Hi all. Need your help.

I don't have sg account. All my banks are in Malaysia at the moment.

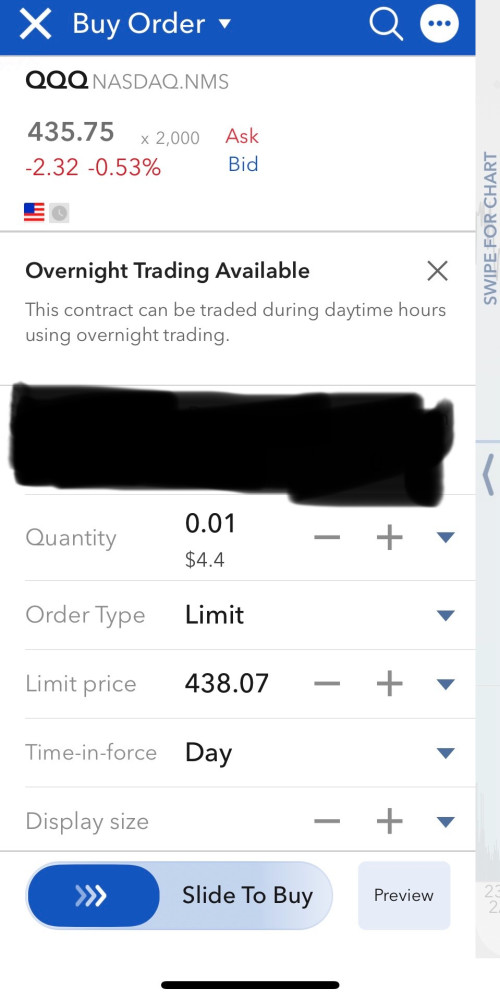

My IB account has been activated, so is it best for me to approach local bank to do transfer wise to IB? But where's the details for me to send fund?

I don't trade often. Maybe once a month. And I hate monthly charges purely for maintanence.

Appreciate your help in this matter. Thanks

Yes. I've tried reading the thread but at 75 pages and for newcomers, it gets a little tough.

This post has been edited by gashout: Jul 10 2020, 11:24 PM

Interactive Brokers (IBKR), IBKR users, welcome!

Jul 10 2020, 11:21 PM

Jul 10 2020, 11:21 PM

Quote

Quote

0.2523sec

0.2523sec

0.75

0.75

7 queries

7 queries

GZIP Disabled

GZIP Disabled