QUOTE(Hedgychat @ Apr 13 2021, 01:14 AM)

Hi all! Would like to ask, how do I decide how long should my insurance sustainability period be?

Most insurance agent that I talk to recommend a plan with sustainability until I am age 70, aka same premium until age 70. But I understand that the fixed premium is sustain frm cash value in the investment link product.. And may need to top up if the funds is finish..

Im only 24yrs old now. If I'm confident in doing my own investment, is it advisable for me to opt for maybe shorter sustainability ie until 50 yrs old, so that I pay lower premium, and use the extra amount for investment so that I can afford the higher premium when I extend my sustainability later on?

What are the cons of short sustainability period? If someone can elaborate?

The purpose of a sustainability period is to ensure that whatever the premium that you're paying for the insurance will sustain until the particular term of coverage.

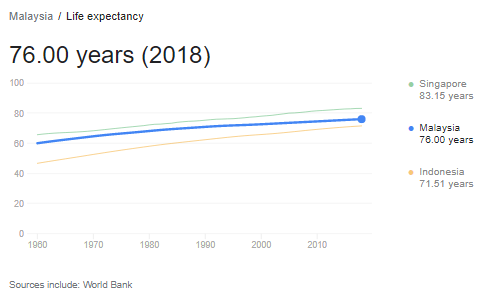

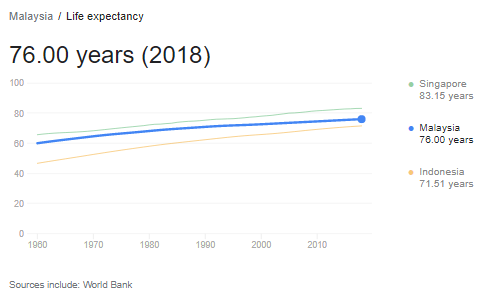

Based on the average Malaysian lifespan, it's about 76 years old so it's recommended to insure until that age otherwise if you're having plan to pay out for your next of kin at that point of time but your policy had already expired, then it's too bad your insurance policy will not have any payout. From the medical point of view, you'd want to make sure you are covered until that age as well to pay off any medical cost as the older you get, the more health problem you'll encounter and you'd not want to break your bank account which is mostly your retirement money.

With a lower sustainability, you'll have a cheaper policy but don't think that's a great thing because if you choose to top up later at that point of time, you may be required to pay a much more higher premium than if you had started a policy with a longer sustainability and paying a slightly higher premium due to the snowball factor.

You can't cheat the insurance system and there is no shortcut behind them, all of it is already pre-calculated by the actuarial.

This post has been edited by lifebalance: Apr 13 2021, 01:27 AM

Apr 12 2021, 08:55 AM

Apr 12 2021, 08:55 AM

Quote

Quote

0.0338sec

0.0338sec

0.32

0.32

6 queries

6 queries

GZIP Disabled

GZIP Disabled