Outline ·

[ Standard ] ·

Linear+

Interactive Brokers (IBKR), IBKR users, welcome!

|

Medufsaid

|

Feb 22 2024, 09:11 AM Feb 22 2024, 09:11 AM

|

|

QUOTE(cybermaster98 @ Feb 21 2024, 11:39 PM) without providing the WHY i'll give it a try to answer this, since it's a reasonable request for both FIFO/LIFO, your - buying power after freeing up cash

- amount of shares you own

- combined profit & loss

remains the same. only reason for selecting either one is - tax report purposes

- to see no red

|

|

|

|

|

|

dwRK

|

Feb 22 2024, 09:55 AM Feb 22 2024, 09:55 AM

|

|

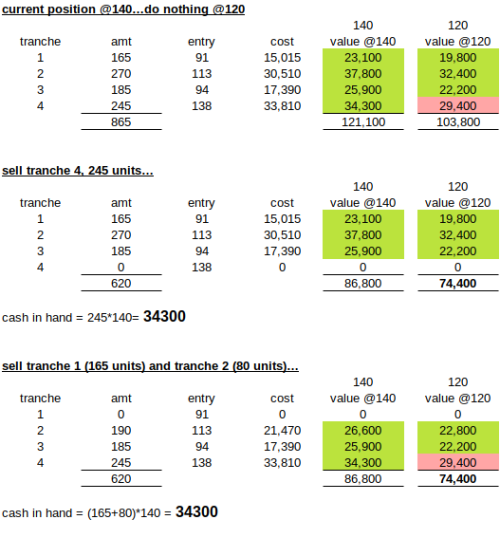

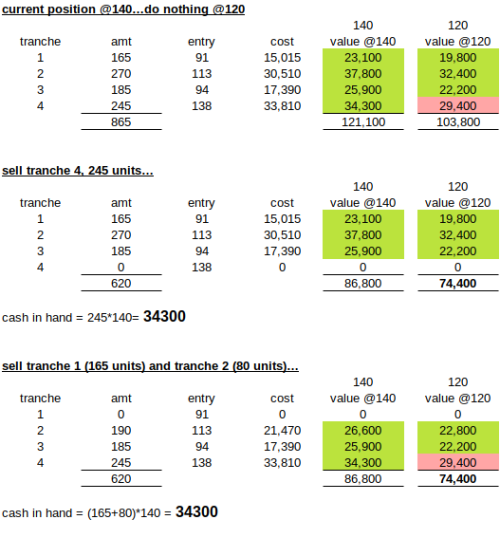

QUOTE(cybermaster98 @ Feb 21 2024, 11:39 PM) The sentence in bold is what you (and others) keep repeating without providing the WHY Re-entering at a higher price point doesn't lose me any money for sure UNTIL there is a correction/crash (which happens more often that most ppl anticipate) and then those positions go negative (again no loss because its still on paper) but it does lower my buffer. here you go...  can you now see why we say doesn't matter which tranche you sell from, only the units matter? both gives you same cash in hand... both still sucks the same when price drop to 120... only difference is color...  |

|

|

|

|

|

LostAndFound

|

Feb 22 2024, 01:39 PM Feb 22 2024, 01:39 PM

|

|

QUOTE(cybermaster98 @ Feb 21 2024, 11:39 PM) The sentence in bold is what you (and others) keep repeating without providing the WHY Re-entering at a higher price point doesn't lose me any money for sure UNTIL there is a correction/crash (which happens more often that most ppl anticipate) and then those positions go negative (again no loss because its still on paper) but it does lower my buffer. Your buffer is made up, you lose the same amount (on paper and in reality) when there is a correction, WHATEVER your entry price. It does not matter whether you bought in at a low or high price, the stock price change means you have already lost value. See my last example targetted exactly at this scenario, also illustrating why a very early/cheap buy in price may actually be hindering your earnings. What you're actually talking about is just pure psychology. If you kept the earlier 'batch' you can tell yourself (oh I'm still in the green), but if you had taken profit then you feel bad about yourself cos you see red. Both are deceiving yourself, and both totally ignore that by selling and locking in profit you have ALREADY received the profit. |

