The cruel joke of it all, for all the operational and IT expenses these insurers have been dumping onto Participating (Par) Funds, one would think they would have at least kept stellar accounting and policy records, and be competent enough to calculate reliable Asset Share figures.

But that is just too big of an ask.

In the end, the government's coffers will be the biggest beneficiary.

Great Eastern stands out.

There probably is still over RM 8 billion ringgit left within the Estates of both their closed Participating Funds.

We wouldn't know for sure until Great Eastern makes further disclosures.

» Click to show Spoiler - click again to hide... «

There probably is still over RM 8 billion ringgit left within the Estates of both their closed Participating Funds.

We wouldn't know for sure until Great Eastern makes further disclosures.

If the gate to continue increasing Great Eastern's Estate distribution proportion to their shareholders — beyond 10% — for public interest initiatives may have been prematurely closed, BNM has sought to keep another one open — see below.

From the Management of Participating Life Business Policy Document

While BNM and the government may still have designs on ensuring at least a further portion of GELM's Estates ends up in government coffers — as most of the past policyholders who were underpaid may likely be uncontactable — the above two paragraphs violate, at least partially*, the contractual rights and interests of the current generations of Participating policyholders, and Sections 82.(1)© and 83.© of FSA.

* While it is not lawful to restitute past policyholders who were underpaid from the 'Estate', the situation is a bit more nuanced for those who are current policyholders and who are entitled to a portion of the Estate as a result of current distributions made by the insurer. If they are uncontactable or the amounts can't be banked in for whatever reason, it would be lawful to transfer the underpayments to the Registrar of Unclaimed Moneys.

From Insurance Regulations 1996

From the Financial Services Act

Although no one in their right mind can deny that the build-up in GELM's Estates is in large part a result of past underpayments, this does not alter the contractual rights and interests of the current generations of policyholders within those funds.

Bear in mind that in making final policy payouts to past policyholders at levels resulting in the underpayments, the insurer established, at point of payout, that the balance of unpaid Asset Shares were needed for the purposes of operating and managing the Par Fund.

In other words, it was needed to meet the interests, fair treatment and reasonable expectations of the remaining block of policies.

The same principle applies for the Kaotim Legasi 30 year no surrender value family takaful plans.

So, the retained 'Estate' is, for all intents and purposes, a properly incurred liability of the fund.

Its 'properness' is not dinted by the fact that there were past underpayments or mismanagement.

The underpayments were just a truly unfortunate byproduct of the behaviour of senior executives, the insurer's management & board of directors, and to a greater extent, the Malaysian life insurance industry's culture.

What ultimately matters is that the insurer made a CONSCIOUS and CALCULATED decision to retain those surpluses, which can only be construed for the benefit of remaining policyholders.

The only question left is how assets backing the Estates are to be fully distributed by the time the last policyholders exit their respective funds.

It has to be fair and equitable between and across the different generations of current policyholders over various contemporaneous and non-contemporaneous time periods.

And the Estates can only be used for smoothing purposes.

Besides, in the case of GELM's closed funds, balance of unpaid Asset Shares should rightly be classified as part of the remaining Par policies' Asset Shares, not the Estates.

Now, this then puts past policyholders who were actually underpaid in a very precarious, awkward and unfair position.

What is to be of them?

Are they not entitled to fair treatment, restitution and compensation for poor and unfair consumer outcomes?

They deserve fair restitution and compensation amounts for being underpaid.

Ultimately, these amounts will have to be forked out from the Shareholders' Fund.

The current Policy Document on the Management of Participating Life Business has provisions catering to such a scenario:

From the Management of Participating Life Business Policy Document

For those underpaid policyholders who are uncontactable, compensation and restitution amounts will have to be transferred from the Shareholders' Fund to the Registrar of Unclaimed Monies.

For current policyholders who are still uncontactable, and if monies from any future distributions from the Estates or Asset Shares can't be banked in, it will have to be distributed and retained within the insurer until all contacting efforts have been exhausted and such time that the amounts may be released to the Registrar for Unclaimed Moneys.

At this juncture, we don't yet know if insurers have started unlawfully transferring monies directly from the Estates - instead of using their own funds - to the Registrar of Unclaimed Moneys on account of past underpayments.

Current Participating policyholders have to unite and voice out their concerns.

They must demand and insist that past underpayments be addressed solely using shareholder funds, and that such payments not interfere with their rights and interests in the Estates.

In fact, current Participating policyholders should take every possible effort to directly contact and seek clarification from not only their insurers, but also from the Unclaimed Money Management Division - on whether the Estates within Par Funds were utilized in making restitutions for past underpayments.

Granted, the Division may not even be aware if policy monies received from insurers were from the Par Funds' Estates.

But they will know whether the policy monies received were from Pre-2005 Par policies.

If there were a sudden influx of such receipts, it behoves them to understand the source and cause for such abnormal sums.

The Unclaimed Money Management Division must, at the very least, help confirm or deny the existence of such receipts to potentially affected current Participating policyholders.

The Press and current policyholders should try getting in touch with the following Division officers.

Unclaimed Money Management Division (BWTD)

Anyone thinking this issue is limited to only GELM would be sorely mistaken.

