QUOTE(Jason @ Apr 20 2025, 01:42 AM)

Now I am curious

1. Is that level premium contribution legit? Like does such a thing exist and really work?

2. I genuinely don’t care about life insurance. My main need is medical coverage esp. when I am old, retired and jobless.

3. Does GE have deductible medical coverage? Per annum? I don’t mind having deductible of RM1k ~ RM3k. Got company coverage, and I can still afford RM3k/year after retirement.

» Click to show Spoiler - click again to hide... «

Edit: don’t really want to talk to my agent. I don’t want to Kena upsell. If anything I want to add on deductible to pull the premium down.

Edit2

hafizmamak85 thanks for sharing

Interesting read. Based on your info, all ITOs are evil. So who is the least evil where I can get guaranteed renewal up to 100 years old. With a premium that would not be raised at the whim and fancy of the ITO? It looks like we do not have a choice and at their mercy?

You, the consumers, do have a choice. You are not at their mercy. You can always band together and haul the ITOs to court for contract non-performance and unfair/unreasonable contract practices. The sorry state of affairs in Malaysia means most, if not all, ITOs have such similar unfair/unreasonable practices.

Closing medical pools every three to four years when utilisation gets near to or breaches 10%, and subsequently opening new ones with better coverage (higher annual/lifetime limits, better inner limits coverage), is nothing but a sham excuse to reel 'healthy' consumers like yourself - those who don't make claims - in from older pools and to re-price the IL annual premiums and medical rider coverage cost of insurance charges.

My bet is that the ITOs are doing this to correct for their initial pricing errors (mispricing/underpricing), the ones that occured during the policies' inception, and to maintain their profit margins. That is not to say that there is no legitimate need for higher annual or lifetime limits, or better inner limits, for that matter.

The limits may seem ridiculous, but will come in handy if advanced treatments (e.g. cell, tissue, gene therapy treatments) are covered and utilized. The question is, while most medical insurance/takaful products with high annual limits must cover such medically necessary treatments/procedures, do our ITOs do so in practice or do they employ deny and delay claims tactics???

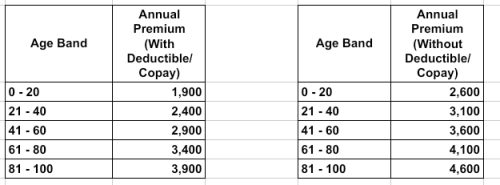

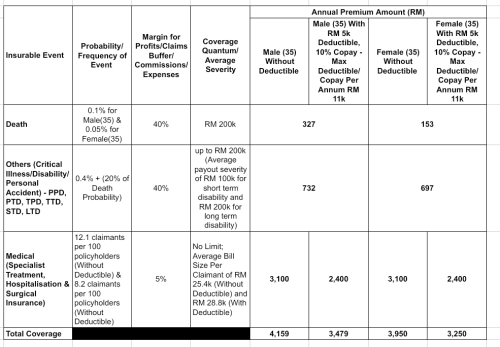

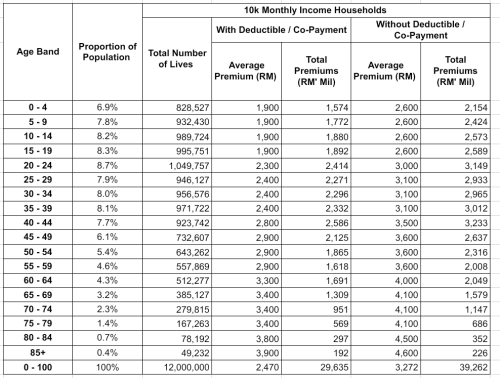

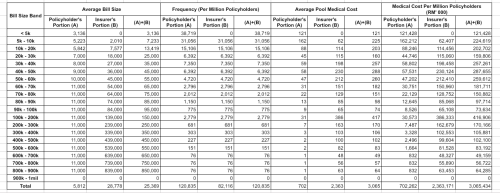

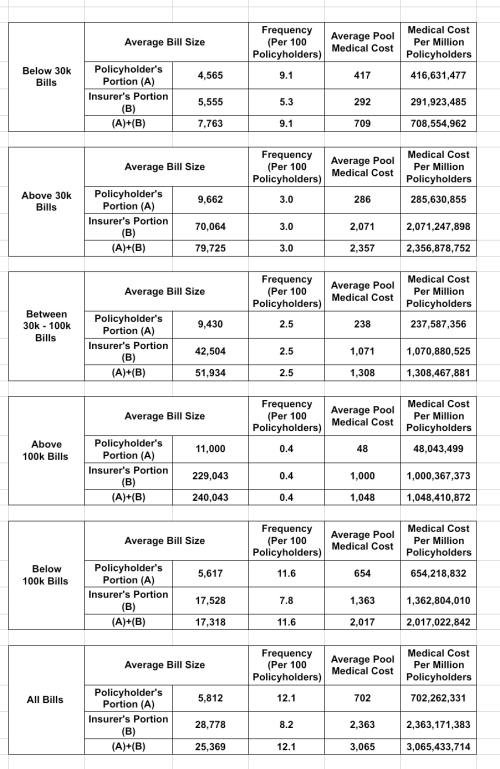

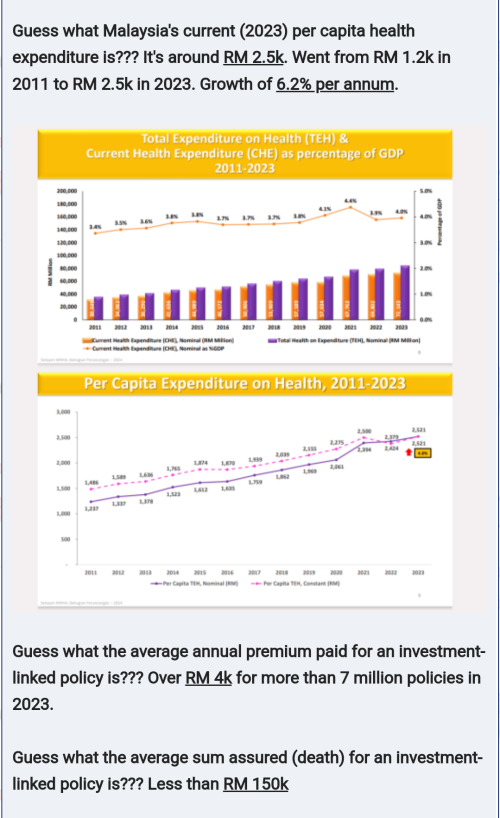

Great Eastern's current average medical pool claims cost per policyholder is less than RM 800 - which I think tallies more or less with the LIAM industry average. Prudential's PruHealth is around RM 1.1k. Malaysia's health expenditure per capita in 2023 was around RM 2.5k and is growing at an annual rate of 6%. Let's assume that around RM 1.7 to 1.8k per capita goes to hospitals/specialists for medically necessary treatments/procedures. That's more than a 100% difference when compared to GE's average pool claims cost. For Pru, it's more than a 60% difference.How many more re-pricing cycles are Malaysian insurance/takaful consumers expected to endure before the average medical pool claims cost can at least catch up to the per capita health expenditure component for hospitals/specialists???Bear in mind that the current average IL policy annual premium is already above RM 4.4k and there are more than 7 million IL policies paying around RM 29 billion in annual premiums. You can easily design and price an insurance/takaful product with RM 200k in death and disability benefits, RM 3.1k in average medical pool claims cost, all for RM 4.2k - has a 40% expense/profit margin for the death and disability components and a 5% expense margin for the medical component. RM 3.1k is almost 4 times as high as GE's average pool claims cost.» Click to show Spoiler - click again to hide... «

You are right to point out that the ITO only wants you for the sweet spot years of between 25 and 55. Their products are, in my view, intentionally designed to not be able to meet your reasonable expectations of policy sustainability and meaningful coverage. They basically want policyholders to leave after the age of 55 and have intentionally jacked up the medical coverage cost of insurance charges after that age which, as you are well aware, the annual premiums will find difficultly in sustaining. Another trick is to mostly allow small medical claims to go through while denying/delaying a significant proportion of large claims.

Above 60 lives currently only constitute less than 15% of the total population. Even if we assume a 30% proportion of claimants for this cohort, the average proportion of claimants for the total population will still only be less than 12% if we assume those below 60 have an 8% proportion of claimants. And the RM 4.2k policy is good enough to cover

12.1% proportion of claimants with an average bill size of

RM 25.4k.

Your expectation as an IL policyholder of annual premium sustainability is legit. It's just natural to expect ITOs to price a long term contract with level premiums such that its sustainability until the end of the contract term is ensured. You're not an expert nor have you any accountability when it comes to premium pricing, determining long term medical inflation or investment returns.

Short of expecting the digital ITOs to collaborate with hospitals/specialists in coming up with better product propositions, your best bet is to sue the ITOs & BNM.» Click to show Spoiler - click again to hide... «

Fun fact. Malaysian actuaries usually use a slapdash approach when it comes determining 'reasonable estimates' of long term investment returns in pricing IL level premiums. Two key ingredients: past investment return performance and future expectation of investment returns. Past performance is basically a review of the geometric average annual investment return for the 3yr, 5yr, 10yr and 20yr (if available) periods and prior to this, especially for IL pricing, it would be settled based on the 10 yr equity fund or total return equity index geometric average annual return. Since no one in the investment team would have had the chops or gumption to have any long term view or expectation in relation to equity performance, the assessment was basically limited to this review of historical returns. This was how we ended up having IL annual premiums priced assuming 7%, 8%, 9%, 10%, 11% annual returns for policies with terms of over 30 years.

This brings up an interesting question. Why were actuaries comfortable with imputing a certain investment return expectation - why not 0%? - for the entire duration of the contract in pricing IL level premiums, even though they have had an abysmal run at predicting the long term performance of IL equity funds, but were not comfortable with imputing a certain medical inflation expectation for the entire duration of the IL contract, even though the forecasting signal fidelity from the persistent 6% growth in per capita health expenditure could have been argued to be much stronger???

» Click to show Spoiler - click again to hide... «

Could it be because assuming higher investment return performance for the entire policy term meant lower annual premiums while assuming medical inflation for the entire term meant higher annual premiums???

This post has been edited by hafizmamak85: Apr 20 2025, 11:51 PM

Apr 18 2025, 05:38 PM

Apr 18 2025, 05:38 PM

Quote

Quote

0.0230sec

0.0230sec

0.44

0.44

6 queries

6 queries

GZIP Disabled

GZIP Disabled