|

|

|

|

|

john123x

|

Feb 22 2024, 02:55 PM Feb 22 2024, 02:55 PM

|

|

del

This post has been edited by john123x: Feb 22 2024, 02:57 PM

|

|

|

|

|

|

SUSTOS

|

Feb 22 2024, 03:41 PM Feb 22 2024, 03:41 PM

|

|

A lot of earnings coming in from Europe today. French insurance company AXA, Swiss insurance company Zurich, UK high-street lender Lloyds Banking Group, French yoghurt maker Danone, Swiss food giant Nestlé, German premium carmaker Mercedes-Benz, UK engine maker Rolls-Royce and Spanish telco Telefónica. Nestle results: https://www.nestle.com/media/mediaeventscal...ll-year-results |

|

|

|

|

|

cybermaster98

|

Feb 22 2024, 05:28 PM Feb 22 2024, 05:28 PM

|

|

Maybank seems to be placing more restrictions on transfer of funds to IBKR. Wise transfers for MYR30K costs RM204 in transaction fee.

Has anybody withdrawn funds from IBKR to Wise and then onward to Maybank Malaysia?

|

|

|

|

|

|

Davy123

|

Feb 23 2024, 11:15 AM Feb 23 2024, 11:15 AM

|

Getting Started

|

Hi all, I’m new to IBKR and PDT rules. I got questions wrt PDT as a margin account user, much appreciated if sifus here can give me accurate answer..

1. When we BUY with ATTACH-ORDER (either bracket/stop loss/take profit) there will be a chance you buy and sell within few hours for a volatile stock. When this happens, do we get flagged as PDT? Assuming we do this(BUY with ATTCH ORDER) for multiple stock purchases (4 times within 5 days)

2. We are flagged as PDT if we execute 4 day trades within 5 business days. Does it mean this is refreshable? E.g.: Day trade 3 times today and wait till +5 days later to do another 3 day trades..

3. What is counted as a single day trade..Does buying 1 stock and sell within 24hours consider 2 day trades or 1 day trade?

This post has been edited by Davy123: Feb 23 2024, 11:26 AM

|

|

|

|

|

|

Medufsaid

|

Feb 23 2024, 11:37 AM Feb 23 2024, 11:37 AM

|

|

Davy123QUOTE In order to day trade, the account must have at least 25,000 USD in Net Liquidation Value, where Net Liquidation Value includes cash, stocks, options, and futures P+L. seems like PDT won't apply if you have $25k https://www.interactivebrokers.com/en/tradi...rgin-stocks.phpThis post has been edited by Medufsaid: Feb 23 2024, 11:39 AM

|

|

|

|

|

|

Davy123

|

Feb 23 2024, 12:43 PM Feb 23 2024, 12:43 PM

|

Getting Started

|

QUOTE(Davy123 @ Feb 23 2024, 11:15 AM) Hi all, I’m new to IBKR and PDT rules. I got questions wrt PDT as a margin account user, much appreciated if sifus here can give me accurate answer.. 1. When we BUY with ATTACH-ORDER (either bracket/stop loss/take profit) there will be a chance you buy and sell within few hours for a volatile stock. When this happens, do we get flagged as PDT? Assuming we do this(BUY with ATTCH ORDER) for multiple stock purchases (4 times within 5 days) 2. We are flagged as PDT if we execute 4 day trades within 5 business days. Does it mean this is refreshable? E.g.: Day trade 3 times today and wait till +5 days later to do another 3 day trades.. 3. What is counted as a single day trade..Does buying 1 stock and sell within 24hours consider 2 day trades or 1 day trade? Okay I sort of found my answers..thanks 1. BUY with ATTACH ORDER counts as day trade if the SELL executes within the same day regardless by accident or not. 2. Yes refreshable. IBKR mobile app can check under PORTFOLIO > BALANCES > BUYING POWER -> DAY TRADES LEFT 3. A single day trade is a ‘Buy and sell’ executed in a day. Maximum day trade allowable for a margin acc with less than 25k USD is 3 times (not 4). After the 3rd transaction is made, the IBKR algorithm disables your 4th transaction for the next 5 days bcos u have been flagged as a ‘potential’ PDT. If 4th day trade is executed by us, then your acc is labelled PDT and has to go through several inconvenient steps to reset.. |

