QUOTE(Takudan @ Feb 14 2021, 03:04 AM)

Hello, did I just get conveniently excluded from the statistics with my -0.56% TWR/MWR?

Thanks. I do have some long term investment on stocks outside SA, so increasing risk index to focus on equities feels like I'm putting too many eggs into the same basket... or am I wrong to think so? I'm not saying I have eyes on all kinds of industries/sectors, but I'm thinking a market crash would affect every stock out there.

Honestly I was expecting it to perform better than FD or heck, my saving account lol, but I can't bring myself to top up to a portfolio that tells me -0.56% TWR, meanwhile my manual investment is going strong at 15%+

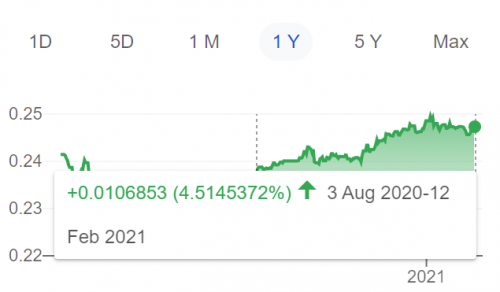

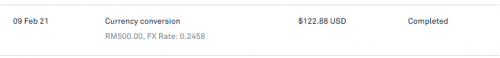

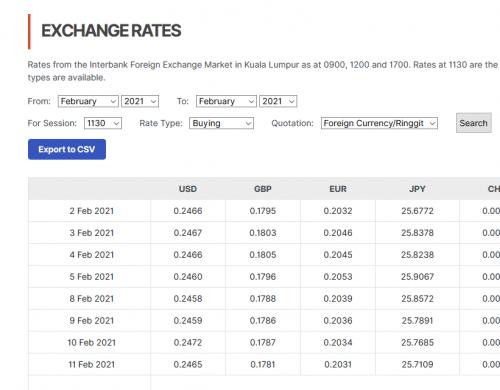

It's hard to think that it was a bad peak when the market right now is better than in Aug 2020. So was I really just unlucky with the AI/whoever working on my account? I'm trying hard to convince myself about SA haha

Bonds and gold are underperforming these past few months, so to have a loss is not surprising in these “bull times” for equities, bear for bonds. Even my 14 % ri portfolio is not performing as well as the higher risk ones. BUT, during the bad times at the worst of COVID last year, i assure you it was outperforming the equity heavy portfolios, and by a strong margin. At one time the 14% risk portfolio was doing 20% return per annum. Of course I was doing DCA and this guaranteed average results. Now it is roughly 10-12% XIRR.

As has been discussed many many times, lump sum during down turn is going to loss out to DCA (your situation for bond heavy portfolio).

The plus factor is you hardly lost any significant money during this period and I bet you are still very much in the 10% risk index performance bracket, ie 1% chance of losing 10% in a year. There is actually no guarantee that the lowest risk portfolio must make profit, it is just lower in volatility. I’d say a 0.5% loss over 6 months is damn low volatility.

There are a few ways to look at this:

1. Stay invested and eventually it will rise back to close to the benchmark 9.5% p.a.

2. Invest more and it will reach 9.5% sooner

3. If you actually looking for more reward vs risk then switch to higher risk as many have recommended.

Now the question that remains is what are you going to do and it is not up to others to decide or even for you to decide based on historical returns. If you think market gonna tank, suggest you top up your 10% port, if you think market going up, do the 36% instead.

Feb 14 2021, 12:51 AM

Feb 14 2021, 12:51 AM

Quote

Quote

0.0237sec

0.0237sec

0.36

0.36

6 queries

6 queries

GZIP Disabled

GZIP Disabled