QUOTE(JIUHWEI @ Jul 10 2023, 11:35 PM)

Hi bro,

You see the

"Net Surrender Value" there?

That's your answer.

» Click to show Spoiler - click again to hide... «

Beyond that, I can't help you.

Because I don't know you.

I don't know your financial situation, I don't know what your expectations are, I don't know the purpose this policy was put in place to achieve in the very beginning.

Until we conduct a thorough interview, this policy is just a policy loh.

You may read through the policy contract to understand the policy and how it works.

Is it relevant or not... You be the judge after you read through, because you would know yourself best.

QUOTE(denion @ Jul 11 2023, 12:40 PM)

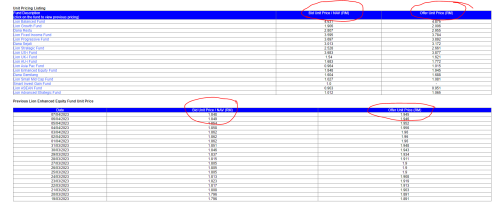

hi kuwy86, if you surrender you will get the

total amount here of 30k. i will advise you to keep the plan actually. it still has the life insurance coverage, should you need any life insurance in the future, can contra from here.

hi poweredbydiscuz, i do agree it is confusing. for GE, the net surrender value doesn't include bonuses. so why is it call Net Surrender Value.

the Net Surrender Value here is Surrender Value - any unpaid premium (+ policy loan interest).

So when you surrender a GE traditional policy, it will be

Net Surrender Value + any other bonuses (except for Revisionary Bonus which is only paid out upon policy maturity OR upon death of life assured)

QUOTE(lifebalance @ Jul 11 2023, 01:57 PM)

» Click to show Spoiler - click again to hide... «

What's the declared bonus for last year?

If your parents not >Age 55 yet, they may not be able to withdraw the money if you need to "use" it for any emergencies if you decide to put into their EPF account.

Since this is a whole life policy, you can consider to keep if the coverage amount is still sufficient.

But if you've decided to use the money elsewhere, there's no harm doing so, after all it's your money.

Since this policy comes with the Cash Bonus, the surrender amount should be the

Nett Surrender Value + Cash Bonus as others have pointed out.

You may check if you do get any maturity benefit should you decide to keep the policy till maturity.

Seems like there were a few posts that contradict with you reply. Any response on that?

Apr 7 2023, 08:56 AM

Apr 7 2023, 08:56 AM

Quote

Quote

0.0326sec

0.0326sec

0.59

0.59

7 queries

7 queries

GZIP Disabled

GZIP Disabled