QUOTE(tehoice @ Mar 1 2022, 05:56 PM)

Thanks.. that’s good to know 👍Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

|

|

Mar 1 2022, 06:14 PM Mar 1 2022, 06:14 PM

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

|

|

|

|

|

Mar 1 2022, 09:03 PM Mar 1 2022, 09:03 PM

|

Junior Member

241 posts Joined: Oct 2021 |

now that the ETFs for KDI has come out, any thoughts?

Seem like KDI focuses only on USA, quite scared if anything happens, while SA is more international that includes Canada and Australia |

|

|

Mar 1 2022, 09:08 PM Mar 1 2022, 09:08 PM

Show posts by this member only | IPv6 | Post

#263

|

All Stars

14,854 posts Joined: Mar 2015 |

Since last year,....there are investors moving out of SA into some other platforms that had heavy US equities portfolio...

and they had been telling that they are very pleased with the result....alot better than what SA had made for them. |

|

|

Mar 1 2022, 09:30 PM Mar 1 2022, 09:30 PM

|

Junior Member

417 posts Joined: Apr 2010 |

Every time I had to key-in username/pw to login. Is there anyway to login by fingerprint or smth?

|

|

|

Mar 1 2022, 09:36 PM Mar 1 2022, 09:36 PM

Show posts by this member only | IPv6 | Post

#265

|

Senior Member

5,529 posts Joined: Oct 2007 |

QUOTE(MUM @ Mar 1 2022, 09:08 PM) Since last year,....there are investors moving out of SA into some other platforms that had heavy US equities portfolio... Maybe someone from Kenanga lurking in this forum and they hear them... that's why design KDI Invest in such manner.and they had been telling that they are very pleased with the result....alot better than what SA had made for them. QUOTE(dreamfasten @ Mar 1 2022, 09:30 PM) So far not yet, we all hope they will improvise on this too. |

|

|

Mar 1 2022, 09:54 PM Mar 1 2022, 09:54 PM

|

Senior Member

1,210 posts Joined: Nov 2011 |

Hmm, likely passing on KDI Invest. Doesn't seem to offer anything much over my DIY portfolio, just paying them fee for fun.

KDI Save is a beast though, gonna stay with them for the entire campaign period for sure. |

|

|

|

|

|

Mar 1 2022, 10:00 PM Mar 1 2022, 10:00 PM

|

Probation

3 posts Joined: Nov 2021 |

|

|

|

Mar 1 2022, 10:04 PM Mar 1 2022, 10:04 PM

|

Senior Member

1,210 posts Joined: Nov 2011 |

|

|

|

Mar 1 2022, 10:59 PM Mar 1 2022, 10:59 PM

|

Senior Member

3,485 posts Joined: Jan 2003 |

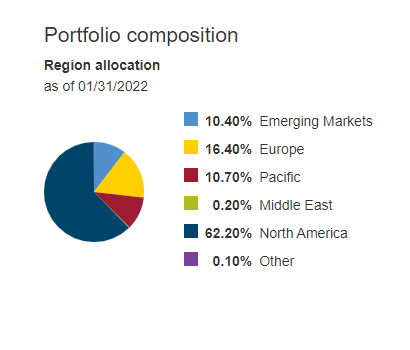

QUOTE(MUM @ Mar 1 2022, 09:08 PM) and they had been telling that they are very pleased with the result....alot better than what SA had made for them. have you spoken to them in 2022? there was a major crash after new year (can refer to the SA thread)QUOTE(CoolStoryWriter @ Mar 1 2022, 09:03 PM) Seem like KDI focuses only on USA, quite scared if anything happens, while SA is more international that includes Canada and Australia 40% in VT. below is piechart for VT QUOTE(tadashi987 @ Mar 1 2022, 10:39 AM) This post has been edited by Medufsaid: Mar 1 2022, 11:08 PM |

|

|

Mar 1 2022, 11:00 PM Mar 1 2022, 11:00 PM

Show posts by this member only | IPv6 | Post

#270

|

Senior Member

3,520 posts Joined: Jan 2003 |

First RM3k managed for free by KDI invest. I will utilize this as part of my portfolio.. Investing in "conservative" risk since my IBKR DIY portfolio is already aggressive. Being 30+ good to have some reserves in bonds and KDI Invest one of the ways for me to do it.