|

|

|

|

|

gashout

|

Feb 25 2024, 11:56 AM Feb 25 2024, 11:56 AM

|

|

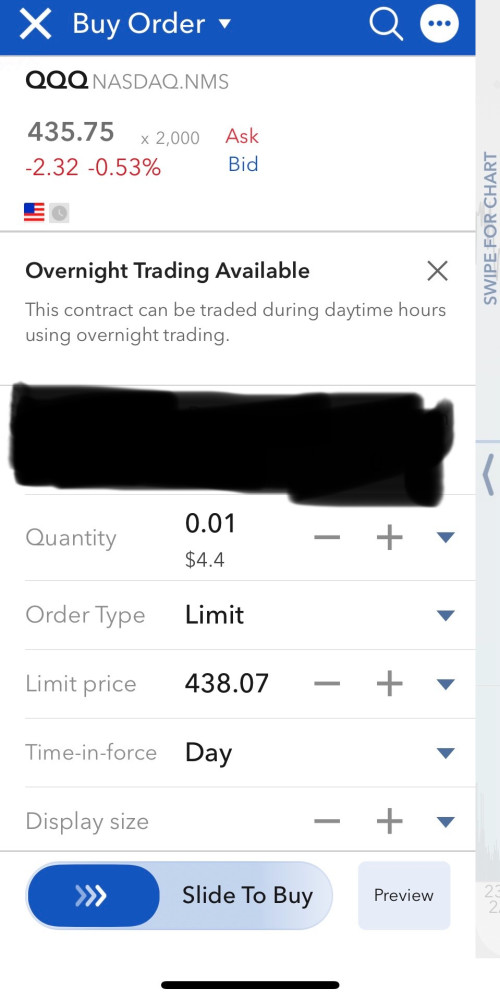

im looking for ticker for snp500 and nasdaq 100, but both only show options... how to buy their index....

|

|

|

|

|

|

lola88

|

Feb 25 2024, 02:02 PM Feb 25 2024, 02:02 PM

|

Getting Started

|

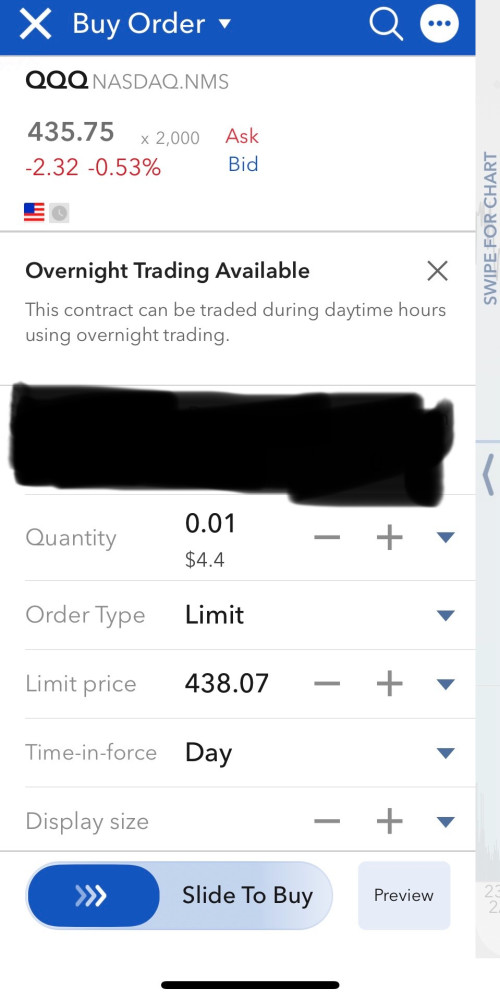

QUOTE(gashout @ Feb 25 2024, 11:56 AM) im looking for ticker for snp500 and nasdaq 100, but both only show options... how to buy their index.... QQQ or QQQM would be the tickers fr Nasdaq100. Which snp500’specifically do u wanna buy? |

|

|

|

|

|

gashout

|

Feb 25 2024, 02:16 PM Feb 25 2024, 02:16 PM

|

|

QUOTE(lola88 @ Feb 25 2024, 02:02 PM) QQQ or QQQM would be the tickers fr Nasdaq100. Which snp500’specifically do u wanna buy? found my answer. thanks a lot. do you know the min unit i must buy? if 100, then surely i cannnnot |

|

|

|

|

|

Medufsaid

|

Feb 25 2024, 02:26 PM Feb 25 2024, 02:26 PM

|

|

gashout buy-to-open no big issues. however, if you plan to sell-to-open(short) 1 option, it's best if you already have 100 of the underlying stocks (or cash, to explain this further i'll have to explain the difference between covered call & cash secured put). else it's a naked short

