and the fund just updated in my portfolio. But my assets still remain as 0.00% (could be still in process?)

But already have lost 0.11% from initial deposit, this is for the 0.1% currency conversion fee, right?

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Jul 13 2020, 11:54 AM Jul 13 2020, 11:54 AM

Return to original view | Post

#1

|

Junior Member

900 posts Joined: Oct 2009 |

just started stashaway on last thurs

and the fund just updated in my portfolio. But my assets still remain as 0.00% (could be still in process?) But already have lost 0.11% from initial deposit, this is for the 0.1% currency conversion fee, right? |

|

|

|

|

|

Jul 14 2020, 07:26 PM Jul 14 2020, 07:26 PM

Return to original view | Post

#2

|

Junior Member

900 posts Joined: Oct 2009 |

QUOTE(backspace66 @ Jul 14 2020, 06:54 PM) Quite expected since it needs to clear from the fund side. Even for transfer from bank account , the time taken from deposit to actual investment is quite varied for me, sometimes is as fast as one working day and sometime 2 or even 3 working day. yup, it took me 3 working days, and my value already dropped by 0.11% on T+2, then 0.18% on T+3. I gave a call to SA, they said it is currency exchange value... |

|

|

Jul 14 2020, 07:59 PM Jul 14 2020, 07:59 PM

Return to original view | Post

#3

|

Junior Member

900 posts Joined: Oct 2009 |

|

|

|

Jul 18 2020, 11:46 PM Jul 18 2020, 11:46 PM

Return to original view | Post

#4

|

Junior Member

900 posts Joined: Oct 2009 |

QUOTE(joshtlk1 @ Jul 18 2020, 11:03 PM) quite a long video, but when he talks negatively on other users reviewing on their experience, i seriously got turned off.But some points sort of valid. robo-advisor is not a sure win platform. robo-advisor doesn't provide human touch to customer, but then, the agents i deal with don't either. So not much concern for me. stashaway is relatively new without mass numbers of clients now, and may follow the same footstep of those apps that bankrupt before that (i am kind of worry on this to be frank, i can't see 10-20 years later, but then this may also happen to wealth management firm as well) other points like robo-advisor doesn't bring as much return as what they claimed, and human advisors can do better, etc etc etc. This post has been edited by gundamsp01: Jul 19 2020, 01:31 AM joshtlk1 liked this post

|

|

|

Jul 20 2020, 09:00 PM Jul 20 2020, 09:00 PM

Return to original view | Post

#5

|

Junior Member

900 posts Joined: Oct 2009 |

QUOTE(majorarmstrong @ Jul 20 2020, 08:42 PM) i have tested for almost 1 month now on a mix portfolio 10%, 14% and 24% invested 7k profit RM60 it is a long term investment as per advertised, you need at least 5 years and above only see result, as you are investing on ETF, not speculating on specific stock.uncle really no luck so gonna just stick with my bond will see if this week rally a bit then i going to sell all and tutup account la and on annualized basis, it should be around 8% - 10% on average. This post has been edited by gundamsp01: Jul 20 2020, 09:02 PM |