Too many type of bond ETFs till I'm confused when looking at them. So gonna let a robo do it for me. KDI save is gooding if don't wanna leave too much cash in savings yet still need it for emergency use. Quick withdrawal useful in this case. 3% till end of year is great.. hope next year's rate is at least as good as Versa's. This post has been edited by Davidtcf: Mar 1 2022, 11:03 PM |

|

|

Mar 1 2022, 11:37 PM Mar 1 2022, 11:37 PM

|

Probation

3 posts Joined: Nov 2021 |

|

|

|

Mar 1 2022, 11:40 PM Mar 1 2022, 11:40 PM

Show posts by this member only | IPv6 | Post

#272

|

All Stars

24,333 posts Joined: Feb 2011 |

|

|

|

Mar 2 2022, 12:16 AM Mar 2 2022, 12:16 AM

Show posts by this member only | IPv6 | Post

#273

|

Senior Member

3,520 posts Joined: Jan 2003 |

Go to their website on a pc and use chat function if u want a faster reply. I just tried it today.

|

|

|

|

|

|

Mar 2 2022, 12:39 AM Mar 2 2022, 12:39 AM

Show posts by this member only | IPv6 | Post

#274

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(80ckaijin @ Mar 1 2022, 11:37 PM) this is SC standard yeah, deposit in and withdrawal must be same name, applied to all fund houses including FSM.refund would take days Hoshiyuu liked this post

|

|

|

Mar 2 2022, 04:40 AM Mar 2 2022, 04:40 AM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(CoolStoryWriter @ Mar 1 2022, 09:03 PM) now that the ETFs for KDI has come out, any thoughts? YOU need to check list as there international from Ewz to rsx which is currently trending crash Seem like KDI focuses only on USA, quite scared if anything happens, while SA is more international that includes Canada and Australia |

|

|

Mar 2 2022, 09:49 AM Mar 2 2022, 09:49 AM

Show posts by this member only | IPv6 | Post

#276

|

Junior Member

102 posts Joined: Dec 2021 |

QUOTE(dreamfasten @ Mar 1 2022, 09:30 PM) i actually send email to them to request for biometric or 2FA login, guess they working on it now Davidtcf liked this post

|

|

|

Mar 2 2022, 10:01 AM Mar 2 2022, 10:01 AM

Show posts by this member only | IPv6 | Post

#277

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

|

|

Mar 2 2022, 10:09 AM Mar 2 2022, 10:09 AM

Show posts by this member only | IPv6 | Post

#278

|

Senior Member

3,485 posts Joined: Jan 2003 |

i think it's there for the "AI" to choose. so if you are unlucky to have it chosen for you, make noise to kenaga to remove.

|

|

|

Mar 2 2022, 10:14 AM Mar 2 2022, 10:14 AM

Show posts by this member only | IPv6 | Post

#279

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Medufsaid @ Mar 2 2022, 10:09 AM) i think it's there for the "AI" to choose. so if you are unlucky to have it chosen for you, make noise to kenaga to remove. There's still a fund manager that set the AI on what to invest in. Similar to Stashaway having Freddy Lim to manage and set which ETFs to buy for every risk portfolio chosen (which explains why always see KWEB in their general investing portfolio). Majority of the process then they are managed by AI - such as buy/sell orders.If this part (choosing which ETFs to buy) leave it to AI to decide then is dangerous liao.. current AI still not smart/safe enough to make such decisions. This post has been edited by Davidtcf: Mar 2 2022, 10:15 AM |

|

|

Mar 2 2022, 10:21 AM Mar 2 2022, 10:21 AM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(Davidtcf @ Mar 2 2022, 10:01 AM) don't see anyone's porfolio has these 2 allocated. It's just there in the statement. If it in the list it means they are allocated it for portfolio management KDI should remove them if they are currently not investing in these ETFs. Only thing is question on how they use the AI for the asset allocation QUOTE(Medufsaid @ Mar 2 2022, 10:09 AM) i think it's there for the "AI" to choose. so if you are unlucky to have it chosen for you, make noise to kenaga to remove. AI is to perform buy, sell, reopt, rebalancing and fractional purposes only |

| Change to: |  0.0300sec 0.0300sec

0.58 0.58

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 29th November 2025 - 06:14 AM |