QUOTE(kakalaku @ May 17 2023, 01:37 AM)

Similarities between Visa Signature and TravelOne MC:

- 8x points for foreign spending (online and retail)

- 6x Plaza Premium entry per calendar year

-

Differences between VS and TO:

- Income requirement: VS-RM72k; TO-RM60k

- Annual fee waiver condition: VS-12x swipe per calendar year and RM2k annual spending; TO-RM20k annual spending

- 5x points: VS-Eligible Retail MCCs and Online; TO-Dining and Local Travel (airlines, hotel, travel agency)

- Additional points capping: VS-max 15k additional points for all categories; TO- max 20k for foreign spending, max 10k each for dining and local travel

- Points redemption options: VS-vouchers and goods; TO-miles and hotel points

remains to be seen which is the better card, will depend on TO points redemption rate

Based on TravelOne eWelcome Pack Slide (page 6):-- 8x points for foreign spending (online and retail)

- 6x Plaza Premium entry per calendar year

-

Differences between VS and TO:

- Income requirement: VS-RM72k; TO-RM60k

- Annual fee waiver condition: VS-12x swipe per calendar year and RM2k annual spending; TO-RM20k annual spending

- 5x points: VS-Eligible Retail MCCs and Online; TO-Dining and Local Travel (airlines, hotel, travel agency)

- Additional points capping: VS-max 15k additional points for all categories; TO- max 20k for foreign spending, max 10k each for dining and local travel

- Points redemption options: VS-vouchers and goods; TO-miles and hotel points

remains to be seen which is the better card, will depend on TO points redemption rate

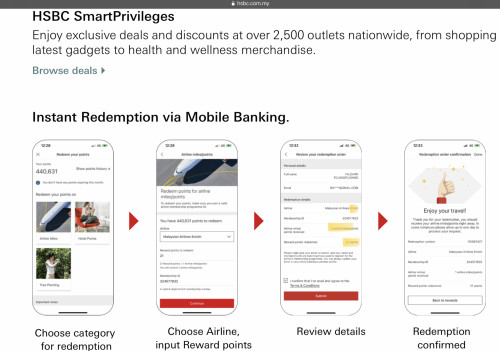

On the third step to redeem using HSBC mobile app under “Review Details”, it can be seen that 21 HSBC Rewards Point will get 1 Malaysia Airlines Enrich Point.

If this is the case, I think the redemption rate would be based on the HSBC Visa Signature card as per this link:-

https://sp.hsbc.com.my/hsbcrewards/

Anyway, since HSBC Malaysia has not officially publish how much the redemption rate for this newly launched TravelOne card, we should not make any assumption first. *keeping my finger crossed that this would not be the case.

Otherwise, even the generic Maybank 2 AMEX card would have better redemption rate of return for SIA KrisFlyer miles at:-

14,000 Treatpoints to 1,000 KF Miles

VS

HSBC

25,000 point to 1,000 KF Miles

May 18 2023, 02:14 AM

May 18 2023, 02:14 AM

Quote

Quote 0.2340sec

0.2340sec

0.64

0.64

7 queries

7 queries

GZIP Disabled

GZIP Disabled