QUOTE(stormkiller @ May 1 2023, 01:58 PM)

QUOTE(xxradeonxx @ May 2 2023, 12:50 PM)

Yes. Reload ShopeePay, Boost & BigPay can entitled for 5x pts.RM3k e-wallet reload will get 15k pts every month.

Credit Cards HSBC Credit Cards V.2, Read the T&C before applying!

|

|

May 17 2023, 07:25 PM May 17 2023, 07:25 PM

|

Senior Member

1,102 posts Joined: Jan 2003 |

QUOTE(stormkiller @ May 1 2023, 01:58 PM) QUOTE(xxradeonxx @ May 2 2023, 12:50 PM) Yes. Reload ShopeePay, Boost & BigPay can entitled for 5x pts.RM3k e-wallet reload will get 15k pts every month. |

|

|

|

|

|

May 17 2023, 09:14 PM May 17 2023, 09:14 PM

Show posts by this member only | IPv6 | Post

#10982

|

Senior Member

1,704 posts Joined: Feb 2011 |

|

|

|

May 18 2023, 02:14 AM May 18 2023, 02:14 AM

|

Junior Member

196 posts Joined: Aug 2017 |

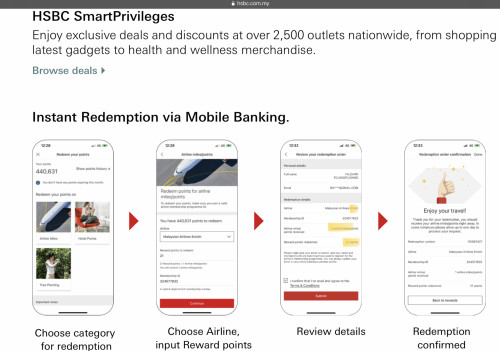

QUOTE(kakalaku @ May 17 2023, 01:37 AM) Similarities between Visa Signature and TravelOne MC: Based on TravelOne eWelcome Pack Slide (page 6):-- 8x points for foreign spending (online and retail) - 6x Plaza Premium entry per calendar year - Differences between VS and TO: - Income requirement: VS-RM72k; TO-RM60k - Annual fee waiver condition: VS-12x swipe per calendar year and RM2k annual spending; TO-RM20k annual spending - 5x points: VS-Eligible Retail MCCs and Online; TO-Dining and Local Travel (airlines, hotel, travel agency) - Additional points capping: VS-max 15k additional points for all categories; TO- max 20k for foreign spending, max 10k each for dining and local travel - Points redemption options: VS-vouchers and goods; TO-miles and hotel points remains to be seen which is the better card, will depend on TO points redemption rate  On the third step to redeem using HSBC mobile app under “Review Details”, it can be seen that 21 HSBC Rewards Point will get 1 Malaysia Airlines Enrich Point. If this is the case, I think the redemption rate would be based on the HSBC Visa Signature card as per this link:- https://sp.hsbc.com.my/hsbcrewards/ Anyway, since HSBC Malaysia has not officially publish how much the redemption rate for this newly launched TravelOne card, we should not make any assumption first. *keeping my finger crossed that this would not be the case. Otherwise, even the generic Maybank 2 AMEX card would have better redemption rate of return for SIA KrisFlyer miles at:- 14,000 Treatpoints to 1,000 KF Miles VS HSBC 25,000 point to 1,000 KF Miles |

|

|

May 18 2023, 09:33 AM May 18 2023, 09:33 AM

Show posts by this member only | IPv6 | Post

#10984

|

Junior Member

238 posts Joined: Dec 2010 |

Guyz, recently got my hsbc cc but how do i add into hsbc app? Inside only show my current bank account and i cant find the manage button

