QUOTE(TOS @ Apr 7 2022, 11:06 PM)

It's ok. I misread people's message too

(and I am not really a people's person).

Academic research on active vs passive investing has been mixed, though evidences point to passive as the winner in the past few years, after adjusting for fees and costs.

I personally take a mixed approach, with the understanding that I will not be able to outperform the market. I plan to have active holdings which I use to express my views, supplemented with index funds which represent the overall market. For active, I must understand the companies which I invest in, their business models, market structures, etc. Then I invest in them.

For example, I personally don't like Google (Alphabet), Amazon and Meta's business models, and favour Apple's and Microsoft's, so I don't touch the former 3, only hold the other 2, AAPL and MSFT. I like JNJ, Roche and Novartis for their conservative balance sheets, compared to Pfizer, Merck and Astrazeneca etc. For individual positions, I pay close attentions to counters if they generally drop 20-30% from their recent peaks and decide if it's favourably to enter for long-term positions at that level. This is for the active part.

On the passive side, I need to buy the whole market, say S&P 500, in that case, I have no choice but to buy an S&P 500 index fund and have exposure to the whole market. I would buy the index when the discount is very large, say 30-50% drop in market (at least 2 historical annual standard deviations, i.e. >= 2 s.d., which is around 36% ish for the S&P 500).

So in short, I adopt a mixed model, passive supplemented with active views whenever the opportunity arises. So far, I only have individual stock holdings (26 holdings, last I count), not yet buying any index funds since it's nowhere near a 30-50% drop yet.

Note that this is for international portfolio, and I have not included bonds in the picture yet. For Malaysian portfolio, things are very different. Due to the significant alpha that PNB and EPF managers can generate on top of KLCI, a rational investor would overweigh EPF or PNB FP funds (when NAV is above 1) rather than gaining passive exposure via KLCI.

Hence, it is important to note that active/passive also depends on market efficiency. If the market is rigged by large funds like in Malaysia (hence inefficient), the index is not the most optimized way of earning returns. On the other hand, in a mature market like S&P 500, it's exteremely difficult for fund managers earn consistent alpha and to beat it.

Hope that helps.

Sorry I don't meant to provoke ppl in this thread. I run out of quota yesterday and couldn't response. I can see all the sifus explained much better of my comment than myself, so I can save a little effort.

My earlier comment is focusing on the VWRA as it covers 3k+ stocks world wide, with around 59% in US and 6% in China sector, and @Hoshiyuu mentioned to put 80% of asset in this ETF. Hence my comment.

My "view":

1. Geopolitics dictates the long term economy and then the asset price. Example of that is the effect of Plaza Accord. Moving forward this world is very likely to have 2 super powers hence we need to have higher weightage and participate more in these 2 super powers economy. This is long term trend. You can check on Ray Dalio's analysis. According to him, the rise of the successful investors like Buffet and Bill Gross during 70-90 is due to the fed's rate policy and the economy opportunities. They ride on the right waves. Now if China's path of growth follows the US, this waves might be in place already. I know there are a lot of narrative on china assets' investible but I think if you are not looking to grow at the expense of their interest there are still opportunities. Being in a third world country citizen, I have the opportunity to stay neutral and make gains from both sides.

2. Of the topic of diversification, I think asset class diversification is more important than having multiple stocks. And I have limited investible fund, spreading out into 3k+ stocks is really not feasible. And I think the index fund just follow the % to invest like @Naranjero mentioned. They follow a top down approach not bottom up. With such low fees, they won't analyze the fundamental of each stock before investment. Besides, it covers too much of stocks so I think inside could be a lot of tier 3,4,5 asset. With my limited fund, I want to be sure I put them only on the tier 1 asset according to my understanding. For example GM is part of the index but to me this type of automakers is not tier 1 asset (large capital investment required and high debt) but it is part of the index and I'm force to hold a certain % of it if I want to participate in the fund.

