Outline ·

[ Standard ] ·

Linear+

Interactive Brokers (IBKR), IBKR users, welcome!

|

Wedchar2912

|

Mar 3 2024, 11:14 PM Mar 3 2024, 11:14 PM

|

|

QUOTE(TOS @ Mar 3 2024, 10:31 PM) .... By the way, if your portfolio size is as big as 100k USD you should seriously consider buying US T-bills directly... it costs 5 USD per trade but given your fund size, the fees are peanuts when expressed as a percentage of the overall investment, thus you get to keep the bulk of returns... would like to ask/confirm... buying US T-bills directly, as a not US person, there are no tax withholding right? that should also include US notes and bonds right? This post has been edited by Wedchar2912: Mar 3 2024, 11:20 PM |

|

|

|

|

|

Wedchar2912

|

Mar 3 2024, 11:33 PM Mar 3 2024, 11:33 PM

|

|

QUOTE(TOS @ Mar 3 2024, 11:24 PM) Yea no WHT. IBKR won't mess up with Uncle Sam directly... ETF is a different story... withhold then refund... These are infos a few months back, still pretty new. https://www.reddit.com/r/singaporefi/commen...ortfolio_whats/https://www.reddit.com/r/tax/comments/17cr9...l_interest_for/many thanks. the links are of great help. |

|

|

|

|

|

Wedchar2912

|

Jul 6 2024, 08:50 PM Jul 6 2024, 08:50 PM

|

|

QUOTE(MrBaba @ Jul 6 2024, 08:35 PM) How to convert SGD to USD in ibkr account ? in the order entry, type "USD.SGD" (without the quotation marks of course). select buy usd put your quantity in usd (I prefer this, but you can choose the amount in sgd also... just becareful with the amount) select market order in advanced, choose FXCONV click save and when you are 100% sure, click submit in the live order screen. |

|

|

|

|

|

Wedchar2912

|

Sep 16 2024, 03:42 PM Sep 16 2024, 03:42 PM

|

|

QUOTE(adam1190 @ Sep 16 2024, 12:38 AM) Currently we have this option of adding MYR in ibkr using transfer from wise balance. So it should be cheaper right if we top up MYR in our wise, then transfer MYR from wise to IBKR before converting MYR to USD internally in IBKR compared to the option of converting MYR to USD in WISE and transfer this USD to IBKR? sorry, would like to enquire. can interactive brokers accept ringgit? or did you mean wise converted the ringgit to usd/sgd/whatever before transferring the funds to your ibkr account? Medufsaid's example actually indicated that conversion happened with wise. |

|

|

|

|

|

Wedchar2912

|

Sep 16 2024, 09:19 PM Sep 16 2024, 09:19 PM

|

|

QUOTE(TOS @ Sep 16 2024, 08:34 PM) Yea the conversion happened within Wise regardless of which method you choose. ... IBKR does not support MYR (for now... not sure if things will change in the future...) i doubt our gov has the confidence to allow ringgit to be "internationalized", as bnm will have lesser control on what happens to ringgit. This post has been edited by Wedchar2912: Sep 16 2024, 11:20 PM |

|

|

|

|

|

Wedchar2912

|

Sep 27 2024, 10:09 PM Sep 27 2024, 10:09 PM

|

|

QUOTE(Medufsaid @ Sep 27 2024, 05:57 PM) not worth it. Minimum RM12 fees unless your monthly trades exceed RM10mil https://www.interactivebrokers.com/en/prici...sia-pacific.phpNo screenshots as I'm not at desktop may I ask... how to settle the payment? ie ringgit... ibkr will auto settle by converting all cashflow from ringgit to usd/sgd (as per base currency) for user? how fine will the usdmyr bid-ask spread? |

|

|

|

|

|

Wedchar2912

|

Sep 27 2024, 10:24 PM Sep 27 2024, 10:24 PM

|

|

QUOTE(dwRK @ Sep 27 2024, 10:21 PM) auto convert from base... spread should generally be ok... but i didn't find it... i guess for most of us, it doesn't really matter much since we are malaysians and should have brokerage account here... would be nice if it is seamless cos then foreign investors can invest here via IBKR.... and help ur bursa be a bit more exciting... |

|

|

|

|

|

Wedchar2912

|

Sep 28 2024, 12:45 PM Sep 28 2024, 12:45 PM

|

|

QUOTE(NoComment222 @ Sep 28 2024, 11:57 AM) Now that bond interest rates are down, what are the other best safe avenues of investment? I take US stocks as high risk given that I am still greenhorn. Options puts and shorts are not in my list for this reason too. Sifus, please advice a falling rate environment directly makes bonds even safer... if you believe this is going to be sustained, you should load up on more bonds... the coupons are fixed... and you get to enjoy the capital gain from the bond price too. |

|

|

|

|

|

Wedchar2912

|

Mar 13 2025, 12:38 PM Mar 13 2025, 12:38 PM

|

|

QUOTE(swiss228 @ Mar 12 2025, 11:24 PM) I login IBKR via Face Recognition method and I know no other method other than this. I never use the login/password method, so US estate duty may apply if my estate writes to IBKR for withdrawal of funds & assets. So, I play safe and will buy only Irish domiciled US ETFs. I think the login via Face Recognition is enabled by you somehow on your phone... cos I login via thumbprint and password. |