|

|

|

May 18 2023, 10:09 AM May 18 2023, 10:09 AM

|

Senior Member

7,574 posts Joined: May 2012 |

|

|

|

May 18 2023, 10:53 AM May 18 2023, 10:53 AM

|

Senior Member

3,878 posts Joined: Jul 2005 |

QUOTE(leootan @ May 17 2023, 04:15 PM) It is a tier. Anyway, perhaps not all getting to enjoy all of the privileges provided by his or her premium cc. But that doesnt mean “no real life benefits”. Example like someone who fly frequently, i mean real frequent. So if he or she own an unlimited worldwide airport lounge entry, then he or she can have a good rest, nice shower, and some meals before the flight. This is kind of example “real life benefits”. ya. i get your point.A good cc doent have to only have cashback, some perk is much better than cashback. And i am sure these perks, a classic card dont have. And yup, dedicated call line for customer service. This one real good, you dont have to wait and listen to the music for so long before someone attend to your call😅. Especially you are in urgent matter. Cheers. but my point is the privileges or benefits are tied to the specific card offered by specific bank, rather than the branding of VS, VI etc which did not bring much value itself. for eg. Alliance VI only offer 2x , PB VI 3x lounge access, while HSBC VS offer 6 times lounge access annually. PB Visa Platinum 2x , comparable to Alliance VI. Aeon Visa Gold 3X, Visa Platinum 6x, already better than Alliance VI. supposedly Gold->Plat->VS->VI, but due to different bank offerings, you could be getting better benefits while holding a lower tier card. This post has been edited by sjz: May 18 2023, 10:53 AM |

|

|

|

|

|

May 18 2023, 11:08 AM May 18 2023, 11:08 AM

Show posts by this member only | IPv6 | Post

#10987

|

Junior Member

224 posts Joined: Oct 2018 |

QUOTE(sjz @ May 18 2023, 10:53 AM) ya. i get your point. 😓, the 2x airport lounge entry from Alliance VI is for worldwide ah😅. Just have a browse on the supported worldwide airport lounge list from Alliance website. but my point is the privileges or benefits are tied to the specific card offered by specific bank, rather than the branding of VS, VI etc which did not bring much value itself. for eg. Alliance VI only offer 2x , PB VI 3x lounge access, while HSBC VS offer 6 times lounge access annually. PB Visa Platinum 2x , comparable to Alliance VI. Aeon Visa Gold 3X, Visa Platinum 6x, already better than Alliance VI. supposedly Gold->Plat->VS->VI, but due to different bank offerings, you could be getting better benefits while holding a lower tier card. Non of your said cards beat the list from Alliancebank. That is why the meaning of tier card. And of course the card benefits are tied to bank, because bank themselves will have to pay for the service we used or entitled. Just that bank offered varies perks or compliments based on every card tier. Higher tier card usually come with better entitlements. |

|

|

May 18 2023, 03:35 PM May 18 2023, 03:35 PM

|

|

VIP

1,923 posts Joined: Jan 2003 From: NL/MY |

Based on initial impressions, seems like the Premier Travel card (PTC) is still significantly better for miles conversion. Reward limits on foreign/local spend are the same I think? 20k foreign, 10k local.

But PTC gives a 1:1 conversion to Enrich, as opposed to 21:1 for TravelOne... The lounge access is kind of not important at all, since Plaza Premium lounges are mostly garbage and at not many locations worldwide - if you want lounge access, you're better off getting some other card. I definitely haven't used my HSBC MY CC for any lounge access for years since they moved away from LoungeKey. |

|

|

May 18 2023, 04:50 PM May 18 2023, 04:50 PM

Show posts by this member only | IPv6 | Post

#10989

|

Junior Member

195 posts Joined: May 2010 |

QUOTE(joice11 @ May 17 2023, 03:22 PM) got an sms saying i won rm15 from that campaign, but... i didn't use it for foreign spending (min spend rm80 in foreign currency per month). was aiming for the rm100 lazada/shopee voucher (spend min 1k on online & groceries).feels like they mixed something up. did you win anything? |

|

|

May 18 2023, 05:58 PM May 18 2023, 05:58 PM

|

Junior Member

429 posts Joined: Jun 2019 |

QUOTE(biatch0 @ May 18 2023, 03:35 PM) Based on initial impressions, seems like the Premier Travel card (PTC) is still significantly better for miles conversion. Reward limits on foreign/local spend are the same I think? 20k foreign, 10k local. Reward limit for PT on local spend is 30k airmiles per month, 20k for foreign spendBut PTC gives a 1:1 conversion to Enrich, as opposed to 21:1 for TravelOne... The lounge access is kind of not important at all, since Plaza Premium lounges are mostly garbage and at not many locations worldwide - if you want lounge access, you're better off getting some other card. I definitely haven't used my HSBC MY CC for any lounge access for years since they moved away from LoungeKey. 1 airmiles = RM0.91 (foreign) & RM4 (local) If travel one require 21k points to get 1k enrich, 1 enrich = RM2.63 (foreign) & RM4.20 (local) This post has been edited by francis226: May 25 2023, 05:00 PM |