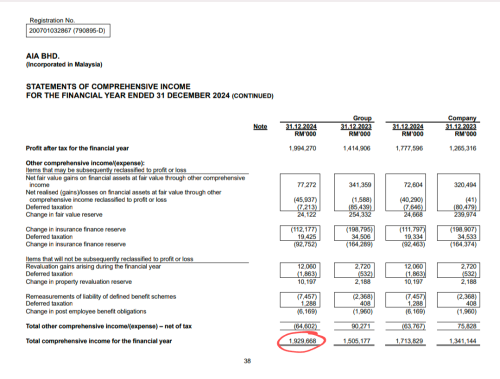

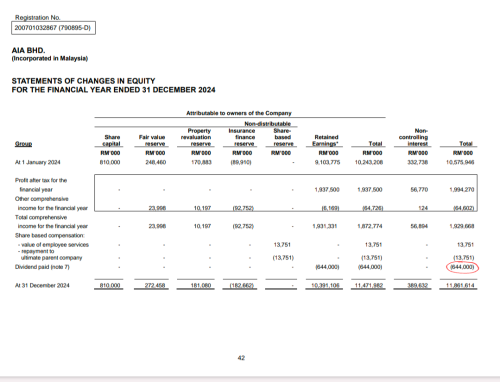

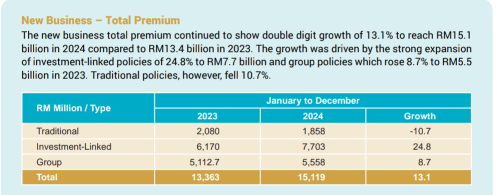

While GELM's egregious behaviour and Estate sizes far exceed those of the other players, AIA, Prudential, Tokio Marine and the other life insurers definitely have their own Par Fund Estates to contend with.

What surprises await policyholders when those black boxes are opened for public inspection would be anyone's guess.

We have to start being empowered consumers

Over 100 billion ringgit is at stake here. This is not a small matter.

If policyholders are unhappy with how their funds are managed, surrendering their Participating policies is not going to cut it.

If just a few policies are surrendered, insurers can simply transfer funds from existing cash equivalent assets, specifically bank deposits, to policyholders.

Provided policyholders get an amount reflective of their fair share of assets within the fund, including those backing the Estate, there's not much to complain about.

It's a whole different ball game when there is a mass exodus, which is not something to be recommended.

The dynamics change dramatically.

There will be parties, other than policyholders, looking to make hay at both ends.

The insurer will be forced to liquidate high quality assets, including blue-chip stocks, and perhaps, god forbid, be forced to sell them at unreasonably low prices.

And what happens to policyholders?

They will initially be left with bank deposits, and if the amounts are substantial, be looking to invest them again, perhaps into similar types of assets the insurer once held on their behalf.

It's the other financial institutions, brokers and fund managers that get to benefit by shortchanging policyholders in this equation.

Why sell something cheap, only to buy it later dearer?

Rather, what policyholders must strive to do collectively is to channel their dissatisfaction into something that actually empowers them.

It starts with demanding and mobilising for a formal trust or some other legal arrangement / instrument imbuing direct beneficial ownership of the assets be put in place, so that their rights and interests can't be further ignored and abused.

Demand for a seat at the table and a right to look into and influence the governance and outcome of those assets.

We already have such a mechanism in place for unit trust funds.

Why not for Participating and other takaful funds?

Participating (Par) policyholders should demand the following be required by BNM and implemented by Malaysian life insurers:

Regular (at least annually) publication of financial reports for each Par Fund.

The reports should contain:

These wonderful BNM senior management personnel should be able to see this through.

The information within these reports become invaluable as not only do Par policyholders get a better handle on how their Par Funds perform or underperform, it also allows them to push for fairer consumer outcomes.

If insurers previously paid — on average — less than 90% of the unsmoothed Asset Share amount upon a policy's termination, not many people outside the actuarial and finance departments would have known about it.

This report would make it apparent.

Policyholders will now know each cohort's average smoothed and unsmoothed Asset Share values and can easily deduce their proportionate or fair share of the Estate / Surplus (where the Estate / Surplus is separate from the unsmoothed Asset Share account).

Par policyholders should not only demand for final payouts close to their policy's unsmoothed Asset Share values, but also for their fair share of the Estate / Surplus.

Great Eastern's Estates grew from RM 1.8 billion in 2001 to RM 8 billion by end of 2005 mainly because it failed to roll over the unpaid Asset Share amounts to the remaining policies' Asset Shares.

Their previous Appointed Actuaries acknowledged such shortcomings (lack of roll over) in the Asset Share computation methodology.

Even the RM 1.8 billion 2001 Estates figure is suspect — perhaps most of Great Eastern's Estates should rightfully be classified as part of the Funds' Asset Shares.

There is enough evidence within the industry to show that past and even current Par policyholders were and are likely currently being underpaid.

Unless affected policyholders start exerting pressure, not much will change.

