QUOTE(TOS @ Nov 17 2022, 11:03 PM)

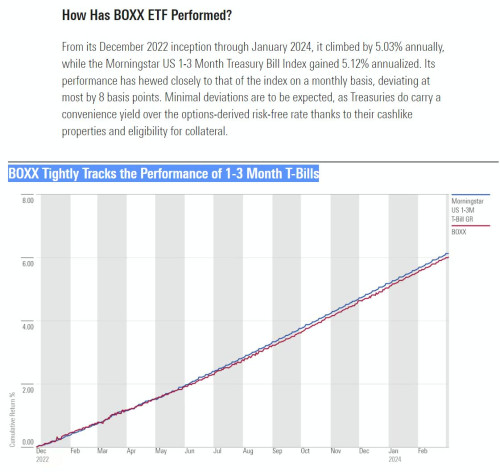

For those of you seeking short-term (1-3 month) ultraliquid USD parking facility in IB, I found several US 1-3 month Treasury bill ETFs like BIL and SGOV.

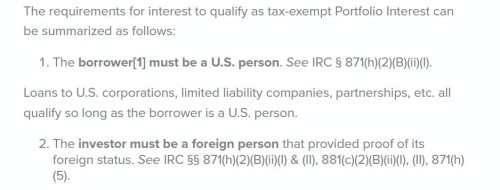

Assume you adjust SMART routing to VLow (High volume exchange with lowest fee), you can get your trades executed with as low as 0.24 USD instead of the usual "0.35 USD". BIL is liquid but expense ratio is high at 0.14% p.a., SGOV's expense ratio is low but that is due to temporary fee rebate by BLK which would terminate on 30th June 2023 (after which it would be around 0.14-0.15% p.a., on par with BIL). Moreover, SGOV has about 6% asset exposure in its own institutional cash fund which has Treasury floating rate notes and introduces additional counterparty risks with banks like Citi, Credit Agricole etc. So, not truely "risk-free".

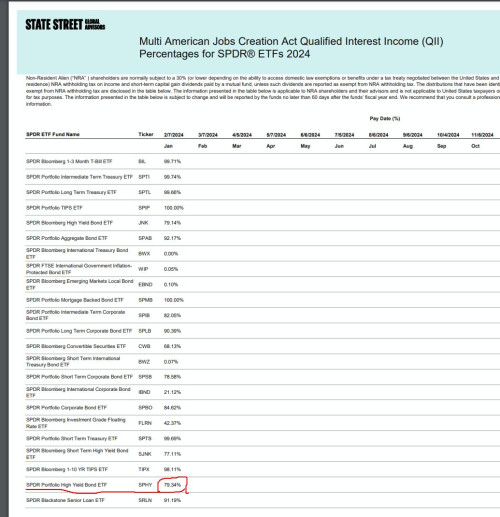

I did some IRR calculations and found that you can get returns of about 1.3% p.a. for the 2-month holding period, factoring 30% WHT for the monthly distributions and 0.24-0.35 USD commissions, charged twice (once during purchase, once during sell).

Much lower than contemporary 2-month UST yield, but better than holding everything on cash balance and let IB suck all your interests away I guess. After all, in terms of opportunity costs, there is nothing more "risk-free" than risk-free rates. So, in theory, as long as better than 0% p.a., one should bite.

Hi would like to ask some clarification. Assume you adjust SMART routing to VLow (High volume exchange with lowest fee), you can get your trades executed with as low as 0.24 USD instead of the usual "0.35 USD". BIL is liquid but expense ratio is high at 0.14% p.a., SGOV's expense ratio is low but that is due to temporary fee rebate by BLK which would terminate on 30th June 2023 (after which it would be around 0.14-0.15% p.a., on par with BIL). Moreover, SGOV has about 6% asset exposure in its own institutional cash fund which has Treasury floating rate notes and introduces additional counterparty risks with banks like Citi, Credit Agricole etc. So, not truely "risk-free".

I did some IRR calculations and found that you can get returns of about 1.3% p.a. for the 2-month holding period, factoring 30% WHT for the monthly distributions and 0.24-0.35 USD commissions, charged twice (once during purchase, once during sell).

Much lower than contemporary 2-month UST yield, but better than holding everything on cash balance and let IB suck all your interests away I guess. After all, in terms of opportunity costs, there is nothing more "risk-free" than risk-free rates. So, in theory, as long as better than 0% p.a., one should bite.

1.These products are as liquid as cash balance in ibkr in terms of trade turn around? Meaning if i sell today i can use the money in my account to buy stocks soon after? Or do i have to wait for a settlement period?

2. Does the dividend accrues daily by an increase in the NaV and is paid out monthly/ quarterly when it goes ex dividend right?

3. And how did you get only 1.3% annualized? The current t bill should be around 5% and even with a 30% wht you should be getting 3.5% pa? And the dividen eventually gets refunded right?

Reason is I have about a 100k and as you know the first 10k usd doesn’t earn anything while the balance currently earns 4.83%. If BiL is almost as good as cash balance while able to earn 4.8% I’ll put all that money in it while I look for stocks to buy.

This post has been edited by diffyhelman2: Mar 3 2024, 10:14 PM

Mar 3 2024, 09:48 PM

Mar 3 2024, 09:48 PM

Quote

Quote

0.0272sec

0.0272sec

0.83

0.83

7 queries

7 queries

GZIP Disabled

GZIP Disabled