QUOTE(hafizmamak85 @ Mar 20 2025, 02:47 PM)

If you don't stick to your premium payment schedule, there is the risk that you would not be able to later claim that the policy is not performing according to expectation when it is unable to meet all those high cost of insurance charges, esp. at the older ages but also before then, as a lot of these older policies and even some of the current ones, have high investment return rates assumed in the pricing (which allowed for the lower premiums). These high rates are not sustainable. You can then claim that it is the insurer or takaful operator who is responsible and should foot the bill. If you plan on investing your spare cash that should have gone to paying premiums in an ETF outside the insurer, then why bother having an investment-linked policy in the first place?

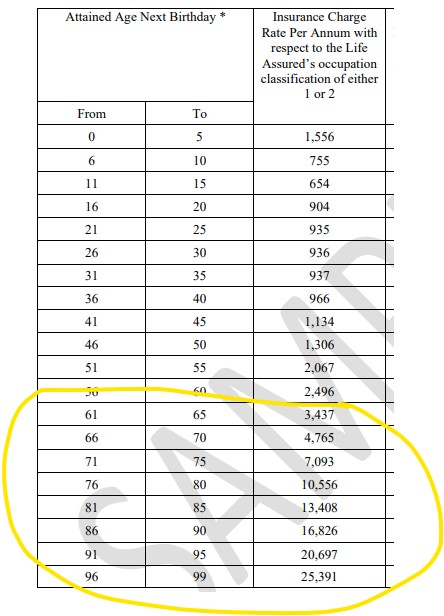

What insurers and takaful operators have sneakily done is to reduce the policy coverage term to ages 70 or 80, compared to the previous term of 100 years+, and thereafter operate the main policy and medical rider on a renewal basis up to ages 100 and above. The way the policies are currently priced, it is highly questionable even as to whether the policy can be sustained up until the end of even the shorter policy terms.

The original sins are the high investment return rate assumptions and the unsubstantiated and ridiculously priced high cost of insurance charges at older ages. This needs to change.

