Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

backspace66

|

Apr 6 2020, 11:55 AM Apr 6 2020, 11:55 AM

|

|

QUOTE(GrumpyNooby @ Apr 6 2020, 11:45 AM) Even MCO, Bursa trading still continues. It does not make sense for Wahed MY team not operating during MCO period. They are allocating in Myetf MMID and MYetf US50. Those two have very low volume and almost no movement in the past week. No offence, but i find the idea of investing in bursa listed etf through wahed a bit silly. It is easily accesible however not recomended due to very low liquidity. The point of SA other than being a robo adviser, it also make exposure to US etf more accesable to the general population. This post has been edited by backspace66: Apr 6 2020, 12:02 PM |

|

|

|

|

|

backspace66

|

Apr 6 2020, 12:05 PM Apr 6 2020, 12:05 PM

|

|

QUOTE(stormseeker92 @ Apr 6 2020, 11:40 AM) I read they say no market movement for one whole week in the app. Plus it's getting red since Malaysia started MCO so market declines since everyone stays at home similar to other countries. Plus the withdrawal takes almost 1 week or more. People scared edi cz they think it's skim cepat kaya lol Not easy for them to liquidate the investment for wahid, no demand for those two etf listed in bursa. This post has been edited by backspace66: Apr 6 2020, 12:05 PM |

|

|

|

|

|

backspace66

|

Apr 6 2020, 12:38 PM Apr 6 2020, 12:38 PM

|

|

Issue on the market maker especially with such a low demand etf

|

|

|

|

|

|

backspace66

|

Apr 7 2020, 01:50 PM Apr 7 2020, 01:50 PM

|

|

All the etf they are invested into increase within a range of 4.xx to 8.xx % yesterday.

|

|

|

|

|

|

backspace66

|

Apr 7 2020, 01:54 PM Apr 7 2020, 01:54 PM

|

|

QUOTE(GrumpyNooby @ Apr 7 2020, 01:51 PM) Yes even xle at 5.xx%. even xom increase more than 3%. |

|

|

|

|

|

backspace66

|

Apr 7 2020, 02:03 PM Apr 7 2020, 02:03 PM

|

|

QUOTE(stormseeker92 @ Apr 7 2020, 01:52 PM) I tried to do some calculations. If all my ETFs in my portfolio goes back up again at the point before crash, I would make RM500 ($112) easy lol When did you start to invest in SA? |

|

|

|

|

|

backspace66

|

Apr 8 2020, 01:24 PM Apr 8 2020, 01:24 PM

|

|

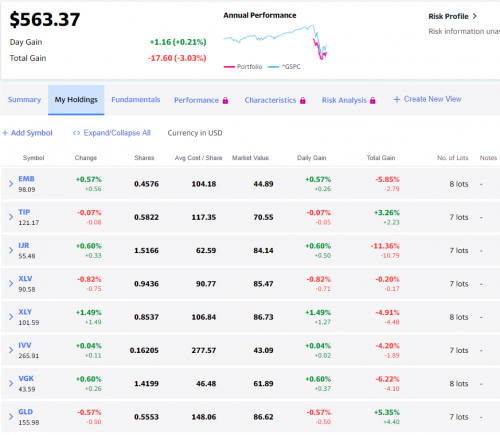

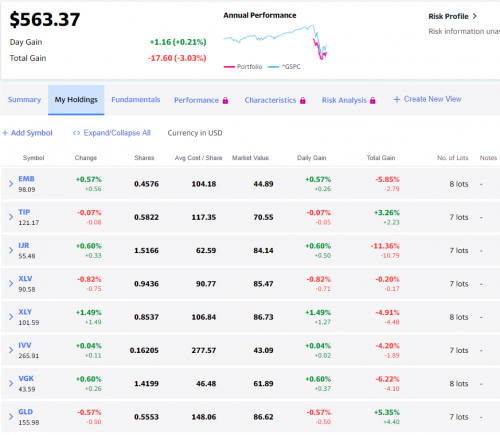

QUOTE(dummies @ Apr 8 2020, 10:55 AM) sorry new to SA, what is XLE and XOM means? btw, if i invest in SA, which currency i should use now, USD or MY ? I guess it should be USD since USD is strong now..thanks XLE is one of ETF allocated by SA , it is tracking energy sector. XOM is exxon mobil, just one of the main component of DJIA. Investment will be done in USD, the money you deposited will be converted to USD. Other than what is already shared by the other forumer, it might also be good for you to install the yahoo finance app and add the following ticker before you start investing; VGK IVV XLY XLK XLE XLV XLC IJR These are mostly relevant to 36% risk ratio. |

|

|

|

|

|

backspace66

|

Apr 8 2020, 03:28 PM Apr 8 2020, 03:28 PM

|

|

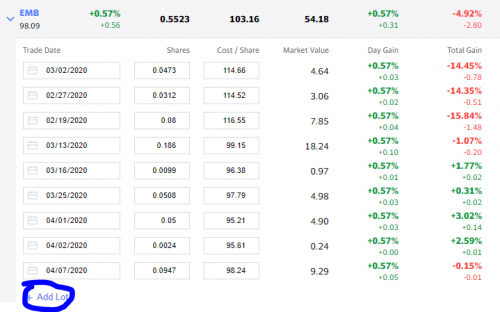

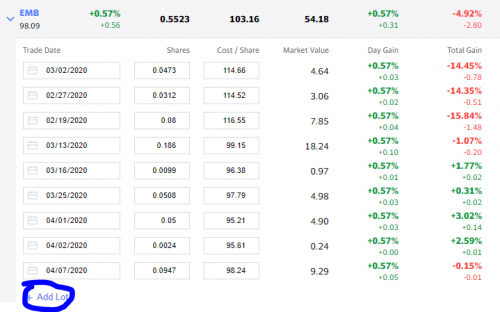

QUOTE(stormseeker92 @ Apr 8 2020, 02:41 PM) Like this! HAHA  Mine is only 22% Risk tho. Does that correspond to the current portfolio? Did you opt for auto re-optimization? |

|

|

|

|

|

backspace66

|

Apr 8 2020, 04:15 PM Apr 8 2020, 04:15 PM

|

|

QUOTE(stormseeker92 @ Apr 8 2020, 03:54 PM) This only follows real time ETFs prices. Any reoptimization or buy/sell orders done by SAMY have to manually key-in here to show accurate data. What i meant was, the proportion shown there lot/total lot or percentage allocation per etf correspond to the current portfolio you have right now? |

|

|

|

|

|

backspace66

|

Apr 8 2020, 04:21 PM Apr 8 2020, 04:21 PM

|

|

Cant comment much about the auto reoptimization, i dont have enough data to compare and SA has not been around long enough.

|

|

|

|

|

|

backspace66

|

Apr 8 2020, 04:29 PM Apr 8 2020, 04:29 PM

|

|

QUOTE(stormseeker92 @ Apr 8 2020, 04:19 PM)  Just follow the buy/sell orders from the Transaction tab in the SAMY app. 1 Lot for 1 transaction. Key-in how many shares you bought and price per share and wallah there you go. But I must warn following the prices everyday increases anxiety and gets your trigger finger more itchy to buy or sell more lol Steps: 1. Add Symbol (EMB,VGK or anything) 2. Expand the symbol you added 3. Add lots according to the Transactions in your SAMY account. More transactions = more lots to add in haha Ahh, sorry ,mistakenly looking at the wrong column. Thinking in term of stock market lot and didnt see the share amount column. I shouldnt compare lot/share anyway as the proportion of value/market valur per etf is the one that matters. This post has been edited by backspace66: Apr 8 2020, 04:32 PM |

|

|

|

|

|

backspace66

|

Apr 13 2020, 08:46 PM Apr 13 2020, 08:46 PM

|

|

QUOTE(brokenbomb @ Apr 13 2020, 08:16 PM) using JomPay.  I think that time I have 2 portfolio, 36% and 30%. why I have two is because konon that time I need to have 2 separate "goals" haha so my total return rate the whole 2019 is around 7% But Could be higher, if not for my attempt to "time" the market during huawei ban and october china trade war threat. Keep changing the risk profile from 36 to 25 then to 18 then back to 36 haha   Savings is all about emotion, some people cannot tahan the act of login to their cimbclicks and transfer RM1000 every month, but what if we staggered that RM1000 into 30 days? 1000/30 its only RM33.333 bah per day. So thats why I DCA daily. haha. even if i miss one day two day or even 1 week I still manage to save RM700-RM800 per month, and if my budget is ok, maybe even more.  Wow man, u take DCA to the next level. |

|

|

|

|

|

backspace66

|

Apr 15 2020, 09:42 AM Apr 15 2020, 09:42 AM

|

|

That is just the impact of covid 19 and only partially affecting Q1 result . What if it compounds with oil and gas company in US going bust. https://www.marketwatch.com/story/heres-a-b...tank-2020-03-12 |

