QUOTE(kart @ Jan 11 2024, 10:25 PM)

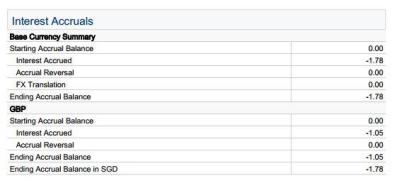

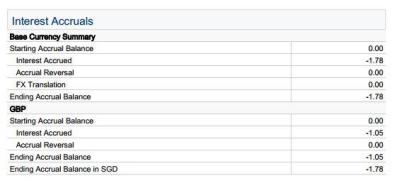

What does negative interest accrued mean? Do I have to pay the interest accrued to IBKR?

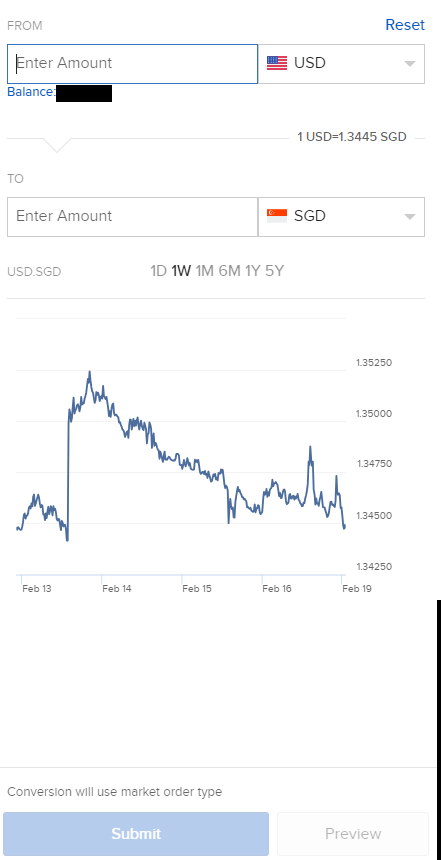

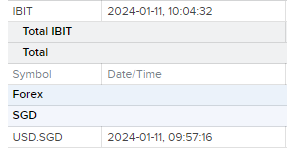

I have IBKR Cash Account. A few days ago, I deposited some money in my IBKR account, via FAST. Then, I converted SGD to GBP with limit order, via "Forex" tab in IBKR website. Lastly, I used the converted GBP to participate in Preferential Offering of Elite Commercial REIT.

I am pretty sure that I used the money in my IBKR account for the conversion from SGD to GBP.

Thank you for your information.

IBKR CS replied that when IBKR deducted the GBP cash in my account for the Preferential Offering, the forex conversion to GBP was not yet settled at that time, so I need to pay interest to IBKR.I have IBKR Cash Account. A few days ago, I deposited some money in my IBKR account, via FAST. Then, I converted SGD to GBP with limit order, via "Forex" tab in IBKR website. Lastly, I used the converted GBP to participate in Preferential Offering of Elite Commercial REIT.

I am pretty sure that I used the money in my IBKR account for the conversion from SGD to GBP.

Thank you for your information.

--

Well, I can understand that we should wait T + 2 working day, for the trade of stock to be settled, before we can proceed to perform further trading of the stock, such as selling the stock. However, the forex conversion in IBKR should immediately be settled, and the SGD cash in my account was already deducted to pay for the forex conversion.

Moreover, I did not withdraw GBP cash out from my IBKR Cash Account, because GBP cash was used to pay for Preferential Offering.

I just cannot really understand why we should wait T + 2 working day, for the forex conversion to be settled.

This post has been edited by kart: Feb 19 2024, 08:13 AM

Feb 19 2024, 08:09 AM

Feb 19 2024, 08:09 AM

Quote

Quote

0.0242sec

0.0242sec

0.65

0.65

6 queries

6 queries

GZIP Disabled

GZIP Disabled