Outline ·

[ Standard ] ·

Linear+

Interactive Brokers (IBKR), IBKR users, welcome!

|

Medufsaid

|

Apr 7 2022, 10:33 AM Apr 7 2022, 10:33 AM

|

|

QUOTE(nicholaswkc @ Apr 4 2022, 07:48 AM) What u mean? If ew get premium immediately, so we must buy back the options right before expiry date. depends on what you want to do. if you want to own the stocks via cash-covered puts strategy, just keep it until it gets physically converted to shares (obviously have to be in-the-money or near-the-money) This post has been edited by Medufsaid: Apr 7 2022, 10:34 AM |

|

|

|

|

|

Medufsaid

|

Apr 14 2022, 11:01 AM Apr 14 2022, 11:01 AM

|

|

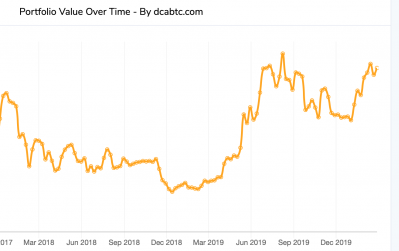

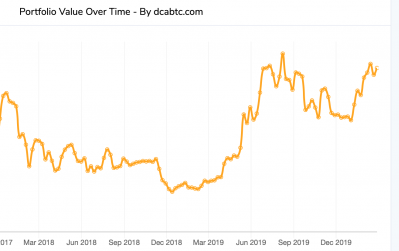

to be frank, DCA works in scenarios like this  if the share price chart looks like this, you should lump sum at the beginning in 2017  you're probably thinking of "time in the market" This post has been edited by Medufsaid: Apr 14 2022, 11:39 AM |

|

|

|

|

|

Medufsaid

|

Apr 14 2022, 02:01 PM Apr 14 2022, 02:01 PM

|

|

QUOTE(Lon3Rang3r00 @ Apr 14 2022, 12:00 PM) the First lesson of investing in the stock market = Be "Mentally Prepared". have a trading (or exit plan) in place whenever you buy stocks. the most recent lows (in Mar) is $756. only you can decide if you'll stay put or cut loss This post has been edited by Medufsaid: Apr 14 2022, 02:02 PM |

|

|

|

|

|

Medufsaid

|

Apr 19 2022, 09:43 AM Apr 19 2022, 09:43 AM

|

|

yea...  whenever a dividend is announced for VWRA, you'll only be taxed 15% of the dividend rather than the normal 30% |

|

|

|

|

|

Medufsaid

|

Apr 19 2022, 11:41 AM Apr 19 2022, 11:41 AM

|

|

normally when you sell (naked) options, broker will ask to "reserve" a certain amount of money in your account (aka margin). if the money falls below margin, you'll get a margin call. if you fail to meet it, they'll realise your losses.

This post has been edited by Medufsaid: Apr 19 2022, 11:49 AM

|

|

|

|

|

|

Medufsaid

|

Apr 22 2022, 09:41 AM Apr 22 2022, 09:41 AM

|

|

QUOTE(Davidtcf @ Apr 21 2022, 10:22 AM) Options are for those impatient also want faster earnings. But remember higher returns = higher risk. One wrong move in options can incur much losses. only if you play with leverage.. without leverage, it's like below naked buy-to-open -> you pay a small premium (like insurance) to protect against stock losses covered sell-to-open -> the max losses = your stocks going down to $0 (which is the original risk you take when you buy a stock anyway) minus the premium you received This post has been edited by Medufsaid: Apr 22 2022, 09:49 AM |

|

|

|

|

|

Medufsaid

|

Apr 22 2022, 12:10 PM Apr 22 2022, 12:10 PM

|

|

QUOTE(Davidtcf @ Apr 22 2022, 11:51 AM) for covered options you still need 100 stocks or 100 ETFs, no? that is a lot to buy for an average retailer. if buy cheaper stocks usually their prices fluctuate and harder to predict their rise /fall. for naked options type it will be on margin/cash balance? any losses will hit the margin/cash balance straight on. yup. from day 1 Ramjade & I never advocated using options if you can't cover it fully (aka naked). QUOTE(Medufsaid @ Apr 12 2022, 11:05 PM) well as long as you don't sell too much calls that can't be covered by your stocks, and you accept that there's a 5% chance your stocks will shoot up and you miss out, it's not unexpected (also, don't be too greedy and sell a OTM call that's too near the current price) This post has been edited by Medufsaid: Apr 22 2022, 12:17 PM |

|

|

|

|

|

Medufsaid

|

Apr 25 2022, 11:41 PM Apr 25 2022, 11:41 PM

|

|

To be fair, it's also assuming you have a First World cost of living.

