Outline ·

[ Standard ] ·

Linear+

Interactive Brokers (IBKR), IBKR users, welcome!

|

lee82gx

|

Apr 22 2021, 05:46 PM Apr 22 2021, 05:46 PM

|

|

Hi everyone

Lets say my friend has >100k USD net liquidated worth and plans to do between 5 to 30 buys per month with each transaction say around 200-300 or 2-3x US shares /ETF's. And most of these are buy and holds. Just 1 to 5 sells a month.

With IBKR Pro (already signed up etc) he just needs to change the fee structure to Tiered for lower fees right?

This way around US0.35 per transaction, and will be less than US10 per month?

Rgds

This post has been edited by lee82gx: Apr 22 2021, 05:47 PM

|

|

|

|

|

|

lee82gx

|

Apr 22 2021, 06:52 PM Apr 22 2021, 06:52 PM

|

|

QUOTE(Ramjade @ Apr 22 2021, 06:40 PM) Yes. But keep in mind even with > 100k, the value will flacuate based on current market conditon. So if some how market drop badly the ETF value can drop below USD100k then the inactivity fees will kick in. Noted with thanks. But so on months where the net value drops below 100k, then the just pay minimum 10usd, right? |

|

|

|

|

|

lee82gx

|

Apr 23 2021, 09:32 AM Apr 23 2021, 09:32 AM

|

|

QUOTE(Ramjade @ Apr 22 2021, 06:58 PM) Yes. That's why I myself going to switch to pure IB once I get USD200k. That's a buffer of 51% for market to drop. Can market drop 51%? Yes but very unlikely. That way I know for sure I won't get hit by inactivity fees while still having the cheapest commision. Good plan. Hopefully it will never reach that state (>51% drop). All the same I'm still more or less resigned to pay around 10USD of fees per month. Lower expectations easier. This post has been edited by lee82gx: Apr 23 2021, 09:33 AM |

|

|

|

|

|

lee82gx

|

May 28 2021, 12:10 PM May 28 2021, 12:10 PM

|

|

after 2 months of using IBKR, I'm still not used to the web portal. (I cannot install TWS for company IT reasons).

Can someone guide me....

1. How to export the holdings with cost basis to excel or csv?

2. How to sell by particular lot split by date?

3. Can we see the lots by date?

|

|

|

|

|

|

lee82gx

|

Jun 1 2021, 05:20 PM Jun 1 2021, 05:20 PM

|

|

QUOTE(AnasM @ Jun 1 2021, 05:05 PM) why dont u use personal pc to install? Because I don't want to be stuck with using only 1 particular pc to do something. Does tws sw show the holdings by lot by date ? For the exporting needs, TOS has kindly provided the answer up there. |

|

|

|

|

|

lee82gx

|

Jul 10 2021, 12:53 PM Jul 10 2021, 12:53 PM

|

|

QUOTE(Mr.Weezy @ Jul 10 2021, 12:00 PM) guys since IBKR removed inactivity fees, I would love to join the platform. Anyone can pm me your referral code? Thanks! Done. |

|

|

|

|

|

lee82gx

|

Aug 3 2021, 10:51 PM Aug 3 2021, 10:51 PM

|

|

I recently found out that the dividend reinvestment in IB is conditional. Your dividend received must exceed the value of 1 unit of share for the reinvestment to occur. Is this normal?

To top it off, I received another dividend which exceeded the value of 1 unit of share, but at the same time nothing happen too. I just get cash credited to my balance. Is this normal or do you guys dont mind?

|

|

|

|

|

|

lee82gx

|

Aug 9 2021, 12:28 PM Aug 9 2021, 12:28 PM

|

|

QUOTE(miuk @ Aug 9 2021, 11:40 AM) Just want to ask, if I have some cash money in USD, how do I transfer it to my IBKR account? Is there a better way besides going to money changer and doing it the normal way? Hopefully there is some sifu to guide me here.. Tq if it is substantial, maybe you can open a Foreign currency account. Then you can deposit in USD. But from that particular bank to IBKR in USD, you probably have to TT electronically and that will cost some money, maybe 5-20USD per transfer. So yes, it depends on how much you have. As a matter of fact if it is not substantial, I would just keep it as cash as I will need USD in to travel in the future (Looking so far ahead to the day there is no covid...maybe it will never happen  ). |

|

|

|

|

|

lee82gx

|

Dec 10 2021, 08:22 PM Dec 10 2021, 08:22 PM

|

|

i use IB to buy all sorts etf and stocks for with $0.35 transaction, especially for those that I buy fractionally. Even if you have to do forex conversion inside of IB, do a bigger amount once and be done, you don't have to always convert your USD to local currency (SGD?) everytime you sell and you don't have to hold your local currency until the day you want to buy a US security.

