QUOTE(lucerne @ Apr 18 2011, 05:19 PM)

not sure u hv read my old posts. after travelled to so many cities , i know the $ will become smaller and smaller.. (if u dun know how to invest and grow your $ eg stock, prop, do business etc). 1mil may worth oni 10k in 30, 40 years time..

i am too lazy/not smart to do biz and no good in share market, so i went to invest in prop to saveguard my $...

i know i will suffered when i m old if i dun invest in prop regularly. in today world, u cant depend/rely on your children nor the govt especially msia/BN.

That's why I said earlier, we kenot use normal eye to see abnormal country one, proper countries like HK & Singapore, their house serves a function as shelter, passive income generator and wealth accumulationi am too lazy/not smart to do biz and no good in share market, so i went to invest in prop to saveguard my $...

i know i will suffered when i m old if i dun invest in prop regularly. in today world, u cant depend/rely on your children nor the govt especially msia/BN.

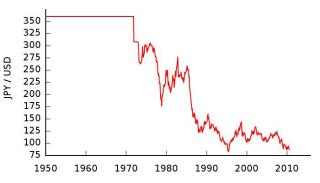

in Malaysia, apart fr sheltering, it is more to an insurance to hedge against inflation, currency depreciation. So, some people say if rental kenot cover the installment, the house owner wiill be forced to sell their property at cheaper price, ideally the mkt mechanism shd work that way, but one must realise that certain property owners & investors dun care at all, we used to see many houses left it vacant without renting for more than > 5 yrs, and no owners selling it, why?

For me, if my shop/apt rental can fetch nett yield of 3% is enough, I know rental will increase in long run (15-30 yrs). Unless major incident happen, otherwise the house installments are fixed for the whole tenure, but rental not likely to drop b'coz inflation, it won't be surprise prawn mee cost you RM50/bowl in 2040, shop rental could be easily RM30K/mth (example in Puchong) by then...

Added on April 18, 2011, 7:30 pm

QUOTE(lch78 @ Apr 18 2011, 06:45 PM)

Yes, we just hv a discussion, at 1st we say Iskandar sure die one but we change our statement now, kenot under estimate Singapore's effect, Toooooooooooooooooooooooooooooooooooooo strong!! This post has been edited by UFO-ET: Apr 18 2011, 07:30 PM

Apr 18 2011, 07:08 PM

Apr 18 2011, 07:08 PM

Quote

Quote

0.0311sec

0.0311sec

1.22

1.22

6 queries

6 queries

GZIP Disabled

GZIP Disabled