Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

blur19755

|

Sep 11 2019, 10:46 PM Sep 11 2019, 10:46 PM

|

|

Hi all,

i just jump ship to this without really find out the details, deposit 1k(risk at 36%) since 1st Sept. All i know this engine relatively invest on US & Europe ETFs, and the return is around 6% or more. I'm not finance guy, but can anyone explain why is everyone so positive on ETFs which SAMY selected, compare to the finance opportunity (stocks, REITs, ETFs) which available too in Malaysia? Is our local market that least attractive?

Sorry asking dumb question, it took me quite a lot to digest 129 pages here. I just finding more solid reasons to trust on the advantage on this platform.

This post has been edited by blur19755: Sep 11 2019, 10:58 PM

|

|

|

|

|

|

blur19755

|

Nov 5 2019, 02:39 PM Nov 5 2019, 02:39 PM

|

|

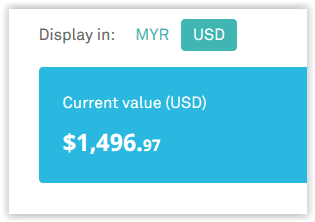

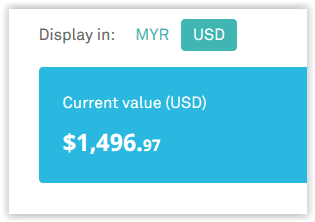

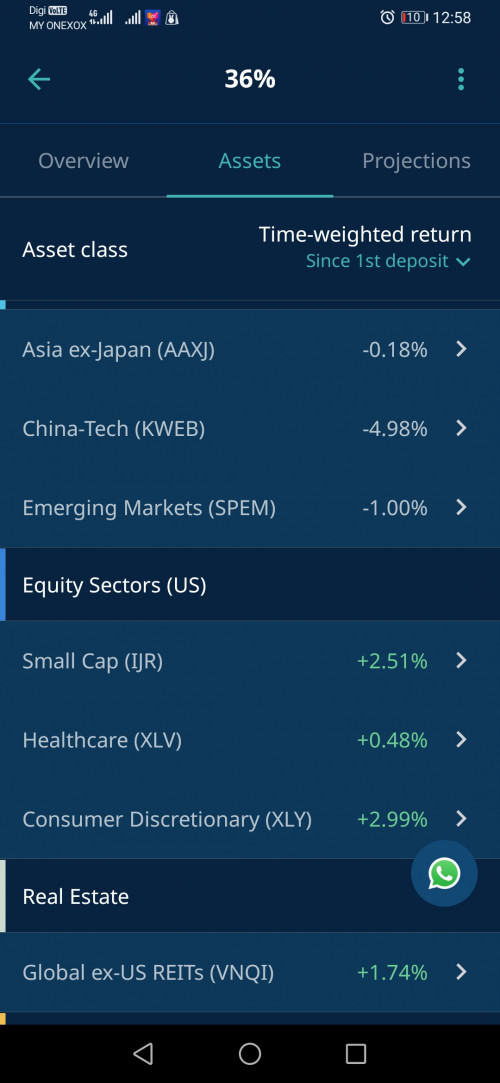

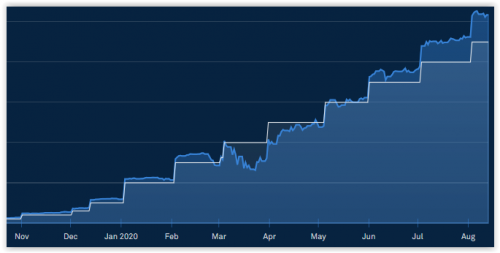

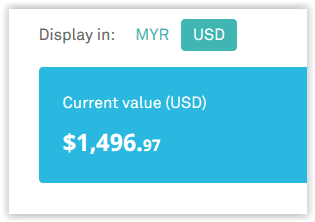

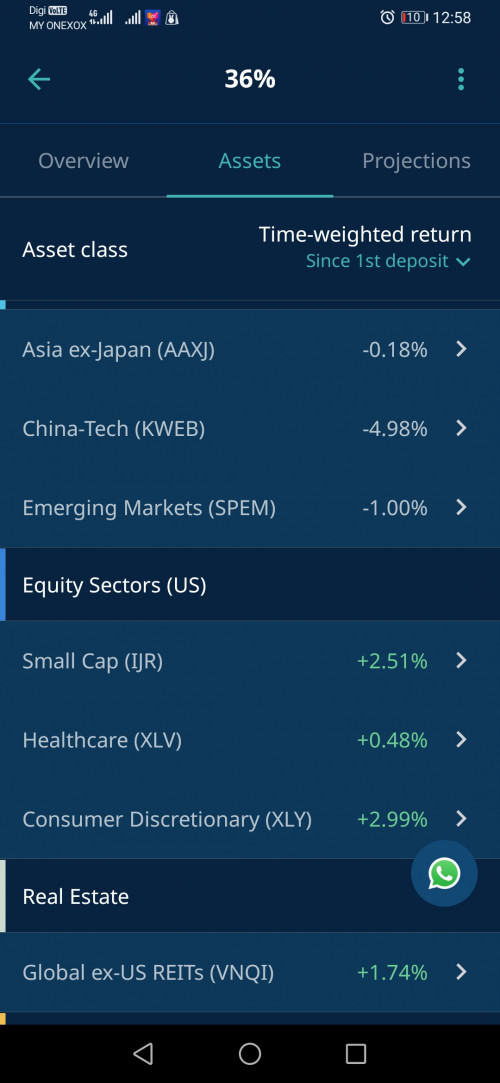

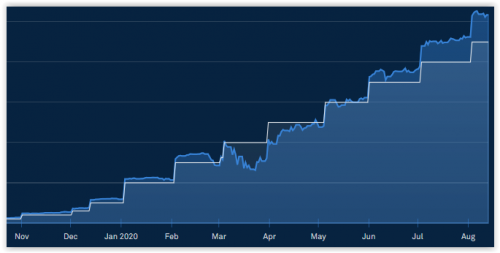

started 3rd Sept with 36% risk index, DCA on 1st Oct, and 1st Nov :-

MYR : MWR 3.97%, TWR 3.84%

USD : MWR 5.55%, TWR 5.37%

|

|

|

|

|

|

blur19755

|

Dec 24 2019, 09:54 AM Dec 24 2019, 09:54 AM

|

|

so... if there's a downfall of US stocks.... many of here not gonna be happy because of overwhelmed few months of happiness..

|

|

|

|

|

|

blur19755

|

Feb 20 2020, 03:11 PM Feb 20 2020, 03:11 PM

|

|

