Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

DragonReine

|

May 7 2021, 11:25 AM May 7 2021, 11:25 AM

|

|

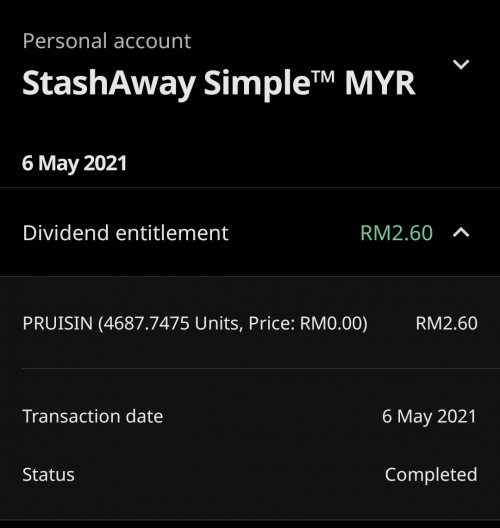

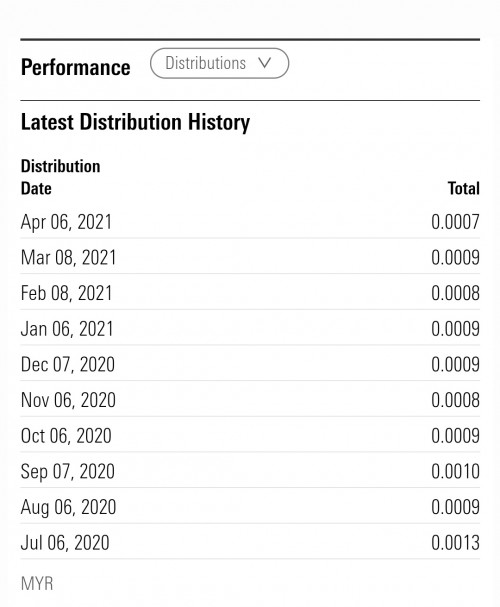

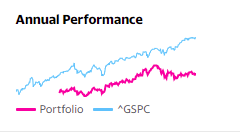

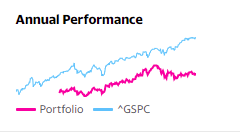

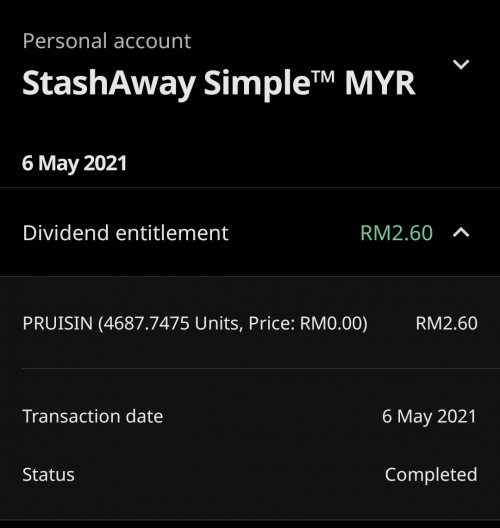

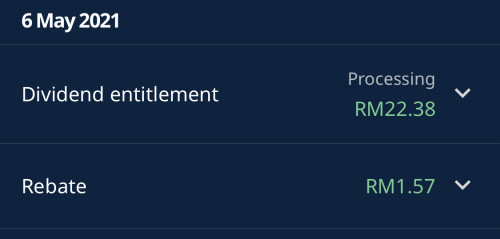

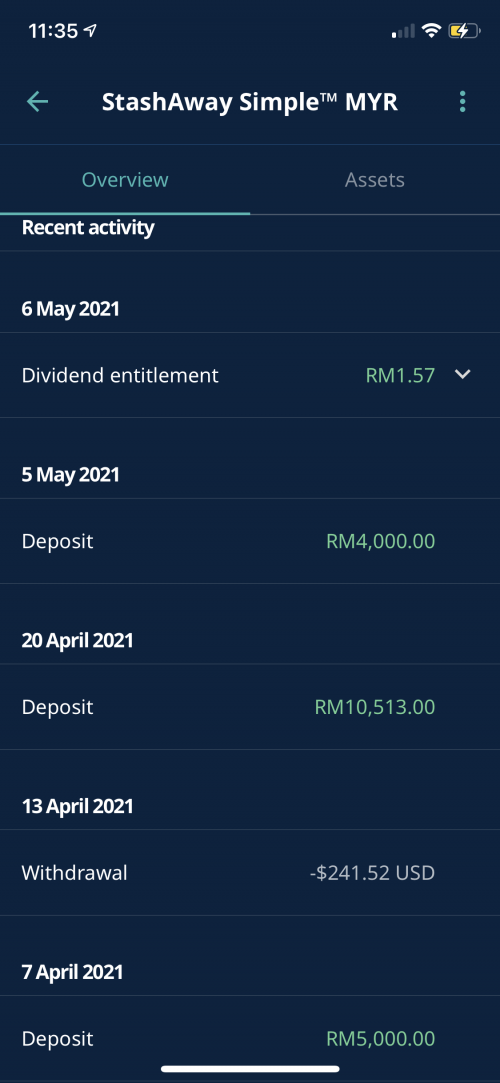

QUOTE(tsutsugami86 @ May 7 2021, 09:04 AM)  This month distribution rate should be RM 0.0008 per unit, why I just get RM 2.60 ? (4,687 units x RM 0.0008 =RM 3.75) QUOTE(south_panda @ May 7 2021, 10:25 AM) Did anyone noticed the dividend distribution for Stashaway Simple is very low this month compared with previous month? I received RM1.57 when I have Rm4k in the account. QUOTE(MUM @ May 7 2021, 10:29 AM) of this 4K you had, you got RM1.57 for last month (April) mind telling how much in RM did you get for the month of Feb, Mar? Where did you get the 0.0008 per unit from?  MMF dividends fluctuate, don't base entirely on SA's projected rates. PRUISIN is going on a downward trend at least for next few months while OPR remains low, following information from Morningstar:  |

|

|

|

|

|

Nelsonz

|

May 7 2021, 11:27 AM May 7 2021, 11:27 AM

|

Getting Started

|

QUOTE(DragonReine @ May 7 2021, 12:16 PM) When did you invest? It's money market, dividends paid out on 6th, "returns" look lower because unit price reduced to pay dividends which you'll see in cash form. Your unit count is the same but NAV lower, you check assets there should have dividends in the form of cash. I DCA weekly from early march till the end of march total RM3k, and in April I didn't deposit any money since it keeps getting a consistent return. Just today morning I noticed the total returns had reduced. I am new to SA-Simple. Should I keep DCA like march or left it alone like FD ? This post has been edited by Nelsonz: May 7 2021, 11:53 AM |

