QUOTE(cms @ Mar 28 2025, 09:59 AM)

Perhaps one of the consideration point for the big pricing increase is the vastly different in features of SMX and ILHP.

From the screenshot, im assuming the SMX has annual limit of 117k with unlimited lifetime limit. Whereelse the ILHP has 50k annual limit and 200k annual lifetime.

The SHP should be in the range of RM 3-5 mil annual limit and unlimited lifetime limit. As for the other benefits table would need further comparison.

Now to the question if its worth it or not, im not sure as im not involved in pricing or RI business. But as a consumer if i am looking for more comprehensive protection, i would compare with a quote from another policy, waiting period etc, is my coverage sufficient, affordability etc etc

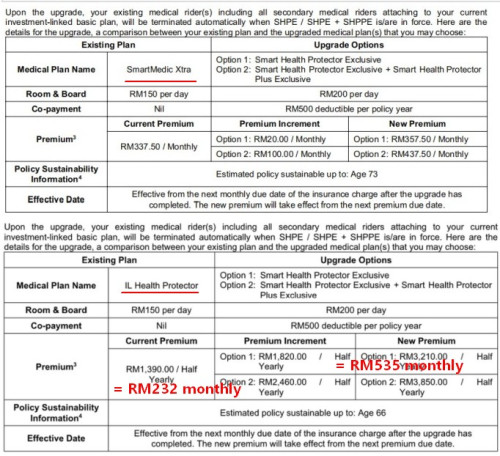

There isn't a vast difference in coverage or features between the SMX and ILHP policies, once the upgrade to SHP is taken into account.

The ILHP policy, post upgrade to SHP, is required to pay RM 535 per month or an

additional RM 180 per month (RM 2.2k per annum) for essentially an extra 50k in death and accidental benefits, compared to SMX's post upgrade monthly premium of RM 337.5. This part needs to be appreciated.

Perhaps it is due to the ILHP base (excl. medical) coverage - death, critical illness, accident benefit, waiver of premium - having higher cost of insurance charges compared to the SMX policy.

Policy 1 (SMX): 50k death benefit, 50k critical illness & early payout critical illness benefits, hospitalisation GL/reimbursement (SMX & extension of coverage until age 99), hospitalisation benefits, waiver of premium (disability & critical illness)

RM 337.5 per month (current premium)

RM 357.5 per month (post SHP upgrade)

Increment: RM 20 per month

Policy 2 (ILHP): 100k death benefit, waiver of premium for death & TPD, 50k critical illness benefits, hospitalisation GL/reimbursement (ILHP), 50k accidental benefits

RM 232 per month (current premium)

RM 535 per month (post SHP upgrade)

It really is frustrating to see people wanting better coverage for hospitalisation but end up paying so much more just because they have an old policy and are forced to upgrade within a bad basic plan that has very high cost of insurance charges.

In such situations, I would implore policyholders to be open to surrendering their old policies and purchasing a new one altogether if they truly wished to have better hospitalisation coverage.

Let's face it, the usual suspects when it comes to hospitalisation policies is going to be either AIA, GE, PRU or one of the smaller kutus such as Allianz or HLA. These are the main contenders. And every one of them will have a different underwriting and claims philosophy.

