QUOTE(Hoshiyuu @ Apr 21 2022, 08:54 AM)

hopefully you already cashed out the RM250

This post has been edited by Medufsaid: Apr 23 2022, 01:10 PM

Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

|

|

Apr 23 2022, 01:04 PM Apr 23 2022, 01:04 PM

|

Senior Member

3,492 posts Joined: Jan 2003 |

QUOTE(Hoshiyuu @ Apr 21 2022, 08:54 AM) hopefully you already cashed out the RM250 This post has been edited by Medufsaid: Apr 23 2022, 01:10 PM |

|

|

|

|

|

Apr 23 2022, 01:24 PM Apr 23 2022, 01:24 PM

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(Medufsaid @ Apr 23 2022, 01:04 PM) hopefully you already cashed out the RM250 |

|

|

Apr 23 2022, 03:01 PM Apr 23 2022, 03:01 PM

Show posts by this member only | IPv6 | Post

#923

|

Probation

1 posts Joined: Apr 2022 |

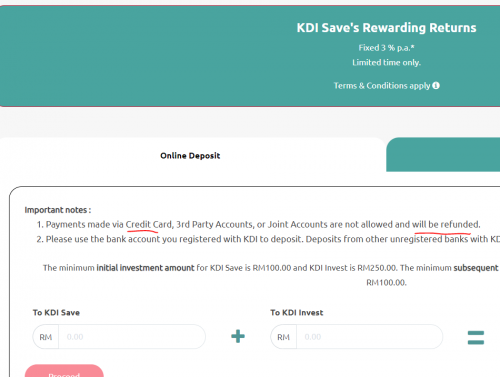

I depo into KDI with Maybank CC via FPX, the apps rejected it but CC still kena charge, payment successfully went through.

CS said take within 40 days to refund. Anyone did the same before? So sad haiya they didn't disable CC as payment option tempted me |

|

|

Apr 23 2022, 03:23 PM Apr 23 2022, 03:23 PM

Show posts by this member only | IPv6 | Post

#924

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(helmet.mark0 @ Apr 23 2022, 03:01 PM) I depo into KDI with Maybank CC via FPX, the apps rejected it but CC still kena charge, payment successfully went through. Yep notti us tried that before, refund took around few days to a weekCS said take within 40 days to refund. Anyone did the same before? So sad haiya they didn't disable CC as payment option tempted me helmet.mark0 liked this post

|

|

|

Apr 23 2022, 03:31 PM Apr 23 2022, 03:31 PM

|

Senior Member

7,568 posts Joined: May 2012 |

QUOTE(helmet.mark0 @ Apr 23 2022, 03:01 PM) I depo into KDI with Maybank CC via FPX, the apps rejected it but CC still kena charge, payment successfully went through. cc is not suppose to use for any investment in malaysia. so no need to try next time. it is consider playing margin in stock market, SC and bank negara wont allowCS said take within 40 days to refund. Anyone did the same before? So sad haiya they didn't disable CC as payment option tempted me This post has been edited by ericlaiys: Apr 23 2022, 03:32 PM helmet.mark0 liked this post

|

|

|

Apr 23 2022, 03:33 PM Apr 23 2022, 03:33 PM

|

Senior Member

3,492 posts Joined: Jan 2003 |

they don't have time/budget to restrict cc altogether, so use the cheaper way aka "warn you with words"  helmet.mark0 liked this post

|

|

|

|

|

|

Apr 23 2022, 05:55 PM Apr 23 2022, 05:55 PM

|

Junior Member

53 posts Joined: Sep 2005 |

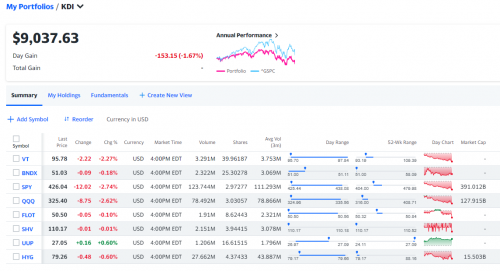

hello..just wondering anyone has KDI invest account here? whts the return looks like