3. Fund is too big and too slow to react (not agile enough). And there is a lot of policy or protocols they are tied to. For example, a 98% equity fund need to always invest to keep to that 98% even if there is no good candidate or the market is going to crash. An index fund need to stick to its weightage for the stock as well so some low tier stock is included which I find it hard to be acceptable. When certain bad stock sell down, the fund need to rebalance to make up to the target % by putting more into the bad stock. Kinda dump to me. And when there is a crash or event, big fund takes too long to clear due to their size so most of the time the fund holder is left holding the bag. Of course if you select active fund the fees is high and there is no certainty the higher the fee the higher the return thingy.

4. These funds often serve the wall street and I don't think I am high on the list of wall street. Very often we see the news smart money or the so called ppl with insider news sold the blocks of stocks while the teacher's pension fund, firefighter's pension fund go big to pick up those stock on the narrative of value. Later when the risk unveiled it crashed and the pension fund holder holds the bag. Some event the fund is being used to be a political weapon such as the sell down on the Hong Kong market just to give pressure on to the HK chief etc. and latest one is the sanctions to Russia thing. Sometime it is totally not considering the interest of the investor. Even within the fund there are different grades - when first launched private placement at who knows price for those top of the chain hedge fund/investor, then later goes to privilege banking retail customer and last goes to unsuspected bottom of the chain retail customer. When top investor wants to unload for any reason, privilege banking start to promote to retail customers and the balance get fill up by the non-privileged banking retail customers. So most of the time we the powerless group is the bottom of the food chain. We can remain powerless but we need to have knowledge on this.

Investing is a hard journey. No one will work hard for your wealth other than yourself. That is my belief.

I'm kinda agreed with @Ramjade on his strategy. Play nimble and strike fast when you see a clear shot and in the area you understand. I also agree with @TOS mixed approach.

My approach:

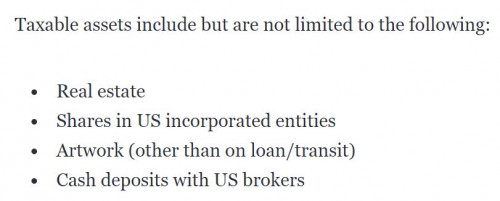

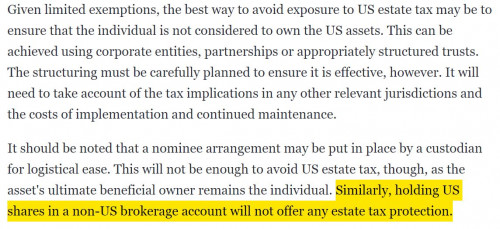

1. To me, since the only benefit of investing in an irish domiciled ETF is to avoid US WHT and estate tax, I only pick ETF that covers only US equity of the sector I'm interested in.

2. Focus on balance and total return of portfolio. I put more emphasize to asset class diversification on top of equity diversification. Equity, Commodity, currencies and bond or equivalents. My target is to get some exposure to 1 or 2 leaders of each sector. Go for quality as @Ramjade said. Not more than 30 stocks for equity so that it is manageable. I still have much to learn from TOS how to dissect the business model/structure on GOOGL, MSFT etc.

3. Dividend and options. Seek opportunities on income from dividend and options.

4. As I suspect the world is going to be more divided between the west and east, I foresee I need to pay more attention on the stock pick, the asset where it is domiciled and the broker where it is instituted. Li Ka Sheng starts to divest UK assets and CNOOC divests North sea oil field and turn to invest in Africa and South America. All moves are to derisk on Geopolitical risk and prepare for unhooked.

Sorry if I accidentally said something provoking anyone. It is not my intention. Pls correct me sifus.

)

)

Apr 7 2022, 03:54 PM

Apr 7 2022, 03:54 PM

Quote

Quote

0.0412sec

0.0412sec

0.39

0.39

7 queries

7 queries

GZIP Disabled

GZIP Disabled