This post has been edited by Medufsaid: Feb 25 2024, 02:31 PM

|

|

|

|

|

|

lola88

|

Feb 25 2024, 02:56 PM Feb 25 2024, 02:56 PM

|

Getting Started

|

QUOTE(gashout @ Feb 25 2024, 02:16 PM) found my answer. thanks a lot. do you know the min unit i must buy? if 100, then surely i cannnnot U may check frm ibkr. Fr QQQ cn buy fractional shares  |

|

|

|

|

|

gashout

|

Feb 25 2024, 02:58 PM Feb 25 2024, 02:58 PM

|

|

QUOTE(Medufsaid @ Feb 25 2024, 02:26 PM) gashout buy-to-open no big issues. however, if you plan to sell-to-open(short) 1 option, it's best if you already have 100 of the underlying stocks (or cash, to explain this further i'll have to explain the difference between covered call & cash secured put). else it's a naked short a small risk taker, so will stick to purchasing unit than playing long and short. thanks for the help. QUOTE(lola88 @ Feb 25 2024, 02:56 PM) U may check frm ibkr. Fr QQQ cn buy fractional shares  this is good. thanks! |

|

|

|

|

|

Yluxion

|

Feb 26 2024, 05:54 PM Feb 26 2024, 05:54 PM

|

|

Just successfully opened an account in IBKR recently.

Question: If my Wise have both MYR & USD balance, do I have the options choose deposit from the USD or MYR (before conversion) balance in IBKR?

|

|

|

|

|

|

Medufsaid

|

Feb 26 2024, 06:15 PM Feb 26 2024, 06:15 PM

|

|

i think it'll take USD first then MYR. if you want to be sure, lock up the money u don't want converted in Wise Jars. so only the free monies will be utilized

|

|

|

|

|

|

SUSTOS

|

Feb 26 2024, 08:23 PM Feb 26 2024, 08:23 PM

|

|

Not that much related, but good info for you guys.

Proprietary Salary Info from D. E. Shaw Research (based in New York City, main office next to Times Square in Midtown Manhattan, with data centers and supporting offices in Pittsburg)

Drug Discovery Fellow (3-year contract, PhD qualification and above): expected annual base salary 260k-290k USD

Senior Scientist Opportunities (permanent roles like PI in academia): expected annual base salary 300k to 475k USD

ML Researcher and engineer (permanent role, python experience required): expected annual base salary 300k to 600k USD

Scientific/Drug Discovery Software Developer (permanent role, Python experience needed): 230k-550k USD

Company policy is WFH Tuesday through Thursday, with option to WFH on Monday and Friday.

In case you confuse this D. E. Shaw Research with the D. E. Shaw hedge fund, well, the research company and the hedge fund are founded by the same person (D. E. Shaw) and the research company is funded by the profits from the hedge fund and also royalties, patents, commissions etc. from collaboration with Big Pharma like Eli Lilly etc.

Their Anton supercomputer is pretty good and specialized in drug molecule modelling, targeting etc.

------------------------------------

I also overheard conversations during the lunch session just now that professors earn some 100k USD a year in the US.

This post has been edited by TOS: Feb 26 2024, 08:28 PM

|

|

|

|

|

|

gashout

|

Feb 27 2024, 09:32 AM Feb 27 2024, 09:32 AM

|

|

ibkr if i buy singapore stocks today, when must i pay?

does it use my existing shares as collateral

|

|

|

|

|

|

dwRK

|

Feb 28 2024, 07:58 AM Feb 28 2024, 07:58 AM

|

|

QUOTE(gashout @ Feb 27 2024, 09:32 AM) ibkr if i buy singapore stocks today, when must i pay? does it use my existing shares as collateral pay immediately no for cash account |

|

|

|

|

Feb 22 2024, 09:11 AM

Feb 22 2024, 09:11 AM

Quote

Quote

0.0954sec

0.0954sec

0.55

0.55

6 queries

6 queries

GZIP Disabled

GZIP Disabled