QUOTE(normanTE @ Jul 12 2020, 10:29 PM)

had you ever try to trasnfer usd or gbp from hk account to IBKR?

To my experience most hk account is integrated (mean they are single numbered multicurrency account even their credit card is coming with choices of dual currency and the popular one is hkd + cny

is this statement correct?

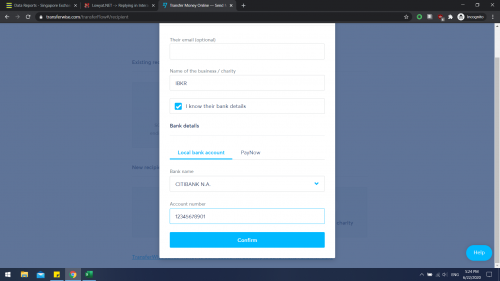

No, because I only invested in SG stocks thus far, so no experience of transferring USD or GBP to IBKR before. I was told that USD transfer is quite cumbersome. Given the USD-HKD peg, and that IBKR charges little commission at spot rate for forex, it would make more sense to deposit HKD then convert to your designated currency such as USD. At least it's cheaper and can avoid high mark-up charged by HK banks and avoid all kinds of scrutiny from IBKR (especially USD-related transactions).

As for integrated account, yup. That's pretty much the case. I don't like to owe people money, so when they give me a credit card, I break it up and destroy the chip immediately. The so-called integrated account is for them to make more money out of your pocket because you have all services under one umbrella. Integrated account is just similar to your premier/preferred banking in Malaysia. From low-profit margin basic banking services to high-profit margin securities business. Their NII is their main source of revenue. FD rates is just miserable, 1.5% at most. but loans are typically 5%. NII is quite high in HK banks. (2.2% for Hang Seng).

https://www.hangseng.com/en-hk/about-us/inv...s-announcement/HKD-CNY account is popular for mainland students and professionals studying and working in HK, and also for businessmen in HK to deal with mainland business. For a Malaysian you won't find it useful unless you have big business in HK and want to expand your business in mainland China. I don't use any of the other currency accounts in my HK bank.

Side note, ranting: The thing is they don't have a debit card. (You call this place an IFC?) In Malaysia, my Maybank card can be used as both an ATM card and a debit card, but in HK, your ATM card is just an ATM card. I tried typing my "ATM" card number into an online bookstore where I want to buy books but failed. It's only when I asked other schoolmates that I realized in HK, they encourage you to owe and spend more, to the extreme that uni students can be given credit cards when they earn nothing. (In Malaysia, no job = no credit card). No wonder loan firms are so common in TVB advertisement there.

Guess what, I even have a current account there and can write cheques...

Apr 22 2020, 10:57 PM

Apr 22 2020, 10:57 PM

Quote

Quote

0.0338sec

0.0338sec

0.38

0.38

7 queries

7 queries

GZIP Disabled

GZIP Disabled