|

|

|

|

|

backspace66

|

Apr 15 2020, 09:57 AM Apr 15 2020, 09:57 AM

|

|

QUOTE(stormseeker92 @ Apr 15 2020, 09:52 AM) Some of the effects of covid to the economy have already been priced in. As usual it is a forward looking mechanism,looking ahead 6-9 months. It could be all priced in, but i believe nobody is 100% sure of this, so i will still tread carefully. The comment there is in referrence to the above post about the bank earning. |

|

|

|

|

|

backspace66

|

Apr 22 2020, 11:55 AM Apr 22 2020, 11:55 AM

|

|

Equity and nothing to worry about does not belong in one sentence. We are talking about etf here which have been proven to be ok for the longer term. Although the same cant be said for etf such as XLE, IVV should be OK , again for longer term.

Of course there are some example of index which never recovered after its peak

|

|

|

|

|

|

backspace66

|

Jun 13 2020, 03:59 PM Jun 13 2020, 03:59 PM

|

|

If u want exposure and performance similar to s&p 500, u can consider HLAL etf provided by Wahid. 65% invested there if you take the most aggresive portfolio. The disadvantage is that it is not exactly based on s&p 500 but instead a selected component of it. Other disadvantage is exposure to MYETF-MMID (20%) where the index it is based on basically sucks. HLAL etf also do not have any exposure to financial institution and almost non existant exposure to telecommunication

This post has been edited by backspace66: Jun 13 2020, 04:14 PM

|

|

|

|

|

|

backspace66

|

Jun 14 2020, 10:48 AM Jun 14 2020, 10:48 AM

|

|

QUOTE(abcn1n @ Jun 14 2020, 01:54 AM) Sorry--OT a bit. I really don't understand why Wahid doesn't have a portfolio that can exclude MYETF-MMID. I'm sure if they do that, they will have more customers and more $ going into them. Maybe if enough of us make noise they will do that. One of the attractions of Wahid is that we can buy in smaller amounts each time which allow us to do more frequent DCA. So although we can buy HLAL directly, many will still choose to do it through Wahid due to the above reason. Ever since SA reoptimize to having very little exposure to USA markets, Wahid has become more attractive I have contacted their customet service, they do not even have any plan to exit myetf-mmid. If they have a really small exposure less than 10% , i would actually be fine with that. Other problem is the I-VCAP being unreliable and might close down anytime in the future. As for stash away, if i am not mistaken, if you are invested few months ago before the reoptimization, you can reject the reoptimisation This post has been edited by backspace66: Jun 14 2020, 10:50 AM |

|

|

|

|

|

backspace66

|

Jun 16 2020, 06:54 PM Jun 16 2020, 06:54 PM

|

|

Stashaway seems to be pretty efficient, transfered fund on sunday morning and it is already invested.As for Wahid, transfered twice on thursday and friday last week, none of them are invested ( or at least not updated as invested in the app)

|

|

|

|

|

|

backspace66

|

Jun 17 2020, 10:28 AM Jun 17 2020, 10:28 AM

|

|

QUOTE(abcn1n @ Jun 14 2020, 12:50 PM) Nah, you can't reject reoptimisation from what I heard although in the email , SA do put it very nicely as if you can Makes me think, maybe Wahed invests in Malaysia a fair bit due to agreement with Malaysia to support the local stock market and maybe get some incentive for doing so. Otherwise, they are really dumb if they have never thought of creating a portfolio that excludes Malaysia market  This is my current screenshot for the current asset allocation. I rejected the optimisation and still exposed around 70++% to US stock market  |

|

|

|

|

|

backspace66

|

Jun 17 2020, 05:00 PM Jun 17 2020, 05:00 PM

|

|

QUOTE(encikbuta @ Jun 17 2020, 10:35 AM) hey this is awesome! did they send an email or notification of any sorts that they will soon 'force' you to revert to the new allocation? P/S: look at the XLE (Energy) share, my goodness. deteriorated until left 0%. i'm guessing they never rebalanced coz there was no DCA into this portfolio? FYI, auto reoptimisation is off and this is from fresh fund transferred last sunday. I only received email for permission to reoptimize and asking for permission to enable auto reoptimization more than a month ago. I rejected the reoptimization btw. |

|

|

|

|

Apr 6 2020, 11:55 AM

Apr 6 2020, 11:55 AM

Quote

Quote

0.0418sec

0.0418sec

0.52

0.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled