QUOTE(diffyhelman2 @ Mar 4 2024, 01:51 AM)

Got it. Thanks for the tip on t bills. I figure if the fund expense cost is 0.14% then for a usd5 commission i just need to make a purchase that’s greater than 5/0.0014=~$3700 to make the usd5 fee breakeven vs buying BIL.

But BIL makes sense for small amounts and has the added convenience of automatically rolling over vs having to manually roll over every three months?

Also there is not clear info can Google, but if interest rates remain constant, the secondary market price of the T bill should increase slightly everyday, approaching the face value, just like the NAV of BiL right?

Hehe that's opportunity cost, not really breakeven per se. But yea, that's one way to compare. Another way is to look at an IRR of 4.8x% (for BIL) vs the return of a 4-week T-bill yield of 5.4% minus the 5 USD fee (assume you pay once and hold the T-bill till maturity). I use a 4-week T-bill because the duration of BIL is around 1 month too (0.08 years = 0.96 months).

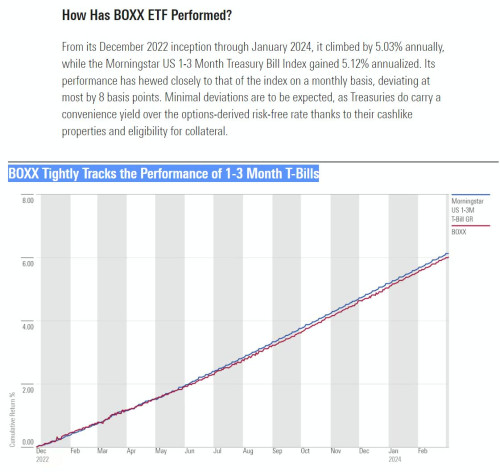

As for the automatically roll over part, yea, BIL ETF manager will purchase T-bills, T-notes and T-bonds with maturities of 1-3 months in the market on behalf of you whereas if you DIY you get to choose the T-bills/notes/bonds you wish to hold. If you choose a short-term one, you will have to rollover the proceeds of the previous matured issue to the next one and incur 5 USD charge every time you do so. So there is a tradeoff here you need to decide. In general, T-bills/notes/bonds which will mature in less than 12 months are very liquid, especially the very short-end ones. There is a big secondary market and you should be fine with either the 1,3 or 6 month issue.

Correct. T-bills are issued at a discount to the face value. Day by day the value of a T-bill appreciates until the date of maturity when the entire principal/face value is returned to you. The maturity profile looks something like that except that since T-bills are short-term, the line should start from somewhere around $950 instead of $100ish, i.e., the curve is not that steep.

It is important to note that BIL is a portfolio of Treasury bills/notes/bonds, not just a particular issue of T-bill. You can have a look at the detailed portfolio holdings of BIL here:

https://www.ssga.com/us/en/intermediary/etf...-t-bill-etf-bilThis post has been edited by TOS: Mar 4 2024, 09:38 AM

Mar 3 2024, 11:30 PM

Mar 3 2024, 11:30 PM

Quote

Quote

0.0187sec

0.0187sec

0.53

0.53

6 queries

6 queries

GZIP Disabled

GZIP Disabled