Wow amasia. From 0.52% to 0.82%!!!!

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Mar 16 2017, 05:31 PM Mar 16 2017, 05:31 PM

|

All Stars

24,392 posts Joined: Feb 2011 |

Wow amasia. From 0.52% to 0.82%!!!!

|

|

|

|

|

|

Mar 16 2017, 05:32 PM Mar 16 2017, 05:32 PM

|

Senior Member

948 posts Joined: Dec 2005 |

QUOTE(puchongite @ Mar 16 2017, 05:28 PM) Not so straight forward lar. Most of the time we make guesses only, sometimes with a little luck. Not everything is predictable I been there before, main buy only because recommended fund, waited 2 yrs still minus 5 percent...and then switch to others after study abut, gain in less than a yr.fund make me lose that tine was global titans....but after read here and read in fundsupermart, buy again titans, it gain. means good timing. |

|

|

Mar 16 2017, 05:42 PM Mar 16 2017, 05:42 PM

Show posts by this member only | IPv6 | Post

#2043

|

Senior Member

756 posts Joined: Dec 2016 |

QUOTE(fense @ Mar 16 2017, 05:32 PM) I been there before, main buy only because recommended fund, waited 2 yrs still minus 5 percent...and then switch to others after study abut, gain in less than a yr. There is a saying which goes It’s time in the market that builds returns, not timing the market.fund make me lose that tine was global titans....but after read here and read in fundsupermart, buy again titans, it gain. means good timing. Not sure how true is that these days. |

|

|

Mar 16 2017, 05:59 PM Mar 16 2017, 05:59 PM

|

All Stars

33,697 posts Joined: May 2008 |

|

|

|

Mar 16 2017, 06:05 PM Mar 16 2017, 06:05 PM

|

Senior Member

948 posts Joined: Dec 2005 |

QUOTE(2387581 @ Mar 16 2017, 05:42 PM) There is a saying which goes It’s time in the market that builds returns, not timing the market. it does. if the fund manager didn't fall asleep. hahaNot sure how true is that these days. I used EPF buy AffinHwang Growth 3 yrs ago after reading he got so kany start in morningstar and earn is constant good. but nightmare, dro like diarrhoea for 3 yrs, never positive, until first quarter thisbyear, positive 5 percent. Fund is not stock, not for short term. I done some short term invest in fund when right time, when Brexit buy europe, and when Japan crush last year buy pure japan invested fund. both also significant earn nearly 20%. But as Trump effect, still can not see much yet. Timing is gppd sometime.Too bad can find a @xuzen Crystal ball. |

|

|

Mar 16 2017, 06:09 PM Mar 16 2017, 06:09 PM

|

Senior Member

948 posts Joined: Dec 2005 |

QUOTE(adele123 @ Mar 16 2017, 03:05 PM) I own both AffinHwang Growth PRS, shariah and none shariah, more than 3 yr. Shariah one masih lausai.... none shariah bagus.I help ky wife brough AffinHwang moderate PRS 2 yrs plus, look good, but slower theb Growth, but if cmpare tye risk rating,AH Moderate is very good among the moderate risk. |

|

|

|

|

|

Mar 16 2017, 06:13 PM Mar 16 2017, 06:13 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

future's so bright i gotta wear shade

All markets jumped high today... those not in equities, so lugi lor. ============= Btw the above phrase comes from a song... about a grim future of nuclear holocaust, but young students in the 80's took it as their anthem - a bright future after graduation. |

|

|

Mar 16 2017, 06:18 PM Mar 16 2017, 06:18 PM

|

All Stars

33,697 posts Joined: May 2008 |

QUOTE(j.passing.by @ Mar 16 2017, 06:13 PM) future's so bright i gotta wear shade I don't have anything in Europe. So I hope US will be good for another day. All markets jumped high today... those not in equities, so lugi lor. ============= Btw the above phrase comes from a song... about a grim future of nuclear holocaust, but young students in the 80's took it as their anthem - a bright future after graduation. |

|

|

Mar 16 2017, 06:28 PM Mar 16 2017, 06:28 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

The Fed raised its benchmark lending rate a quarter point and continued to project two more increases this year. U.S. equities extended gains as Chair Janet Yellen said in a press conference that the “simple message is the economy is doing well.”