|

|

|

|

|

Wedchar2912

|

Jul 17 2025, 12:54 PM Jul 17 2025, 12:54 PM

|

|

QUOTE(swiss228 @ Jul 16 2025, 01:30 PM) Hi. I have a question which I hope IBKR users can answer. Let's say I have $50,000 in my IBKR Pro account, of which $40,000 is my cash balance & $10,000 is from stocks that I have shorted. Do I earn the idle cash balance interest on $50,000 or $40,000 or no interest paid at all? Would appreciate feedback on the above question. Tq! as far as I can tell, the entire balance of your cash (cash is fungible... ie cash is cash and it doesn't matter the source) in a particular currency is eligible for interest, in accordance to their tiering table. for example: you started off with 0 cash. you then convert 785K HKD to 100K USD. the 100K usd will earn whatever interest according to the usd table tiering (ie 0% for 10K, 3.83% pa for 90K) the -785K hkd will kena the margin rate according to hkd margin table tiering (ie 2.824% pa for 780K, 2.324% pa for 5K) |

|

|

|

|

|

Wedchar2912

|

Jul 17 2025, 11:15 PM Jul 17 2025, 11:15 PM

|

|

QUOTE(swiss228 @ Jul 17 2025, 09:24 PM) Thanks for the above example. So, to qualify for the interest of 3.83% pa, I have to have CASH 100k? I thought IBKR meant if the portfolio is above $100k (inclusive of all stocks already purchased) , any idle cash would earn an interest rate of 3.83% pa.nope. have to follow the tiering for usd as set by IBKR. the first 10K usd currently doesn't earn any interest. the amount above 10K usd only earn 3.83% (IBKR Pro status). This post has been edited by Wedchar2912: Jul 17 2025, 11:16 PM |

|

|

|

|

|

Wedchar2912

|

Jul 21 2025, 12:30 PM Jul 21 2025, 12:30 PM

|

|

QUOTE(jasontoh @ Jul 20 2025, 03:26 PM) I think it is paid not sure in a month or year. Its settled on monthly basis... usually within the first week of each month. |

|

|

|

|

|

Wedchar2912

|

Jul 22 2025, 09:13 PM Jul 22 2025, 09:13 PM

|

|

QUOTE(bokbokchai @ Jul 22 2025, 12:05 PM) Guys if in future I have plan to withdraw all my usd out from ibkr to my malaysia savings account account. Whats the best way or safest way to do so? I have seen many post and comments on how to convert myr to other currency but no so much on other currency to malaysia. My understanding is you can open a usd account with say CIMB MY, and then transfer the usd from IBKR account to CIMB MY USD. |

|

|

|

|

|

Wedchar2912

|

Sep 10 2025, 04:18 PM Sep 10 2025, 04:18 PM

|

|

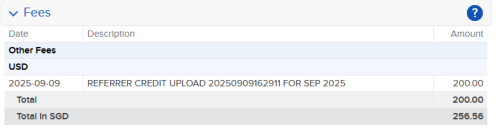

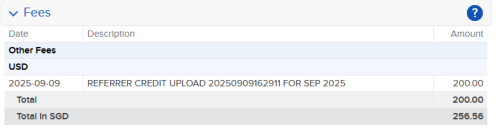

QUOTE(TOS2 @ Sep 10 2025, 02:58 PM) Not sure who used my referral code to open IBKR account... I got my 200 USD credit today... To my horror...  Does anyone have this issue? Wrongly credited with money? Yum yum.... Nice... Can have a very nice omakase. Lol. |

|

|

|

|

|

Wedchar2912

|

Nov 23 2025, 02:16 PM Nov 23 2025, 02:16 PM

|

|

QUOTE(TOS2 @ Nov 23 2025, 02:07 PM) Hi all, I received email notification that my USD balance is about to close.  I wish to retain the USD balance so I will need to either transfer USD from IBKR to Wise USD balance or deposit MYR/SGD into Wise and convert via Wise internally to fund my USD balance. Do you guys have any suggestions which method costs less money? If I move money from IBKR to Wise, I will convert to MYR and move to my MY digital bank accounts. Conversion done by Wise will incur charges... Another alternative is to move money from IBKR to Wise, then move back again to IBKR... but not sure if there are charges for this. If move money from MYR/SGD to Wise then convert to USD, Wise will charge money in the process... still incur costs. Thanks for the suggestion ya everyone. Haven't been here for a looooong time  usually for bank accounts, any deposit of that currency funds will reactivate the account. so why not just covert 43rm to 10 usd within wise itself and see if that trick works? should be the cheapest option... if not, pretend you donated 43rm to charity at worse. |

|

|

|

|

|

Wedchar2912

|

Nov 23 2025, 02:34 PM Nov 23 2025, 02:34 PM

|

|

QUOTE(TOS2 @ Nov 23 2025, 02:27 PM) If closed, can I reopen the USD balance? Scared they kacau me some day down the road if I wanna move my USD assets back to Malaysia... Ok deposit 40-50ish ringgit. Sounds like a plan. Afterwards what to with the 10 USD lol Move to IBKR using ACH? No charges right? Follow this? https://ringgitfreedom.com/banking/wise-mul...direct-depositsif the trick works, then just leave the 10 usd there.... in 3 years time (more like 2.75 years later), you reconvert it back to myr to reactivate again the usd account... (or is it within 1 year, you need to have an activity to keep the account active... something like that. ) haha... and who knows, if usdmyr is back to 4.7, you just made like 3.7% pa return.   This post has been edited by Wedchar2912: Nov 23 2025, 02:37 PM This post has been edited by Wedchar2912: Nov 23 2025, 02:37 PM |

|

|

|

|

Mar 3 2024, 11:14 PM

Mar 3 2024, 11:14 PM

Quote

Quote

0.2378sec

0.2378sec

0.43

0.43

7 queries

7 queries

GZIP Disabled

GZIP Disabled