QUOTE(dwRK @ Feb 28 2024, 07:58 AM)

ok, if not sufficient fund, then cannot buyInteractive Brokers (IBKR), IBKR users, welcome!

Interactive Brokers (IBKR), IBKR users, welcome!

|

|

Feb 28 2024, 08:42 AM Feb 28 2024, 08:42 AM

Show posts by this member only | IPv6 | Post

#7521

|

Senior Member

5,741 posts Joined: Apr 2019 |

|

|

|

|

|

|

Feb 28 2024, 11:54 AM Feb 28 2024, 11:54 AM

Show posts by this member only | IPv6 | Post

#7522

|

Newbie

11 posts Joined: May 2013 |

|

|

|

Feb 28 2024, 01:24 PM Feb 28 2024, 01:24 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(vernontan @ Feb 28 2024, 11:54 AM) Yup, full refund, save for the -0.01 USD "fee" vernontan liked this post

|

|

|

Feb 28 2024, 06:29 PM Feb 28 2024, 06:29 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Having fun with WCRS function on Bloomberg to compute carry trade returns using different currency pair... Look at MYR...  MasBoleh! liked this post

|

|

|

Feb 28 2024, 06:30 PM Feb 28 2024, 06:30 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

This is using SGD as base currency.

|

|

|

Feb 29 2024, 04:57 AM Feb 29 2024, 04:57 AM

Show posts by this member only | IPv6 | Post

#7526

|

Senior Member

5,741 posts Joined: Apr 2019 |

Anyone knows if 6 to 7 digit amount of funds in IBKR.. When withdrawing won't have any issues?

They're definitely funds which have paid tax. I don't want to see problems where it's frozen by banks or there are issues happening. Hence. Till today I never dare to park so much funds outside a country that'll go back to my bank account eventually. |

|

|

|

|

|

Feb 29 2024, 09:27 AM Feb 29 2024, 09:27 AM

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(gashout @ Feb 29 2024, 04:57 AM) Anyone knows if 6 to 7 digit amount of funds in IBKR.. When withdrawing won't have any issues? just keep your paperwork n paper trails... why worry if you have nothing to hide?They're definitely funds which have paid tax. I don't want to see problems where it's frozen by banks or there are issues happening. Hence. Till today I never dare to park so much funds outside a country that'll go back to my bank account eventually. kena audit is part of life... This post has been edited by dwRK: Feb 29 2024, 09:29 AM |

|

|

Feb 29 2024, 09:29 AM Feb 29 2024, 09:29 AM

Show posts by this member only | IPv6 | Post

#7528

|

Senior Member

5,741 posts Joined: Apr 2019 |

|

|

|

Feb 29 2024, 10:11 AM Feb 29 2024, 10:11 AM

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(gashout @ Feb 29 2024, 04:57 AM) Anyone knows if 6 to 7 digit amount of funds in IBKR.. When withdrawing won't have any issues? I also worry about this. but the fact is if you are not cashing out today, things may change drastically in -n years time. They're definitely funds which have paid tax. I don't want to see problems where it's frozen by banks or there are issues happening. Hence. Till today I never dare to park so much funds outside a country that'll go back to my bank account eventually. Or if you really reach 7 digits USD maybe you want to FLY to IBKR Office and open a local bank account there AND SPEND IT there instead? That's what I think. My default plan if I live and mentally aware until 80 is I will withdraw 5 figure MYR per quarter when I am 60, hopefully it won't trigger too much issue. If issue come out I will fly to Singapore (where my IB account is currently domiciled) and manually intervene. I suppose there are far too many Malaysians in Singapore with 6-7 figure MYR that want to cross the border back, there should not be too big of a hassle. |

|

|

Feb 29 2024, 10:23 AM Feb 29 2024, 10:23 AM

Show posts by this member only | IPv6 | Post

#7530

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(lee82gx @ Feb 29 2024, 10:11 AM) I also worry about this. but the fact is if you are not cashing out today, things may change drastically in -n years time. That sounds like a plan. Appreciate this. Or if you really reach 7 digits USD maybe you want to FLY to IBKR Office and open a local bank account there AND SPEND IT there instead? That's what I think. My default plan if I live and mentally aware until 80 is I will withdraw 5 figure MYR per quarter when I am 60, hopefully it won't trigger too much issue. If issue come out I will fly to Singapore (where my IB account is currently domiciled) and manually intervene. I suppose there are far too many Malaysians in Singapore with 6-7 figure MYR that want to cross the border back, there should not be too big of a hassle. |

|

|

Feb 29 2024, 10:47 AM Feb 29 2024, 10:47 AM

|

Senior Member

3,494 posts Joined: Jan 2003 |

|

|

|

Feb 29 2024, 01:14 PM Feb 29 2024, 01:14 PM

Show posts by this member only | IPv6 | Post

#7532

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(Medufsaid @ Feb 29 2024, 10:47 AM) using CIMB SG->MY internal transfer should suffice I think Cimb sg to Cimb MY is a great tool. I just checked with some of my friends working in Spore and family in Malaysia they use this method too. also, see if can modify from IBKR individual account to "joint account" (for that live & aware until 80) The joint account with survivorship control was another option but last I checked it was not trivial to do even within IB itself (transferring stocks or cash from single to joint ownership). |