QUOTE(xcxa23 @ Feb 19 2020, 03:54 PM) Anybody know what's the annualised return for SA? >15% for the highest risk 36%? United Quality and TA global have annualised return of at least 13% for the past 3 years. started with 36% risk since 3rd Sept with rm1k, DCA till now till 2.5k. Today's return is rm2736.47 already close to 10% within 6 months. Not sure how good the annualized return gonna be, depends on US market! This post has been edited by blur19755: Feb 20 2020, 06:05 PM |

|

|

|

|

|

blur19755

|

Feb 21 2020, 04:48 PM Feb 21 2020, 04:48 PM

|

|

QUOTE(tehoice @ Feb 21 2020, 04:38 PM) 10% in 6 months is not a good return??? reason for one to say so is because of the risk level of 36%? if you lower the risk level to 18%, will you still see the 5% return? reflecting the same return for the same corresponding period? agree! This post has been edited by blur19755: Feb 21 2020, 04:49 PM |

|

|

|

|

|

blur19755

|

Feb 22 2020, 01:10 AM Feb 22 2020, 01:10 AM

|

|

QUOTE(cucumber @ Feb 21 2020, 05:10 PM) I just want to point out that it doesnt work that way. 18% risk level just means your asset allocation is different, if commodities are doing well, the return could be higher than 36% risk level. My 18% profile performs better than my 36% profile at the moment. i don't go against with any risk profile is doing better than another, as long you are comfortable with it. Different risks profile do have their own advantage, and i understand how the risk portfolio works. thx for sharing QUOTE(BacktoBasics @ Feb 21 2020, 10:28 AM) 36% risk, 10% return. i think very high risk with not a high return 10% is not high? Your expectation is 20%? I can't find any investment tool in the market can provide such return within 6 months, of course thx to US bull market in the past 6 months. |

