QUOTE(dwRK @ Mar 10 2024, 08:53 PM)

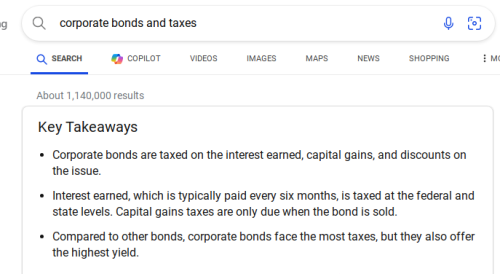

corporate bonds are generally taxable

not quite, see below.

QUOTE(TOS @ Mar 10 2024, 10:05 PM)

I think this is the closest I can find:

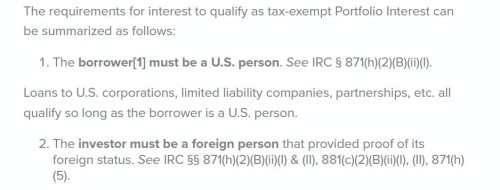

https://www.ssga.com/library-content/produc...-us-en-cash.pdfBased on the original PATH act, only 4 of these are qualified for a refund:

1. original issue discount on an obligation payable within 183 days of issuance

2. interest on an obligation in registered form (other than interest on an obligation issued by an obligor in which the RIC is a 10 percent shareholder or interest that does not qualify as portfolio interest)

3. interest on deposits, and

4. interest-related dividends received from other RICs.

Point 1 above is relevant for primary market-issues of 4-week, 12-week,... up to 6-month T-bills.

If you hold commercial papers (original issues with less than 183 days/6 month of maturities) I suspect it may be eligible for a refund as well.

Anything longer than 6-month generally will be a no.

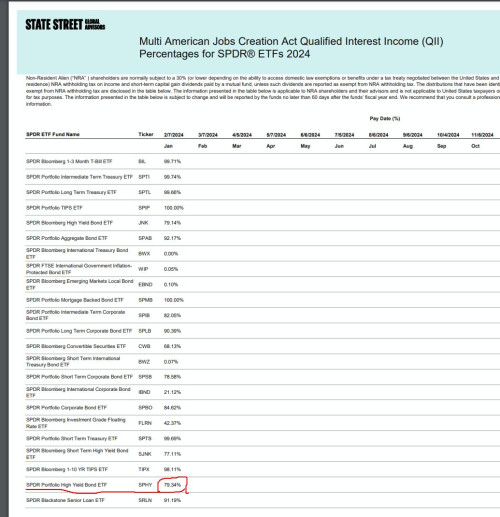

thanks, I actually found a more updated list (7 Feb) here

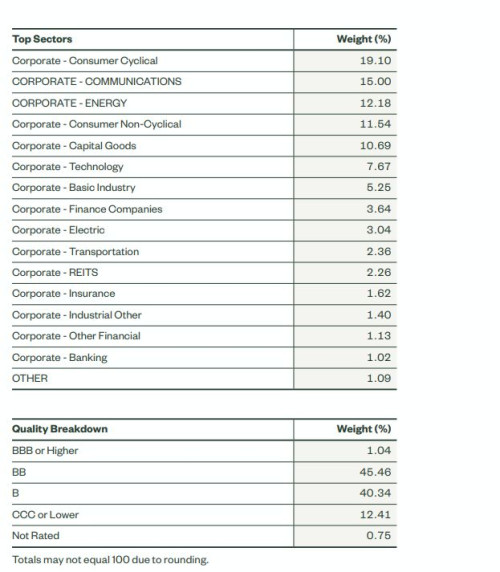

https://www.ssga.com/library-content/produc...eation-2024.pdfif you look at SPBO (corp bond) 85% of the income is qualified interest, SPHY (junk bond) is 79%. and the average tenure is 4-5 years for their holdings. the part that is not qualified is for those issuers who are non US companies issuing corp debt in the US market.

this makes it very attractive fund for me, as the expense ratio is only 5bp, and effective yield after factoring in a tax drag of 30% for the 20-25% of the porfolio that is not QII is about 5.1-7%.

QUOTE

Anything longer than 6-month generally will be a no.

even corporate long term bond (SPLB) fund is 90% QII.

PS: interestingly even BIL is not 100% QII, 99.7% only. maybe that explains the 0.01 that you didnt get back in refund?

This post has been edited by diffyhelman2: Mar 11 2024, 01:11 PM

Mar 7 2024, 10:56 PM

Mar 7 2024, 10:56 PM

Quote

Quote

0.0222sec

0.0222sec

0.58

0.58

6 queries

6 queries

GZIP Disabled

GZIP Disabled