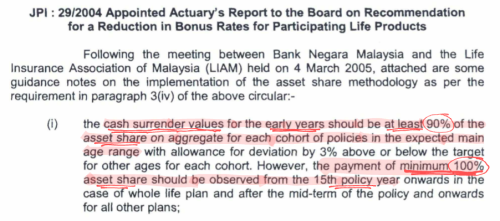

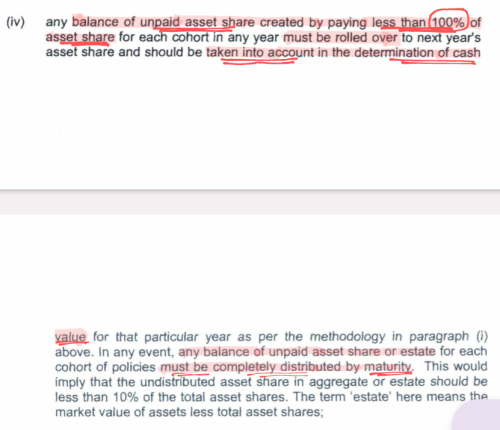

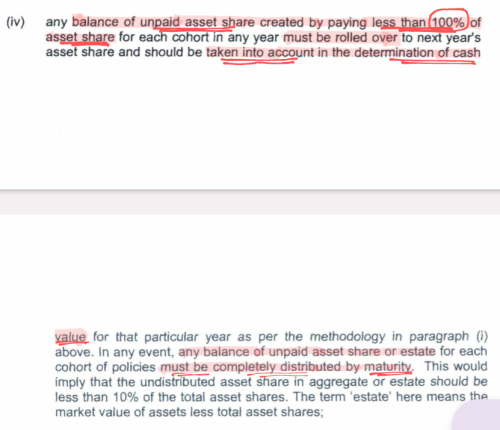

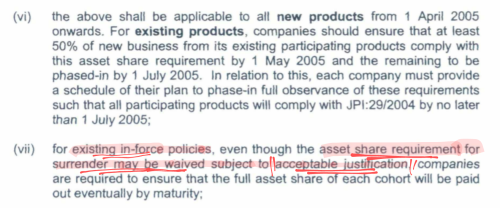

The above are excerpts from the JPI 29/2004 guidance notes and it makes clear the following:

- Cash surrender values should be at least 90% of Asset Share during the early years of policies in the expected main age range, and at least 100% of Asset Share from the 15th year or mid-term of the policy, whichever comes first;

- Any balance of unpaid Asset Shares, arising from final payouts being lesser than the policies’ Asset Shares, must be rolled over to form part of the remaining policies’ Asset Shares, and be taken into account in the determination of cash surrender values

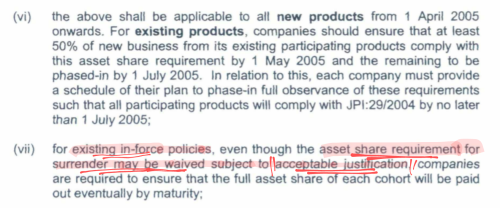

- For policies incepted prior to 1 April 2005 and including those incepted during the transition period between 1 April and 1 July 2005, unless waived subject to acceptable justification, the ‘at least 90% of Asset Share' cash surrender value requirement has to be complied with.

The good news is that the Guidance Notes to JPI 29/2004 (issued by BNM in 2005) requires compliance to the minimum '90% of Asset Share' cash surrender value requirement even for policies issued prior to 2005.

It also requires that unpaid Asset Shares be rolled over to the remaining policies' Asset Shares.

Compliance to the minimum '90% of Asset Share' cash surrender value requirement may only be waived subject to acceptable justification.

High and poorly justified investment-return rate assumptions and guaranteed values in the design of Par products are shareholder concerns.

The Estate and Asset Shares must never be used to ameliorate shareholder peccadilloes — it is not an acceptable justification.

There doesn't seem to be much reasonable ground for a compliance waiver.

There are other serious abuses when it comes to the management of Par Fund assets, such as the treatment of Par Funds as a dumping ground for management and agency related expenses.

Par policies don't require much servicing — most Par policyholder engagement with the insurer or agent would revolve around premium payments, policy loan applications & repayments, and cash bonus / survival benefit withdrawals.

Not much in the way of heavy duty claims processing.

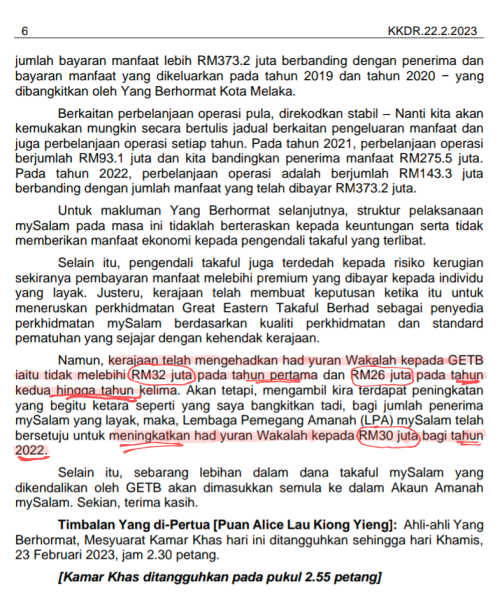

Great Eastern Takaful (GET) managed to do heavy duty claims processing for its mySalam coverage to the B40 group (more than 4 million members) with only an annual wakalah (management) fee budget of around RM 30 million.

Which is at most RM 7 in wakalah fees per covered person.

Govt pays over RM936 mln for claims under MySalam scheme

RM 7 per annum, per covered person was apparently more than sufficient to process claims for over 1.27 million beneficiaries, including critical illness claims, over a span of 5 year (2019 - 2023) — GET even managed to record regular surpluses from its wakalah fees, perhaps close to RM 6 million per annum during the period.

Through the magic of transfer pricing, shared services and group costs pooling, it shouldn't surprise anyone if it's found that Great Eastern's Par Funds had cross subsidized mySalam's incurred management expenses.

It then stands to reason that RM 60 million per annum, per million policyholders (RM 60 per policyholder) should be more than sufficient to manage Participating policies.

RM 60 per policyholder, nearly 9 times RM 7, should be more than enough to manage Par Fund assets, Par policy servicing requirements and other such administrative matters.

There is no need to charge Par Funds for agency related expenses - even if there were a need, it should be managed within the RM 60 budget.

After all, how many agents have continued regular engagement with their Par policyholders - especially those with policies issued prior to 2005??

How many even still have their clients' contact details??

How many agents have sought to fight for fair consumer outcomes vis-a-vis close to Asset Share final payouts???

How many stood by watching silently while RM 2.37 billion got siphoned off from Great Eastern's Par policyholders??

Yes, RM 60 per annum, per Par policyholder should be more than reasonable to manage Par Funds.

EPF only spent RM 1.81 billion to manage its contributors' funds in 2023.

RM 1.81 billion is only 0.17% of the size of its contributors' funds (2023: RM 1,146.8 billion, 2022: RM 1,036.7 billion).