|

|

|

|

|

zstan

|

May 7 2021, 11:28 AM May 7 2021, 11:28 AM

|

|

Huge spike in gold for the past 2 days  |

|

|

|

|

|

WhitE LighteR

|

May 7 2021, 11:31 AM May 7 2021, 11:31 AM

|

|

QUOTE(zstan @ May 7 2021, 11:28 AM) Huge spike in gold for the past 2 days  hopefully its sustainable this time. dont fall back under 200sma |

|

|

|

|

|

tsutsugami86

|

May 7 2021, 11:31 AM May 7 2021, 11:31 AM

|

|

QUOTE(DragonReine @ May 7 2021, 11:25 AM) Where did you get the 0.0008 per unit from?  MMF dividends fluctuate, don't base entirely on SA's projected rates. PRUISIN is going on a downward trend at least for next few months while OPR remains low, following information from Morningstar:  I get the info from FSM. |

|

|

|

|

|

DragonReine

|

May 7 2021, 11:32 AM May 7 2021, 11:32 AM

|

|

QUOTE(Nelsonz @ May 7 2021, 11:27 AM) I DCA weekly from early march till the end of march total RM3k, and in April I didn't deposit any money since it keeps getting a consistent return. Just today morning I noticed the total returns had reduced. I am new to SA-Simple. Should I keep DCA like march then left it alone like FD ? SA Simple is money market, you have to treat more like a fixed deposit with a bit extra liquidity, or a high yield savings account. At only around 2.x% per annum it's not that much better than FD. Don't keep too much there, it's best for emergency fund storage or for short term cash you wish to park and eventually DCA into SA's regular portfolios. |

|

|

|

|

|

south_panda

|

May 7 2021, 11:38 AM May 7 2021, 11:38 AM

|

Getting Started

|

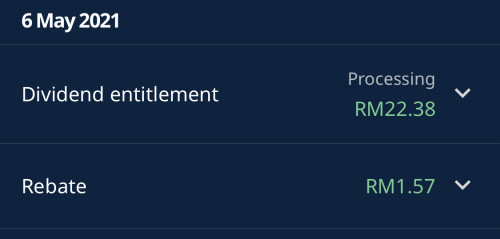

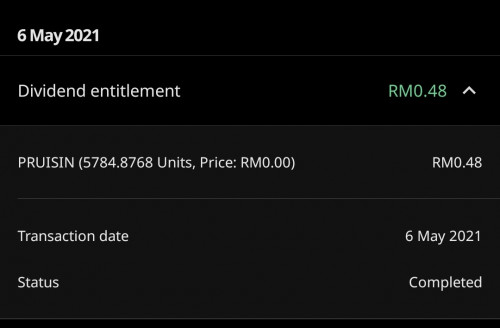

Edited: My Stashaway Simple dividend is back to normal after I Whatsapp to their customer service Before  After  This post has been edited by south_panda: May 7 2021, 07:36 PM This post has been edited by south_panda: May 7 2021, 07:36 PM |

|

|

|

|

|

DragonReine

|

May 7 2021, 11:38 AM May 7 2021, 11:38 AM

|

|

QUOTE(tsutsugami86 @ May 7 2021, 11:31 AM) 🤔 not sure then, just checked my dividends, mine is actually a little higher than 0.0008 per unit lol |

|

|

|

|

|

tsutsugami86

|

May 7 2021, 11:41 AM May 7 2021, 11:41 AM

|

|

QUOTE(DragonReine @ May 7 2021, 11:38 AM) 🤔 not sure then, just checked my dividends, mine is actually a little higher than 0.0008 per unit lol normally they take few days only to payout the dividend, why this round so fast but got error ? |

|

|

|

|

|

tsutsugami86

|

May 7 2021, 11:49 AM May 7 2021, 11:49 AM

|

|

QUOTE(south_panda @ May 7 2021, 11:38 AM) i think their system error  |

|

|

|

|

|

SwarmTroll

|

May 7 2021, 11:53 AM May 7 2021, 11:53 AM

|

|

I've already surpassed the 6 months fee waiver amount. Any large holders here that just continue paying mgmt fees or just try to refer more and stack the amount? Or just sell off lol

|

|

|

|

|

|

DragonReine

|

May 7 2021, 11:54 AM May 7 2021, 11:54 AM

|

|

QUOTE(tsutsugami86 @ May 7 2021, 11:41 AM) normally they take few days only to payout the dividend, why this round so fast but got error ? beats me 😅 tbh I'm already making full withdrawal because hit goal for short term LOL |

|

|

|

|

|

SUSyklooi

|

May 7 2021, 11:55 AM May 7 2021, 11:55 AM

|

|

QUOTE(SwarmTroll @ May 7 2021, 11:53 AM) I've already surpassed the 6 months fee waiver amount. Any large holders here that just continue paying mgmt fees or just try to refer more and stack the amount? Or just sell off lol if it can continue to gives me "better" than expected roi that are on par with other similar platform...i would continue..... |

|

|

|

|

|

DragonReine

|

May 7 2021, 11:59 AM May 7 2021, 11:59 AM

|

|

QUOTE(SwarmTroll @ May 7 2021, 11:53 AM) I've already surpassed the 6 months fee waiver amount. Any large holders here that just continue paying mgmt fees or just try to refer more and stack the amount? Or just sell off lol Why would someone invest in SA for 6 months then lari lol, barely can see any gains 😅 The management fees are so low once you go more than 100k, the only way to get less is to DIY ETFs honestly I don't care about fees as long as nett gains are higher than 5.5% pa This post has been edited by DragonReine: May 7 2021, 12:00 PM |

|

|

|

|

|

Nelsonz

|

May 7 2021, 12:01 PM May 7 2021, 12:01 PM

|

Getting Started

|

I sent request to SA WhatsApp to get some information on current dividend rate but no reply at all...hahaha

