QUOTE(hafizmamak85 @ Mar 23 2025, 06:46 PM)

Unfortunately, for those currently with long-term medical policies, other that suing the ITOs and BNM for unjustifiable and unfair premium hikes, there is nothing much we, as in the public, can do.

But, there is something that can be done by hospitals and specialist centres. They can approach these fledgling digital insurers and takaful operators with a 'friendly' third party administrator, if there is such a thing, and propose to partner in the provision of high coverage medical insurance products for the general public at affordable prices. Get rid of the Big Three's (AIA, PRU and GELM) monopoly and the other mini kootus (Allianz, Hong Leong Assurance etc.).

APHM (private hospitals association) and the specialist centres can tell the DITOs and TPAs, "we'll 'promise' or at least try to keep our costs low but you guys need to do something for us. Get rid of the inner limits and just compete on annual/lifetime limits and R&B, but make them all above 1 mil coverages with or without deductibles/co-pays for all medically necessary treatments/procedures. Cover all medical devices/surgical implants, advanced treatments/procedures, with no exclusions and include coverage for all age groups and pre-existing conditions - no linking of R&B coverage with coverage for treatments/procedures, every type of R&B gets the same level and type of medical care. In exchange, the hospitals and specialists will lower the margins embedded in hospital supplies and services and push some of it back into R&B pricing."

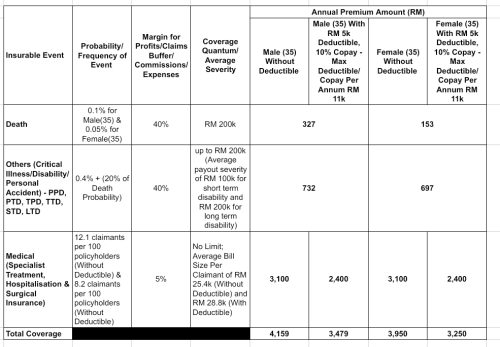

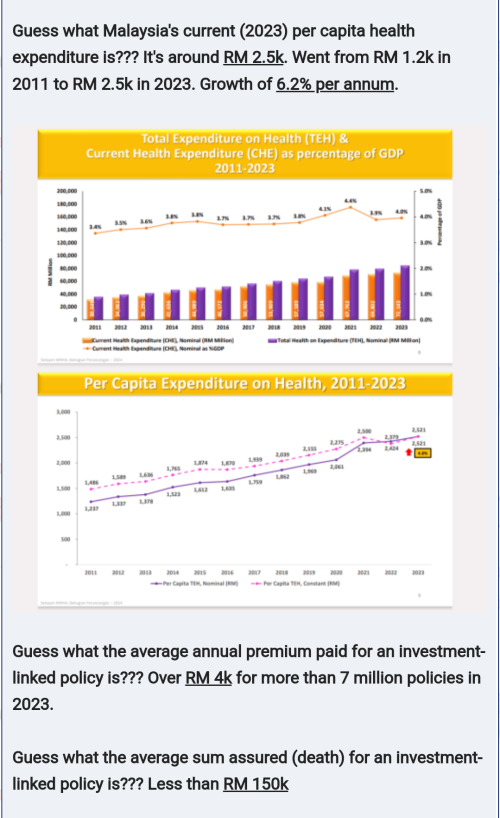

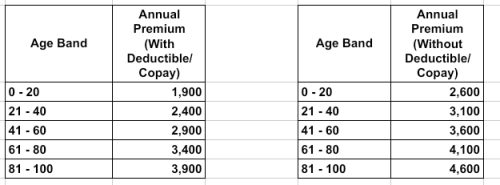

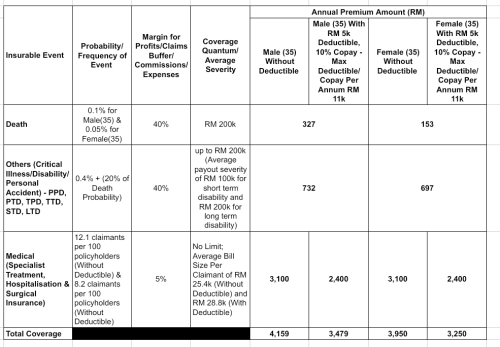

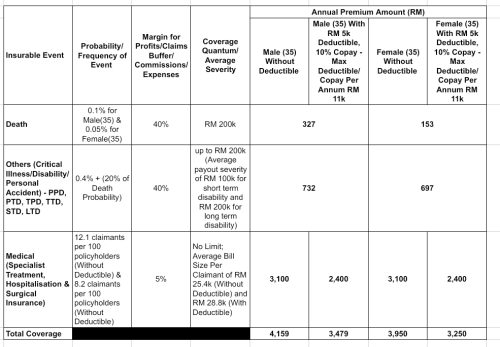

Something tells me that even if all age groups and lives with pre existing conditions were covered, the product would still be affordable. It only costs RM 3100 for a 35 yr old to have a full cover medical card with 12.1 claimants per 100 policyholders and average medical bill size per claimant of RM 25.4k.

Just looks at the ridiculous amounts the BIG three are earning in net profits.

Over RM 23 billion within 6 years (2018 - 2023). And they managed to pay out nearly RM 13 billion in dividends/capital reduction during that period. The funny thing is GELM made RM 6.2 billion during the same period and paid out the same amount in dividends. 100% dividend payout - if earnings account for adjustments.

Since nothing much the public like us can do, what's your advise on reducing the impact for high-cost and forever increasing premium?

I've seen you've mentioned :

1. Don't take ILP Medical Plan.

I've check with a few agents, nowadays most of the available plan is ILP, not much Standalone plan available nowadays.

2. Take something with Co-Pay or "High-Deductible". (Which is not available in most of the lower tier plan)

3. Any ITO to avoid? I've seen you've mentioned GE , despite they are the cheapest in the premium.

What about the other companies, PRU? AIA?

This post has been edited by 1234_4321: Apr 21 2025, 05:44 PM

Apr 21 2025, 07:13 AM

Apr 21 2025, 07:13 AM

Quote

Quote

0.0229sec

0.0229sec

0.58

0.58

6 queries

6 queries

GZIP Disabled

GZIP Disabled