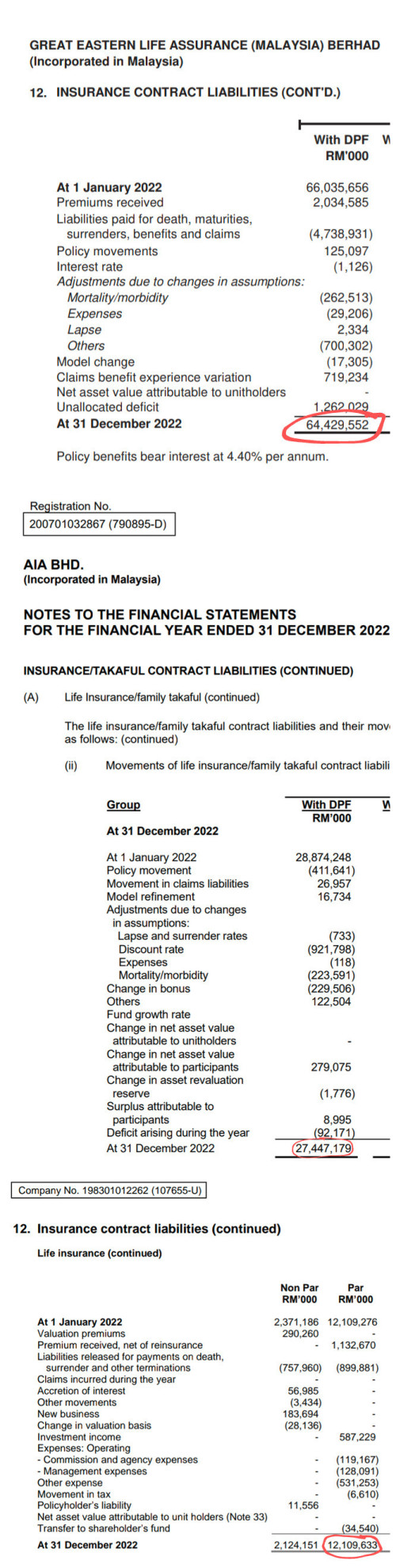

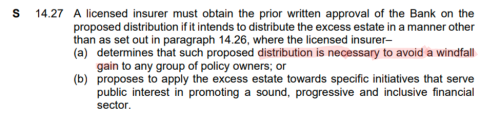

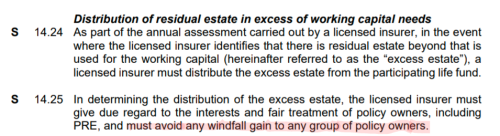

As at end 2022, the Big Three collectively had around RM 104 billion in Par Fund liabilities with GE, AIA, PRU each respectively having RM 64.4 billion, RM 27.5 billion and RM 12.1 billion.

Using EPF's 0.17% incurred management expenses benchmark, the Big Three should have spent at most RM 180 million per annum managing their Par Funds with GE, AIA, PRU each respectively limited at RM 110 million, RM 46.5 million and RM 20.6 million.

I wouldn't be surprised if the Big Three are charging their Par Funds at least 2 to 3 times the RM 180 million benchmark annually. And these figures may not have even accounted for agency related expenses.

No one is going to put a stop to this unless policyholders step in.

Oh, yes. There is one other thing.

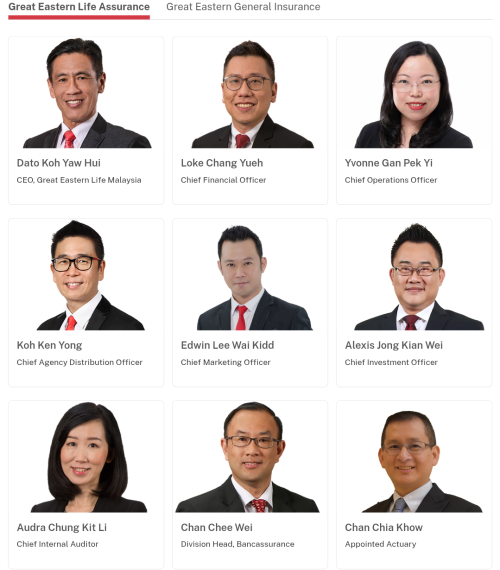

BNM may also allow insurers to increase the estate distribution proportion to shareholders without the money being earmarked for public interest initiatives.

This would be in instances where the insurer deems such distributions as "necessary" to avoid any "windfall gain" to policyholders.

This is all just pure cockamamie talk.

There is no such thing as a Par Fund surplus distribution that could be deemed as a "windfall gain" to policyholders.

So, please, do ask your insurer if they were instances where they hadn't distributed Par Fund surpluses to policyholders in line with the 90/10 rule - 90% to policyholders - on account of the so-called "no windfall gain" rule.

Insist to them that they must adhere to the 90/10 rule and that you are owed restitution and compensation for such practices.

Never let them get away with it.

We wouldn't know for sure until Great Eastern makes further disclosures.

If the gate to continue increasing Great Eastern's Estate distribution proportion to their shareholders — beyond 10% — for public interest initiatives may have been prematurely closed, BNM has sought to keep another one open — see below.

From the Management of Participating Life Business Policy Document

» Click to show Spoiler - click again to hide... «

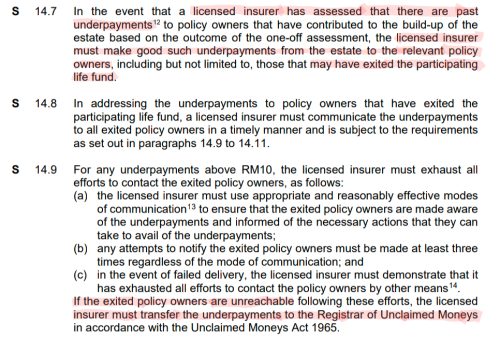

Para 14.7 — In the event that a licensed insurer has assessed that there are past underpayments to policy owners that have contributed to the build-up of the estate based on the outcome of the one-off assessment, the licensed insurer must make good such underpayments from the estate to the relevant policy owners, including but not limited to, those that may have exited the participating life fund.

