QUOTE(MUM @ May 24 2021, 10:19 PM)

just a note,...putting money in lowest risk index does not mean you will not lose money....

see post 13842, page 693 by forummer ChipZ

as mentioned earlier,....if you are wondering if you should wait for it to drop before throwing all the money in? Or just put in immediately?...try research more on DCA (Dollar Cost Averaging) method....maybe it suit you

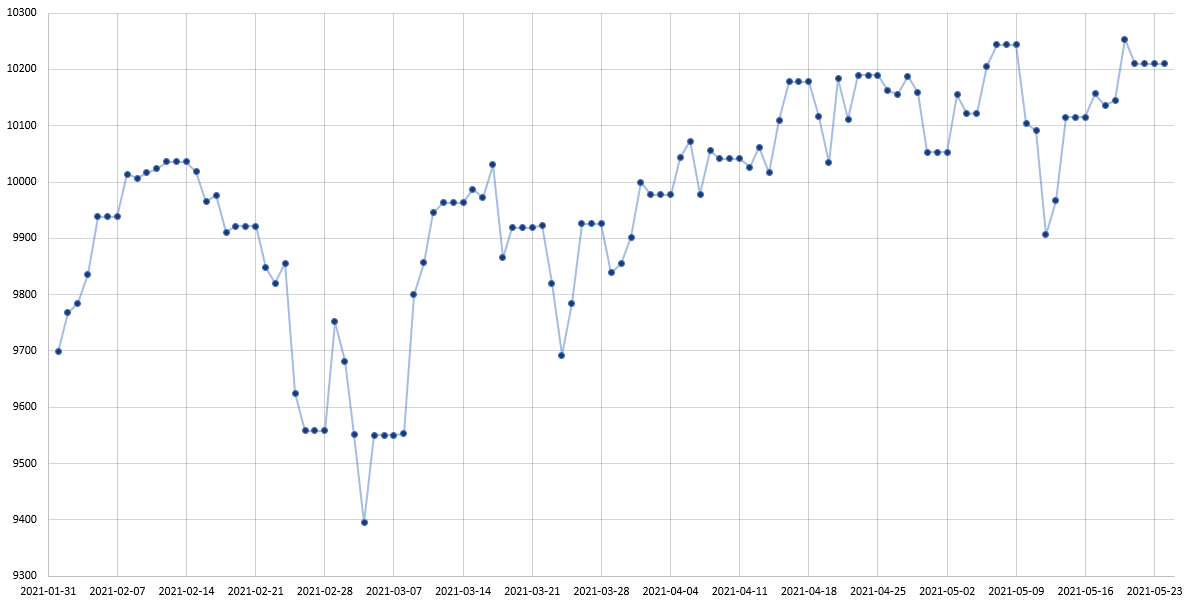

BTW,...just some info,...now most of the mkts are NOT high ...already dropped some % from it high in Mid Feb 2021

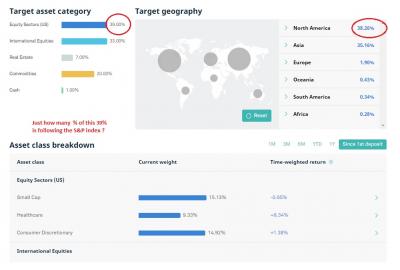

Thx bro. I checked the S&P 500 and it seemed at a high point now but not so sure about other markets. Because for my portfolio a significant share would be in the USA.

QUOTE(datolee32 @ May 24 2021, 10:22 PM)

You can try dollar cost averaging to reduce your risk. If you put a big amount in 1 time, if it has a big drop, you will take time to recover your investment.

Yea will probably do that, thx man!

QUOTE(ironman16 @ May 24 2021, 11:21 PM)

R u confidence that now is ATH? If yes, u can wait until the dip come n u lump sum in so that u can buy low sell high later.

Bcoz u know how to timing market very well.

I'm not well in timing market, so i practice dca all the time.

I will split the amount into several small amounts, eg total 50k split to 5k each or 1.25k each, i will regularly top up my portfolio, either monthly or weekly.

If occurs dip in certain month, i will manually topping again.

This is normally i do.

U can use as reference n make ur decisions. 😁

I won't choose low risk in stashaway bcoz I dun like pay the fee n ask professional ppl manage my money.

Low risk punya investment I diy sendiri with SSPN /FD/ASM/MMF/........

Yea I agree on the low risk part - might as well buy bonds. I'll split up the amounts also, that's a pretty good point.

May 24 2021, 11:51 AM

May 24 2021, 11:51 AM

Quote

Quote

0.0407sec

0.0407sec

0.92

0.92

6 queries

6 queries

GZIP Disabled

GZIP Disabled