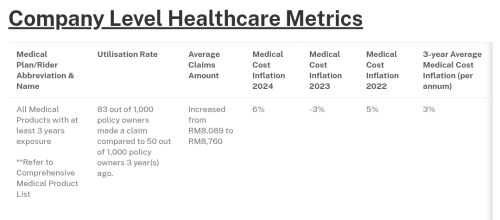

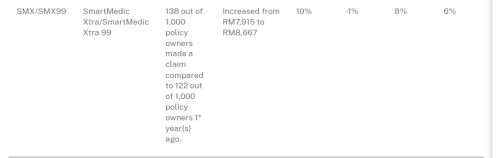

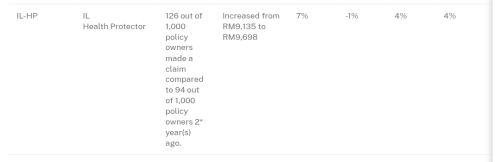

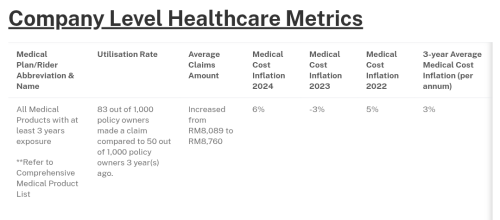

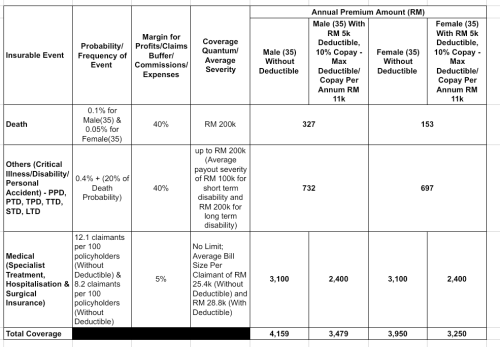

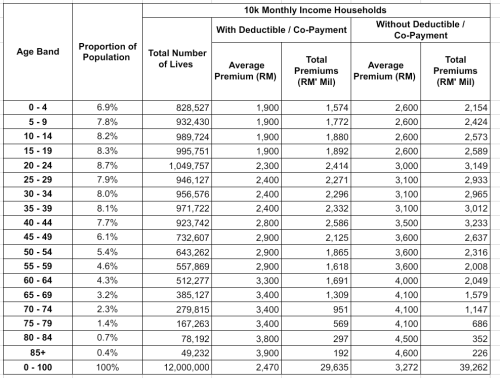

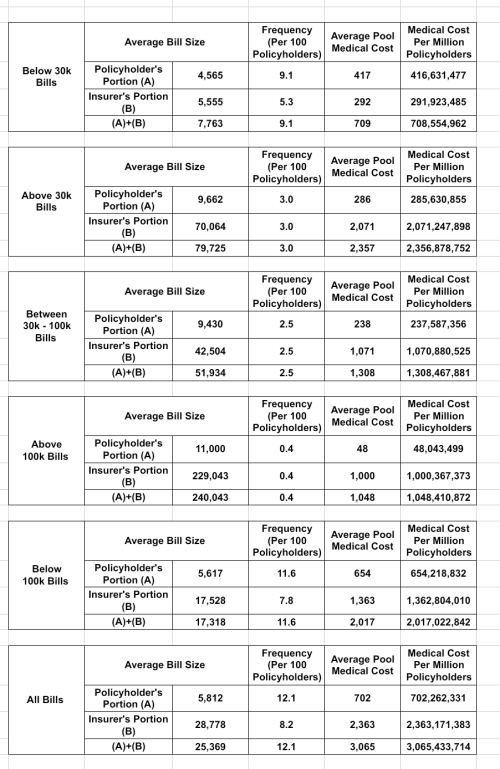

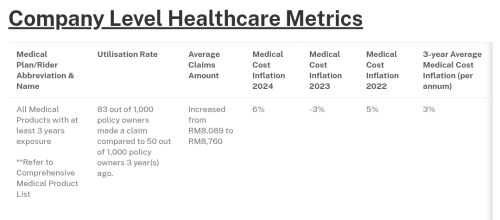

Price is only one aspect that needs to be appreciated. The other aspect, and one that I would argue is more important, is the payout. How much is getting paid out - number of claimants per 100 policyholders and the average claims amount per claimant - is what needs to be asked.

Higher frequency of medical claims and average claims amount indicate a less restrictive claims department. No one wants to purchase an expensive hospitalisation policy only to be later told to pay first and claim later or have impositions on treatment types and other exclusions.

Great Eastern fairs poorly, I would give it a C grade, in this area for only having an average pool medical cost of less than RM 1000 (RM 730). No GE medical policy, with a large number of policies or high claims frequency profile, has got an average claims amount of more than RM 11k.

Prudential, on the other hand, has a got a claim frequency of 7.4 claimants per 100 policyholders and an average claims amount per claimant of RM 14.7k for its PRUHealth plan, which brings the average pool medical cost close to RM 1100. I would give this a B grade.

So, always ask your agent, prior to purchase or upgrade, about the hospitalisation plan's claim frequency and average claims amount per claimant.

Insurer to raise medical premiums ‘because of increase in claims’This post has been edited by hafizmamak85: Apr 3 2025, 10:52 AM

Mar 27 2025, 09:37 PM

Mar 27 2025, 09:37 PM

Quote

Quote

0.0214sec

0.0214sec

0.53

0.53

6 queries

6 queries

GZIP Disabled

GZIP Disabled