Para 14.9 — If the exited policy owners are unreachable following these efforts, the licensed insurer must transfer the underpayments to the Registrar of Unclaimed Moneys in accordance with the Unclaimed Moneys Act 1965.

Para 14.9 — If the exited policy owners are unreachable following these efforts, the licensed insurer must transfer the underpayments to the Registrar of Unclaimed Moneys in accordance with the Unclaimed Moneys Act 1965.

» Click to show Spoiler - click again to hide... «

While BNM and the government may still have designs on ensuring at least a further portion of GELM's Estates ends up in government coffers — as most of the past policyholders who were underpaid may likely be uncontactable — the above two paragraphs violate, at least partially*, the contractual rights and interests of the current generations of Participating policyholders, and Sections 82.(1)© and 83.© of FSA.

* While it is not lawful to restitute past policyholders who were underpaid from the 'Estate', the situation is a bit more nuanced for those who are current policyholders and who are entitled to a portion of the Estate as a result of current distributions made by the insurer. If they are uncontactable or the amounts can't be banked in for whatever reason, it would be lawful to transfer the underpayments to the Registrar of Unclaimed Moneys.

From Insurance Regulations 1996

» Click to show Spoiler - click again to hide... «

Section 11.(4) Where an appointed actuary does not recommend the allocation of the entire surplus, the policy owners or the shareholders shall have no right to require allocation of the surplus carried forward unallocated, except on the recommendation of the appointed actuary in accordance with subregulation (2)** as at the end of a subsequent financial year.

** Subregulation (2) refers to the 90/10 rule

** Subregulation (2) refers to the 90/10 rule

From the Financial Services Act

» Click to show Spoiler - click again to hide... «

"participating life policy" means a life policy conferring a right to the policy owner to participate in allocations, of which the amount or timing is at the discretion of the insurer, from the assets of an insurance fund under subsection 81(2);

"liabilities" includes debts or obligations of every kind, whether present or future, or whether vested or contingent

Section 82.(1)© apply the assets of an insurance fund only to meet the liabilities and expenses properly incurred by that insurance fund

Section 83. A licensed insurer shall not make any withdrawal from an insurance fund, whether from the surplus or otherwise of that insurance fund, unless —

©in respect of an insurance fund for participating life policies, the interests and fair treatment of policy owners, including their reasonable expectations, have been given due regard.

"liabilities" includes debts or obligations of every kind, whether present or future, or whether vested or contingent

Section 82.(1)© apply the assets of an insurance fund only to meet the liabilities and expenses properly incurred by that insurance fund

Section 83. A licensed insurer shall not make any withdrawal from an insurance fund, whether from the surplus or otherwise of that insurance fund, unless —

©in respect of an insurance fund for participating life policies, the interests and fair treatment of policy owners, including their reasonable expectations, have been given due regard.

Although no one in their right mind can deny that the build-up in GELM's Estates is in large part a result of past underpayments, this does not alter the contractual rights and interests of the current generations of policyholders within those funds.

Bear in mind that in making final policy payouts to past policyholders at levels resulting in the underpayments, the insurer established, at point of payout, that the balance of unpaid Asset Shares were needed for the purposes of operating and managing the Par Fund.

In other words, it was needed to meet the interests, fair treatment and reasonable expectations of the remaining block of policies.

The same principle applies for the Kaotim Legasi 30 year no surrender value family takaful plans.

» Click to show Spoiler - click again to hide... «

STMB has to restitute surrendering Kaotim policies, and I would argue even policies terminated due to death, for their withheld Asset Share amounts.

In other words, STMB has to pay leaving policyholders a fair surrender value.

However, it would be unlawful for STMB to pay these leaving policyholders their due Asset Share values using the Tabarru Fund.

For the simple reason that retained Asset Share amounts are needed to support the properly incurred liabilities of remaining Kaotim policies within the Tabarru Fund.

Instead, it's STMB's shareholder funds that would have to foot the bill.

In other words, STMB has to pay leaving policyholders a fair surrender value.

However, it would be unlawful for STMB to pay these leaving policyholders their due Asset Share values using the Tabarru Fund.

For the simple reason that retained Asset Share amounts are needed to support the properly incurred liabilities of remaining Kaotim policies within the Tabarru Fund.

Instead, it's STMB's shareholder funds that would have to foot the bill.

» Click to show Spoiler - click again to hide... «

QUOTE(hafizmamak85 @ May 2 2025, 10:49 AM)

Another way to look at it, the ITO requires for a proportion of the insurance/takaful pool to surrender every year so that the tabarru fund (risk fund) or the non-participating fund does not have a deficit. If they have less than the expected proportion of policies surrendering, say 5% per annum, they are in trouble and would have to pump money into the tabarru or non-participating fund.

So, the retained 'Estate' is, for all intents and purposes, a properly incurred liability of the fund.

Its 'properness' is not dinted by the fact that there were past underpayments or mismanagement.

The underpayments were just a truly unfortunate byproduct of the behaviour of senior executives, the insurer's management & board of directors, and to a greater extent, the Malaysian life insurance industry's culture.

What ultimately matters is that the insurer made a CONSCIOUS and CALCULATED decision to retain those surpluses, which can only be construed for the benefit of remaining policyholders.

The only question left is how assets backing the Estates are to be fully distributed by the time the last policyholders exit their respective funds.

It has to be fair and equitable between and across the different generations of current policyholders over various contemporaneous and non-contemporaneous time periods.

And the Estates can only be used for smoothing purposes.

Besides, in the case of GELM's closed funds, balance of unpaid Asset Shares should rightly be classified as part of the remaining Par policies' Asset Shares, not the Estates.

Now, this then puts past policyholders who were actually underpaid in a very precarious, awkward and unfair position.

What is to be of them?

Are they not entitled to fair treatment, restitution and compensation for poor and unfair consumer outcomes?

They deserve fair restitution and compensation amounts for being underpaid.

Ultimately, these amounts will have to be forked out from the Shareholders' Fund.

The current Policy Document on the Management of Participating Life Business has provisions catering to such a scenario:

From the Management of Participating Life Business Policy Document

» Click to show Spoiler - click again to hide... «

Para 12.3 The licensed insurer must ensure that all costs of compensation provided to policy owners as a result of deficiencies in the management of the participating life fund is borne by the shareholders' fund and not charged to the participating life fund.

The costs of compensation include, but are not limited to costs associated with -

(a) actions to provide restitution or redress to policy owners arising from errors***; and

(b) actions to meet any undue PRE that have been formed, including but not limited to, due to inappropriate management of the participating life fund.

*** Such as system errors in the computation of any benefit payouts.

The costs of compensation include, but are not limited to costs associated with -

(a) actions to provide restitution or redress to policy owners arising from errors***; and

(b) actions to meet any undue PRE that have been formed, including but not limited to, due to inappropriate management of the participating life fund.

*** Such as system errors in the computation of any benefit payouts.

For those underpaid policyholders who are uncontactable, compensation and restitution amounts will have to be transferred from the Shareholders' Fund to the Registrar of Unclaimed Monies.

For current policyholders who are still uncontactable, and if monies from any future distributions from the Estates or Asset Shares can't be banked in, it will have to be distributed and retained within the insurer until all contacting efforts have been exhausted and such time that the amounts may be released to the Registrar for Unclaimed Moneys.

At this juncture, we don't yet know if insurers have started unlawfully transferring monies directly from the Estates - instead of using their own funds - to the Registrar of Unclaimed Moneys on account of past underpayments.

Current Participating policyholders have to unite and voice out their concerns.

They must demand and insist that past underpayments be addressed solely using shareholder funds, and that such payments not interfere with their rights and interests in the Estates.

In fact, current Participating policyholders should take every possible effort to directly contact and seek clarification from not only their insurers, but also from the Unclaimed Money Management Division - on whether the Estates within Par Funds were utilized in making restitutions for past underpayments.

Granted, the Division may not even be aware if policy monies received from insurers were from the Par Funds' Estates.

But they will know whether the policy monies received were from Pre-2005 Par policies.

If there were a sudden influx of such receipts, it behoves them to understand the source and cause for such abnormal sums.

The Unclaimed Money Management Division must, at the very least, help confirm or deny the existence of such receipts to potentially affected current Participating policyholders.

The Press and current policyholders should try getting in touch with the following Division officers.

Unclaimed Money Management Division (BWTD)

Anyone thinking this issue is limited to only GELM would be sorely mistaken.

While GELM's egregious behaviour and Estate sizes far exceed those of the other players, AIA, Prudential, Tokio Marine and the other life insurers definitely have their own Par Fund Estates to contend with.

What surprises await policyholders when those black boxes are opened for public inspection would be anyone's guess.

We have to start being empowered consumers

Over 100 billion ringgit is at stake here. This is not a small matter.

If policyholders are unhappy with how their funds are managed, surrendering their Participating policies is not going to cut it.

If just a few policies are surrendered, insurers can simply transfer funds from existing cash equivalent assets, specifically bank deposits, to policyholders.

Provided policyholders get an amount reflective of their fair share of assets within the fund, including those backing the Estate, there's not much to complain about.

It's a whole different ball game when there is a mass exodus, which is not something to be recommended.

The dynamics change dramatically.

There will be parties, other than policyholders, looking to make hay at both ends.

The insurer will be forced to liquidate high quality assets, including blue-chip stocks, and perhaps, god forbid, be forced to sell them at unreasonably low prices.

And what happens to policyholders?

They will initially be left with bank deposits, and if the amounts are substantial, be looking to invest them again, perhaps into similar types of assets the insurer once held on their behalf.

It's the other financial institutions, brokers and fund managers that get to benefit by shortchanging policyholders in this equation.

Why sell something cheap, only to buy it later dearer?

Rather, what policyholders must strive to do collectively is to channel their dissatisfaction into something that actually empowers them.

It starts with demanding and mobilising for a formal trust or some other legal arrangement / instrument imbuing direct beneficial ownership of the assets be put in place, so that their rights and interests can't be further ignored and abused.

Demand for a seat at the table and a right to look into and influence the governance and outcome of those assets.

We already have such a mechanism in place for unit trust funds.

Why not for Participating and other takaful funds?

Participating (Par) policyholders should demand the following be required by BNM and implemented by Malaysian life insurers:

Regular (at least annually) publication of financial reports for each Par Fund.