|

|

|

Apr 23 2022, 07:44 PM Apr 23 2022, 07:44 PM

|

Senior Member

3,492 posts Joined: Jan 2003 |

|

|

|

Apr 23 2022, 09:16 PM Apr 23 2022, 09:16 PM

|

Junior Member

692 posts Joined: Nov 2021 |

Sorry for butting in but isn't it more better if one can choose what ETF they want at fraction of capital like what Syfe Wealth Custom is offering? If Msian can go through so much hurdle to invest in US overseas broker IBKR I don't see the same effort in Spore Syfe? Maybe Syfe is small no reputation no track record?

Putting monies and let ppl decide what ETF to buy for you is so strange but then I see a lot investors ok or they like the hands free research done by others on behalf of them? This post is not to discredit KDI just pondering on the business model they are offering and I read so many takers. |

|

|

Apr 23 2022, 11:48 PM Apr 23 2022, 11:48 PM

Show posts by this member only | IPv6 | Post

#930

|

Senior Member

5,879 posts Joined: Sep 2009 |

QUOTE(Medufsaid @ Apr 23 2022, 01:04 PM) hopefully you already cashed out the RM250 QUOTE(Medufsaid @ Apr 23 2022, 07:44 PM) Merubin I "started" this yahoo finance simulation with $9358now it's $9k i have 5 accounts with different entry points. waiting to see if anyone will share their real results 19.2.22 - worst loss 2.75%(8.3.22) best gain 3.52%(30.3.22) 22.2.22 - worst loss 3.24%(10.3.22) best gain 3.49%(30.3.22) 25.2.22 - worst loss 4.36%(15.3.22) best gain 2.3%(30.3.22) 28.2.22 - worst loss 3.5%(15.3.22) best gain 3.26%(30.3.22) 2.3.22 - worst loss 3.2%(12.3.22) best gain 3.18%(5.4.22) by today all of them have recovered and gain about 1%. Aggresive seemed worse 1.3.22 RM9358 and now RM9037 = lost 3.43%??? Need similar portfolio entered 1.3.2022 to see if KDI invest real losing 3.43% PS mine all growth. This post has been edited by guy3288: Apr 24 2022, 02:33 AM |

|

|

Apr 24 2022, 09:40 AM Apr 24 2022, 09:40 AM

Show posts by this member only | IPv6 | Post

#931

|

All Stars

24,360 posts Joined: Feb 2011 |

QUOTE(Medufsaid @ Apr 23 2022, 07:44 PM) Merubin I "started" this yahoo finance simulation with $9358now it's $9k You need to understand simc wits holding ETFs and in the past one week, AU's market is down hence your return will also be negative. waiting to see if anyone will share their real results That's just how it works. |

|

|

Apr 24 2022, 11:54 AM Apr 24 2022, 11:54 AM

|

Senior Member

3,492 posts Joined: Jan 2003 |

QUOTE(sgh @ Apr 23 2022, 09:16 PM) This post is not to discredit KDI just pondering on the business model they are offering and I read so many takers. i think 1/2 of us here are only for KDI save (3% FD promo). anyway, if KDI invest has "so many takers", it means KDI is right in this business modelQUOTE(guy3288 @ Apr 23 2022, 11:48 PM) Aggresive seemed worse 1.3.22 RM9358 and now RM9037 = lost 3.43%??? i think last monday or tuesday it was probably in the green, friday was a bloody day, one day alone already -1.6%Need similar portfolio entered 1.3.2022 to see if KDI invest real losing 3.43% PS mine all growth. if really RM9358 (above the RM3k FOC management tariff) was invested, still need to deduct management fees. also need to add back the dividend payouts (regardless of RM9358 or RM3000) as yahoo finance doesn't "readd" them back in This post has been edited by Medufsaid: Apr 24 2022, 12:10 PM |

