Not sure if this is the right forum to ask.

Any comments regarding cspx vs vuaa?

Just curious what are the sifus here feedback.

Bogleheads Local Chapter [Malaysia Edisi]

Bogleheads Local Chapter [Malaysia Edisi]

|

|

Apr 1 2022, 04:52 PM Apr 1 2022, 04:52 PM

Return to original view | IPv6 | Post

#1

|

Senior Member

2,992 posts Joined: Feb 2015 |

Not sure if this is the right forum to ask.

Any comments regarding cspx vs vuaa? Just curious what are the sifus here feedback. |

|

|

|

|

|

Apr 1 2022, 05:50 PM Apr 1 2022, 05:50 PM

Return to original view | IPv6 | Post

#2

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(Hoshiyuu @ Apr 1 2022, 05:01 PM) Same underlying product, same expense ratio, one by iShares, one by Vanguard. iShares will have better spread and liquidity, as well as a bigger fund size, but it doesn't matter much if you are a buy once a month and hold person. I see. Thanks.VUAA share size is much smaller, so much more easier for us to own, personally, I'll go for VUAA just for the granularity. But if you are saving up and buying quarterly, then it's completely preference. Of course, both are subjected to SP500 usual pro and cons. With USD and MYR forex rate. It will be half a year kind a thing. Haha |

|

|

Apr 1 2022, 06:43 PM Apr 1 2022, 06:43 PM

Return to original view | IPv6 | Post

#3

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(Hoshiyuu @ Apr 1 2022, 06:34 PM) Yeap, CSPX hits a pain point for your average Malaysian, so VUAA is such a massive help when it debuted for those who want to focus on SP500. There's plenty of old discussion for more details on CSPX if you are curious on Alex's other thread, [DIY] S&P 500 Index w/ 0.07% Annual Fee, Buy the best companies in the world . Well, I am leaning towards VUAA as lower priced which I am able to buy more shares. Since all things considered constant. Seems like the logical thing to do. However it seems like I am missing something. 👀 |

|

|

Apr 1 2022, 07:41 PM Apr 1 2022, 07:41 PM

Return to original view | IPv6 | Post

#4

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(Hoshiyuu @ Apr 1 2022, 07:33 PM) Not much really. Both Vanguards and iShares are long running, reputable organizations - you are buying the ETF, so you wouldn't need to worry too much about customer support concern of either company, both are Irish domiciled, so you only pay 15% withholding tax and the small details will be handled by the underlying ETF manager, they both share the same fees, and market maker will ensure liquidity even if the volume is low. Spread will be slightly worse, but hardly a concern if you are buy and hold. Not actually sure. Just something bugging me like I am missing something. But so far. Seems fine for both. Is there anything particular in mind? Probably just want to be sure before buying via international broker. 😆 |

|

|

Apr 2 2022, 12:07 AM Apr 2 2022, 12:07 AM

Return to original view | IPv6 | Post

#5

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(Hoshiyuu @ Apr 1 2022, 08:25 PM) Worried is good, being worried save you headache later on when the problem can't be solved by just worrying. Yep, already transfer fund to IBKR via wise successfully USD150.Accept that you will need to pay tuition fees - not in terms of losing money because you gambled on the wrong stock or anything - but simply due to the fact that you need to build confidence and confirm your route. Check your commissions and fees and see if it match what other reports but don't try to save them too hard when testing the waters. Don't one shot remit 2 months of your salary and be scared shitless when both parties say they don't have your money - don't one shot buy everything at once to save $2 of commission but found out you used market order and it filled at a weird price because it just so happens to be market open or something just happened. Don't put money you can't afford to lose and be dead worried about what others think of you when you are losing money 3 months in and it feels bad. Start small, put 50, 100 through the route. If they are successful, save them as favourites and all that, and base your transaction on those. Buy the lowest amount of share, be comfortable with the many warning messages IBKR will warn you along the way, slowly figure out the interface. Once you build confidence, once you confirmed your way works, then you should have less "unknown unknowns" that is at the back of your mind, and you wouldn't have to worry what happened to your money when you go to bed. Later just waiting for bonus and EPF to buy vuaa. Also got your hint regarding market and limit order. I changed it to limit order as it is what I do in local burse. Thanks for info so far This post has been edited by AthrunIJ: Apr 2 2022, 12:23 AM Hoshiyuu liked this post

|

|

|

Apr 4 2022, 09:02 AM Apr 4 2022, 09:02 AM

Return to original view | IPv6 | Post

#6

|

Senior Member

2,992 posts Joined: Feb 2015 |

So how do bogleheads choose their ETF of choice?

I have limited fund and around 3 or 4 ETFs to invest in. VUAA, VWRA, SWRD. My plan is to just invest straight into one of them probably hit the goal then rotate to the other ETFs. Or can get some advice from sifus here. 👀😬 Some info regarding my portfolio. SA - RM60k (include simple) Local burse - RM85k Soon International ETFs - RM10k This post has been edited by AthrunIJ: Apr 4 2022, 09:03 AM |

|

|

|

|

|

Apr 4 2022, 09:51 AM Apr 4 2022, 09:51 AM

Return to original view | IPv6 | Post

#7

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(Hoshiyuu @ Apr 4 2022, 09:47 AM) The goal is to buy the entire haystack, not look for a needle in it that's outperforming. For classic American Bogleheads, it's simple, the equities part of the portfolio is either VT (~9300 stocks globally, Large,Mid,Small caps by market weight) which auto balances to roughly 60US:40ex-US, or VTI (US total market)+VXUS (ex-US total market) at their preferred ratio. For us Malaysians, due to withholding tax concerns and that there is no direct VT and VTI+VXUS equivalent, we often buy their Irish-domiciled equivalent ETFs to mimic the portfolio. From there, we decide what kind of coverage we want. VWRA/VWRD (Recommended): =Less stock due to missing small caps, but still holds 85% of the invest-able market cap. +Single ticker portfolio possible +Overall higher return overtime compared to VT due to 15% withholding tax VWRD+WSML(Developed countries small caps): +Covers Global large and mid caps and developed countries small caps -Lacks emerging market small caps VWRD+WSML+EIMI(Emerging market all caps): +Almost fully replicates VT -Terrible for rebalancing For me personally, I strongly recommend VWRA and chill - one ticker, 0 rebalance troubles, save transaction cost. However, I should put out a disclaimer that my actual portfolio is VWRA (80%), AVUV(9%), AVDV(6%), Others (5%) and I do strongly recommend against this portfolio. AVUV and AVDV are my choices due to Avantis's factor filtered small caps have empirical evidence that it out performs general market-weighted small cap ETFs. They are however US-domiciled, but the re-balancing cost is low and dividends is not much of a concern for small caps stocks. So that is how I've come to the conclusion to what I hold. -------- Why I dont hold X: Stashaway: Actively managed funds with high fees (0.7% a year for my level), severely underperforms everything, could not commit to their portfolio and high turnover for what is touted as passive investing. After I've started my DIY portfolio, Stashaway has zero value to me at all angles and I've fully dropped it. Local bursa: The notable companies in Bursa is also already included in VWRA. Furthermore, Bursa has spent the last 20 years trading sideways with 0 improvement, gains come from swings but not overall market growth, political and currency risk threatens it everyday, and a strong, consistent foreign fund outflow meant it's hopeless eventually. Not to mention the trading costs are ironically higher than foreign stocks. Strong pass, I will not waste my time and money here. VUAA/CSPX/SP500: Insanely overvalued, too concentrated. Winners rotate and historically speaking, US and ex-US market take turns winning. I'll play on both sides instead of betting US will win forever and maintain my average returns. If I am buying the haystack anyway, why limit myself to only parts of the haystack? And for those who love tech stocks, no AMD, no TSMC, no TencentBaba here. SWRD: obsolete in my portfolio due to superior VWRA holdings, and if I buy both, they overlap quite much and will overweight a lot of stocks in my portfolio (VWRA tracks FTSE, SWRD tracks MSCI, it's generally not good to track multiple overlapping indexes). Criticism and discussion welcomed! I will slowly drop local burse and SA and rotate to the ETFs. I do love US tech stocks. Probably VUAA & VWRA as a start. 👀 With VWRA higher weightage. |