For those that buy and hold, its not a big deal. For those you trade frequently then TD is a great option.

ETF for all sorts of countries will have all sorts of different fees. It is very diverse.

|

|

|

|

|

|

lee82gx

|

Jun 14 2022, 07:41 PM Jun 14 2022, 07:41 PM

|

|

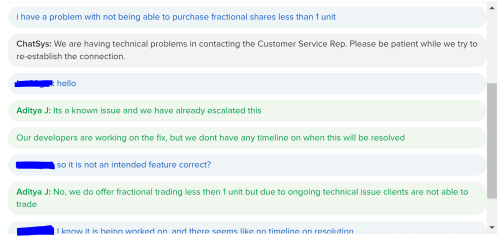

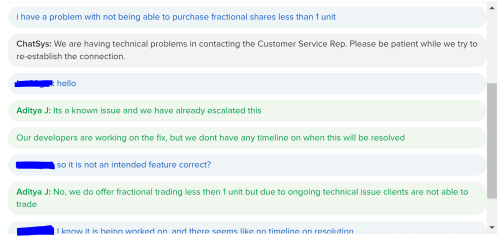

Guys recently my account cannot buy fractional shares less than 1. For example 0.5 shares of GOOG. It can go through if I go for 1.5 but what the heck is the point???? Is it same for you also? I am sure last time a few months ago no such restrictions. edit:  technical issue resolution in progress This post has been edited by lee82gx: Jun 14 2022, 08:04 PM |

|

|

|

|

|

lee82gx

|

Feb 29 2024, 10:11 AM Feb 29 2024, 10:11 AM

|

|

QUOTE(gashout @ Feb 29 2024, 04:57 AM) Anyone knows if 6 to 7 digit amount of funds in IBKR.. When withdrawing won't have any issues? They're definitely funds which have paid tax. I don't want to see problems where it's frozen by banks or there are issues happening. Hence. Till today I never dare to park so much funds outside a country that'll go back to my bank account eventually. I also worry about this. but the fact is if you are not cashing out today, things may change drastically in -n years time. Or if you really reach 7 digits USD maybe you want to FLY to IBKR Office and open a local bank account there AND SPEND IT there instead? That's what I think. My default plan if I live and mentally aware until 80 is I will withdraw 5 figure MYR per quarter when I am 60, hopefully it won't trigger too much issue. If issue come out I will fly to Singapore (where my IB account is currently domiciled) and manually intervene. I suppose there are far too many Malaysians in Singapore with 6-7 figure MYR that want to cross the border back, there should not be too big of a hassle. |

|

|

|

|

|

lee82gx

|

Feb 29 2024, 01:14 PM Feb 29 2024, 01:14 PM

|

|

QUOTE(Medufsaid @ Feb 29 2024, 10:47 AM) using CIMB SG->MY internal transfer should suffice also, see if can modify from IBKR individual account to "joint account" (for that live & aware until 80) I think Cimb sg to Cimb MY is a great tool. I just checked with some of my friends working in Spore and family in Malaysia they use this method too. The joint account with survivorship control was another option but last I checked it was not trivial to do even within IB itself (transferring stocks or cash from single to joint ownership). |

|

|

|

|

|

lee82gx

|

Sep 6 2024, 10:21 AM Sep 6 2024, 10:21 AM

|

|

the most important thing IF IB comes to malaysia is survivorship / estate planning.

You die as individual account holder, hopefully your heir can directly go to their office, present your will and death cert and they transfer the account to the heir.

As of today, you send a pdf to HK office. Imagine the security and possible pitfalls.

I'm also very much looking forward to re-opening a joint account with rights of survivorship with my wife.

As of today if you already have an individual account they treat you like a terrorist / money launderer if you try to do this kind of changes via "chat" or phone call.