|

|

Apr 24 2022, 11:07 PM Apr 24 2022, 11:07 PM

Show posts by this member only | IPv6 | Post

#933

|

Senior Member

5,879 posts Joined: Sep 2009 |

QUOTE(Medufsaid @ Apr 24 2022, 11:54 AM) i think 1/2 of us here are only for KDI save (3% FD promo). anyway, if KDI invest has "so many takers", it means KDI is right in this business model can say most go in for the 3% daily interesti think last monday or tuesday it was probably in the green, friday was a bloody day, one day alone already -1.6% if really RM9358 (above the RM3k FOC management tariff) was invested, still need to deduct management fees. also need to add back the dividend payouts (regardless of RM9358 or RM3000) as yahoo finance doesn't "readd" them back in i reckon almost all would also allocate some in KDI invest for the referral RM10, clever tricks from KDI, yet still not paying the RM10.. question is how long people stay in KDI invest, how good is the portfolio? up down up down back down again... at the end people will withdraw if like that. engyr liked this post

|

|

|

|

|

|

Apr 25 2022, 09:13 AM Apr 25 2022, 09:13 AM

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(guy3288 @ Apr 24 2022, 11:07 PM) can say most go in for the 3% daily interest World indices are swinging up and down lately, not much anyone can do about that. The portfolio at highest aggressiveness is mostly VT - you can pretty much guesstimate the performance just by looking at VT's price history.i reckon almost all would also allocate some in KDI invest for the referral RM10, clever tricks from KDI, yet still not paying the RM10.. question is how long people stay in KDI invest, how good is the portfolio? up down up down back down again... at the end people will withdraw if like that. |

|

|

Apr 25 2022, 09:34 AM Apr 25 2022, 09:34 AM

|

Senior Member

3,492 posts Joined: Jan 2003 |

QUOTE(guy3288 @ Apr 24 2022, 11:07 PM) question is how long people stay in KDI invest, how good is the portfolio? should be ok, less volatile than pure S&P500 (^GSPC). as long as you don't expect no losses like FDup down up down back down again...  This post has been edited by Medufsaid: Apr 25 2022, 09:37 AM |

|

|

Apr 25 2022, 06:28 PM Apr 25 2022, 06:28 PM

Show posts by this member only | IPv6 | Post

#936

|

Newbie

37 posts Joined: Aug 2017 |

Let's say I deposit rm250 into kdi invest today since share price drop, will KDI buy the share at today's price or the price 3 to 4 days later since it takes them 3 to 4 days to give you your share unit.

Any sifu pls help clarify? |

|

|

Apr 25 2022, 08:48 PM Apr 25 2022, 08:48 PM

|

Junior Member

241 posts Joined: Oct 2021 |

is now a good time to put money in KDI invest?

|

|

|

Apr 25 2022, 11:01 PM Apr 25 2022, 11:01 PM

|

Junior Member

993 posts Joined: Jun 2013 |

|

|

|

Apr 26 2022, 01:29 PM Apr 26 2022, 01:29 PM

|

Senior Member

2,106 posts Joined: Jul 2018 |

Kenanga’s Robo-Advisor Crosses RM100 Million AUM Milestone in 2 Months This post has been edited by tadashi987: Apr 26 2022, 01:30 PM lovelyuser liked this post

|

|

|

Apr 26 2022, 03:38 PM Apr 26 2022, 03:38 PM

|

Junior Member

993 posts Joined: Jun 2013 |

QUOTE(tadashi987 @ Apr 26 2022, 01:29 PM) Two months manage to get RM 100 million of AUM with 6500 success sign up, that's average of RM 15.3k++ per account holder, not bad! |

| Change to: |  0.0259sec 0.0259sec

0.83 0.83

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 12:37 PM |