QUOTE(jhodyj @ Apr 20 2021, 09:03 PM)

https://www.thestar.com.my/news/nation/2021...surance-companycame across this news just now. The lady didnt delcare she has depression when she apply for insurance and few years later, the lady got cancer and insurance company reject her claim because she didnt declare her depression.

If i visit clinic because i sakit perut/sakit kepala but i didnt declare when apply insurance, will insurance company reject my claim if i am hospitalized in the future?

The issue is not about the cancer critical illness payout but rather; the issue of non-disclosure.

Insurance Contract runs on Principle of Utmost Good Faith.

What is the principle of utmost good faith?

1. The principle of utmost good faith, uberrimae fidei, states that the insurer and the insured must disclose all material facts before the policy inception.

2. Facts which may enhance the level of risk are called material facts.

3. The insurer or insurance company needs to declare all public disclosures and investment strategies while the insured needs to declare health condition, family medical history, lifestyle, food habits, smoking and alcohol history etc.

4. In case of non-disclosure or misrepresentation of material facts, the policy can be considered null and void.

5. This principle applies to both life insurance and general insurance policies.

The insurance company could have choose to

NOT accept the applicant's application back then if she had declared all her health status for the insurance company to consider her application whether to accept her risk or not.

below is an expanded explanation by Limster88 on the Principle above.

QUOTE

And yes, insurers adopt the utmost good faith concept in approving policies. This is also in line with PDPA regulations. After all, if you are honest upfront, there's nothing to worry about right? An insurance policy is just a contract, so the insurer is bound by it if the premise of the contract is valid.

The government also do not want the insurers to willy nilly obtain and keep people's personal health information, so this is the current practice. Not all policies will turn into claims, so there is no need for insurers to be so intrusive and check everyone's health background. You think that the insurers don't want to get everyone's information? Given the chance they definitely want to. More information means more accurate actuarial projection, means better pricing and competitiveness.

Long ago, before PDPA laws came into force, we used to have this LIAM system, where insurers will share with each other on the health conditions of their clients. There is no escape. If you are rejected by company A, then you try to apply with company B, you will also be rejected coz they also know about the health conditions too.

Then came PDPA enforcement and all these ended. Now the industry had to operate on a more limited information and therefore had to start trusting their customers based on utmost good faith.

The only time the insurer has expressed approval to check everything regarding to your medical background is during claims, because this is the only time that PDPA rules allow them to fully access your medical records. So you can be sure that if you do not disclose information to your insurer and they find out about it, it will then go to post claims underwriting, where we will re-underwrite the application again, assuming that if we know about the condition in the first place, what will the underwriting decision be.

----------------

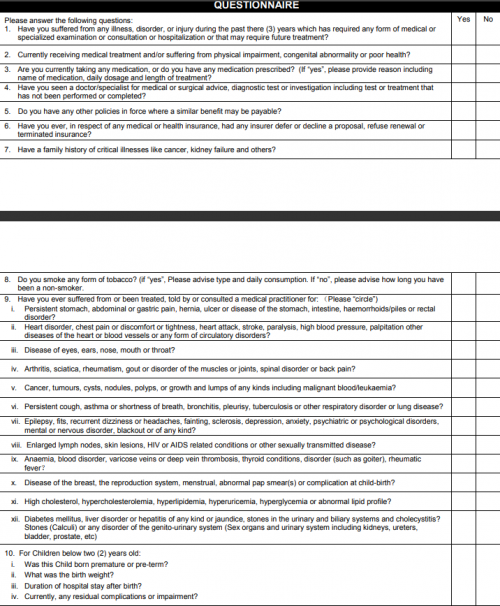

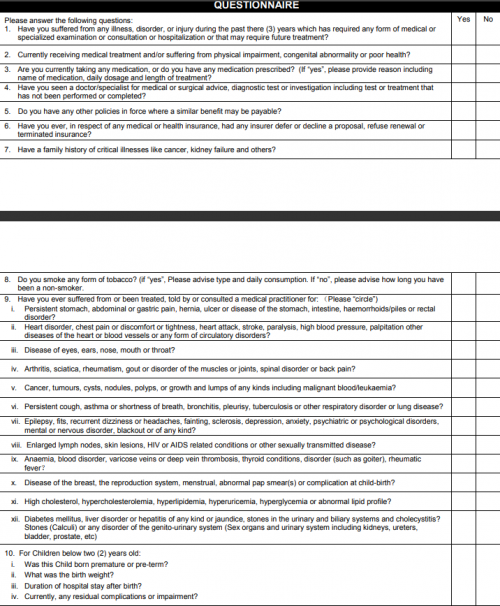

With that being said, as long as you can answer the questions below truthfully, there should be no problem

QUOTE

If i visit clinic because i sakit perut/sakit kepala but i didnt declare when apply insurance, will insurance company reject my claim if i am hospitalized in the future?

Apr 19 2021, 05:58 PM

Apr 19 2021, 05:58 PM

Quote

Quote

0.0167sec

0.0167sec

0.26

0.26

6 queries

6 queries

GZIP Disabled

GZIP Disabled