|

|

May 19 2023, 02:19 PM May 19 2023, 02:19 PM

Show posts by this member only | IPv6 | Post

#10991

|

Junior Member

876 posts Joined: Feb 2022 |

QUOTE(passmaster14 @ May 18 2023, 04:50 PM) got an sms saying i won rm15 from that campaign, but... i didn't use it for foreign spending (min spend rm80 in foreign currency per month). was aiming for the rm100 lazada/shopee voucher (spend min 1k on online & groceries). Yes, finally, i got RM20. the shopee voucher RM100, no luck.feels like they mixed something up. did you win anything? |

|

|

May 22 2023, 11:47 AM May 22 2023, 11:47 AM

Show posts by this member only | IPv6 | Post

#10992

|

Junior Member

195 posts Joined: May 2010 |

|

|

|

May 22 2023, 08:22 PM May 22 2023, 08:22 PM

|

Junior Member

192 posts Joined: Oct 2009 |

Hello everyone

I asked HSBC CS, and she said HSBC Amanah Mpower Visa Platinum cashback is calculated following the monthly statement. But the Finory app mentions it is by calendar month. Which one is correct? |

|

|

|

|

|

May 23 2023, 08:09 AM May 23 2023, 08:09 AM

Show posts by this member only | IPv6 | Post

#10994

|

Junior Member

109 posts Joined: Jan 2023 |

QUOTE(xuanchew @ May 22 2023, 08:22 PM) Hello everyone U can refer to their cc t&c, cashback calculate based on calendar month..cashback will be credited to u within 6 weeks in following month statement...I asked HSBC CS, and she said HSBC Amanah Mpower Visa Platinum cashback is calculated following the monthly statement. But the Finory app mentions it is by calendar month. Which one is correct? |

|

|

May 23 2023, 08:10 AM May 23 2023, 08:10 AM

Show posts by this member only | IPv6 | Post

#10995

|

Junior Member

109 posts Joined: Jan 2023 |

-deleted-

This post has been edited by robt1013: May 23 2023, 08:11 AM |

|

|

May 23 2023, 02:09 PM May 23 2023, 02:09 PM

Show posts by this member only | IPv6 | Post

#10996

|

Junior Member

114 posts Joined: Jul 2006 |

May I know Amanah MPower Visa Credit Card's cashback is based on statement based or calendar based ?

|

|

|

May 23 2023, 02:21 PM May 23 2023, 02:21 PM

|

Senior Member

3,878 posts Joined: Jul 2005 |

|

|

|

May 23 2023, 02:23 PM May 23 2023, 02:23 PM

|

Junior Member

238 posts Joined: Dec 2010 |

Guyz, regarding the rm400 reward, I just spend 1k on the card then i can have it for sure right?

|

|

|

May 23 2023, 02:49 PM May 23 2023, 02:49 PM

Show posts by this member only | IPv6 | Post

#10999

|

Junior Member

431 posts Joined: Sep 2010 |

QUOTE(adamchen @ May 23 2023, 02:23 PM) referring to this???https://sp.hsbc.com.my/cc-apply-online/cred...007:ProVPlatXXX based on TnC is yes la... https://sp.hsbc.com.my/cc-apply-online/pdfs...otion-final.pdf |

|

|

May 23 2023, 03:03 PM May 23 2023, 03:03 PM

|

Junior Member

238 posts Joined: Dec 2010 |

QUOTE(confusedway @ May 23 2023, 02:49 PM) referring to this??? yayay, really hope can get ithttps://sp.hsbc.com.my/cc-apply-online/cred...007:ProVPlatXXX based on TnC is yes la... https://sp.hsbc.com.my/cc-apply-online/pdfs...otion-final.pdf |

| Change to: |  0.0237sec 0.0237sec

0.58 0.58

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 11:47 AM |