|

|

|

|

|

blur19755

|

Feb 27 2020, 10:18 AM Feb 27 2020, 10:18 AM

|

|

QUOTE(zenquix @ Feb 27 2020, 08:29 AM) i think MNet confused sales charge with annual management fee. UT also has this. https://www.imoney.my/articles/investment-g...sts-and-chargesYes, many ppl do not know UT did charge 1.5% annually, and some might have other miscellaneous charges. However this can be check via KWSP portal, since they do allow us DIY on UT purchases.  This post has been edited by blur19755: Feb 27 2020, 10:20 AM This post has been edited by blur19755: Feb 27 2020, 10:20 AM |

|

|

|

|

|

blur19755

|

Feb 29 2020, 01:59 PM Feb 29 2020, 01:59 PM

|

|

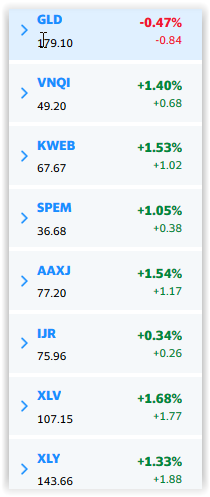

QUOTE(lifenoregret @ Feb 29 2020, 10:49 AM) Is there a way to track the profit/losses of market gain and total profit of dividend? DIY using finance yahoo app which got introduce via this thread. Key in purchasing units and price, as well when dividend distributed. Every morning just swipe this app will roughly know the gain/loss |

|

|

|

|

|

blur19755

|

Apr 23 2020, 11:48 PM Apr 23 2020, 11:48 PM

|

|

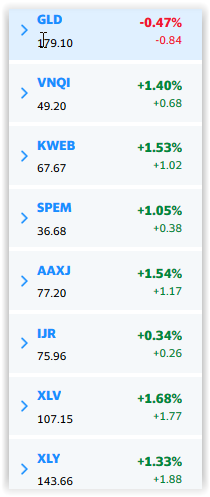

QUOTE(ben3003 @ Apr 23 2020, 01:38 PM) So weird, yesterday market up 2-3% Sp500 but my 26% portfolio still can go down.. lol did you follow closely on all the assets within your 26% portfolio? s&p 500 is not your only asset within your portfolio, it goes up does not mean other asset are up too. |

|

|

|

|

|

blur19755

|

Aug 7 2020, 04:31 PM Aug 7 2020, 04:31 PM

|

|

i tried tracked every single transaction with yahoo finance app, but the amount return is always different from what i see from SA app, anyone encounter the same and know why?

|

|

|

|

|

|

blur19755

|

Aug 7 2020, 04:48 PM Aug 7 2020, 04:48 PM

|

|

QUOTE(yklooi @ Aug 7 2020, 04:34 PM) is the currency conversion rate the same??  huh? everything track in USD... where's the conversion comes from?   |

|

|

|

|

|

blur19755

|

Aug 7 2020, 09:07 PM Aug 7 2020, 09:07 PM

|

|

QUOTE(bourse @ Aug 7 2020, 08:52 PM) I do use yahoo finance to check, there is small diff like 10 cents compare with SAMY (excl 1% cash). have you track every single transaction follow like SAMY buy order unit and price? for a quick check: Yahoo finance > My Portfolio > My Watchlist > My Holdings > GLD > MARKET VALUESAMY > Portfolios > My investment > Assets > Gold > Value (USD)MARKET VALUE and Value (USD) SHOULD be same figure. yup i tracked every single transaction in SAMY by replicate them into the yahoo finance app. yes, the market values are same in both apps |

