Click here to HSBC Malaysia Official Credit Card Website and to apply for thier credit cards.

*

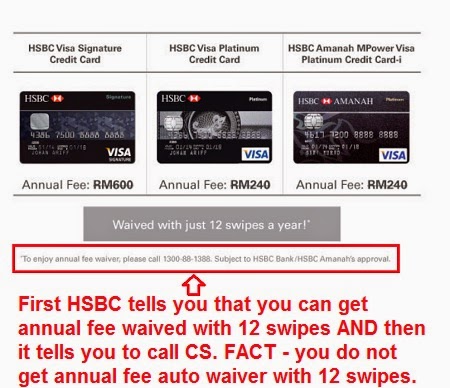

I can confirm that for the last 3 years (2012, 2013 & 2014), I did not get annual fee auto waiver for my HSBC Visa Signature even tho I swipe more than 12 times (click on the links I provided below to my articles to learn more). Before you sign up for a HSBC Credit Card, reconfirm if the annual fee is automatically waived with 12 swipes, i.e. get black and white from CS or ask the HSBC agent to show you where this is stated in the T&C.

Below is what cyang81 reported:

QUOTE(cyang81 @ Aug 29 2012, 10:06 PM)

My HSBC Signature have been charge RM600 annual fees on 27/Aug/12 without auto waive.

I have swiped more then 50x @ RM 10K+++

Have to call HSBC CS just now to ask about the annual fees auto waive 12x.

The CS told me now no more auto waive for all HSBC CC except HSBC Advance & Premier.

When I told him to cancel my card, then only he try to offer to waive the annual fees.

But I have to pay RM 600 first for this current statement and HSBC will credit back the annual fees in next statement billing.

Main Benefits of HSBC Credit Cards in generalI have swiped more then 50x @ RM 10K+++

Have to call HSBC CS just now to ask about the annual fees auto waive 12x.

The CS told me now no more auto waive for all HSBC CC except HSBC Advance & Premier.

When I told him to cancel my card, then only he try to offer to waive the annual fees.

But I have to pay RM 600 first for this current statement and HSBC will credit back the annual fees in next statement billing.

1. Discount at selected merchants (go to HSBC website to learn more)

2. Contest (not sure if this should be a benefit but many members here do win something from time to time).

3. More than 1X Points at selected malls.

4. Travel Insurance for Gold Card.

5. Free Purchase Protection Insurance Coverage for Gold Card.

6. 0% installment plan at selected outlets. Go to HSBC website to see list.

Disadvantage of HSBC Credit Cards versus other cards

1. Reward points 1X only (however you may earn more than 1X Reward Points at selected malls/transactions for limited time subjected to quota)

2. HSBC credit cards promos (i.e. 5X, 8X and 10X Reward Points) are designed to make you spend more money on non-essential stuff. You get 1X points only for essential expenses (TNB, Mobile Phone Bills, Astro, Unifi, etc).

3. HSBC tele-marketing agents will disturb you very frequent and pester you to sign up for their Personal Loans (quickest way to drown in the shit hole of debt).

4. Reward points are not evergreen, good for 3 years only.

5. You get nothing when using it to pump petrol unless there is a promotion by HSBC. Click here to Petrol Thread.

HSBC limited time Balance Transfer Offer

Please note that HSBC do not issue separate account for their Balance Transfer Plan and payment is based on hierarchy. You are advised to understand the terms and conditions before you proceed to apply for their Balance Transfer Plan. Click here to read my article on Balance Transfer Plans - Facts You Need To Know.

Ways to apply for the HSBC Credit Cards

1. Online by clicking on the official website and click Apply Now, the 1st link of this Thread/Post. Usually they offer some kind of welcome gift.

2. If you are in Klang Valley, best place is at Mid Valley on weekends where there are tons of HSBC representatives more than willing to assist you in getting a HSBC Credit Card.

HSBC Customer Service Contact Numbers - In my opinion, they are now the worst and unfriendliness auto tele-answering system in Malaysia as far as Credit Card Customer Service is concerned.

1. HSBC Malaysia Customer Service General Line 1-300-88-1388 or 03-83215400

Useful Information

When calling HSBC Customer Service, select BM instead of English to speak to a Malaysian representative. Thanks to aeiou228 where he posted at FD thread at Main Finance Section.

Notice to HSBC Agents, please click spoiler below:

» Click to show Spoiler - click again to hide... «

NOTE

If you sign up for an online account to check your credit card transactions, you will no longer be issued any paper statements in the mail. So, if you want to have paper statement sent to you monthly, DO NOT sign up for online account.

When we call HSBC to beg for annual fee waiver, nowadays HSBC will tell us to pay the annual fee upfront and then they will credit us back the payment. Well, I won't tolerate that kind of ridiculous insincere offer but will demand that my annual fee be waived on the spot. Click here to read my article titled "My HSBC Visa Signature Pisses Me Off Big Time" where I shared my experience on annual fee waiver for my HSBC Visa Signature and hopefully you can learn a thing or two from it.

HSBC also advertised that their Permeir and Visa Signature offers you 5X, 8X and even 10X Reward Points at selected malls and for certain overseas transactions. But what HSBC never tells you is that what they advertised as benefits are not standard card features but limited time promos. And if you did not know, HSBC promos ARE NOT valid all year round but for selected months within a year. And you need to register for HSBC so call card benefits yearly!!!

UPDATE January 2016 - Super Mini Review of the HSBC Amanah MPower Platinum-i

If any of you are considering of signing up for the HSBC Amanah MPower Platinum -i and thinks you're going to get 8% cash back for Petrol and Groceries.. best you click here and read my Introduction To Credit Cards - CC 101 where I will show you the that max cash back for petrol or groceries with the HSBC MPower is 2.35%

This post has been edited by Gen-X: Jan 7 2016, 07:12 PM

Jan 2 2015, 10:28 AM, updated 10y ago

Jan 2 2015, 10:28 AM, updated 10y ago

Quote

Quote

0.0321sec

0.0321sec

0.94

0.94

6 queries

6 queries

GZIP Disabled

GZIP Disabled