|

|

Jul 21 2020, 09:54 AM Jul 21 2020, 09:54 AM

Return to original view | Post

#6

|

Junior Member

900 posts Joined: Oct 2009 |

|

|

|

|

|

|

Jul 21 2020, 12:30 PM Jul 21 2020, 12:30 PM

Return to original view | Post

#7

|

Junior Member

900 posts Joined: Oct 2009 |

i have 18%, 26%, 36%

18 is the main while 26 and 36 just a small amt for a bet on higher return |

|

|

Jul 21 2020, 09:15 PM Jul 21 2020, 09:15 PM

Return to original view | IPv6 | Post

#8

|

Junior Member

900 posts Joined: Oct 2009 |

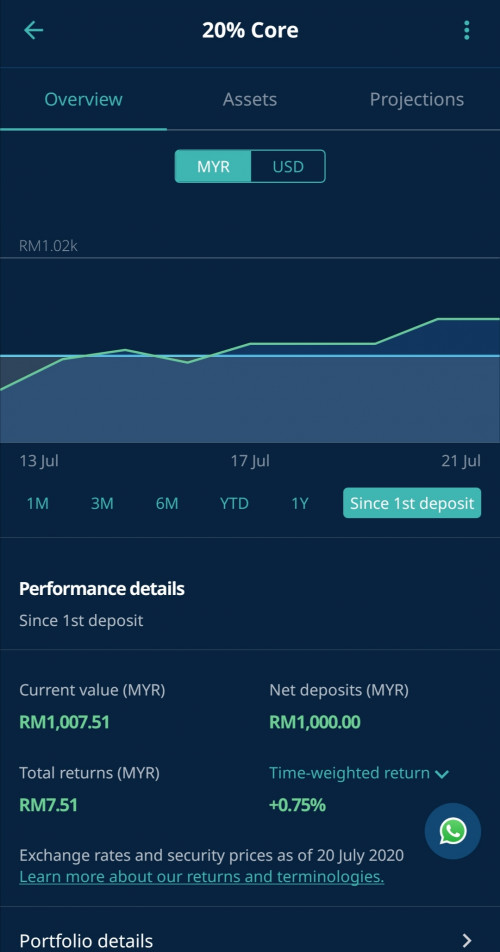

QUOTE(jacksonpang @ Jul 21 2020, 08:21 PM) Hi all sifu, newbie here who just joined for 1 week.. so far feeling satisfying.. and planned to have direct debit few hundred every month afterward, accumulate and wait 5 years and see the outcome.. but I wanted to ask, let say if right now I want to withdraw all the amount I have (pic below), does it mean I might get less than my initial deposit amount because of conversion rate, charges, etc? Thanks in advance! alot of factors need to be considered. the value during the ur assets being sold, the conversion rate after they receive the payment from selling ur assets. even if SA stated that ur current value is 1007, it doesn't mean u can receive 1007 when it reaches ur acc |

|

|

Jul 21 2020, 09:25 PM Jul 21 2020, 09:25 PM

Return to original view | IPv6 | Post

#9

|

Junior Member

900 posts Joined: Oct 2009 |

QUOTE(jacksonpang @ Jul 21 2020, 09:23 PM) Thanks for replying. Yes, i fully understand that definitely not receiving fully 1007 but isit possible to say, maybe up to 2% difference less than the current value, or maybe even more (and unpredictable) because when we place for withdrawal, it might take many hours to really sell off all assets? if i am not wrong, someone replied that he loss more than 30% from the point issue withdrawal order to the point he received the money |

|

|

Jul 21 2020, 10:07 PM Jul 21 2020, 10:07 PM

Return to original view | IPv6 | Post

#10

|

Junior Member

900 posts Joined: Oct 2009 |

|

|

|

Jul 22 2020, 02:50 PM Jul 22 2020, 02:50 PM

Return to original view | Post

#11

|

Junior Member

900 posts Joined: Oct 2009 |

|

|

|

Jul 24 2020, 03:31 PM Jul 24 2020, 03:31 PM

Return to original view | Post

#12

|

Junior Member

900 posts Joined: Oct 2009 |

QUOTE(encikbuta @ Jul 24 2020, 03:12 PM) that means it's time to pick up so cheap stock? honsiong liked this post

|

|

|

Jul 24 2020, 03:35 PM Jul 24 2020, 03:35 PM

Return to original view | Post

#13

|

Junior Member

900 posts Joined: Oct 2009 |

QUOTE(MUM @ Jul 24 2020, 03:32 PM) currently only have 2k worth of investment (start from mid jul), as waiting for market crash for some cheap stocki am able to dca my current assets with more money pump in, anticipating end of july for the first crash and after US election |

|

|

|

|

|

Jul 24 2020, 04:23 PM Jul 24 2020, 04:23 PM

Return to original view | Post

#14

|

Junior Member

900 posts Joined: Oct 2009 |

QUOTE(MUM @ Jul 24 2020, 03:40 PM) means you have 2k invested in EQ? i have 2k invested in SA.and have alot more backstage waiting to buy in more in anticipation end of july for the first crash then buy by DCA and sell before US election then buy again by DCA after US election? then another question "what is your ratio of this 2k against your war chest fund"? never intend to sell, want to keep for 20 years, that's why whenever there is bargain sale, will put in more, while for DCA for rest of the months with my scheduled purchase limit. ratio...hmmm, put it this way, i have 3 months saving emergency fund and building towards 6 months, then will revise my monthly investment fund again. I always have the thought that the money i put for investment are the money that i wouldn't feel pain if i lose it. This post has been edited by gundamsp01: Jul 24 2020, 04:24 PM MUM liked this post