|

|

|

|

|

blur19755

|

Aug 8 2020, 12:01 AM Aug 8 2020, 12:01 AM

|

|

QUOTE(blur19755 @ Aug 7 2020, 04:48 PM) huh? everything track in USD... where's the conversion comes from?   sorry guys, i found out my problem. i tracked all the "buy order", but i forgot about the re-optimization in May which have "sell order" which consist less units of total i should have. hhhmm... now it can't be tally as yahoo finance app only tracks "buy transactions" This post has been edited by blur19755: Aug 8 2020, 12:04 AM |

|

|

|

|

|

blur19755

|

Aug 8 2020, 09:06 PM Aug 8 2020, 09:06 PM

|

|

QUOTE(blur19755 @ Aug 8 2020, 12:01 AM) sorry guys, i found out my problem. i tracked all the "buy order", but i forgot about the re-optimization in May which have "sell order" which consist less units of total i should have. hhhmm... now it can't be tally as yahoo finance app only tracks "buy transactions" i did quick google and found simple solution [/B] "Click “+” to Add a new lot. Supply all the info for your sale, but enter the number of shares as a negative number, by keying a minus sign. In the Cost Basis column put price per share at which you sold the stock."[B] |

|

|

|

|

|

blur19755

|

Aug 11 2020, 01:12 PM Aug 11 2020, 01:12 PM

|

|

What's the point of all these testing? while result can only tell on long run DCA. Keep making changes on your portfolio do you no good!!!

There are always ups and downs in market, just stick with one, DCA and result will tell!

This post has been edited by blur19755: Aug 11 2020, 01:13 PM

|

|

|

|

|

|

blur19755

|

Aug 13 2020, 12:40 AM Aug 13 2020, 12:40 AM

|

|

QUOTE(chichabom @ Aug 12 2020, 12:10 PM) How accurate is this tracking vs the SA app? Do you have to like update every single dividend received and any rebalancing activity? Looks like alot of monitoring and work needed to maintain? Nope, you only track units and price you bought, that's all. Rebalancing is a very rare occasion which easy to track too (i had shared earlier post on how to do it). dividend received will be port back to your "cash profile" which i don't track (in android version). |

|

|

|

|

|

blur19755

|

Aug 13 2020, 09:59 AM Aug 13 2020, 09:59 AM

|

|

QUOTE(honsiong @ Aug 13 2020, 09:20 AM) sorry my bad, re-optimisation.. |

|

|

|

|

|

blur19755

|

Aug 13 2020, 11:55 AM Aug 13 2020, 11:55 AM

|

|

QUOTE(majorarmstrong @ Aug 13 2020, 11:34 AM) The only portfolio that looks good for me is 26% The worst is 36% Even 14% which I allocated the most money also coming down So dca vca here I come weird, mine running 36% is good. Mind share when did u start?  |

|

|

|

|

|

blur19755

|

Aug 13 2020, 05:13 PM Aug 13 2020, 05:13 PM

|

|

QUOTE(majorarmstrong @ Aug 13 2020, 12:57 PM) I started very late just early August China tech cause it to go down  No worries, you guys didn't went through the March period, whatever u going through now is just norm  This post has been edited by blur19755: Aug 13 2020, 05:14 PM This post has been edited by blur19755: Aug 13 2020, 05:14 PM |

|

|

|

|

|

blur19755

|

Aug 15 2020, 11:19 PM Aug 15 2020, 11:19 PM

|

|

QUOTE(majorarmstrong @ Aug 14 2020, 11:15 AM) Just take the noise out and DCA will do If you keep seeing those negative news you withdraw or see positive news you invest not correct die faster DCA weekly For me I dca weekly Vca when I see huge drop Like my 36% portfolio I vca recently due to drop The rest dca How do you know it's huge drop and your VCA do work? scenario: 10pm, your portfolio red sea, 11pm you bank in to VCA in.... early morning 5am close market with hyper green..... and your money only goes in after 2 business day(or even more), god knows by then how's stock market performing??????? This post has been edited by blur19755: Aug 15 2020, 11:20 PM |

|

|

|

|

Sep 11 2019, 10:46 PM

Sep 11 2019, 10:46 PM

Quote

Quote

0.4225sec

0.4225sec

0.79

0.79

7 queries

7 queries

GZIP Disabled

GZIP Disabled