|

|

Apr 4 2022, 10:01 AM Apr 4 2022, 10:01 AM

Return to original view | IPv6 | Post

#8

|

Senior Member

2,992 posts Joined: Feb 2015 |

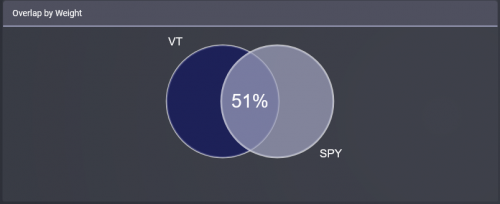

QUOTE(Hoshiyuu @ Apr 4 2022, 09:58 AM) Well, just remember, do it because you truly think it's better for you, not because someone on the internet said so. If a decision does not come from yourself, it's easier to be stricken with doubt when things go sideways. Yep, I plan to just invest and forget.Holding both VUAA & VWRA would be overweighting US and more than half of VWRA holdings by market cap.  If that is your intention, then all good, if not, be aware that you will have trouble balancing between VUAA & VWRA when only US large/mega caps drop in value. I prefer US stock more. But still can always have other countries stock as investment. Might just check other ETFs that have higher non US weightage. More to read. Where do you get that pie chart? Can share the link? 😬 |

|

|

Apr 4 2022, 10:11 AM Apr 4 2022, 10:11 AM

Return to original view | IPv6 | Post

#9

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(Hoshiyuu @ Apr 4 2022, 10:08 AM) What I can tell you is, as of today, there is no VXUS equivalent on Irish-domiciled funds. So your choice do quickly become limited when you want to have multiple tickers in your portfolio but avoid overlapping. For this I will really hold in long term.The chart is from ETF Research Center https://www.etfrc.com/funds/overlap.php But US tickers only, you'll have to use similar US funds to simulate your numbers. It will quickly devolve into a mess when you start having SP500 ETFs, some random SG REITs, a gold ETF from Australia, a handful of VWRA, a pinch of KWEB and TPE... so, be careful, be mindful. I strongly recommend having an investment policy, limit yourself to only change it every 6 month or ideally 1 year. If it's something you can't hold for 5 years, don't buy it. As for local burse and SA. Will take time to rotate to ETFs. As I might require the funds soon. Once all is sorted out. I will only hold a small amount in local burse for dividends while most of it will be on the ETFs. For now just aim one ETFs and set an amount goal then rotate to get others. Hopefully my funds will increase as I further progress in my career then probably can comfortably buy more ETFs. As for SG and Gold. Probably not in foreseeable future. Probably when I need to reduce the risk when I am older. Probably just rotate to REITs and some Gold. Now just aim at some growth ETFs. Hmm, need to read more by end of this month. As have more funds soon. 🤤 This post has been edited by AthrunIJ: Apr 4 2022, 10:17 AM |

|

|

Apr 4 2022, 10:31 AM Apr 4 2022, 10:31 AM

Return to original view | IPv6 | Post

#10

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(Hoshiyuu @ Apr 4 2022, 10:19 AM) Looking forward to the 10k from EPF myself too. With everyone withdrawing I have less and less confidence in EPF too anyway, might as well take it out and be productive with it... |

|

|

Apr 4 2022, 11:31 AM Apr 4 2022, 11:31 AM

Return to original view | IPv6 | Post

#11

|

Senior Member

2,992 posts Joined: Feb 2015 |

|

|

|

Apr 4 2022, 02:47 PM Apr 4 2022, 02:47 PM

Return to original view | IPv6 | Post

#12

|

Senior Member

2,992 posts Joined: Feb 2015 |

Welp, for now I will invest in VWRA first. Very diversified. Just buy and keep And plan for the future Abit. 👀😬 This post has been edited by AthrunIJ: Apr 4 2022, 02:48 PM Hoshiyuu liked this post

|

|

|

Apr 4 2022, 05:29 PM Apr 4 2022, 05:29 PM

Return to original view | IPv6 | Post

#13

|

Senior Member

2,992 posts Joined: Feb 2015 |

|

|

|

|

|

|

Apr 4 2022, 09:12 PM Apr 4 2022, 09:12 PM

Return to original view | IPv6 | Post

#14

|

Senior Member

2,992 posts Joined: Feb 2015 |

|

|

|

Apr 4 2022, 11:14 PM Apr 4 2022, 11:14 PM

Return to original view | IPv6 | Post

#15

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(Hoshiyuu @ Apr 4 2022, 09:22 PM) We can circumnavigate it by only taking my international ETFs into account and voilà 100% 😜🤣 Hoshiyuu liked this post