|

|

|

|

|

|

lee82gx

|

Sep 6 2024, 10:25 AM Sep 6 2024, 10:25 AM

|

|

QUOTE(TOS @ Sep 1 2024, 10:25 PM) Oh that would be bad... Let's hope they get out of Malaysia then  That said, to collect stamp duty of a couple of MYR every time we trade stocks/ETFs would mean IBKR will have to allow MYR cash account for the fees to be deducted. So your couple of MYR stamp duty can be offset with cheaper FX rates at IBKR, hopefully... why would they collect additional stamp duty if we are dealing with US / non-Malaysian securities? Its not like LHDN has a legal right there. |

|

|

|

|

|

lee82gx

|

Sep 6 2024, 10:35 AM Sep 6 2024, 10:35 AM

|

|

QUOTE(TOS @ Sep 6 2024, 10:29 AM) I have the same question too. But Moomoo charges it anyway: https://www.moomoo.com/my/pricingI checked FSM Malaysia's charges for buying US shares, stamp duties are imposed as well: https://www.fsmone.com.my/pricing/stocksSo looks like you can't run away with it. thanks for the enlightenment. Looks like Anwar is hungry for tax, and I can't blame him. But he won't blame me if I legally evade it too. Doubling the fees for their customers without any added value is a good way to make oneself poor and competitors rich. |

|

|

|

|

|

lee82gx

|

Sep 6 2024, 12:03 PM Sep 6 2024, 12:03 PM

|

|

QUOTE(sp3d2 @ Sep 6 2024, 10:59 AM) im 100% agree with you. nowadays im very worried what will happened to all my investment in IBKR should i suddenly die. my family dont know a thing about how IBKR works. I thought I opened an SG account, but I believe mine is handled via Hong Kong. This was what the chat customer service told me. |