|

|

Feb 29 2024, 02:31 PM Feb 29 2024, 02:31 PM

|

Senior Member

6,230 posts Joined: Jun 2006 |

|

|

|

|

|

|

Mar 3 2024, 09:48 PM Mar 3 2024, 09:48 PM

Show posts by this member only | IPv6 | Post

#7534

|

Junior Member

863 posts Joined: Apr 2019 |

QUOTE(TOS @ Nov 17 2022, 11:03 PM) For those of you seeking short-term (1-3 month) ultraliquid USD parking facility in IB, I found several US 1-3 month Treasury bill ETFs like BIL and SGOV. Hi would like to ask some clarification. Assume you adjust SMART routing to VLow (High volume exchange with lowest fee), you can get your trades executed with as low as 0.24 USD instead of the usual "0.35 USD". BIL is liquid but expense ratio is high at 0.14% p.a., SGOV's expense ratio is low but that is due to temporary fee rebate by BLK which would terminate on 30th June 2023 (after which it would be around 0.14-0.15% p.a., on par with BIL). Moreover, SGOV has about 6% asset exposure in its own institutional cash fund which has Treasury floating rate notes and introduces additional counterparty risks with banks like Citi, Credit Agricole etc. So, not truely "risk-free". I did some IRR calculations and found that you can get returns of about 1.3% p.a. for the 2-month holding period, factoring 30% WHT for the monthly distributions and 0.24-0.35 USD commissions, charged twice (once during purchase, once during sell). Much lower than contemporary 2-month UST yield, but better than holding everything on cash balance and let IB suck all your interests away I guess. After all, in terms of opportunity costs, there is nothing more "risk-free" than risk-free rates. So, in theory, as long as better than 0% p.a., one should bite. 1.These products are as liquid as cash balance in ibkr in terms of trade turn around? Meaning if i sell today i can use the money in my account to buy stocks soon after? Or do i have to wait for a settlement period? 2. Does the dividend accrues daily by an increase in the NaV and is paid out monthly/ quarterly when it goes ex dividend right? 3. And how did you get only 1.3% annualized? The current t bill should be around 5% and even with a 30% wht you should be getting 3.5% pa? And the dividen eventually gets refunded right? Reason is I have about a 100k and as you know the first 10k usd doesn’t earn anything while the balance currently earns 4.83%. If BiL is almost as good as cash balance while able to earn 4.8% I’ll put all that money in it while I look for stocks to buy. This post has been edited by diffyhelman2: Mar 3 2024, 10:14 PM |

|

|

Mar 3 2024, 10:31 PM Mar 3 2024, 10:31 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(diffyhelman2 @ Mar 3 2024, 09:48 PM) Hi would like to ask some clarification. Hello. I admit that's an old post... November 2022... not all info are correct... To answer your questions:1.These products are as liquid as cash balance in ibkr in terms of trade turn around? Meaning if i sell today i can use the money in my account to buy stocks soon after? Or do i have to wait for a settlement period? 2. Does the dividend accrues daily by an increase in the NaV and is paid out monthly/ quarterly when it goes ex dividend right? 3. And how did you get only 1.3% annualized? The current t bill should be around 5% and even with a 30% wht you should be getting 3.5% pa? And the dividen eventually gets refunded right? Reason is I have about a 100k and as you know the first 10k usd doesn’t earn anything while the balance currently earns 4.83%. If BiL is almost as good as cash balance while able to warm 4.8% I’ll put all that money in it while I look for stocks to buy. 1. For margin account yes, you can sell the holdings and buy stocks thereafter. I think IBKR won't charge you interests. I don't use margin account, you may check with other sifus on that dwRK Medufsaid and Ramjade. For cash account, it used to be T+2 but not sure how things will be after the T+1 settlement cycle comes into place after May 27 this year but definitely for cash account there will be delay of 1-2 days before the cash is available for you to use. 2. Yes, the NAV increases daily and is paid out monthly (start of month). BIL for example has a dividend distribution schedule as stated here: https://www.ssga.com/library-content/produc...on_Schedule.pdf 3. Yea, that's my mistake... I wasn't aware of the refund back then... over the months and years I learnt from others here... Taking into account the lost in time value of money due to the late refund my BIL ETF IRR is around 4.8x% p.a. This 4.8x% is for ALL units of BIL ETF hold, unlike IBKR's own interest scheme which excludes the first 10k USD. By the way, if your portfolio size is as big as 100k USD you should seriously consider buying US T-bills directly... it costs 5 USD per trade but given your fund size, the fees are peanuts when expressed as a percentage of the overall investment, thus you get to keep the bulk of returns... diffyhelman2 liked this post