|

|

|

Apr 4 2022, 11:15 PM Apr 4 2022, 11:15 PM

Return to original view | IPv6 | Post

#16

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(Davidtcf @ Apr 4 2022, 11:14 PM) 300+ cheap le for a US stock.. Nvidia is around that range also. No funds to buy individual for now. Probably in the future 🤤Compare with Tesla, Alphabet (google), and Amazon they are much more expensive. Still I have faith in Alphabet. Bought one recently. Looking forward to its stock split in July to see what happens. After stock split usually their prices will go up.. as some ppl will buy them to play options or more affordable for them at 100+. |

|

|

Apr 10 2022, 10:48 AM Apr 10 2022, 10:48 AM

Return to original view | IPv6 | Post

#17

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(Hoshiyuu @ Apr 10 2022, 06:03 AM) Hmm, I am a little on the younger side, so I'm not sure how valid my opinion is, or perhaps people would think less of me for being on the paranoid side, but I'll share it anyway. Well, that is alot of work. But needed none the less.First of all, I invest primarily in VWRA, an Irish-domiciled ETF. I will never have an holding of more than 60k in US stocks/ETF/cash in my IBKR account so I shouldn't be liable for any US estate tax concerns. I've told my close family that I have foreign investment, and that in the event of my demise, they are free to help themselves to it, at least I would have paid for my own funeral. As a backup plan, I've also prepared a document detailing my access info, screenshots of how to liquidate my portfolio, my withdrawal routes, as well as instructions on how to contact IBKR for assistance should they are unable to or unwilling to pretend to be me and access my funds. Of course, there's always an option to proceed with my will and death certificate to access it legally - if it does come to this, and they find it worth the trouble. The document is then stored in an encrypted volume requiring PASSWORD_A, attached to my gmail on scheduled send in 6 months, and also stored in a physical thumbdrive, mentions that password will be emailed in 1 month. Then in another gmail account, PASSWORD_A is also on scheduled send in 7 months. Then, I set an reminder to myself to renew the send date every 5 or so months to keep it from sending out until I die, acting like a dead man's switch. This should keep my access detail safe even if I made a mistake now and then (e.g. forget to renew encrypted volume send date), stolen, or my relationship with my family deteriorates in the future. If it sounds mega paranoid, it is. I am a selfish person and my benefits should always comes first above all else. I wouldn't trust a second soul to access any of my finances as long I am still alive. I've seen enough bad story regarding family and money as it is. TL;DR: Family is aware of where I am invested, will have access to my investment as soon as my death certificate is issued, or in 7 months as a backup. 👀 |

|

|

Apr 19 2022, 12:46 PM Apr 19 2022, 12:46 PM

Return to original view | IPv6 | Post

#18

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(Ramjade @ Apr 19 2022, 10:58 AM) If is me personally, I will just buy QQQ. Once it reached 100 shares, just sell covered calls on it to generate weekly/monthly income in place of dividends. Hmm, is there a tutorial for this covered calls or simple explanation?Just want to increase my knowledge. 👀 |

|

|

Apr 22 2022, 07:41 AM Apr 22 2022, 07:41 AM

Return to original view | IPv6 | Post

#19

|

Senior Member

2,992 posts Joined: Feb 2015 |

|

|

|

Apr 22 2022, 07:42 AM Apr 22 2022, 07:42 AM

Return to original view | IPv6 | Post

#20

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(Davidtcf @ Apr 20 2022, 02:46 PM) sometimes you have to see whether worth waiting so long or not.. to save 10k for most people would need a few mths. What is your DCA amount in USD? 👀 Just curious 😆Or if DCA in a shorter time period (yet smaller amount) more worth it? especially in a bear market now in the US where prices are near to or even below support levels. |

| Change to: |  0.0542sec 0.0542sec

0.54 0.54

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 03:57 AM |