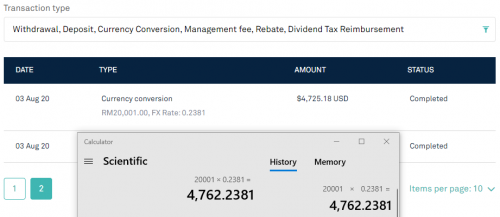

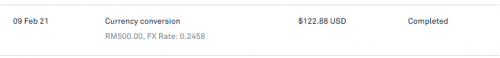

Question about SA's conversion rate - I don't like what I'm seeing but I might be wrong in this. Here's a snapshot of my SA transaction history:

The transfer fee was USD37.0581, considering SA's exchange rate displayed there, there was a hidden processing fee of 37.0581 USD.

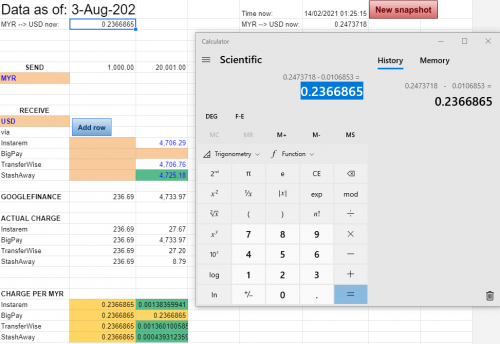

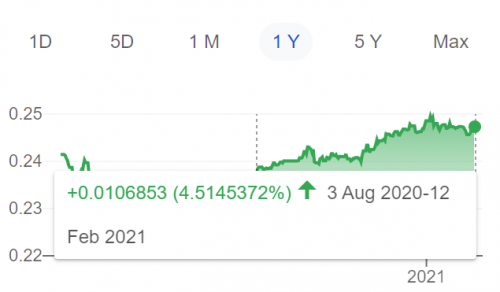

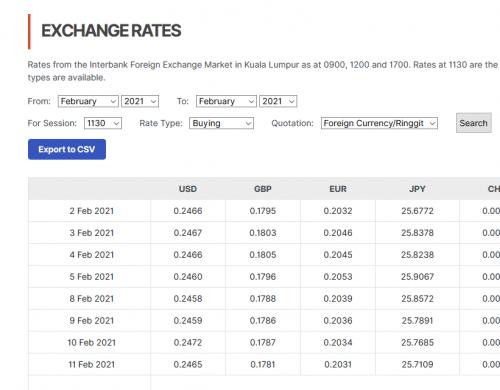

Now to reverse engineer to find out what was the MYR>USD rate on 3 Aug 2020:

Today (13 Feb), 1MYR = 0.2473718USD

On 3 Aug, 1MYR = 0.2473718 - 0.0047429 = 0.2426289

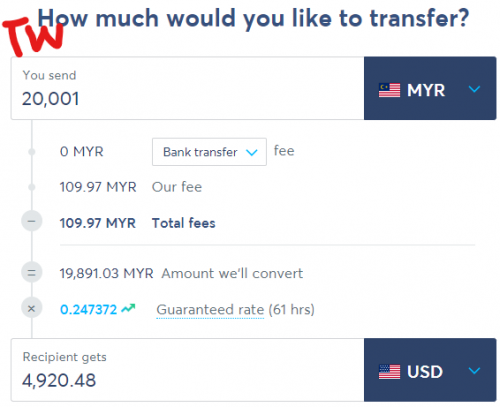

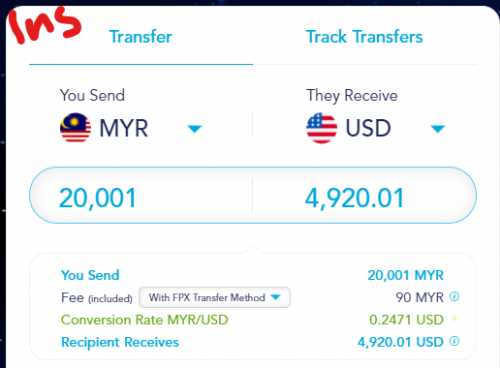

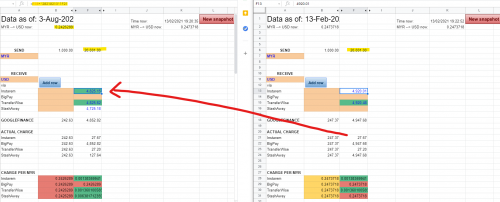

But of course, I have no way to reverse engineer fintech's or bank's offers so I went to Instarem and TransferWise to check the rates, and plotted them onto my own transfer rate calculator (Special thanks to a forumer who did a sheet like this himself, I made my own copy with some additional functions). Google finance is the benchmark, and the various fintechs are more realistic values:

TW and Instarem:

Excel comparison:

RHS: Today's exchange. I'm taking 27.67 USD as the actual charge incurred for the exchange and put that into 3 Aug sheet (LHS). Meaning, if I did the transfer on 3 Aug instead using TransferWise, I would've receive approx 4825 USD instead. That is 100 USD spread from SA's conversion compared to other fintechs! Did I miss out something or is SA conversion rate really that bad?

inb4 "Why are you trying to reverse engineer this?"

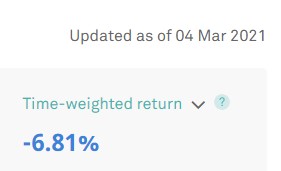

I didn't know what I was doing back then, now I want to know if I should continue keeping my money in SA or take it out to invest manually. Frankly speaking, the performance has been disappointing, and I want to know why.

On top of that, there's a 3+USD conversion back to RM to pay the management fee every month, so shitty conversion rate would really hurt investments in SA.

OR, if anyone is going to make a deposit into SA soon, please do me a favour and compare your post-conversion amount to other fintechs? Thank you!

Feb 13 2021, 07:38 PM

Feb 13 2021, 07:38 PM

Quote

Quote

0.0568sec

0.0568sec

0.60

0.60

7 queries

7 queries

GZIP Disabled

GZIP Disabled