This post has been edited by Nelsonz: May 7 2021, 12:02 PM

|

|

|

|

|

|

lee82gx

|

May 7 2021, 12:24 PM May 7 2021, 12:24 PM

|

|

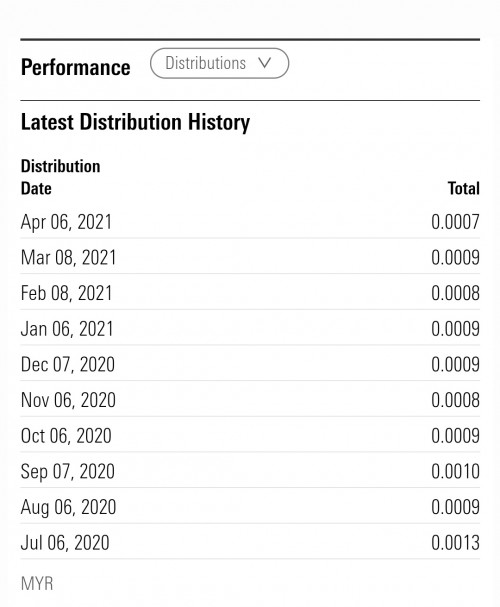

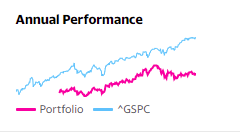

QUOTE(DragonReine @ May 7 2021, 11:59 AM) Why would someone invest in SA for 6 months then lari lol, barely can see any gains 😅 The management fees are so low once you go more than 100k, the only way to get less is to DIY ETFs honestly I don't care about fees as long as nett gains are higher than 5.5% pa very high tolerance you have there buddy.  I'm ok for fees, if they don't underperform the SP500.....in general |

|

|

|

|

|

DragonReine

|

May 7 2021, 12:37 PM May 7 2021, 12:37 PM

|

|

QUOTE(lee82gx @ May 7 2021, 12:24 PM) very high tolerance you have there buddy.  I'm ok for fees, if they don't underperform the SP500.....in general 🤣🤣 I have higher yield DIY stonks portfolio, I treat SA more like a liquid EPF in my portfolio  "forced" long term passive investment LOL, so anything higher than EPF is just cherry on top This post has been edited by DragonReine: May 7 2021, 12:38 PM |

|

|

|

|

|

gundamsp01

|

May 7 2021, 02:06 PM May 7 2021, 02:06 PM

|

|

QUOTE(lee82gx @ May 7 2021, 12:24 PM) very high tolerance you have there buddy.  I'm ok for fees, if they don't underperform the SP500.....in general speaking of that, sorry a noob here, does that mean for my portfolio, it is below SP500 performance?  |

|

|

|

|

|

ChessRook

|

May 7 2021, 03:36 PM May 7 2021, 03:36 PM

|

|

QUOTE(gundamsp01 @ May 7 2021, 02:06 PM) speaking of that, sorry a noob here, does that mean for my portfolio, it is below SP500 performance?  OFC SA is going to underperform against S&P 500 in general. SA is not a 100% equity stock portfolio and has fees that drags down the performance. SA is a balanced portfolio with bonds + gold. I don't think SA is optimise for return performance but SA's purpose is to have 99% chance that one's portfolio doesn't drop by 36% (if one choose 36% risk level) or drop by 26% (if one choose 26% risk level). There are other asset allocation portfolio out there for example, a) golden butterfly portfolio https://youtu.be/RsoBIJoJduob) all-weather portfolio https://youtu.be/PAA1cn2xgFoHere is more on SA portfolio philoshophy: Stashaway Risk Index PurposeSpecifically, the SRI uses 99%-VaR, which means that your portfolio has a 99% chance of not losing more than the given SRI percentage in any given year. For instance, if you choose to invest RM50,000 at a 14% SRI, there’s a 99% chance that you won’t lose more than RM7,000 in a given year (RM50,000 * 14% = RM7,000). You can also say that there’s only a 1% chance that you’ll lose more than RM7,000.There is no right or wrong answer on the setup of the asset allocation portfolio. It depends on one's risk tolerance, time to retirement and so on. This post has been edited by ChessRook: May 7 2021, 03:38 PM |

|

|

|

|

May 7 2021, 11:25 AM

May 7 2021, 11:25 AM

Quote

Quote

0.0233sec

0.0233sec

0.33

0.33

6 queries

6 queries

GZIP Disabled

GZIP Disabled