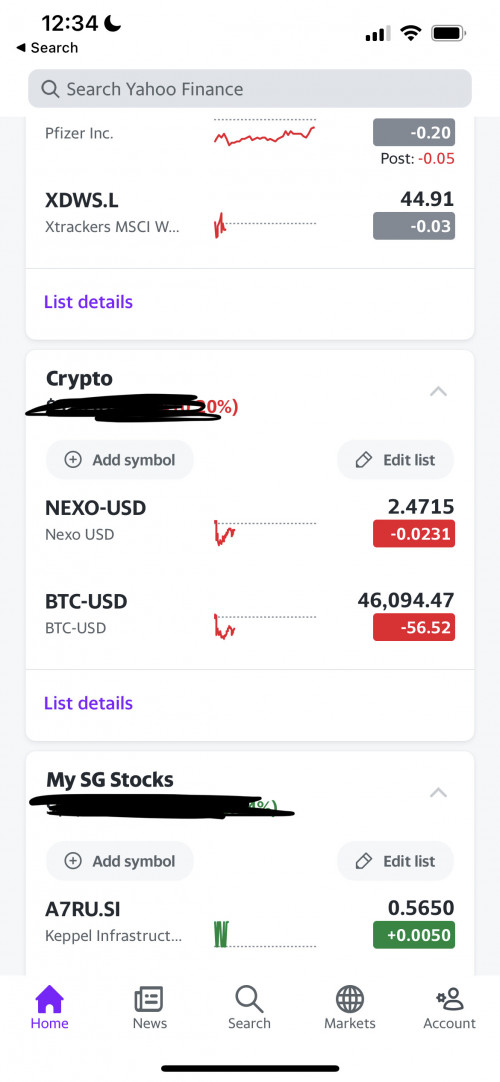

I follow several Instagram accounts where new investors offer their portfolios up for “analysis” and they often comprise entirely of single-stock investments in Tesla and Fang stocks (Facebook, Apple, Amazon, Netflix and Google).

Khalaf calculates that these tech titans have collectively plunged by 31 per cent since the start of this year — quite a lesson in why it pays to diversify.

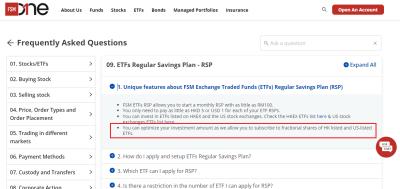

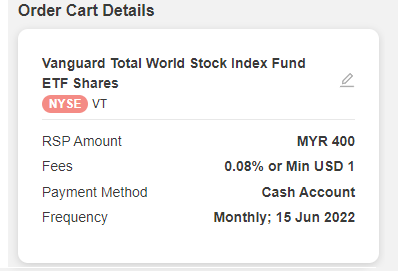

Investors in their 20s or 30s have time on their side to make up these losses, but I’d urge them to consider the “little and often” approach to making automated monthly investments in some quality passive funds — the bedrock of my own stocks and shares Isa.

Robin Powell, founder and editor of the

Evidence-Based Investor website, says he is not in the slightest surprised by the poor performance of active funds. In his forthcoming book,

How to Fund the Life You Want, he argues that the investment industry rarely promotes index funds “because it makes far more money out of selling actively managed ones”.

Active funds are also far more exciting to read and write about. Investors and the financial press are suckers for stories about “star” fund managers such as Terry Smith, James Anderson, Nick Train and Neil Woodford. All have enjoyed serious outperformance in their time (some for longer than others) but recent events have shown that even the biggest beasts cannot keep beating the markets indefinitely.

So should we as investors still bother with active funds?

When you look at the average active vs passive fund performance over 10 years, the number of active funds that beat the market increases to 45 per cent. But this is still fewer than half — and Khalaf notes that this is flattered by “survivorship bias” as unsuccessful funds wind down or merge with others.

If you’re a long-term holder of Fundsmith, Baillie Gifford or Lindsell Train funds, the recent dip will have come after a long period of rip-roaring returns. However, the table shows that the success of active managers is far from uniform across different fund sectors.

While passives form the bedrock of my Isa, I have a few active “rocks” (and occasionally, a single-stock “pebble”) where I have conviction in the ability of the fund managers or management teams to outperform.

I don’t always get this right — nobody does — but I enjoy trying, my exposure is limited to a certain quota of my portfolio, and I review my fund holdings every six months or so.

“If you want to take a mix and match approach, be picky about the areas where you go active,” Khalaf suggests, noting how the US has historically been a much harder market for managers to outperform.

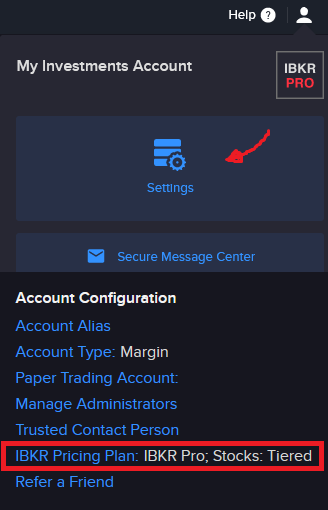

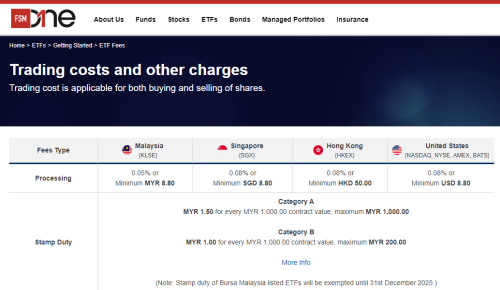

Even with passive funds, investors should be prepared to make an active choice. Most fund platforms now include passive funds on their “best buy” lists, but similar products often have wildly divergent fees.

AJ Bell’s research found that the most costly UK tracker fund is 21 times more expensive than the cheapest (ongoing charges ranged between 0.05 per cent and 1.06 per cent).

The machines may be lording it over the managers, but investors would still be wise to keep a watchful eye.

Claer Barrett is the FT’s consumer editor: claer.barrett@ft.com

Feb 8 2022, 04:23 PM, updated 4 months ago

Feb 8 2022, 04:23 PM, updated 4 months ago

Quote

Quote

0.2502sec

0.2502sec

0.43

0.43

6 queries

6 queries

GZIP Disabled

GZIP Disabled