|

|

|

Mar 3 2024, 10:36 PM Mar 3 2024, 10:36 PM

|

Senior Member

3,494 posts Joined: Jan 2003 |

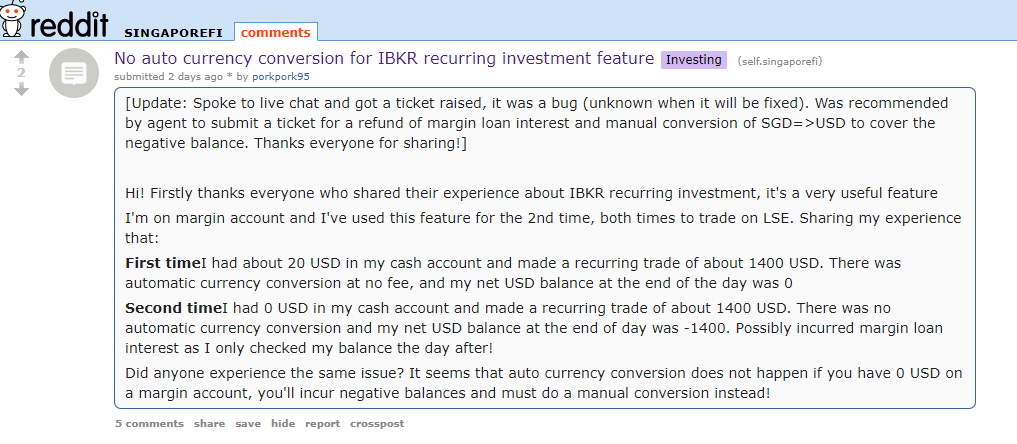

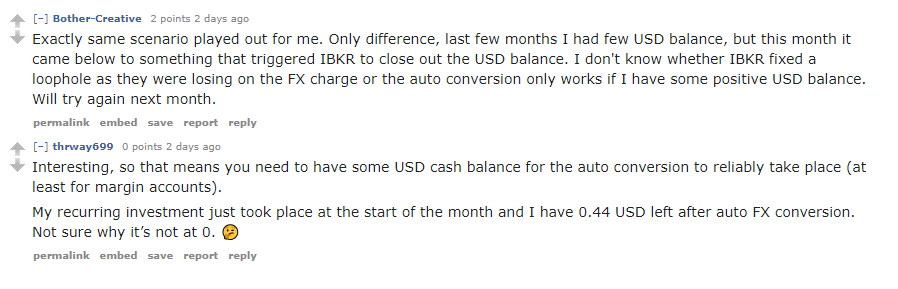

if you have more than $25k in assets, can switch to margin account where u can daytrade without waiting for cash settlement https://www.interactivebrokers.com/en/tradi...rgin-stocks.php i haven't turn on margin trading as there's supposedly a bug affecting half of those who are doing recurring investing (probably fixed by now). funds don't get auto converted from SGD to USD and IBKR assumes they want to borrow USD diffyhelman2 and TOS liked this post

|

|

|

Mar 3 2024, 11:08 PM Mar 3 2024, 11:08 PM

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(Medufsaid @ Mar 3 2024, 10:36 PM) if you have more than $25k in assets, can switch to margin account where u can daytrade without waiting for cash settlement it is not a bug https://www.interactivebrokers.com/en/tradi...rgin-stocks.php i haven't turn on margin trading as there's supposedly a bug affecting half of those who are doing recurring investing (probably fixed by now). funds don't get auto converted from SGD to USD and IBKR assumes they want to borrow USD purpose of margin account is to access margin loans if required problem is you get some noobs who doesn't know shit making fuss out of own ignorance... anyways mine is margin acc... |

|

|

Mar 3 2024, 11:14 PM Mar 3 2024, 11:14 PM

|

Senior Member

3,653 posts Joined: Apr 2019 |

QUOTE(TOS @ Mar 3 2024, 10:31 PM) .... By the way, if your portfolio size is as big as 100k USD you should seriously consider buying US T-bills directly... it costs 5 USD per trade but given your fund size, the fees are peanuts when expressed as a percentage of the overall investment, thus you get to keep the bulk of returns... that should also include US notes and bonds right? This post has been edited by Wedchar2912: Mar 3 2024, 11:20 PM |

|

|

Mar 3 2024, 11:14 PM Mar 3 2024, 11:14 PM

|

Senior Member

3,494 posts Joined: Jan 2003 |

dwRK do refer to my post below

QUOTE(Medufsaid @ Oct 7 2023, 05:03 PM) possible bug on IBKR. even so, if u manually convert your currency, U$0.35 commission fees is still cheaper than 0.05% for LSE instruments https://www.reddit.com/r/singaporefi/commen...ibkr_recurring/  |

|

|

Mar 3 2024, 11:24 PM Mar 3 2024, 11:24 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Wedchar2912 @ Mar 3 2024, 11:14 PM) would like to ask/confirm... buying US T-bills directly, as a not US person, there are no tax withholding right? Yea no WHT. IBKR won't mess up with Uncle Sam directly... ETF is a different story... withhold then refund... that should also include US notes and bonds right? These are infos a few months back, still pretty new. https://www.reddit.com/r/singaporefi/commen...ortfolio_whats/ https://www.reddit.com/r/tax/comments/17cr9...l_interest_for/ Wedchar2912 liked this post

|

| Change to: |  0.0209sec 0.0209sec

0.72 0.72

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 07:16 PM |