QUOTE(Wedchar2912 @ Apr 21 2025, 10:49 PM)

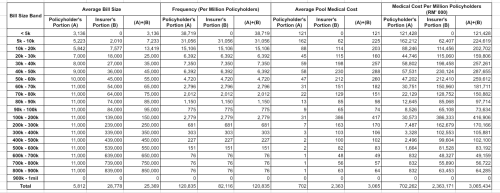

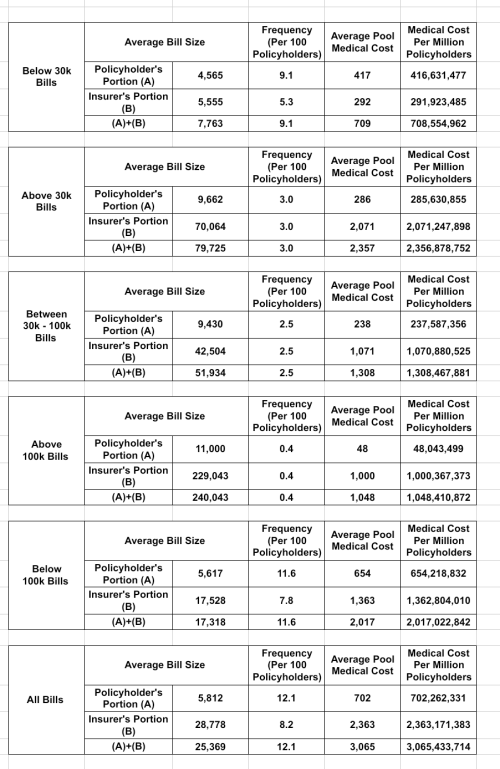

It's interesting cos I always suspected that the super high annual limits are just for "show" in that for cases that require such expensive treatment, the illness should be either very fatal, excluded or very rare.

Need to clarify this. Two things can be true at the same time. The super high annual limits can be mostly just for show if the ITOs keep denying or delaying high claims but they can also be medically necessary, viable and for infrequent events.

As agents need to sell their products, they would naturally be dying to tell you: "my group/ITO got client, cancer/heart disease claim 1.5 mil, really advanced treatment, la di da da cleared". If you don't hear such stories, they you know it's mostly for show as there is no "street talk" of such cases. Even if the frequency of such claims is really small, it's still a major selling point.

Having said that, you're buying a long term product, and while there may or may not be such high cost advanced treatments now, there will definitely be such treatments in future.

So, when you buy a long term policy, you have to, in a sense, gauge whether it is future proof.Part of the current problem is that it is difficult for a lay consumer to evaluate the product's inner limits to understand how well the policy would cover both their present as well as in future medical needs. Consumers don't understand - nor should they be expected to - what exactly falls under post hospitalisation or outpatient treatments.

It's reasonable for them to expect all medically necessary post hospitalisation and outpatient treatments to be covered, especially if they've bought a really high annual limit product.

No point in just clarifying within the product disclosures outpatient as covering kidney and cancer treatments. What else falls under outpatient but is not covered and hasn't been properly disclosed??? Why limit post hospitalisation to only 3 months? Why time bar it in the first place when it could be medically necessary???

There are lots of expensive outpatient treatments and what if, in future, heart disease treatment can also be done on outpatient basis. Then what? Are consumers expected to wait for the ITO to issue a circular notifying coverage???

And then we have these really silly and unfair exclusions on prosthetics, medical devices, blood/plasma and other medical supplies.

There are people out there taking quarter million loans just to purchase prosthetics and the need for blood/plasma can be ever present in many surgical/non-surgical treatment situations and are expensive. Is it a fair contract term to imply "besi implant cover, lain semua tak cover. Blood/plasma kau tanggung"????? Are prosthetics, medical devices, blood/plasma not medically necessary???

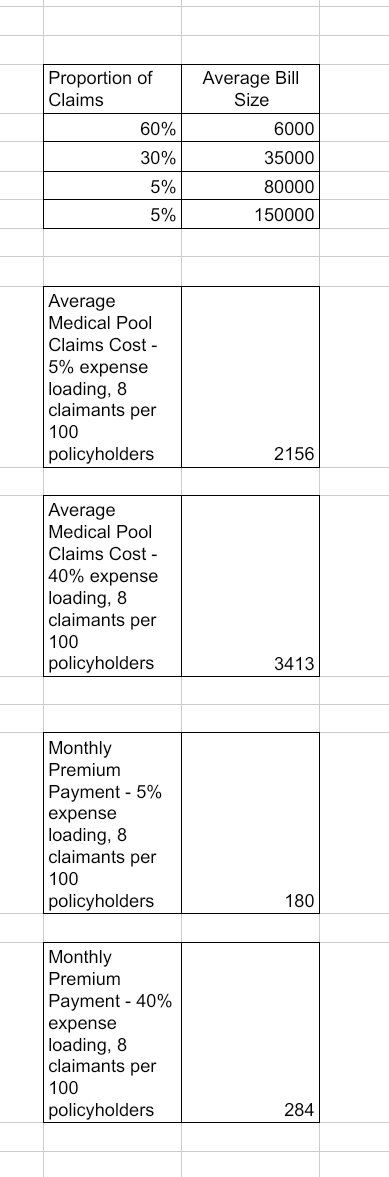

So, while attention needs to be paid on whether the high annual limits are actually a gimmick and have no true value, I would argue that it is more important to actually gather info from agents and the ITOs on what sub 100k treatment/procedures that technically, from a contract standpoint, should be covered, but in practice are not actually covered by the ITO. A majority of robotic surgeries can be done between 30 and 100k but quite a number of them have not been covered until recently.

Make no mistake, the purpose of medical insurance is especially to cover for these above 30k bills. So please be vigilant and enquire more.

I think it's high time that major hospital groups like Sunway, IHH, KPJ, and Asia Onehealthcare either join forces and get a TPA with some digital insurer to issue their product propositions or these 4 champion horsemen of the apocalypse find their own separate TPAs and digital insurers and get it done. Just issue standard cradle to grave yearly renewable family packages covering medically necessary care and all pre-existing conditions and forget these nonsensical inner limits - have high deductibles as that is pretty much the only way to keep the products affordable. The ITOs cannot be having a monopoly on medical insurance products when they are being strangled by the agency force and bloated expense and profit structures.

This post has been edited by hafizmamak85: Apr 22 2025, 08:32 PM

Apr 21 2025, 09:33 PM

Apr 21 2025, 09:33 PM

Quote

Quote

0.0201sec

0.0201sec

0.55

0.55

6 queries

6 queries

GZIP Disabled

GZIP Disabled