The simple message is: The economy is doing well. https://www.bloomberg.com/news/articles/201...ls-markets-wrap future's so bright i gotta wear shade |

|

|

Mar 16 2017, 06:43 PM Mar 16 2017, 06:43 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

To those who likes to do "trading" on their UT funds... this hedge fund says it is a sound strategy and lots to gain than buy-and-hold as "predicting volatility (in the) long term is completely random".

“We trade with a one-day horizon as predicting volatility long term is completely random,” Rune Madsen, founder and portfolio manager of the $17 million fund, said in an interview on Monday. https://www.bloomberg.com/news/articles/201...orrow-literally |

|

|

Mar 16 2017, 06:47 PM Mar 16 2017, 06:47 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

|

|

|

Mar 16 2017, 06:49 PM Mar 16 2017, 06:49 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

|

|

|

Mar 16 2017, 06:52 PM Mar 16 2017, 06:52 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

|

|

|

Mar 16 2017, 06:58 PM Mar 16 2017, 06:58 PM

|

All Stars

14,990 posts Joined: Jan 2003 |

|

|

|

Mar 16 2017, 08:34 PM Mar 16 2017, 08:34 PM

|

Senior Member

2,955 posts Joined: Sep 2009 |

QUOTE(adele123 @ Mar 16 2017, 02:56 PM) I have chosen to invest in CIMB Asia Pacific PRS Fund since 2014. Thanks for the reply AdeleFor those who do not want pure malaysia exposure, fund choices are not plenty, makes it easier to choose i think. 1) Affin Hwang PRS 2) Am Asia Reits PRS 3) the fund mentioned above. |

|

|

Mar 16 2017, 08:58 PM Mar 16 2017, 08:58 PM

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(j.passing.by @ Mar 16 2017, 06:43 PM) To those who likes to do "trading" on their UT funds... this hedge fund says it is a sound strategy and lots to gain than buy-and-hold as "predicting volatility (in the) long term is completely random". worst trading platform. t+2 lag time along with up to 2% service charge at each transaction. better stick to stock trading la. 0.1% per transaction“We trade with a one-day horizon as predicting volatility long term is completely random,” Rune Madsen, founder and portfolio manager of the $17 million fund, said in an interview on Monday. https://www.bloomberg.com/news/articles/201...orrow-literally |

|

|

Mar 16 2017, 11:00 PM Mar 16 2017, 11:00 PM

|

Junior Member

92 posts Joined: Apr 2011 |

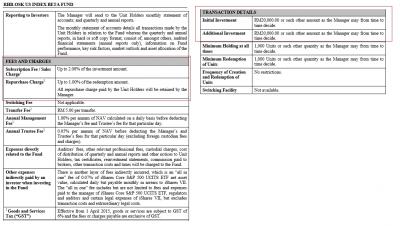

have any one hear of "RHB US INDEX BETA FUND" unit trust before??

just know it today and is a feeder fund into sp500 etf. will we get this as another alternative for us exposure? fsm and eut?? bank channel? This post has been edited by asimov82: Mar 16 2017, 11:11 PM |

|

|

Mar 16 2017, 11:07 PM Mar 16 2017, 11:07 PM

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(asimov82 @ Mar 16 2017, 11:00 PM) have any one hear of "RHB US INDEX BETA FUND" unit trust before?? question is have you checked first whether FSM carries the fund on their platform? just know it today and is a feeder fund into sp500 etf. will we get this as another alternative for us exposure? fsm and eut?? if you did your research you can see you can obviously obtain this only through rhb fund house. |

|

|

Mar 16 2017, 11:14 PM Mar 16 2017, 11:14 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(asimov82 @ Mar 16 2017, 11:00 PM) have any one hear of "RHB US INDEX BETA FUND" unit trust before?? get from RHB....just know it today and is a feeder fund into sp500 etf. will we get this as another alternative for us exposure? fsm and eut?? bank channel? for more info of this fund.... http://www.rhbgroup.com/~/media/files/mala...fund.ashx?la=en Attached thumbnail(s)

|

|

|

Mar 16 2017, 11:18 PM Mar 16 2017, 11:18 PM

Show posts by this member only | IPv6 | Post

#2060

|

Junior Member

285 posts Joined: Jan 2017 |

QUOTE(T231H @ Mar 16 2017, 11:14 PM) get from RHB.... When you gonna add this fund to FSM for more info of this fund.... http://www.rhbgroup.com/~/media/files/mala...fund.ashx?la=en |

| Change to: |  0.0205sec 0.0205sec

0.73 0.73

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 08:08 PM |