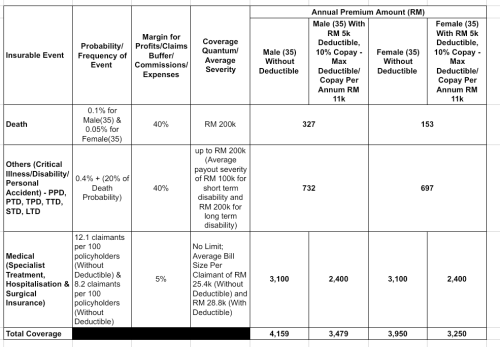

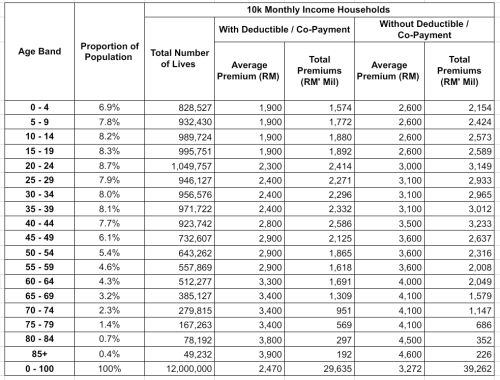

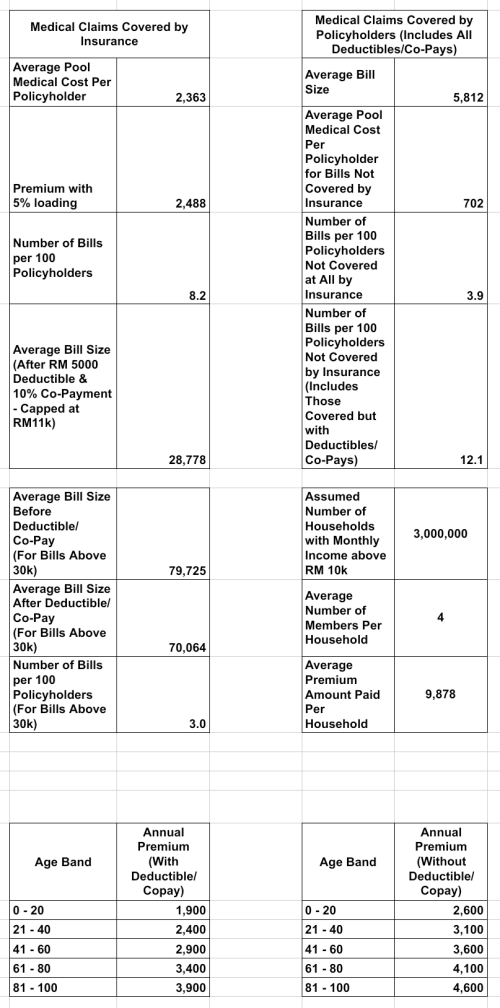

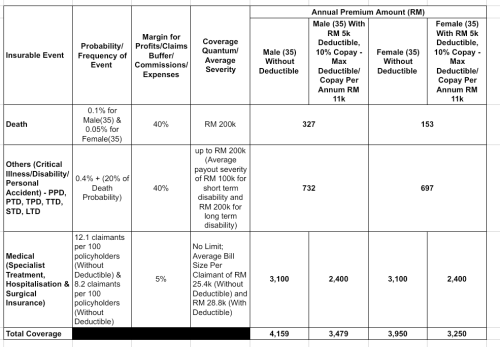

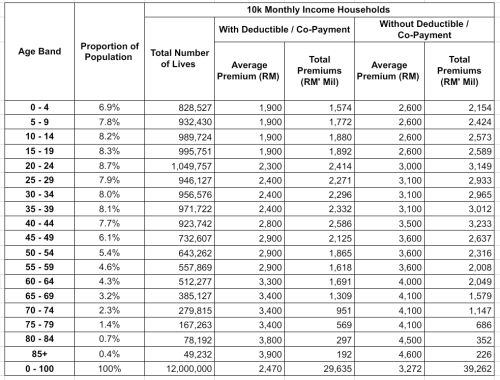

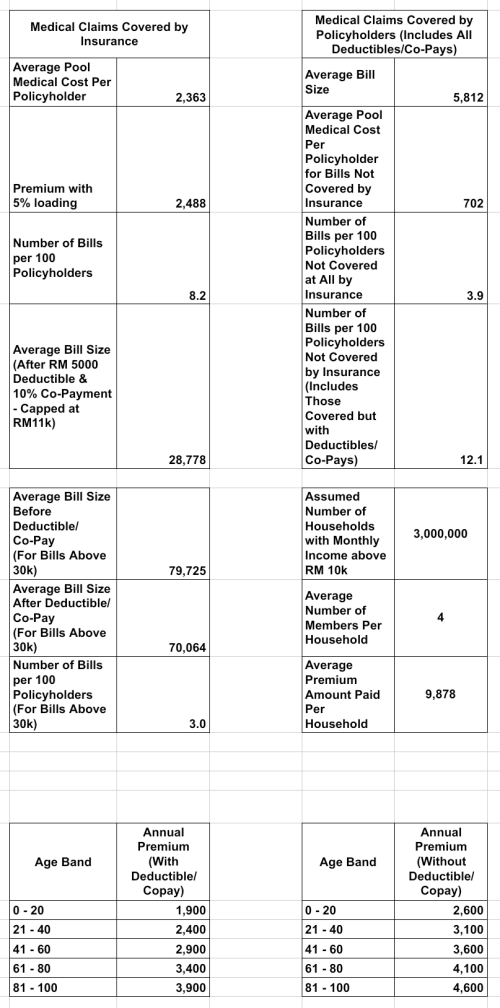

Medical Inflation is a poor excuse.A medical policy with 12.1 claimants per 100 policyholders and average claim amount of RM 25.4k and with a five percent margin for expenses only cost RM 3100 for a person ages 35.

1) If you don't stick to your premium payment schedule, there is the

risk that you would not be able to later claim that the policyMy comments : The bolded part is a risk that insurance will say to me? Just say it happens, can I say this affects everyone in the pool of my plan and not just me? Or is it me only because I never stick to premium schedule? ( I understand your points further down the sentence)

2) If you plan on investing your spare cash that should have gone to paying premiums in an ETF outside the insurer, then why bother having an investment-linked policy in the first place?

My comments : Just say i made a mistake by buying ILP. I cannot U-turn back whatever mistake that has been done. I do not want to change standalone because all kind of consideration (like waiting period, medical underwriting, even none of those , new plan later will say cannot claim after performing investigation down the road when claim time and give all kind of medical exclusion reason due to new plan date). I also cannot just give up since i need protection. Also only recently, i am more savvy with financial, hence thinking of ways to prevent more mistake that pours more money into this ILP investment portion, hence that is why i ask if stop paying premium is any danger or concern since i read policy will not lapse if stop paying premium but still will deduct investment portion.

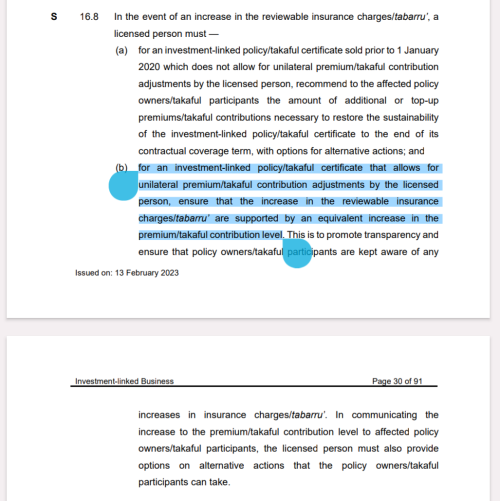

3) Whatever happen, it should affect everyone (most of the time), we are at mercy of it. Like example recent bank negara announce insurance charge hike fiasco, everybody COI will increase 10% irregardless standalone or ILP and i don't believe insurance company can cheat because if I have previous COI charges before increase, I will know the increase COI of 10% is it real or not.

4) Thanks for your detail tables but i don't understand. Is it the last table, you mean COI for 41-60 with deductible should be around 2900?

This post has been edited by Andr3w: Mar 20 2025, 03:57 PM

Mar 15 2025, 12:02 AM

Mar 15 2025, 12:02 AM

Quote

Quote

0.2878sec

0.2878sec

0.26

0.26

7 queries

7 queries

GZIP Disabled

GZIP Disabled