|

|

|

|

|

|

Medufsaid

|

Apr 26 2022, 01:31 PM Apr 26 2022, 01:31 PM

|

|

QUOTE(Yggdrasil @ Apr 26 2022, 12:53 PM) There is no free lunch. Almost everything is priced in. it exists, however, those arbitrage trades are discovered and traded by players with direct computer access before you can even look at it . hence the rich will always get richer |

|

|

|

|

|

Medufsaid

|

May 10 2022, 11:34 AM May 10 2022, 11:34 AM

|

|

you can also sell futures (e.g., nasdaq micro-lot futures) https://www.cmegroup.com/trading/equity-ind...eo6030798035001This post has been edited by Medufsaid: May 10 2022, 11:41 AM |

|

|

|

|

|

Medufsaid

|

Aug 31 2022, 08:32 PM Aug 31 2022, 08:32 PM

|

|

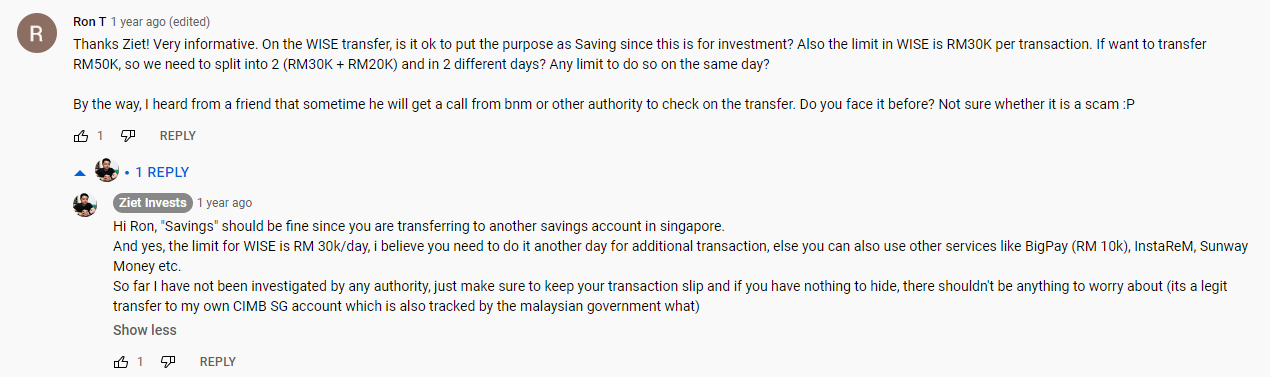

for Wise, you must first create a singapore bank acct with your name, then in Wise, select "transfer to yourself" in the options, so no alarm bells will be triggered as you are transferring from a MY acct to an SG account with identical names. ziet has videos on this https://www.youtube.com/watch?v=_4KJY8MVC5g » Click to show Spoiler - click again to hide... « This post has been edited by Medufsaid: Aug 31 2022, 08:44 PM |

|

|

|

|

|

Medufsaid

|

Sep 9 2022, 10:55 AM Sep 9 2022, 10:55 AM

|

|

credit spread options? (google tells me bond credit spread is a thing)