The reports should contain:

» Click to show Spoiler - click again to hide... «

Statement of Income and Outgo

Statement of Assets and Liabilities

Asset Share Information (by fund & cohort - cohort is to be defined by product and year of entry - levels):

- Opening and closing positions of both smoothed and unsmoothed Asset Shares

- Opening and closing number of policies

- Average opening and closing smoothed and unsmoothed Asset Shares per policy

Asset Share Inflows and Outflows (by fund, cohort levels):

- Amount of inflows and outflows by component, for both smoothed and unsmoothed Asset Shares - minimum components should include premiums, investment returns, management expenses (including non-investment taxes & duties), agency related expenses, agency commissions, policy benefit payments

- Movement in number of policies by movement type

- Average benefit payments per policy by benefit type

- Average contribution to smoothing account or Surplus / Estate per terminated policy by termination type

Surplus/ Estate Information (by fund and cohort) - Only if Surplus / Estate is separate from the unsmoothed Asset Share:

- Opening and closing positions

- Inflows and outflows by component

- Average benefit payments and reclassification to Asset Share per policy by benefit type

- Average contribution to Surplus / Estate per terminated policy by termination type

Cash Bonus / Survival Benefit Account (by fund and cohort):

- Inflows and outflows by component

- Average Cash Bonus / Survival Benefit deposit per policy by deposit type

- Average Cash Bonus / Survival Benefit withdrawal per policy by deposit type

- Average Cash Bonus / Survival Benefit crediting rate and amount per policy by deposit type

Reconciliation Statement:

- Reconciliation between the Income and Outgo Statement, the Assets and Liabilities Statement, and the fund level Asset Share, Cash Bonus / Survival Benefit Account and Surplus / Estate movements and balances

Investment Details:

- Composition of investments by individual assets/securities and by sector

Investment Performance Analysis (across various time periods):

- Assessment of actual investment performance by fund and asset type

- Comparison against the investment yield assumptions used in calculating smoothed and unsmoothed Asset Shares, crediting rates for the cash bonus / survival benefit savings account, and the interest rates charged for automatic premium loans and policy loans

Statement of Assets and Liabilities

Asset Share Information (by fund & cohort - cohort is to be defined by product and year of entry - levels):

- Opening and closing positions of both smoothed and unsmoothed Asset Shares

- Opening and closing number of policies

- Average opening and closing smoothed and unsmoothed Asset Shares per policy

Asset Share Inflows and Outflows (by fund, cohort levels):

- Amount of inflows and outflows by component, for both smoothed and unsmoothed Asset Shares - minimum components should include premiums, investment returns, management expenses (including non-investment taxes & duties), agency related expenses, agency commissions, policy benefit payments

- Movement in number of policies by movement type

- Average benefit payments per policy by benefit type

- Average contribution to smoothing account or Surplus / Estate per terminated policy by termination type

Surplus/ Estate Information (by fund and cohort) - Only if Surplus / Estate is separate from the unsmoothed Asset Share:

- Opening and closing positions

- Inflows and outflows by component

- Average benefit payments and reclassification to Asset Share per policy by benefit type

- Average contribution to Surplus / Estate per terminated policy by termination type

Cash Bonus / Survival Benefit Account (by fund and cohort):

- Inflows and outflows by component

- Average Cash Bonus / Survival Benefit deposit per policy by deposit type

- Average Cash Bonus / Survival Benefit withdrawal per policy by deposit type

- Average Cash Bonus / Survival Benefit crediting rate and amount per policy by deposit type

Reconciliation Statement:

- Reconciliation between the Income and Outgo Statement, the Assets and Liabilities Statement, and the fund level Asset Share, Cash Bonus / Survival Benefit Account and Surplus / Estate movements and balances

Investment Details:

- Composition of investments by individual assets/securities and by sector

Investment Performance Analysis (across various time periods):

- Assessment of actual investment performance by fund and asset type

- Comparison against the investment yield assumptions used in calculating smoothed and unsmoothed Asset Shares, crediting rates for the cash bonus / survival benefit savings account, and the interest rates charged for automatic premium loans and policy loans

These wonderful BNM senior management personnel should be able to see this through.

» Click to show Spoiler - click again to hide... «

QUOTE(hafizmamak85 @ May 16 2025, 06:21 PM)

In fact, please feel free to query the following individuals within BNM on why they aren't doing their jobs or are failing miserably at it.

Abdul Rasheed Ghaffour (Governor)

Aznan Abdul Aziz (Deputy Governor - Regulation & Supervision)

Cindy Siah Hooi Hoon (Assistant Governor - Supervision, previously Director of Prudential Financial Policy Department)

Fraziali Ismail (Assistant Governor - Regulation)

Adnan Zaylani Mohamad Zahid (Deputy Governor - Financial Markets & Development)

Suhaimi Ali (Assistant Governor - Development)

Abdul Rasheed Ghaffour (Governor)

Aznan Abdul Aziz (Deputy Governor - Regulation & Supervision)

Cindy Siah Hooi Hoon (Assistant Governor - Supervision, previously Director of Prudential Financial Policy Department)

Fraziali Ismail (Assistant Governor - Regulation)

Adnan Zaylani Mohamad Zahid (Deputy Governor - Financial Markets & Development)

Suhaimi Ali (Assistant Governor - Development)

The information within these reports become invaluable as not only do Par policyholders get a better handle on how their Par Funds perform or underperform, it also allows them to push for fairer consumer outcomes.

If insurers previously paid — on average — less than 90% of the unsmoothed Asset Share amount upon a policy's termination, not many people outside the actuarial and finance departments would have known about it.

This report would make it apparent.

Policyholders will now know each cohort's average smoothed and unsmoothed Asset Share values and can easily deduce their proportionate or fair share of the Estate / Surplus (where the Estate / Surplus is separate from the unsmoothed Asset Share account).

Par policyholders should not only demand for final payouts close to their policy's unsmoothed Asset Share values, but also for their fair share of the Estate / Surplus.

Great Eastern's Estates grew from RM 1.8 billion in 2001 to RM 8 billion by end of 2005 mainly because it failed to roll over the unpaid Asset Share amounts to the remaining policies' Asset Shares.

Their previous Appointed Actuaries acknowledged such shortcomings (lack of roll over) in the Asset Share computation methodology.

Even the RM 1.8 billion 2001 Estates figure is suspect — perhaps most of Great Eastern's Estates should rightfully be classified as part of the Funds' Asset Shares.

