QUOTE(adele123 @ Apr 20 2025, 01:58 PM)

Answering your question.

1) the level premium is legit if you assume medical inflation remains zero which is impossible. So the answer, nope not legit.

2) no solution.

3) should ask your agent. But based on older plan, usually low or no deductible. But GE current on shelf plan has 2.5k and 5k.

Just a reminder that ITOs are for-profit companies but it is also heavily regulated. If by this definition, then banks are evil too.

Will ITOs continue to raise prices? Ya, if medical claims continue to increase. After all, the ITOs are not in it to run a losing money business. What you hope is they work hard to pay the right claims, catch the customers who make fraudulent claims. Which one? Dunno…

Thanks

1) Then they SHOULD not be allowed to sell ILPs saying that it will sustain the premium over the years. Knowing the answer is no due to inflation. Misrepresentation. Banks are evil but if they say you’re going to get 4% returns on your 20 year FD placement, regardless of the state of economy, in year 15 you will still get 4%! But this isn’t the case for insurance. wtf BNM

2) 😂

3) problem with agents, every time see them also wanna increase. I don’t want to increase I want to retire. Which means optimization of my expenses. Clearly agents are NOT ALIGNED to MY NEEDS. They just want to increase the premium for their pockets.

QUOTE(Ramjade @ Apr 20 2025, 02:18 PM)

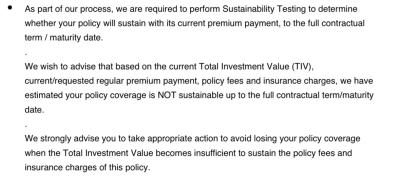

Can sustain only 100 years old is only a dream. If you see the projection table by the insurance company at 2%p.a and 5% p.a (as mandated by BNM) you can see that in actual fact it cannot sustain until 100 years old. Some where down the line 70-80y time, your ILP will run of of cash value. If you don't inject say say 50-100k of cash, no way it can sustain you.

Remember with ILP you are paying the insurance to invest for you to actually able to sustain you until the age require. For them to do that they need to invest to get about the 5%p a rate consistently. Can that happen? I don't know. I have look though lots of ILP and majority can't even match EPF returns, so you tell me.

That's why I don't bother with ILP but rather than let them invest for me, I invest it myself and just buy pure insurance. No investment part from them as I feel it's not worth me paying them money if they cannot even generate a decent return. Basically in plain English why pay them when you can do a better job yourself.

If you haven't claim, you are still in luck as you can still buy standalone. Standalone is just plain insurance without the rubbish investment. You take the savings and dump it into EPF which will generate better returns than whatever the insurance company can do.

Your choice.

Which standalone direct to consumer medical insurance can cover up to 80? Or 100? With an annual limit of min ~RM1m and no lifetime limit. With guaranteed renewal?

The issue I have, reading the fine print, is that they start your policy at age 40, but there’s no guaranteed renewal, then they drop you off at 60 despite you have 0 claims. Then you are fked.

I’ve been looking at all the direct to consumer ones… we don’t really have many choices.

My goal is never having to use the insurance until the day I die. I think policies with >RM5 million annual coverage is perpetuating the issue of rising medical costs and stupid. Bloody hell if you need to spend RM5 million on medical bills in a year you’re probably bionic man already with all the work done to you. I rather go YOLO and live the last of my days than to be bedridden, pissing myself off and either in pain or high as a kite.

Apr 20 2025, 01:42 AM

Apr 20 2025, 01:42 AM

Quote

Quote

0.0256sec

0.0256sec

0.59

0.59

7 queries

7 queries

GZIP Disabled

GZIP Disabled