http://biz.thestar.com.my/news/story.asp?f.../20110325080522Loans likely to lessen

Bank Negara new measures seen helpful in the long term

By YVONNE TAN and SHARIDAN M. ALI

starbiz@thestar.com.my

PETALING JAYA: Bank Negara's new measures to inculcate responsible lending by banks to retail customers is expected to impact the quantum of credit disbursement as weaker borrowers would be rendered ineligible.

However, in the long term, these measures would be helpful to support the stability of the banking sector as it would limit the banking sector's exposure to weak borrowers who are more likely to default in “times of stress”, analysts said.

“It is encouraging to note that Bank Negara is introducing these steps as a pre-emptive measure to address rising household sector debt levels,” said Malaysian Rating Corp Bhd vice-president/head of financial institutions ratings Anandakumar Jegarasasingam.

On Wednesday, the central bank said individual borrowers would be subjected to a stress test to gauge if they could afford a new loan once guidelines are introduced in the third quarter of this year.

Among others, borrowers would be stress-tested in the event interest rates were to rise by 100 to 200 basis points from the time the loan is applied.

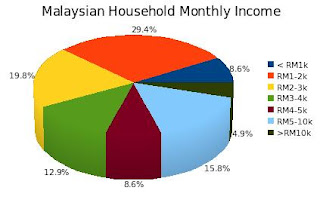

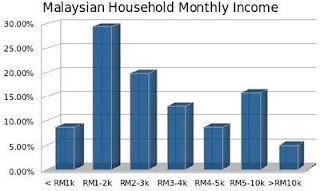

Malaysia's household debt rose at a rapid rate of 11.1% per annum from 2004 to 2009; and from RM516.6bil at end-2009, it climbed by 8.4% to RM560.1bil as at end-August 2010, according to data by CIMB Research.

The household debt to gross domestic product (GDP) ratio increased from 66.7% in 2004 to 76% in 2009 but is estimated to ease to 74.6% at end-2010.

Nevertheless, compared to the entire banking sector's NPL ratio of around 3.1%, the household sector's NPL ratio stood at 2.3% at end-2010.

“Anecdotal evidence suggests that bankers are focusing more on the underlying collateral, especially for mortgages and auto loans.

“However, collateral are an eventual source of repayment during default and not an immediate source of repayment. As a result of this focus, the actual debt servicing ability of the household sector, as reflected by its disposable income, has often not been looked at in detail during credit assessments.

"The proposed guidelines would fill this gap and thereby improve the quality of credit assessments done by banks,” said Jegarasasingam.

The Real Estate and Housing Developers' Association Malaysia (Rehda) president Datuk Michael Yam said the new guidelines were a signal to the banks to be “less exuberant” in their lending.

“But banks in Malaysia are generally stable and have their own ways to curb defaults,” he said.

Yam said he was confident that the “feel-good momentum” in the property market from last year would continue into this year.

CIMB chief economist Lee Heng Guie said Bank Negara's introduction of the latest measures was a good mov e to keep household debts at a sustainable level and to avoid a systemic risk to the entire banking system.

The central bank has gradually introduced macro prudential measures when needed to nip in the bud any buildup of future problems in the country.

It introduced a maximum loan-tovalue ratio of 70% for people wanting to buy their third house or more and recently clamped down the availability of easy credit to the low income group by raising the minimum income to RM24,000 from RM18,000 for credit cards.

But one area of abundant credit has been coming from co-operatives which have been lending vast sums of money to civil servants, and the upcoming new lending affordability rules might be extended to institutions not regulated by the central bank.

Despite the alarm being raised on the amount of debt households are carrying, data indicate it's not a problem for the financial system as much of those loans are back by collateral and the assets of households are more than double their debts.Malaysian cepat lupa or Human cepat lupa??? it is a known fact that the U.S financial crisis is caused by the housing market, the value of the so call collateral (properties) or assets that backing the loans declined significantly during crisis time. The collaterals were of course valued more than the mortgage loans when the banks decided to lend , the value only dropped sharply when crisis kicked in

This post has been edited by godutch: Mar 26 2011, 11:34 PM

This post has been edited by godutch: Mar 26 2011, 11:34 PM

Feb 24 2011, 11:31 AM

Feb 24 2011, 11:31 AM

Quote

Quote

0.0607sec

0.0607sec

1.07

1.07

7 queries

7 queries

GZIP Disabled

GZIP Disabled