FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Mar 16 2017, 10:51 AM Mar 16 2017, 10:51 AM

|

All Stars

33,696 posts Joined: May 2008 |

Good day for Asian Pac, Huat arh .... ! |

|

|

|

|

|

Mar 16 2017, 11:00 AM Mar 16 2017, 11:00 AM

|

Junior Member

617 posts Joined: Oct 2008 |

|

|

|

Mar 16 2017, 11:03 AM Mar 16 2017, 11:03 AM

|

All Stars

33,696 posts Joined: May 2008 |

|

|

|

Mar 16 2017, 11:08 AM Mar 16 2017, 11:08 AM

|

All Stars

24,385 posts Joined: Feb 2011 |

|

|

|

Mar 16 2017, 11:10 AM Mar 16 2017, 11:10 AM

|

All Stars

33,696 posts Joined: May 2008 |

|

|

|

Mar 16 2017, 11:14 AM Mar 16 2017, 11:14 AM

|

Junior Member

617 posts Joined: Oct 2008 |

|

|

|

|

|

|

Mar 16 2017, 11:16 AM Mar 16 2017, 11:16 AM

|

All Stars

24,385 posts Joined: Feb 2011 |

|

|

|

Mar 16 2017, 11:24 AM Mar 16 2017, 11:24 AM

|

Senior Member

1,305 posts Joined: Dec 2008 |

QUOTE(pisces88 @ Mar 16 2017, 10:39 AM) Oh yes, i have 20% in balances fund, and 6% in fixed income fund. 74% equity. Great. Thanks for the sharing. Diversify is a must if we want to minimize the risk otherwise our money 100% in risk... If you're young enough, can consider higher % in equity funds. Dont be too conservative.. This post has been edited by haziqnet: Mar 16 2017, 11:27 AM |

|

|

Mar 16 2017, 11:26 AM Mar 16 2017, 11:26 AM

|

All Stars

24,385 posts Joined: Feb 2011 |

puchongnite the US market can tank after the fed hike. Look at between 1-2 weeks. If nothing than most likely BAU.

|

|

|

Mar 16 2017, 11:29 AM Mar 16 2017, 11:29 AM

|

Senior Member

1,305 posts Joined: Dec 2008 |

edited

This post has been edited by haziqnet: Mar 16 2017, 11:31 AM |

|

|

Mar 16 2017, 11:34 AM Mar 16 2017, 11:34 AM

|

All Stars

33,696 posts Joined: May 2008 |

QUOTE(Ramjade @ Mar 16 2017, 11:26 AM) puchongnite the US market can tank after the fed hike. Look at between 1-2 weeks. If nothing than most likely BAU. I think the market this round has digested the rate hike earlier, so the adjustments were made prior to the announcement.Thanks for the alert anyway. But I also don't know what to do if it tanks. Maybe just hold, and top up opportunistically. |

|

|

Mar 16 2017, 12:22 PM Mar 16 2017, 12:22 PM

Show posts by this member only | IPv6 | Post

#2012

|

Junior Member

285 posts Joined: Jan 2017 |

Missed last month Ponzi 1.0 promo, now emo like hell, got 0 unit

Holding stupid selina and kapchai This post has been edited by Nemozai: Mar 16 2017, 12:22 PM |

|

|

Mar 16 2017, 12:38 PM Mar 16 2017, 12:38 PM

|

Senior Member

2,955 posts Joined: Sep 2009 |

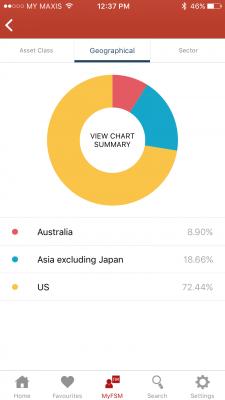

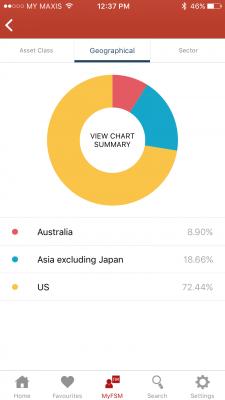

QUOTE(puchongite @ Mar 16 2017, 07:30 AM) US Stock market rallies to the close as Fed hikes interest rates They seem to be positive. Looks like my choice of investing over 72% of my allocation for Q1 2017 into the US was a good move.http://www.marketwatch.com/story/us-stocks...news-2017-03-15 We shall see what's the Asian Market reaction.