There is enough evidence within the industry to show that past and even current Par policyholders were and are likely currently being underpaid.

Unless affected policyholders start exerting pressure, not much will change.

» Click to show Spoiler - click again to hide... «

The above are excerpts from the JPI 29/2004 guidance notes and it makes clear the following:

- Cash surrender values should be at least 90% of Asset Share during the early years of policies in the expected main age range, and at least 100% of Asset Share from the 15th year or mid-term of the policy, whichever comes first;

- Any balance of unpaid Asset Shares, arising from final payouts being lesser than the policies’ Asset Shares, must be rolled over to form part of the remaining policies’ Asset Shares, and be taken into account in the determination of cash surrender values

- For policies incepted prior to 1 April 2005 and including those incepted during the transition period between 1 April and 1 July 2005, unless waived subject to acceptable justification, the ‘at least 90% of Asset Share' cash surrender value requirement has to be complied with.

The good news is that the Guidance Notes to JPI 29/2004 (issued by BNM in 2005) requires compliance to the minimum '90% of Asset Share' cash surrender value requirement even for policies issued prior to 2005.

It also requires that unpaid Asset Shares be rolled over to the remaining policies' Asset Shares.

Compliance to the minimum '90% of Asset Share' cash surrender value requirement may only be waived subject to acceptable justification.

High and poorly justified investment-return rate assumptions and guaranteed values in the design of Par products are shareholder concerns.

The Estate and Asset Shares must never be used to ameliorate shareholder peccadilloes — it is not an acceptable justification.

There doesn't seem to be much reasonable ground for a compliance waiver.

There are other serious abuses when it comes to the management of Par Fund assets, such as the treatment of Par Funds as a dumping ground for management and agency related expenses.

Par policies don't require much servicing — most Par policyholder engagement with the insurer or agent would revolve around premium payments, policy loan applications & repayments, and cash bonus / survival benefit withdrawals.

Not much in the way of heavy duty claims processing.

» Click to show Spoiler - click again to hide... «

Great Eastern Takaful (GET) managed to do heavy duty claims processing for its mySalam coverage to the B40 group (more than 4 million members) with only an annual wakalah (management) fee budget of around RM 30 million.

Which is at most RM 7 in wakalah fees per covered person.

Govt pays over RM936 mln for claims under MySalam scheme

RM 7 per annum, per covered person was apparently more than sufficient to process claims for over 1.27 million beneficiaries, including critical illness claims, over a span of 5 year (2019 - 2023) — GET even managed to record regular surpluses from its wakalah fees, perhaps close to RM 6 million per annum during the period.

Through the magic of transfer pricing, shared services and group costs pooling, it shouldn't surprise anyone if it's found that Great Eastern's Par Funds had cross subsidized mySalam's incurred management expenses.

It then stands to reason that RM 60 million per annum, per million policyholders (RM 60 per policyholder) should be more than sufficient to manage Participating policies.

RM 60 per policyholder, nearly 9 times RM 7, should be more than enough to manage Par Fund assets, Par policy servicing requirements and other such administrative matters.

There is no need to charge Par Funds for agency related expenses - even if there were a need, it should be managed within the RM 60 budget.

After all, how many agents have continued regular engagement with their Par policyholders - especially those with policies issued prior to 2005??

How many even still have their clients' contact details??

How many agents have sought to fight for fair consumer outcomes vis-a-vis close to Asset Share final payouts???

How many stood by watching silently while RM 2.37 billion got siphoned off from Great Eastern's Par policyholders??

Yes, RM 60 per annum, per Par policyholder should be more than reasonable to manage Par Funds.

» Click to show Spoiler - click again to hide... «

EPF only spent RM 1.81 billion to manage its contributors' funds in 2023.

» Click to show Spoiler - click again to hide... «

RM 1.81 billion is only 0.17% of the size of its contributors' funds (2023: RM 1,146.8 billion, 2022: RM 1,036.7 billion).

» Click to show Spoiler - click again to hide... «

As at end 2022, the Big Three collectively had around RM 104 billion in Par Fund liabilities with GE, AIA, PRU each respectively having RM 64.4 billion, RM 27.5 billion and RM 12.1 billion.

Using EPF's 0.17% incurred management expenses benchmark, the Big Three should have spent at most RM 180 million per annum managing their Par Funds with GE, AIA, PRU each respectively limited at RM 110 million, RM 46.5 million and RM 20.6 million.

I wouldn't be surprised if the Big Three are charging their Par Funds at least 2 to 3 times the RM 180 million benchmark annually. And these figures may not have even accounted for agency related expenses.

No one is going to put a stop to this unless policyholders step in.

Oh, yes. There is one other thing.

BNM may also allow insurers to increase the estate distribution proportion to shareholders without the money being earmarked for public interest initiatives.

» Click to show Spoiler - click again to hide... «

This would be in instances where the insurer deems such distributions as "necessary" to avoid any "windfall gain" to policyholders.

This is all just pure cockamamie talk.

There is no such thing as a Par Fund surplus distribution that could be deemed as a "windfall gain" to policyholders.

So, please, do ask your insurer if they were instances where they hadn't distributed Par Fund surpluses to policyholders in line with the 90/10 rule - 90% to policyholders - on account of the so-called "no windfall gain" rule.

Insist to them that they must adhere to the 90/10 rule and that you are owed restitution and compensation for such practices.

Never let them get away with it.

This post has been edited by hafizmamak85: Jul 17 2025, 10:56 PM

Jul 17 2025, 07:30 PM

Jul 17 2025, 07:30 PM

Quote

Quote

0.0287sec

0.0287sec

0.84

0.84

6 queries

6 queries

GZIP Disabled

GZIP Disabled