|

|

|

|

|

|

Medufsaid

|

Jun 13 2023, 09:02 PM Jun 13 2023, 09:02 PM

|

|

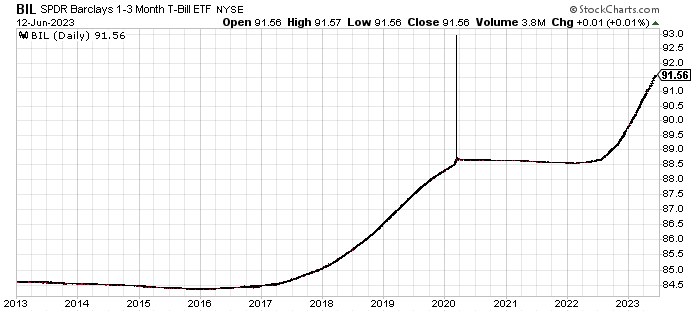

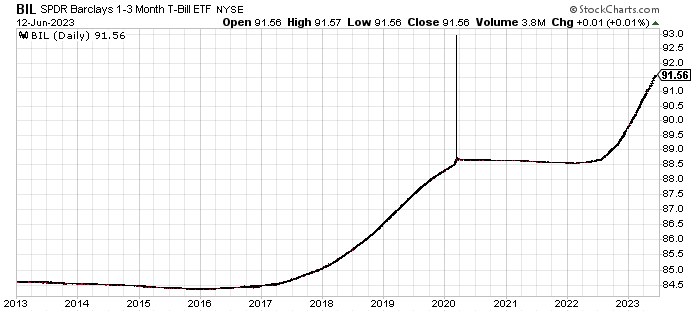

btw, here's $BIL on stockcharts.com (auto adjusted)  |

|

|

|

|

|

Medufsaid

|

Jun 29 2023, 11:53 AM Jun 29 2023, 11:53 AM

|

|

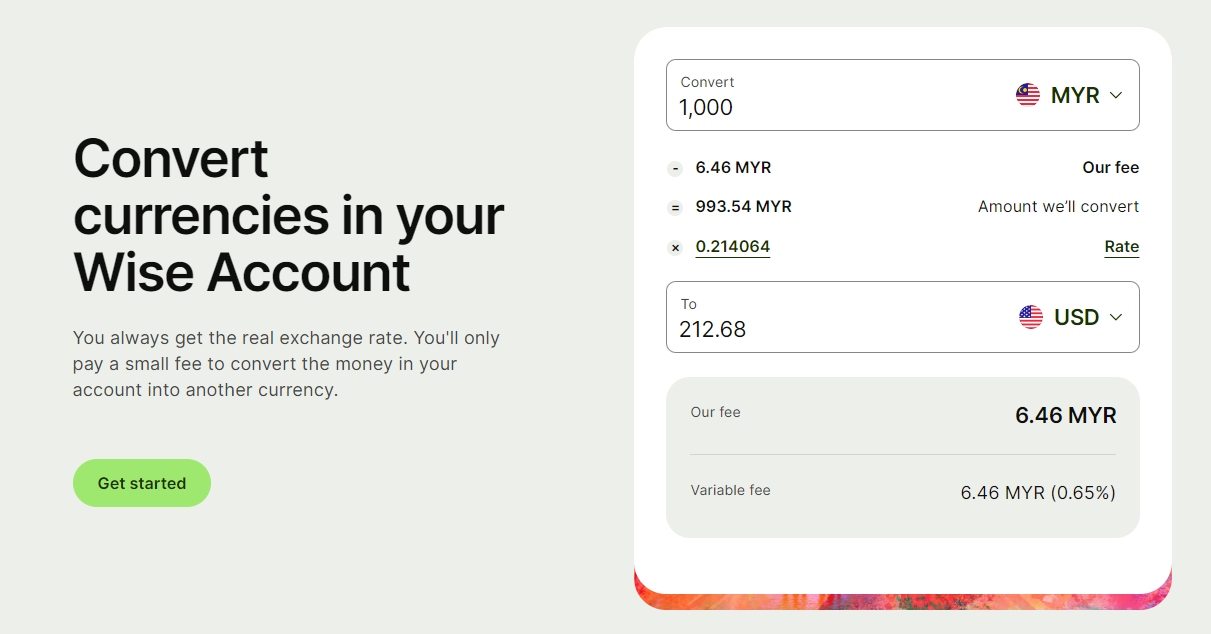

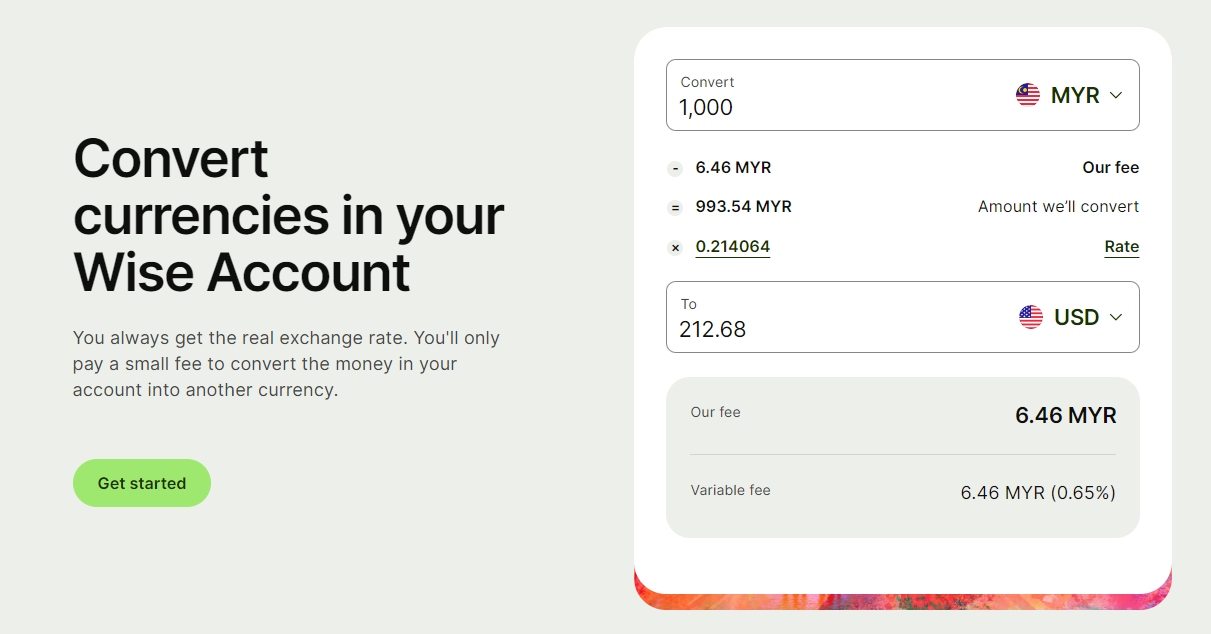

don't know why their fees as percentage is only found in this page, u don't see it elsewhere https://wise.com/my/pricing/hold-fees?sourc...R&targetCcy=USD QUOTE(TOS @ Jun 28 2023, 03:14 PM) Now that Wise can be linked to IBKR, the money transfer is immediate right? It shows up in your IB account on the same day? might be worth it to still send via ACH, delay by few hours but save some RM QUOTE(roarus @ Jun 27 2023, 06:50 PM) For those who use Wise to fund their IBKR: Wise seems to have bumped up their fees for MYR -> USD. Within cents when compared to SunwayMoney MYR->SGD then IBKR SGD->USD (reference amount ~RM4400) soon might be better to go the double conversion route MYR->SGD->USD This post has been edited by Medufsaid: Jun 30 2023, 10:33 PM |

|

|

|

|

|

Medufsaid

|

Jul 2 2023, 02:31 PM Jul 2 2023, 02:31 PM

|

|

i traded XLK bought & sold. first leg only charged U$0.34, then closing trade the regular $0.35... until now i can't think of a reason for the 0.01 cent rebate

|

|

|

|

|

|

Medufsaid

|

Jul 12 2023, 11:15 PM Jul 12 2023, 11:15 PM

|

|

QUOTE(Paradigmata @ Jul 12 2023, 12:25 PM) Also what is the most cost effective way to transfer more than 100k myr into ibkr besides via wise. 1) open a singapore bank account 2) transfer S$ to the account, e.g., you have a friend working there, or you can convert S$29-30k and travel down to deposit 3) deposit SGD into IBKR via FAST, and convert into USD with only U$2 fee (refer to this for proof https://www.interactivebrokers.com/en/prici...currencies.php) QUOTE(Paradigmata @ Jul 12 2023, 12:25 PM) Also, if I purchased US dividend stocks stock, do I subject to 30% WHT ? if you are a malaysian/singaporean, yes. alternatively, buy irish-domiciled ETF where WHT is only 15% This post has been edited by Medufsaid: Jul 13 2023, 07:51 AM |

|

|

|

|

|

Medufsaid

|

Jul 28 2023, 11:47 AM Jul 28 2023, 11:47 AM

|

|

QUOTE(TOS @ Jul 14 2023, 10:12 PM) You may specify your orders to be routed to the ECNs (like Chi-X Europe or BATS Europe). how to do this? --addition-- also, to remind that irish domiciled is U$1.70 or 0.05% of Trade Value (tiered pricing), whichever is higher This post has been edited by Medufsaid: Jul 28 2023, 11:52 AM |

|

|

|

|

|

Medufsaid

|

Jul 31 2023, 04:01 PM Jul 31 2023, 04:01 PM

|

|

buying irish domiciled ETFs, you'll be charged 0.05% + miscellaneous fees issit? take note that i'm buying in a amount that'll exceed that minimum US1.70 fees. aka U$3,400 and above

|

|

|

|

|

|

Medufsaid

|

Aug 2 2023, 09:30 PM Aug 2 2023, 09:30 PM

|

|

QUOTE(joeblow @ Aug 2 2023, 06:36 PM) Sunway money (via FPX rm30k max per day) to Singapore bank (SGD) to IBKR then convert from there. Any other fintech offers better rate? Thank you. use moneymatch QUOTE(nodeffect @ Aug 2 2023, 07:21 PM) inactivity fee of $10 per month inactivity fee already abolished. |

|

|

|

|

|

Medufsaid

|

Aug 23 2023, 11:23 PM Aug 23 2023, 11:23 PM

|

|

Paradigmata short story, if the stock price turned profit when u buy, you won't be subjected to margin call can refer to this for more https://www.youtube.com/watch?v=lzMg04UKuj4

|

|

|

|

|

Apr 7 2022, 10:33 AM

Apr 7 2022, 10:33 AM

Quote

Quote

0.2461sec

0.2461sec

0.55

0.55

7 queries

7 queries

GZIP Disabled

GZIP Disabled