This post has been edited by shankar_dass93: Mar 16 2017, 12:39 PM |

|

|

|

|

|

Mar 16 2017, 12:38 PM Mar 16 2017, 12:38 PM

|

All Stars

33,696 posts Joined: May 2008 |

|

|

|

Mar 16 2017, 12:40 PM Mar 16 2017, 12:40 PM

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(Nemozai @ Mar 16 2017, 12:22 PM) kapchai is doing good. have you not seen its chart? Don't regret la. if you didn't have money to buy in don't take it on yourself unless you were sitting on cash and waiting for it then yes you are to be blamed. |

|

|

Mar 16 2017, 12:49 PM Mar 16 2017, 12:49 PM

Show posts by this member only | IPv6 | Post

#2016

|

Junior Member

285 posts Joined: Jan 2017 |

QUOTE(puchongite @ Mar 16 2017, 12:38 PM) Talking about regret, everyone sure got some regrets lar. Maybe they are just not sharing it (yet). LOL. If you ask me, kapchai is still going up now. QUOTE(Avangelice @ Mar 16 2017, 12:40 PM) kapchai is doing good. have you not seen its chart? Yes Kapchai is doing good. Don't regret la. if you didn't have money to buy in don't take it on yourself unless you were sitting on cash and waiting for it then yes you are to be blamed. Just joined FSM recently, regretted locking money in FD. Once this term FD mature I will quit FD forever |

|

|

Mar 16 2017, 12:52 PM Mar 16 2017, 12:52 PM

|

Senior Member

2,955 posts Joined: Sep 2009 |

|

|

|

Mar 16 2017, 12:53 PM Mar 16 2017, 12:53 PM

Show posts by this member only | IPv6 | Post

#2018

|

Junior Member

285 posts Joined: Jan 2017 |

|

|

|

Mar 16 2017, 01:01 PM Mar 16 2017, 01:01 PM

|

All Stars

24,385 posts Joined: Feb 2011 |

QUOTE(shankar_dass93 @ Mar 16 2017, 12:38 PM) They seem to be positive. Looks like my choice of investing over 72% of my allocation for Q1 2017 into the US was a good move. Wow. You are following xuzen past mistake. He pump 80% of his money into china. China pull a sudden act, overnight xuzen lost 80% of what he have.

QUOTE(Nemozai @ Mar 16 2017, 12:49 PM) Yes Kapchai is doing good. Do not remove FD unless you can find substitute. For me my substitute will be amanah saham fixed price but will change it to affin hwang select bond fund.Just joined FSM recently, regretted locking money in FD. Once this term FD mature I will quit FD forever Guess you didn't experience below FD retuens yet huh? For 6 monrhs + my return was worse than normal FD rate. 6 months you know. Whichi is < 3%. Thank god now it move to +5%. Still cannot beat my amanah saham yet. Ready for day it does. |

|

|

Mar 16 2017, 01:02 PM Mar 16 2017, 01:02 PM

|

Senior Member

2,955 posts Joined: Sep 2009 |

QUOTE(Nemozai @ Mar 16 2017, 12:53 PM) My bet Btw, need a second opinion from you guys here. Called up FSM and spoke to their Client Investment Specialist (named Edward if i heard it correctly) pertaining to investing in PRS. I'm pretty keen in getting into PRS simply due to the governments incentive of giving out an additional RM1K to those that have at least made a RM1K contribution in a given calendar year. Seriously dont know as to which PRS should i go for and FSM recommended me to opt for Kenanga's One PRS Growth. Upon skimming thru the prospectus realized that the given fund has invested over 60%+ in KGF and the balance in Kenanga's Bond Fund. I seriously do not want my PRS to be solely focused on the Malaysian market since I am currently holding a portfolio of stocks in my account. Are there any other equity PRS funds that you guys would recommend me to explore (not solely invested in Malaysia and it has to be an equity fund) ? Thanks |

| Change to: |  0.0190sec 0.0190sec

0.74 0.74

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 05:47 PM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote