Hi guys, any Prudential agents here who can offer some advise?

I tried contacting my previous agent, from whom I purchased my premium, back in 2017, but it seems the agent has gone MIA - no reply to me on WhatsApp

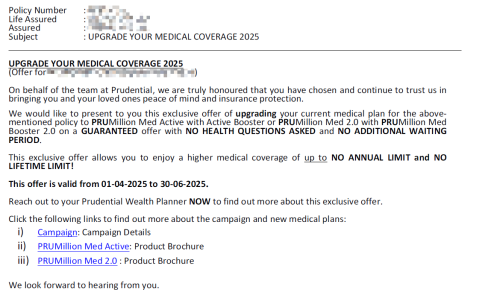

I received this email from Prudential regarding an "offer" or "campaign" stating that I could upgrade my current medial plan -

PruValue Med to

PRUMillion Med Active with Active Booster or

PRUMillion Med 2.0 with PRUMillion Med Booster 2.0 on a

GUARANTEED offer with NO HEALTH QUESTIONS ASKED and NO ADDITIONAL WAITING PERIOD

I am quite confused about whether I should upgrade? because:

1. I have done some readings but I still no clue what benefits the offer provides (compared to upgrading outside of this so-called 'offer' or 'campaign'). Does the offer refer to "NO HEALTH QUESTIONS ASKED" and "NO ADDITIONAL WAITING PERIOD"? these doesn't seem appealing to me hmm

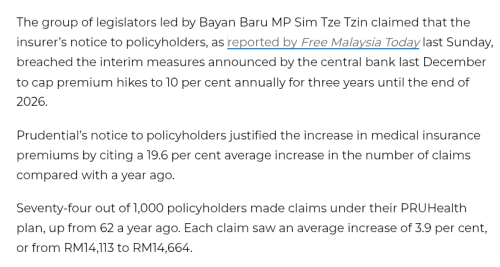

2. I have done some research. It seems if I opt to upgrade, I likely need to pay more? please confirm me. but, I have no idea how much more I need to pay, compared to my existing premium (as mentioned, my agent seems MIA

, could I call Prudential to request another agent reassignment?)

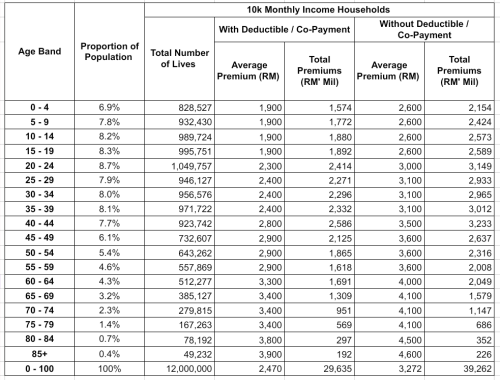

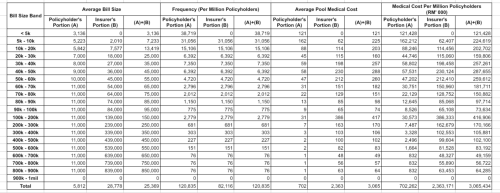

2.1 anyone can estimate how much more I might need to pay?

3. My existing plan is PRUValue Med with a total 1 mil lifetime limit (according to the policy, Prudential will co-pay 80%, if the limit is exceeded, if I remember correctly. Is this co-pay 80% a one time benefit or unlimited after the 1mil limit?

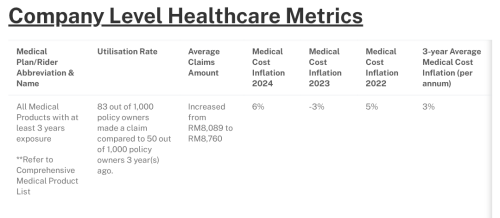

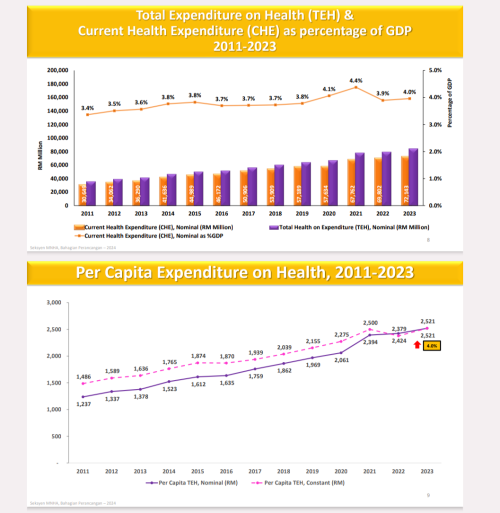

4. I am 32 y/o this year, seeking some general advice. Is point#3 sustainable for my old age? considering inflation and increasing medical cost etc., or I am recommended to upgrade to the offer given to get a higher/unlimited lifetime limit for a worry-free future/elder life

?

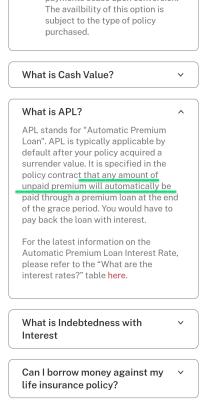

5. If I opt for the upgrade, do I still need to 'vest' for another two years before claims are processed without questions?

Apr 14 2025, 05:03 PM

Apr 14 2025, 05:03 PM

Quote

Quote

0.0228sec

0.0228sec

0.87

0.87

6 queries

6 queries

GZIP Disabled

GZIP Disabled