|

|

|

|

|

lee82gx

|

Nov 14 2024, 10:33 AM Nov 14 2024, 10:33 AM

|

|

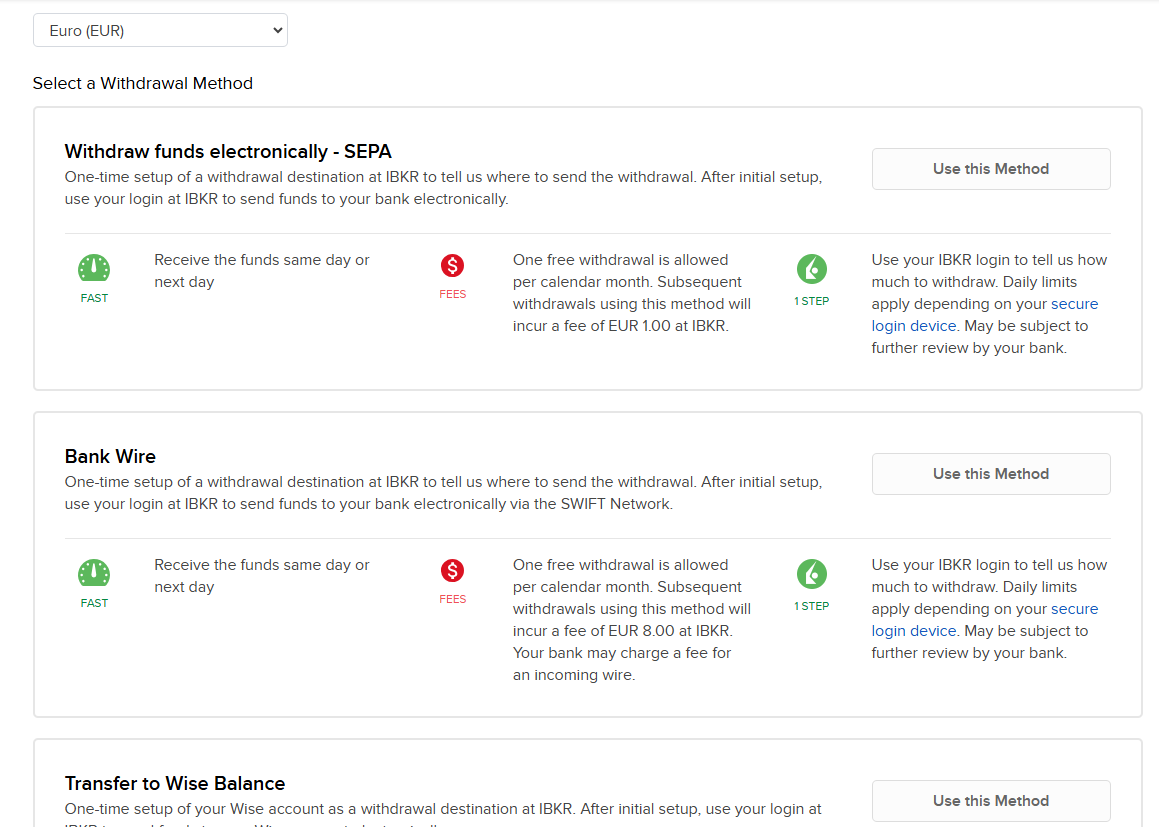

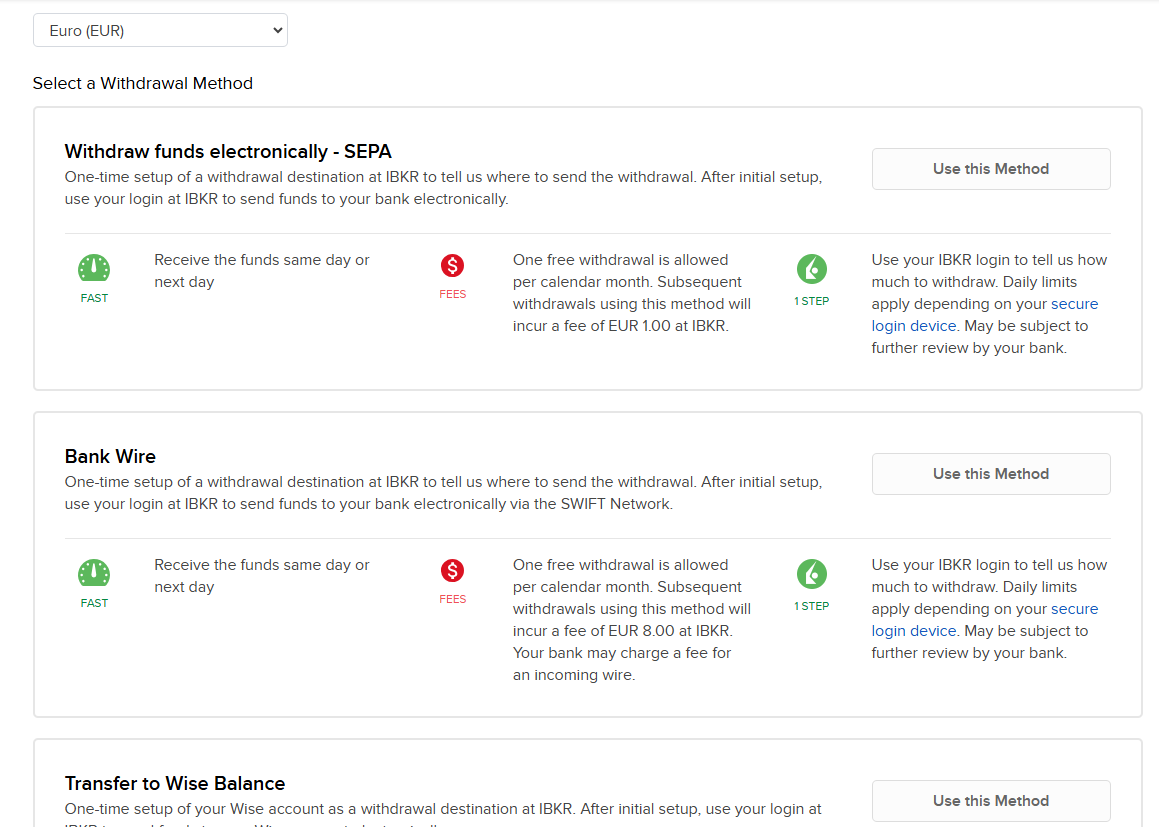

Has anyone withdrawn Euro balance in IB to Euro balance in Wise card / account before?

I've withdrawn in USD before, its already setup and linked.

But I don't think its an option to setup another Wise Euro transfer?

|

|

|

|

|

|

lee82gx

|

Nov 14 2024, 10:40 AM Nov 14 2024, 10:40 AM

|

|

QUOTE(Medufsaid @ Nov 14 2024, 10:37 AM) lee82gx british pound & euros can be withdrawn to wise. i setup Wise EUR and GBP balance some time back already. just in case  thanks and gosh, I missed the top left corner currency selection! Do you know how long it takes? I just made a transfer 30s ago.... |

|

|

|

|

|

lee82gx

|

Dec 17 2024, 12:23 PM Dec 17 2024, 12:23 PM

|

|

QUOTE(james.6831 @ Dec 16 2024, 07:28 PM) anyone bought crypto from ibkr before? lol QUOTE(james.6831 @ Dec 16 2024, 08:05 PM) But you can buy BTCX-U.TO / BTCX.U This post has been edited by lee82gx: Dec 17 2024, 12:24 PM |

|

|

|

|

Apr 22 2021, 05:46 PM

Apr 22 2021, 05:46 PM

Quote

Quote

0.2491sec

0.2491sec

0.44

0.44

7 queries

7 queries

GZIP Disabled

GZIP Disabled