|

|

|

Jul 24 2020, 08:34 PM Jul 24 2020, 08:34 PM

Return to original view | Post

#15

|

Junior Member

900 posts Joined: Oct 2009 |

QUOTE(XweienX @ Jul 24 2020, 08:25 PM) If wanna time then shouldn't be using SA. So I also don't know why they discussing about it here and not in Traders Corner or US Stock Market thread. somewhat you can. IMO. only thing is you may not be the first coach of the train, but anyway still on the train nonetheless This post has been edited by gundamsp01: Jul 24 2020, 08:35 PM |

|

|

Jul 27 2020, 02:02 PM Jul 27 2020, 02:02 PM

Return to original view | Post

#16

|

Junior Member

900 posts Joined: Oct 2009 |

QUOTE(chenkiong @ Jul 27 2020, 01:55 PM) Afternoon all sifu, im newbie here. start invest stashaway since octorber 2019. till now 10% return. i had few question for q1 and q2, refer to stashaway FAQ1. Will this stashaway collapse and our money sink in sea 1 days? 2. If no, where can i get my money back after stashaway disappear 3. Im chinese in malaysia, which no entitle to any bumiputra benefit like asb. Stashaway give me a very bright in sight, i plan to deposit every week into it like many sifu suggest. Around Rm50-100. So in long term i get interest return. Is it ok to do so? 4. Can i put my 25% saving into this stashaway? im just worry hard earn money going to sea bed. Thanks you sifuS "What happens to my money if StashAway gets acquired, goes public, or closes? Your money is kept entirely unmingled with StashAway's finances. To ensure that we never touch your money, we use custodian banks that hold your money, whether it's in cash or in securities. StashAway has made it a top priority to work with global, reputable banks for these purposes. Our custodian bank for receiving your deposits is Citibank Berhad, while Saxo Capital Markets Pte Ltd is our custodian for your investible cash and securities. In these custodian institutions, your assets are always in a segregated account-- one that is separate from StashAway's operations and assets. This means that you will always have full access and claim to your assets no matter what happens to StashAway." for q3 and q4, really depends on your risk appetite, if you can stomach the the fluctuation of the market, then you can put more. my general rule is that have a bucket of emergency fund (3 - 6 months), then allocate the amount which you think is not needed/will not feel pain if total loss, into investment. |

|

|

Jul 27 2020, 02:09 PM Jul 27 2020, 02:09 PM

Return to original view | Post

#17

|

Junior Member

900 posts Joined: Oct 2009 |

QUOTE(chenkiong @ Jul 27 2020, 02:06 PM) no, what i mean is the market crashes, and take time to recover. Let say if invest RM10k in it at the peak of the market, and then, market crashes, and you have a negative return for quite some time with no light on when the market will recover. Can you stomach this situation? If yes, you can put in more, because in a long run, the market is always uptrend, regardless of the ups and downs in between. If no, then put less. |

|

|

Jul 27 2020, 02:12 PM Jul 27 2020, 02:12 PM

Return to original view | Post

#18

|

Junior Member

900 posts Joined: Oct 2009 |

QUOTE(chenkiong @ Jul 27 2020, 02:11 PM) thanks you sifu, when covid initially impact happen. i dont feel worry about the money because i still have saving can be use. Plus that time we dont know the covid will happen so suddenly after chinese new year. but now we can foresee alittle bit about wave 2 is coming, still got to DCA every week using extra money? or wait the tide is low just start DCA. Thanks you you can watch this video on the comparison between DCA and time the market (lump sum) |

|

|

Jul 27 2020, 02:42 PM Jul 27 2020, 02:42 PM

Return to original view | Post

#19

|

Junior Member

900 posts Joined: Oct 2009 |

QUOTE(vkashin @ Jul 27 2020, 02:39 PM) Newbie here, just opened account on StashAway app I think you have to open the account with the referral link, not after you open the accountIs it too late to enter referral codes? If not, anyone want to share? 😅 this is the statement on stashaway for the referral link "Make sure they sign up with your unique referral link so that you both get free investing" |

|

|

Jul 27 2020, 06:53 PM Jul 27 2020, 06:53 PM

Return to original view | Post

#20

|

Junior Member

900 posts Joined: Oct 2009 |

shouldn't you all delete the auto debit instruction in your stashaway acc until they resolve the current system issue? singkalan liked this post

|

| Change to: |  0.0593sec 0.0593sec

0.89 0.89

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 30th November 2025 - 07:09 AM |